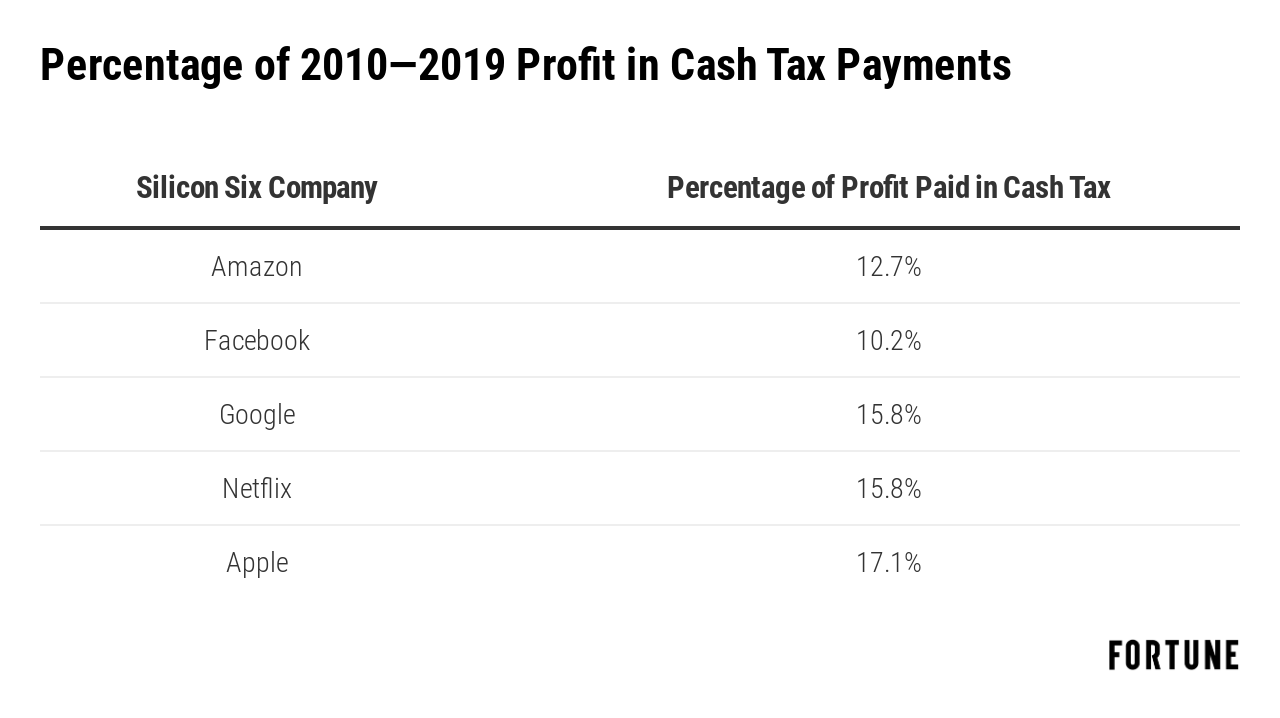

A new report about Amazon, Apple, Facebook, Google, Microsoft, and Netflix—nicknamed the “Silicon Six” by the non-profit Fair Tax Mark—claims a major gap in the taxes they might be expected to owe and how much they actually pay.

According to the report, between 2010 and 2019, using legal tax avoidance strategies that have become popular among corporations, the taxes paid collectively by the companies across all global territories in which they operate was $155.3 billion less than what the actual tax rates would have required. When considering not just the cash paid but money put aside for future taxes, the gap was still $100.2 billion.

“We got the cash taxes paid from the cash flow statement, and we got the cash provisions from the [income statement]” through U.S. financial filings, says Fair Tax Mark chief executive Paul Monaghan. These amounts were matched against the companies’ profits over the time period.

The result is the difference between what national tax laws would seem to expect and what companies can do using legal tax avoidance.

“The bulk of the shortfall almost certainly arose outside the United States, given this ‘foreign’ activity accounts for more than half of booked revenue and two-thirds of booked profits,” the report read.

Corporate taxation has been a contentious issue for a long time, with some profitable Fortune 500s paying no taxes in multiple years, again all on the legal level. The biggest savings are often owed to complex international strategies that strip profits from high-tax districts and shift them to low-tax ones.

But many countries have become increasingly concerned about a lack of tax revenues and are looking for ways to capture more, like France’s attempt to tax digital giants or a push by the Organisation for Economic Co-operation and Development (OECD) to change cross-country tax laws and practices. The upshot could mean significantly higher taxes for the technology elite and possibly an unwelcome surprise for many investors.

Fortune reached out to all the companies targeted by the report. Google and Amazon replied. Apple acknowledged the request but did not provide a comment. There was no response from Microsoft, Netflix, or Facebook.

War of definitions

Google sent a statement that read, in part, the report “ignores the reality of today’s complicated international tax system, and distorts the facts documented in our regulatory filings” and that “we pay the vast majority—more than 80%—of our corporate income tax in our home country.”

According to the company’s 2018 annual report, about 54% of consolidated revenues came from international markets. That raises the question of why 80% of taxes are paid on 46% of revenues, which would suggest that foreign countries aren’t getting equal shares.

Amazon claimed the “suggestions are all wrong” and, citing typically low margins in retail, said that “comparisons to technology companies with operating profit margins of closer to 50% is not rational.” The company also said that it “had a 24% effective tax rate on profits from 2010-2018—neither ‘dominant’ nor ‘untaxed.'”

According to Amazon’s third quarter earnings release, its AWS cloud computing segment had operating income of $2.3 billion, which was 25% of its net sales and almost 72% of its total operating income. Amazon’s 2018 annual report showed a net income of $11.3 billion and provision for income tax of just under $1.2 billion, or 10.6%.

But Amazon’s operations are complex, and tax discussions often come down to intricacies of accounting. For example, there are at least two different references to income tax that corporations typically show—the provision for income tax Amazon listed in one part of the annual report and actual cash payments show in another.

“It’s called the book tax difference,” says Fair Tax Mark’s Monaghan. Provisions show the cash taxes actually paid plus amounts kept aside for expected future tax requirements that might not actually happen because tax provisions aren’t a final statement of taxes. That can lead to complex interplays of numbers.

Going back to Amazon, in 2018 the provision for income tax happened to equal the cash tax paid that year. But in 2017, cash tax paid was $957 million with a net tax provision of $769 million. In 2016, the tax provision was $1.4 billion, with cash taxes of $412 million. Monaghan called Amazon’s numbers “impenetrable.”

“Overall, cash effective tax rates, on average, are lower than GAAP [standard U.S. accounting] effective tax rates,” says Stephen Lusch, assistant professor of accounting at Texas Christian University. “It’s not particularly surprising that someone looking to highlight low tax rates for tech multinationals will focus on the cash rate, while the company, seeking to combat the perception of ‘not paying its fair share,’ will focus on the GAAP rate in its rebuttal. As usual, the truth ultimately probably lies somewhere in the middle.”

Future changes?

“Since the US, France, UK, Germany, Japan, and Italy would all win—or at least lose less—under the OECD proposal, and the nations that currently win—[like] the Netherlands, Ireland, and Switzerland—are not as strong politically, the proposal has a chance,” says Kevin Rejent, an attorney and global risk consultant for Maggiore Risk.

Many of the companies in question are flush with money, but some could still face problems should big changes come.

“Facebook is most exposed,” Monaghan says, “because Facebook has the lowest amount of cash taxes going out, even though it’s a very high margin business in the United States, but apparently not elsewhere.”

Then there are the investors who could face big surprises. “There will be limited or no pricing in [of the risk in shares currently]” because too much is unknown, says Richard Asquith, vice president of indirect tax at tax software vendor Avalara. “It is far from clear which new tax regime will be implemented: the globally agreed OECD model or a proliferation of national inconsistent taxes. Since the US is getting cold feet on the OECD route, we are likely headed for the latter and a range of tax battles and retaliatory tariffs.”

Markets, and even the Silicon Six and other big corporations, still don’t know what the financial effects will be, although “investors think everything is fine,” Monaghan says.

In other words, investors may find the international scene still a place of intrigue, no matter how safe some of their investments have seemed.

More must-read stories from Fortune:

—2020 Crystal Ball: Predictions for the economy, politics, technology, and more

—Fortune poll: Two-thirds of Americans anticipate a 2020 recession

—Want stock market buying opportunities? There’s always a bear market somewhere

—The stock market has hit 19 new highs in 2019 alone. Why?

—Saudi Aramco IPO could be overvalued by as much as 35%

Don’t miss the daily Term Sheet, Fortune’s newsletter on deals and dealmakers.