Throughout 2022, Wall Street has repeatedly warned investors that a recession could be on its way.

From JPMorgan Chase CEO Jamie Dimon to former Federal Reserve officials, the world’s top economic minds have pointed, practically in unison, to the storm of headwinds facing the global economy and expressed fears about the potential for a serious downturn.

In the U.S., consumers are grappling with near 40-year-high inflation and rising interest rates, all while the world struggles to cope with the war in Ukraine, the European energy crisis, China’s COVID-zero policies, and more.

And even after a more than 21% drop in the S&P 500 this year, Wall Street’s best minds still think stocks have further to fall.

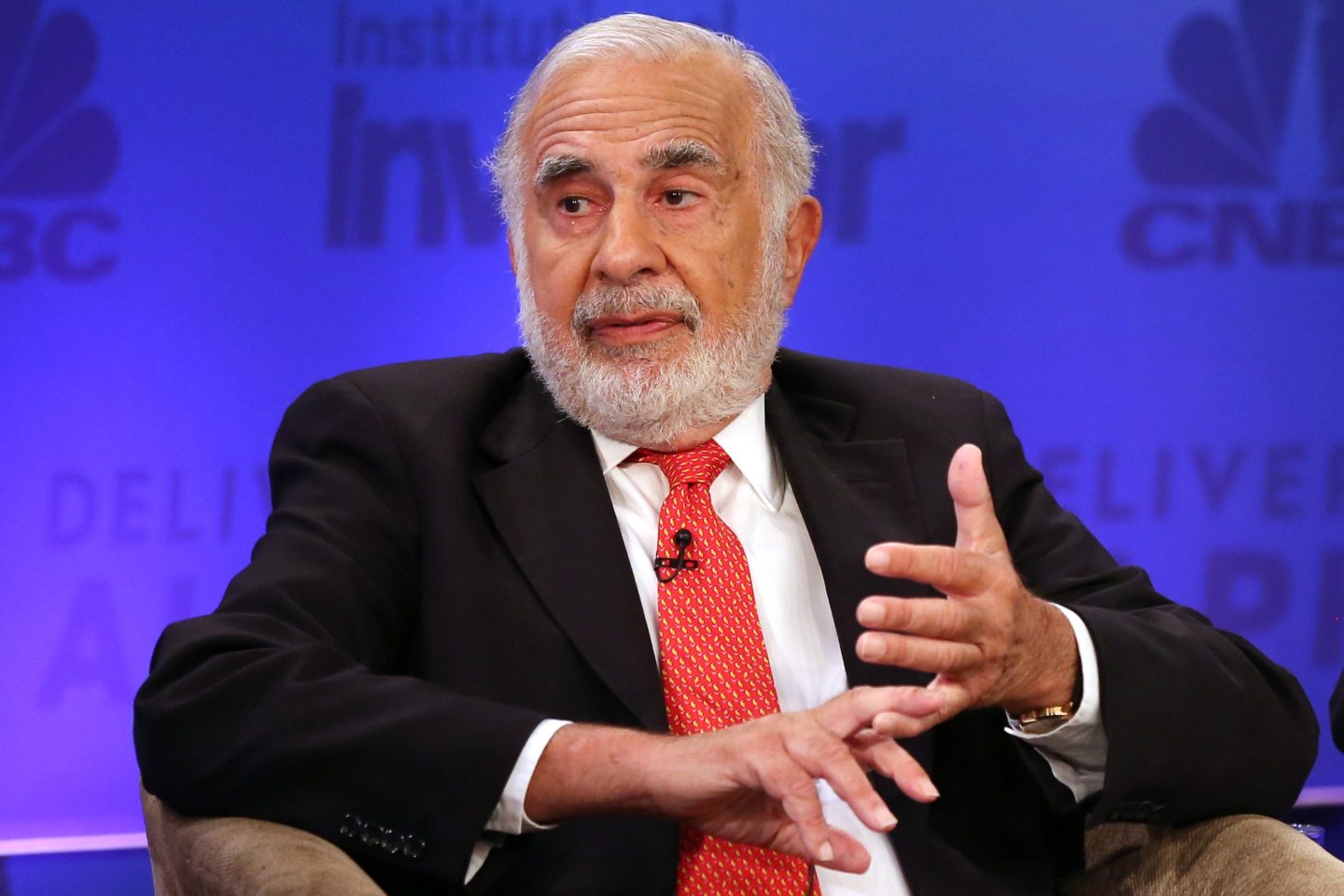

“The worst is yet to come,” Carl Icahn, who serves as the chairman of Icahn Enterprises and boasts a net worth of $23 billion, told MarketWatch at the Best New Ideas in Money Festival on Wednesday.

Icahn made his name as a corporate raider on Wall Street in the 1980s, buying up unloved companies and aggressively advocating for change to improve shareholder value by appointing board members, selling assets, or firing employees.

Even at 86, Icahn remains one of Wall Street’s most respected minds, and this year he has repeatedly warned the U.S. economy and stock market are in trouble.

The investor argues the Federal Reserve boosted asset prices to unsustainable levels amid the pandemic using near-zero interest rates and quantitative easing—a policy where central banks buy mortgage backed securities and government bonds in hopes of spurring lending and investment.

“We printed up too much money, and just thought the party would never end,” he said, adding that with the Fed switching stances and raising rates to fight inflation, he now believes “the party’s over.”

The hangover from the Fed’s loose monetary policies, according to Icahn, is sky-high inflation, which rose 8.3% from a year ago in August.

“Inflation is a terrible thing. You can’t cure it,” Icahn said, noting that rising inflation was one of the key factors that brought down the Roman Empire.

Rome famously experienced hyperinflation after a series of emperors lowered the silver content of their currency, the denarius. The situation then dramatically deteriorated after Emperor Diocletian instituted price controls and a new coin called the argenteus, which was equal in value to 50 denarii.

The result of Roman emperors’ unsustainable policies was an inflation rate of 15,000% between A.D. 200 and 300, according to estimates by some historians.

Icahn said that inflation like this worries him so much that he would have liked to see the Federal Reserve raise interest rates by a full 1% on Wednesday, instead of the 75-basis-point hike that Chair Powell announced, to ensure price increases won’t stick around.

But despite Icahn’s inflation fears, the billionaire investor said he has managed to outperform his peers by hedging his portfolio—a strategy that uses derivatives to limit market risk and increase profits—during the market downturn.

Icahn Enterprises’ net asset value jumped 30% or $1.5 billion in the first six months of 2022.

On Wednesday, Icahn argued that there are still stocks that look appealing on the market today, but he cautioned investors not to get greedy too soon.

“I think a lot of things are cheap, and they’re going to get cheaper,” Icahn said, arguing that companies in the oil-refining and fertilizer businesses should outperform the overall market moving forward.

Wednesday’s warning for investors wasn’t the first from Ichan this year.

The billionaire warned back in September that a recession or “even worse” was likely on the way for the U.S. economy and compared today’s high inflation with that of the 1970s, arguing the Fed will struggle to control rising consumer prices.

“You can’t get that genie back in the bottle too easily,” he said.

Sign up for the Fortune Features email list so you don’t miss our biggest features, exclusive interviews, and investigations.