This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Happy Friday, everyone. Can stocks stage a comeback to avert another down week? It’s not looking promising.

Asia is higher, Europe is mixed and Nasdaq futures are off their lows. That’s good news, particularly for tech bulls, as the Nasdaq flirts with a new correction and some FAAMG stocks even threaten to fall into bear territory.

Let’s check in on the action.

Markets update

Asia

- The major indexes are solidly in the green with Shanghai leading the way, up 2%.

- President Trump has yet to give the green-light (nor has Beijing, for that matter) to the Oracle–TikTok tie-up, but there’s already talk of an IPO as early as next year.

- Coronavirus hit a grim toll in the past day, topping 30 million recorded cases worldwide, and more than 940,000 deaths.

Europe

- The European bourses were mixed at the start with the Stoxx Europe 600 off 0.1%, before climbing.

- Stocks in Madrid were lower despite a major acquisition in the Spanish banking sector as CaixaBank SA and Bankia SA agreed to merge. This will fuel hopes the long awaited consolidation of Europe’s fragmented banking sector is finally underway.

- Do green economies grow? The European Commission offered compelling evidence in the affirmative yesterday, outlining an ambitious plan to grow GDP in the coming decades while dramatically cutting greenhouse gas emissions. A reminder: GDP does a terrible job of measuring the benefits of clean air and clean water for society.

U.S.

- Dow and S&P futures are trading sideways this morning while the Nasdaq futures are pushing higher. That’s after yet another tech-led sell-off on Thursday.

- Investor enthusiasm even cooled for the newest tech darling, Snowflake. It fell 10% yesterday, and is edging lower still in pre-market trading.

- Confusion over Trump’s proclamations about an October coronavirus-vaccine surprise, crummy jobless claims numbers and sinking hopes for a new stimulus package are also weighing on the markets.

Elsewhere

- Gold is up, trading above $1,960/ounce.

- The dollar is down.

- Crude is up with Brent trading above $43/barrel.

By the Numbers

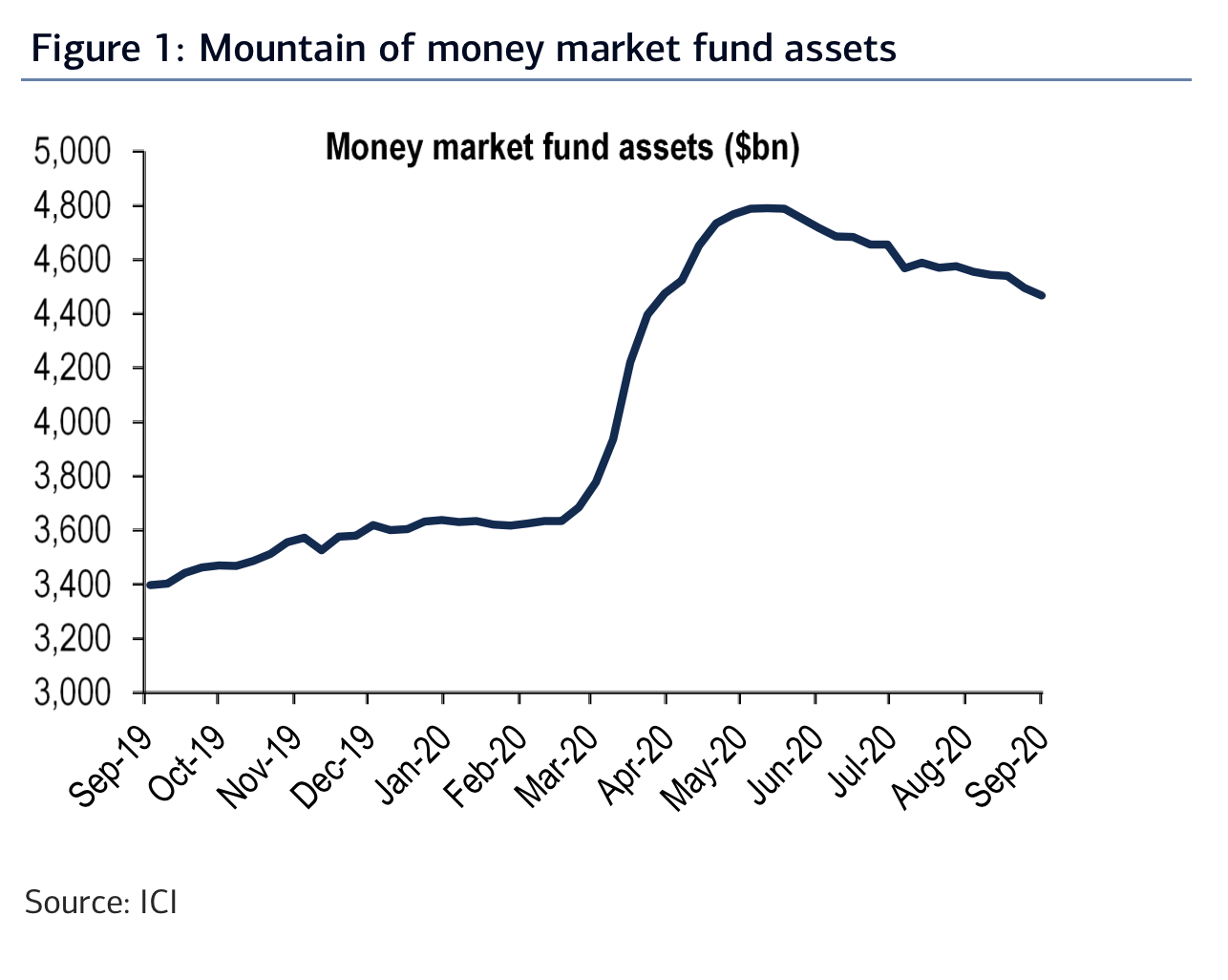

Zero. The Fed this week told us interest rates will be at virtually zero for the next three years. (Many on Wall Street, including Goldman Sachs, believe it could be even longer than that—into 2024 and beyond.) Rock-bottom interest rates reward borrowers and punish savers. You remember that from Econ 101, of course. “So if you have funds parked in a bank or money market account fund, which many do, and you want to earn anything the next three years, the Fed thinks you should take risks—i.e. interest rate, liquidity, credit or equity risk,” BofA Securities analysts write. Not surprisingly, investors started pulling money out of stocks during the March meltdown. The next thing we saw was a rise in money market deposits (see chart below). Now money market holdings are once again declining because, well, it makes little sense to park your cash there if it’s earning meager returns. The big question is: where will that money go? Back into stocks? It’s a tough conundrum.

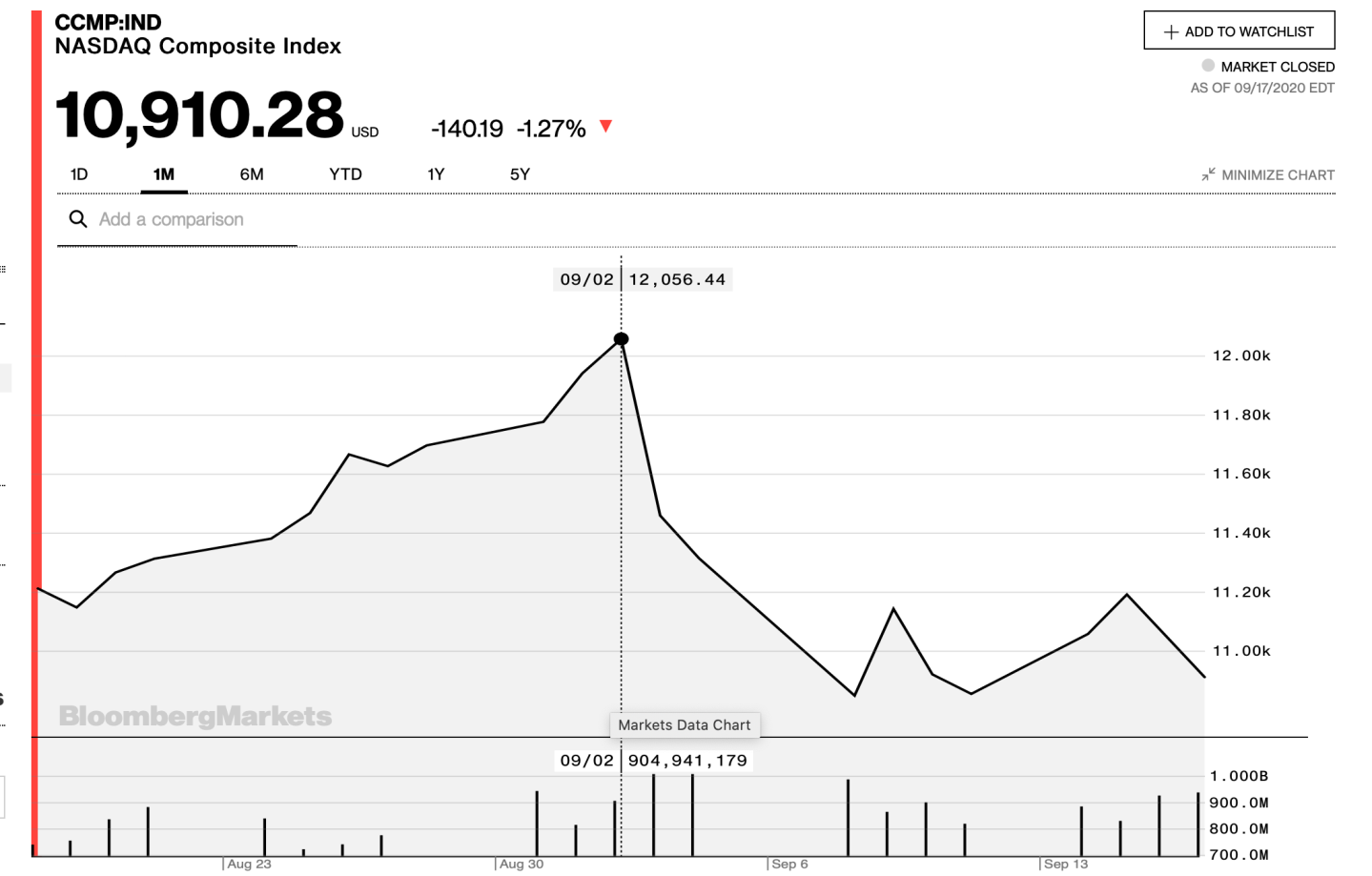

-9.5%. Since hitting an all-time high on Sept. 2, the Nasdaq has fallen seven out of the past 10 trading sessions. Once again, the tech-heavy index is a mere half-percent away from correction territory (defined as a fall of at least 10%). Over that stretch, Facebook is down 15.8%, Microsoft is off 12.4% and stay-at-home powerhouse Amazon is off 14.8%. Apple has fallen even further, down 17.8% over that stretch. Don’t look now, but the biggest names in tech are actually nearing bear territory.

***

Postscript

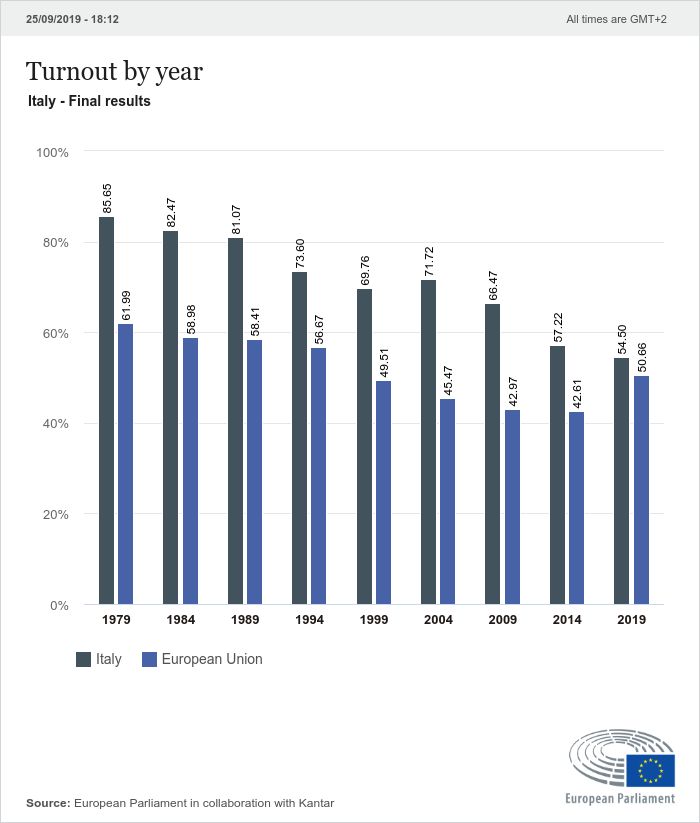

Football (or, calcio) is the national sport in Italy. As national obsessions go, politics is a close second. Voter turnout in Italian elections is impressive. And with national governments rising and falling all the time (there have been 61 governments over the past 75 years), Italians vote a lot.

They go back to the polls this weekend for regional elections and for a referendum on whether to cut down the number of MPs.

It will be an in-person vote. And, despite a recent upswing in COVID cases, turnout again this time is expected to be high.

There are huge political stakes—it always seems as if the governing party is at risk of imminent collapse—in this round of voting. The center-left government is clinging to a tiny majority. As Berenberg Bank economists write in an investor note this morning, “thanks to the EU’s €750bn recovery fund, Italy has c€100bn to distribute over the next couple of years. The two parties [in the ruling coalition] want to hand out the money rather than leave that pleasure to the right.”

But I’m just as fascinated in the mechanics of this vote. Democratic transitions are full of surprises in the best of times. Elections during pandemics dial up the volatility factor to an extreme. And, as is the case everywhere, there are political schemers who see an election held amid a coronavirus outbreak as an opportunity to exploit voters’ deepest fears.

But it will likely go down fairly smoothly. Again. Here’s the simple reason why:

Italy keeps the polls open over a two-day period—on Sunday and Monday—when most of the country is off from work. It’s hardly the only country to do this. But it still mystifies me that so many other democracies try to limit the vote to a 12(ish)-hour window on a single day in the middle of the week. That’s hardly fair to workers or single parents or anyone, really. In the age of COVID, spacing out the vote is not just good for a healthy democracy, it’s good for a healthy electorate.

Nobody expects Italians to wake up on Tuesday morning to a post-election high. Italy has huge problems with a no-growth economy, persistent corruption and intractable political infighting. That’s not going away. But in one area it’s looking like a model to much of the rest of the world: the pandemic hasn’t diminished the country’s faith in the basic functioning of a democracy.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

***

Have a nice weekend, everyone. I’ll see you here on Monday.

Today's read

Tech bubble 1.0. In 2000, I was working for a business magazine (does anybody beyond my Fortune colleague Aaron Pressman remember The Industry Standard?) that grew so fat with ad pages, we had to go to perfect-bound, phone-book-sized weekly issues. Everyone knows what happened next. The wheels fell off the dot-com boom and so many businesses, including The Standard, went belly up in a blink. Investor exuberance for tech stocks is different this time round. Or is it? Fortune's Anne Sraders runs the numbers.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quote of the day

We've seen an unusually high number of IPOs this year that rank near the top in foregone proceeds. But Snowflake dwarfs them all.

That's Jay Ritter, a professor at the University of Florida and an expert in tracking IPO hits and misses. Snowflake goes down in history as the second-most underpriced IPO ever (as measured by dollars left on the table). Fortune's Shawn Tully runs the numbers, and finds SNOW left about $4.88 billion on the table. Here's how.

Learn how to navigate and strengthen trust in your business with The Trust Factor, a weekly newsletter examining what leaders need to succeed. Sign up here.