Good morning,

Crypto is unregulated and volatile. Its true worth is ephemeral. Investing in it is risky. In other words, for most CFOs it’s a total nightmare combination they’ve tried to stay far away from. (Most CFOs are unwilling to put it on the balance sheet.) Which has made the collapse of exchange FTX both a finance horror story—but also an ‘I told you so’ moment.

Last week, FTX, one of the largest cryptocurrency exchanges in the world once valued at $32 billion, and helmed by 30-year-old Sam Bankman-Fried, collapsed. The exchange filed for bankruptcy last week, and Bankman-Fried stepped down as CEO. He was a crypto star, championing crypto on Capitol Hill and creating high-profile business partnerships. For example, in October, Visa announced a long-term global partnership with the company with plans to expand FTX account-linked Visa debit cards in 40 new countries.

“The situation with FTX is unfortunate and we are monitoring developments closely,” a Visa spokesperson told me via email last week. Today, a spokesperson confirmed the following: “We have terminated our global agreements with FTX, and their US debit card program is being wound down by their issuer.”

“The market uncertainty doesn’t change our view that digital currencies and underlying crypto technologies have great potential for the future of financial services,” the spokesperson said.

FTX leadership structure

It’s unclear if FTX has a CFO. When taking a look at the leadership team, there isn’t one listed. I asked Dan Ashmore, a crypto analyst at Invezz, a London-based investment fintech, about his assessment of the company’s leadership. “FTX’s collapse was unique in that it transpired out of the tangled relationship between the exchange (FTX) and the trading firm, Alameda Research, both of which were founded by Sam Bankman-Fried,” Ashmore told me. “There is a reason there was no CFO at FTX— because the leadership structure was highly unusual, given Bankman-Fried essentially made all the decisions for both companies.”

FTX was “notoriously lean, with an employee count of only 75—even as it expanded so rapidly, being valued at one stage at $32 billion,” Ashmore says. “This pales next to rival exchange Coinbase, which had over 6,000 staff before laying off 1,100 earlier this year.”

As the result of a high workload, the former co-CEO of Alameda, Sam Trabucco, quit earlier this year, he says. “This left only Caroline Ellison, co-CEO at Alameda, and Bankman-Fried as the senior leaders, although the latter was very much the number one,” Ashmore says.

The FTX “debacle” can be attributed in part to a “bespoke management structure and lean headcount” with most of the legal and compliance team reportedly quitting, he explains. “There is no doubt that the aggressive leadership, concentrated power structure, and tangled relationship between FTX and Alameda could have been reined in with a more conservative and prudent leadership structure,” he says.

‘Poor internal labeling’

A finance team onboard could have provided the financial clarity Bankman-Fried needed when labeling bank-related accounts, for example.

“The full story here is one I’m still fleshing out every detail of, but at a very high level, I f***ed up twice,” Bankman-Fried wrote in a tweet last week. “The first time, a poor internal labeling of bank-related accounts meant that I was substantially off on my sense of users’ margin. I thought it was way lower.”

In an analysis, Fortune‘s Tristan Bove writes: “He claims that because of this poor labeling, his sense of leverage was 0x when it was actually 1.7x and his sense was that he had 24 times the average amount of daily withdrawals in liquidity when he actually had just 0.8x. In other words, he was more leveraged than he thought and had less cash to cover it than he thought—a lot less. Then, when roughly $5 billion of withdrawals were made on Sunday, he found himself here.”

In gauging CFOs’ sentiment on crypto, finance chiefs at banks are in no hurry to implement it. The U.S. Federal Reserve Board’s senior financial officer survey was distributed to 80 banks. According to findings released in May, two-thirds of respondents said distributed ledger technology and crypto-related products were either not a priority or a low priority in their bank’s growth and development strategy over the next two years.

One thing’s for sure: CFOs who were wary of crypto before, are probably feeling even more cautious now.

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Sign up here to receive CFO Daily weekday mornings in your inbox.

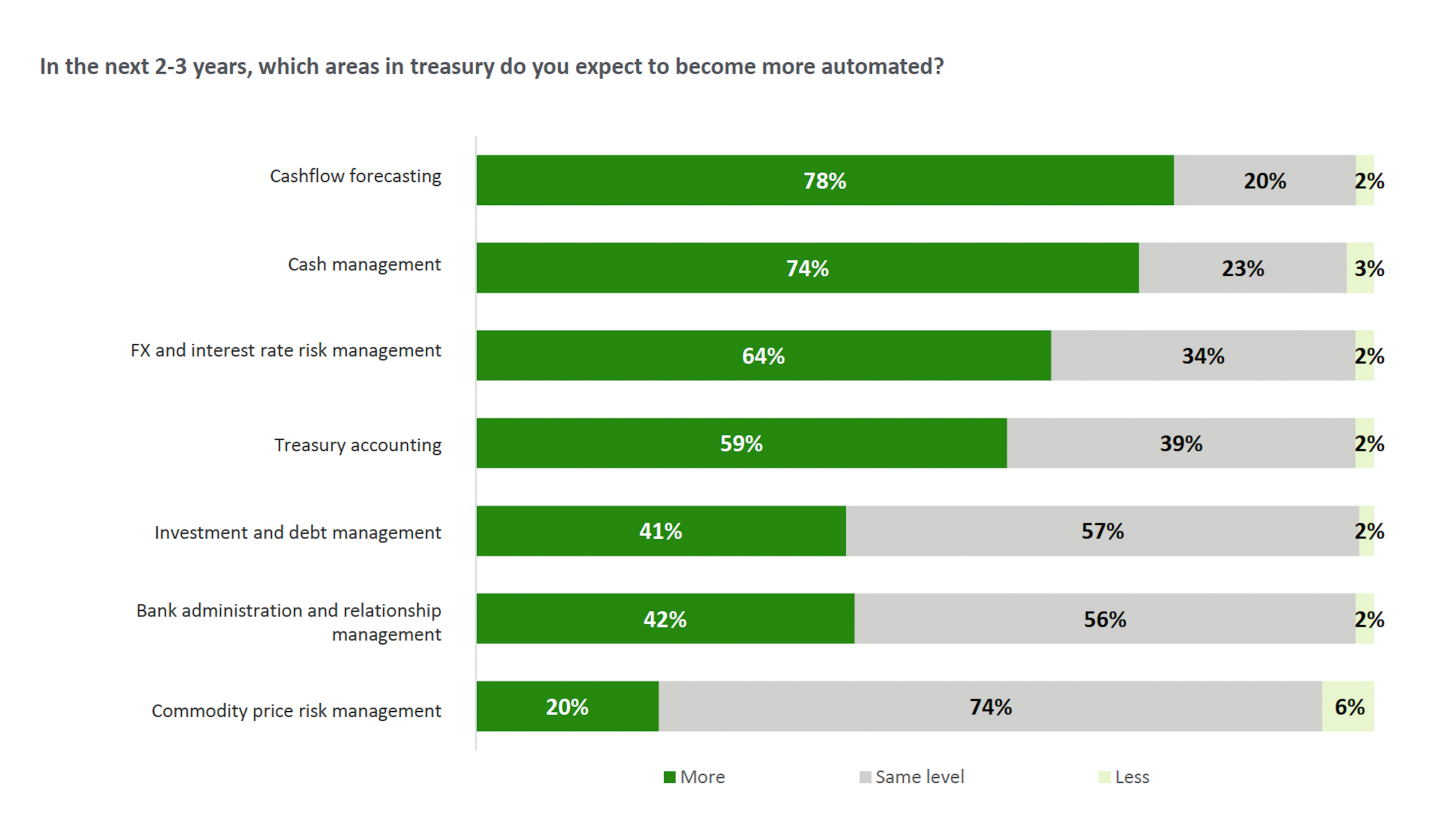

Big deal

Deloitte's recently released its "2022 global corporate treasury survey." Organizations are taking actions to address liquidity management, financial risk, business continuity, and operating model priorities, Deloitte found. "With 54% upvotes, enhancing liquidity risk management is considered as the most critical mandate given to treasury departments by the board or the CFO," according to the report. Another key finding is organizations are planning for more automation in several areas of treasury. In the next two to three years, the top three areas respondents said they expect to become more automated are cashflow forecasting (78%), cash management (74%), and FX and interest rate risk management (64%). The findings are based on a survey of 245 treasurers spanning all industries with most participants from the consumer and industrial products industry.

Courtesy of Deloitte

Going deeper

"Is There a Better Way to Staff Temporary Teams?" a report in Wharton's business journal, suggests a new strategy for staffing high-performing work teams by focusing on the relationships among members, and not just their skills. Wharton professor of operations, information, and decisions Hummy Song is the co-author of research on the composition of teams in hospital emergency rooms that balance both learning and efficiency. “We’re looking at these potential levers that have to do with team composition, specifically team familiarity and partner exposure. How do these things matter when it comes to performance?” Song told Wharton.

Leaderboard

Mardi Dier, CFO and EVP at Ultragenyx Pharmaceutical Inc. (Nasdaq: RARE), is leaving the company, effective Nov. 15. She will assume the dual role of CFO and chief business officer at privately held Acelyrin, Inc. Ted Huizenga, chief accounting officer, and Aaron Olsen, SVP of corporate strategy and finance, will lead ongoing finance activities during the search for a successor. Dier joined Ultragenyx in October 2020.

Chris Sousa was named CFO at JPA Health, a marketing and communications firm based in Washington, D.C. Sousa brings nearly 20 years of experience. Before joining JPA, he spent over 14 years at Dataprise, where he led five acquisitions. He has previously held operations and systems roles at Radical Support, StrategicFusion, and Technical Systems Integrators.

Overheard

"A lot of people have compared this to Lehman. I would compare it to Enron."

—Harvard professor and former treasury secretary Larry Summers commented on the downfall of FTX, the once-heralded crypto exchange, on Bloomberg Television’s Wall Street Week. Summers referred to FTX as "the smartest guys in the room," alluding to the classic documentary of that name that revealed how Enron kept a false set of books before its own spectacular implosion, Fortune reported.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get it delivered free to your inbox.