Stop me if you’ve heard this one: A tech startup raises buckets of money at a crazy valuation but then struggles to turn a profit. Along the way investors discover the startup doesn’t belong to the high-margin world of tech companies at all, but is instead grinding it out in a low-margin industry. This is the story of Uber and Lyft, and more recently of WeWork. Now, one wonders if the same fate will befall Robinhood.

If you’re unfamiliar, Robinhood is a stock-buying app popular with millennials. It has 10 million accounts as of December and has been credited by Jim Cramer and others for disrupting the brokerage industry with its commission-free trading platform. It has charismatic 30-something founders with shaggy hair and enjoys the techy gloss of other San Francisco startups. It has also raised $900 million and is valued at an eye-popping $7.6 billion—a figure within spitting distance of brokerage vet eTrade’s $10 billion valuation. An IPO is rumored to be in the works.

And yet red flags abound. Last month, Robinhood’s head of product departed barely a year into a term that coincided with a series of high profile bungles. The company’s missteps have included announcing a savings product that would pay 3% interest only to walk back the news after regulators warned it would be illegal (the product relaunched with a 2% rate much later). More recently came news of a potentially catastrophic bug that let users trade unlimited amounts on margin accounts.

Such incidents point to governance issues that, if not as epic as those at WeWork, may give prudent investors some pause. Another potential reason for unease is Robinhood’s underlying business model. It may have a slick app—as does Uber—but at the end of the day it is scrounging for revenues alongside a growing number of other brokerages that have recently copied Robinhood’s main selling point of free stock trades.

According to data shared with Fortune by one of Robinhood’s competitors, the company’s lifetime revenue to date is between $600 and $650 million, while 20-25% of its current income comes from interest on customer accounts and 55% from so-called order flow—rebates kicked back to brokerages from market makers and other third parties that execute their orders. Robinhood declined to comment on the figures, though the 55% order flow number is consistent with recent reports that say the startup has been making it an ever bigger part of its business. Meanwhile, a source close to the company said Robinhood has “a very strong balance sheet” and that the “vast majority” of the money it raised is untouched.

This still leaves the question of how the company plans to make a profit. Robinhood won’t say if it is in the black but all signs are the answer is no, despite a recent initiative to save money by building its own clearing system. While its increased reliance on order flow has juiced revenue, it’s unclear if this is sustainable—especially as Robinhood has been sending those customer orders to high frequency trading firms. This practice, say critics, raises the potential for conflict of interest since those firms are assuredly not interested in giving Robinhood customers the lowest price on shares. There is also concern that regulators, who have been uneasy with order flow arrangements in the past, may revisit the issue at a time when more brokerages are telling retail investors their service is “free.”

Finally, there is the question of how many of the 10 million accounts Robinhood is touting are active, and how much money the average one contains. The startup declined to comment on this question but it’s unlikely the value of those accounts is comparable to those at the more boring—but profitable—competitors like eTrade or Charles Schwab.

It’s too soon to say conclusively that Robinhood is overvalued. The company is pressing forward with a UK expansion, and has been addressing its governance issues by hiring a COO and CFO, and adding a former SEC Commissioner to its board of directors. Nonetheless, that $7.6 billion valuation implies a lot of future profits that show no sign of materializing anytime soon. As such, when (and if) Robinhood goes public, it will be hard-pressed to avoid a belly-flop like the ones that befell other one-time tech darlings.

Jeff John Roberts

THE LEDGER'S LATEST

2020 Crystal Ball: Predictions for the Economy, Politics, Technology, and More - Fortune Staff

4 Financially Smart Gifts to Give Yourself and Others This Year - Ben Carlson

This Loan Forgiveness Program Promised to Help Teachers and Police Officers. Then It Denied 99% of Their Applications - Chris Taylor

How the Era of Easy Money May Come to Haunt a Slew of Debt-Ridden Companies - Larry Light

As Small Cap Stocks Hit New Highs, Some See Evidence That the Bull Market Has More Room to Run - Anne Sraders

Want a SIM Card in China? You'll Now Need to Get Your Face Scanned First - Grady McGregor

DECENTRALIZED NEWS

To the Moon…

The European homepage of massive global pyramid scheme OneCoin has been pulled offline by investigators . . . Credit unions have grown more rapidly than banks over the last decade . . . Jack Dorsey says he'll live in Africa for 3-6 months in 2020, and that the continent "will define the future (especially the bitcoin one!)" . . . Kelly Loeffler, CEO of cryptocurrency custodial service Bakkt will be the new Senator from Georgia . . . The U.S. Federal Reserve is reconsidering its inflation policy . . . Digital lender SoFi gets its BitLicense, opening the way for crypto trading.

Rekt…

Other web properties linked to OneCoin are still partially online . . . XRP, the cryptocurrency behind Ripple, is the worst performing major crypto of 2019 . . . But Bitcoin isn't looking so hot either.

MEMES AND MUMBLES

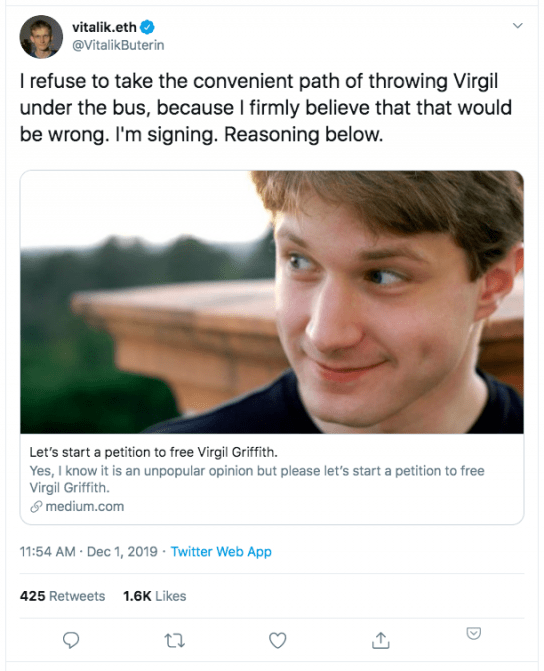

Ethereum founder Vitalik Buterin tweeted his support for Virgil Griffith. Griffith, a researcher with the Ethereum Foundation, was arrested last week on charges that he violated international sanctions by travelling to North Korea to give a talk about cryptocurrency in Pyongyang.

The crypto community has been sharply split over whether what Griffith did gave aid to an authoritarian regime, or, as Buterin argued, represented an open-minded generosity towards "a group of people that one has been trained since childhood to believe is a Maximum Evil Enemy."

"The world would be better if more people on all sides did that," Buterin also wrote.

BUBBLE-O-METER

-82%

That's the decline, from 2015 to 2018, in the number of fintech startups founded annually, according to data cited by the Financial Times. The raw numbers - 390 fintechs were spun up in 2015, but just 71 in 2018. The trend seems to be continuing, with just 12 fintechs reportedly started so far in 2019 by one count.

The big conclusion - if there was ever a fintech 'bubble,' it's over. More substantively, the dropoff speaks to the huge difficulty of challenging incumbents, particularly given the deep, tightly-interwoven technology stack at legacy banks.

(The FT sources much of this from a longer piece at Risk.net).

FOMO NO MO'

“Resist crypto’s evil path, and open blockchain’s right way.”

(坚决打击炒币“堵邪路” 引导区块链应用“开正门”)

Xinhua News, the official press organ of the Chinese regime, warned Chinese citizens away from a plethora of scams, pump-and-dumps, and pyramid schemes floated there under the banner of cryptocurrency. The warning marks a relatively subtle official distinction between crypto, painted here as inherently scammy, and blockchain, touted by no less than Chinese president and CCP General Secretary Xi Jinping.

That, according to the China-focused crypto column Da Bing from Decrypt, has been mirrored by a divide between some cryptocurrency exchanges such as MXC and IDAX getting hounded out of China after apparently fostering scams, and other exchanges, such as Huobi, surviving, and even ingratiating themselves with the CCP.

It is that complex and opaque landscape that Malta-based crypto exchange Binance would love to penetrate. That provides some important context for their strong response to reports that a Binance office in Shanghai had been shut down by Chinese authorities.