This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Surprise!

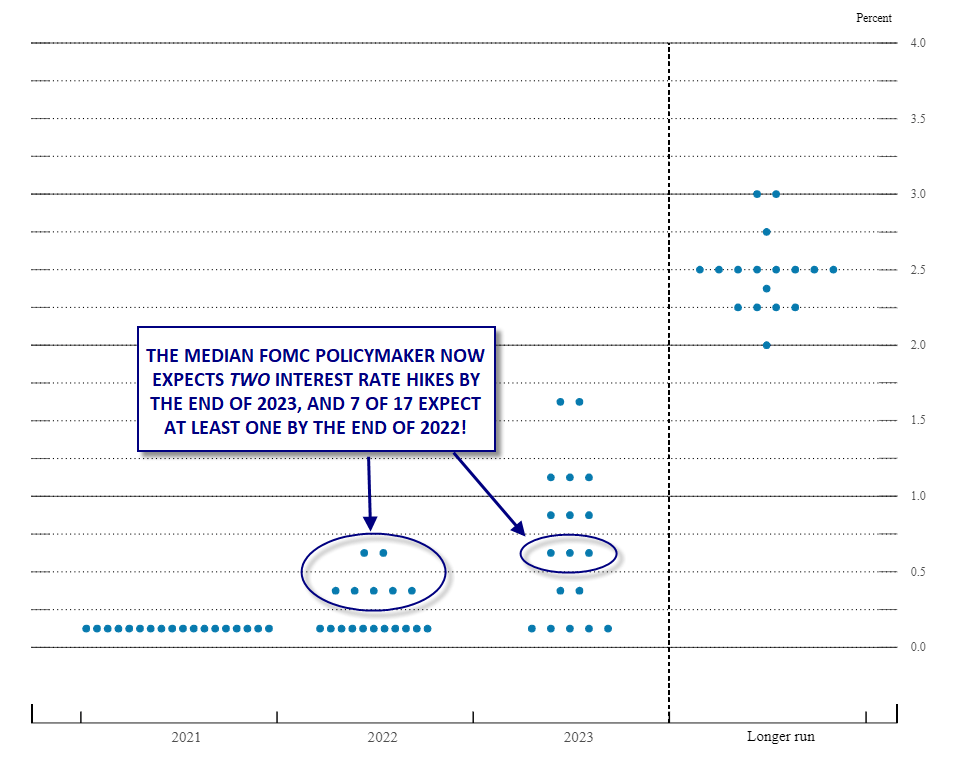

Okay, who among you had two rate hikes by end of 2023 on your FOMC bingo board? Congratulations! Cigars are in the mail.

After an eventful Wednesday in the markets, there are again more sellers than buyers this morning. Global markets and U.S. futures are trading lower as investors react to the Federal Reserve’s suddenly more hawkish view on rising inflation and interest rates.

Perhaps lost in yesterday’s sell-off is legit good news. The labor market is strengthening, as are wages. And economic growth is robust. The glass is hardly half-empty.

What’s up? The dollar, bond yields and bank stocks.

What’s down? Over in the crypto corner, you may hear some grumbles. Bitcoin is edging lower, as is Ethereum and Dogecoin.

Let’s see what else is moving markets.

Markets update

Asia

- The major Asia indexes are mixed in afternoon trading. The Hang Seng, the best of the bunch, is up 0.4%.

- The Ant Group IPO is still on for later this year, according to a Sanford C. Bernstein report, but its valuation has fallen by more than half. Ouch.

Europe

- The European bourses were solidly lower at the start with the Stoxx Europe 600 down 0.3% in the first half-hour of trading. Banks are leading the way higher; tech and utilities are dragging lower.

- The EU is expected tomorrow to announce a new travel policy to welcome more foreign travelers, including Americans. It’s probably still not enough to save the crucial summer season for tourism-dependent Southern Europe.

- Shares in CureVac are down more than 45% in pre-market trading in New York after the German biopharma firm reported underwhelming trial results for its COVID vaccine.

U.S.

- U.S. futures are under pressure this morning. That’s after the Dow Jones Industrial Average shed 265 points on Wednesday. The Nasdaq and S&P, too, closed lower.

- Just one sector finished in the green—consumer discretionary—yesterday. Financials, too, outperformed. That makes sense. Rising rates are good for banks’ core business.

- Shares in Coca-Cola are off again this morning in pre-market after the beverage giant saw $4 billion fizz off its market cap on Thursday. The culprit: Cristiano Ronaldo.

Elsewhere

- Gold is taking a pounding, trading around $1,810.

- The dollar yesterday jumped by the most in a year, and is gaining again this morning.

- Crude is down with Brent trading around $74/barrel.

- I was at a barbecue on Sunday, and this Italian dude was telling me, over a local craft brew, that Bitcoin is primed for a comeback. Why? Inflation, he said. We’ll see if his theory is correct… BTC fell (-5.4%) more than the Nasdaq yesterday. If you must know the beer, it’s this one. And, no, I don’t want to talk Bitcoin at barbecues.

***

By the numbers

10 basis points

At about 1:50 p.m. yesterday, the yield on the U.S. Treasury note stood at a modest 1.4870%. Less than a half-hour later it had shot up to 1.58%, a near 10-basis point jump. And, around that time, the Dow, Nasdaq and S&P all plunged. That’s how the markets respond to unexpected news—with a coordinated shift of money out of one bet, and into another. In retrospect, the market reaction went to script. There was a sell-off, and then a recovery. This morning, futures are down slightly as investors weigh their best options. Not surprisingly, financial stocks are seeing an inflow, and high-flying tech stocks are under pressure. The move into value could be a big theme going forward.

Two is greater than zero

The reason behind yesterday’s sell-off, of course, was the hawkish surprise on interest rate projections. The median forecast from the FOMC now is for two interest rate hikes by the end of 2023, which is more than the zero predicted at the last meeting. Why the change of heart? Yes, rising inflation. But the data also shows good news in the labor market and for economic growth. Matt Weller, global head of Market Research at Forex.com, neatly sums up where we are at the moment. “The Fed believes the U.S. economy will more quickly approach its dual mandate of inflation averaging 2% and maximum sustainable employment, so Jerome Powell and Company expect to normalize policy more quickly than before,” he wrote in an investor note yesterday.

The Fed doesn’t do crystal balls. It does dot plots. And, yes, the dot plot thickens. Here’s what it looks like, according to Weller:

Nearly two out of five

We’re almost ready for Q2 reporting season, so let’s look back one last time at Q1 earnings calls. Let’s call this the “inflation edition.” According to FactSet, a staggering 197 S&P 500 cited the I-word on earnings call over the past three months, the most since 2010. The concern is that rising prices could eat into corporate profits, but so far companies are sticking with their year-end EPS guidance. This too will be one to watch.

***

Editorial note

Bull Sheet will not publish tomorrow. Like a growing number of companies, Fortune will observe tomorrow as a holiday, in celebration of Juneteenth.

Have a nice weekend, everyone. But first, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

The best fintech deal that never happened. Last year, the Department of Justice stepped in and essentially stopped Visa's $5.3 billion merger of financial data startup Plaid. The move puzzled many industry observers. Fortune's Rey Mashayekhi digs into what happened and why in this fascinating feature story.

Transitory—or is it? At the Fed's last meeting, in March, the FOMC members were widely in agreement that inflation was transitory. Fast-forward to yesterday, and a solid majority see it running hot. The Wall Street Journal's Greg Ip writes that anxiety is now creeping into the Fed's thinking. The reason: supply shocks are messing with their forecasts, and that could mean yet more surprises at subsequent Fed meetings.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Timber!

Lumber prices fell into a bear market on Tuesday. Yes, you read that right. That's after a record decline last week, pushing the "cash" price of lumber down 20% since its late-May all-time high. The reason? "Homebuilders and DIYers alike are finally balking at the exorbitant price of lumber," writes Fortune's Lance Lambert.

Our mission to make business better is fueled by readers like you. To enjoy unlimited access to our journalism, subscribe today.