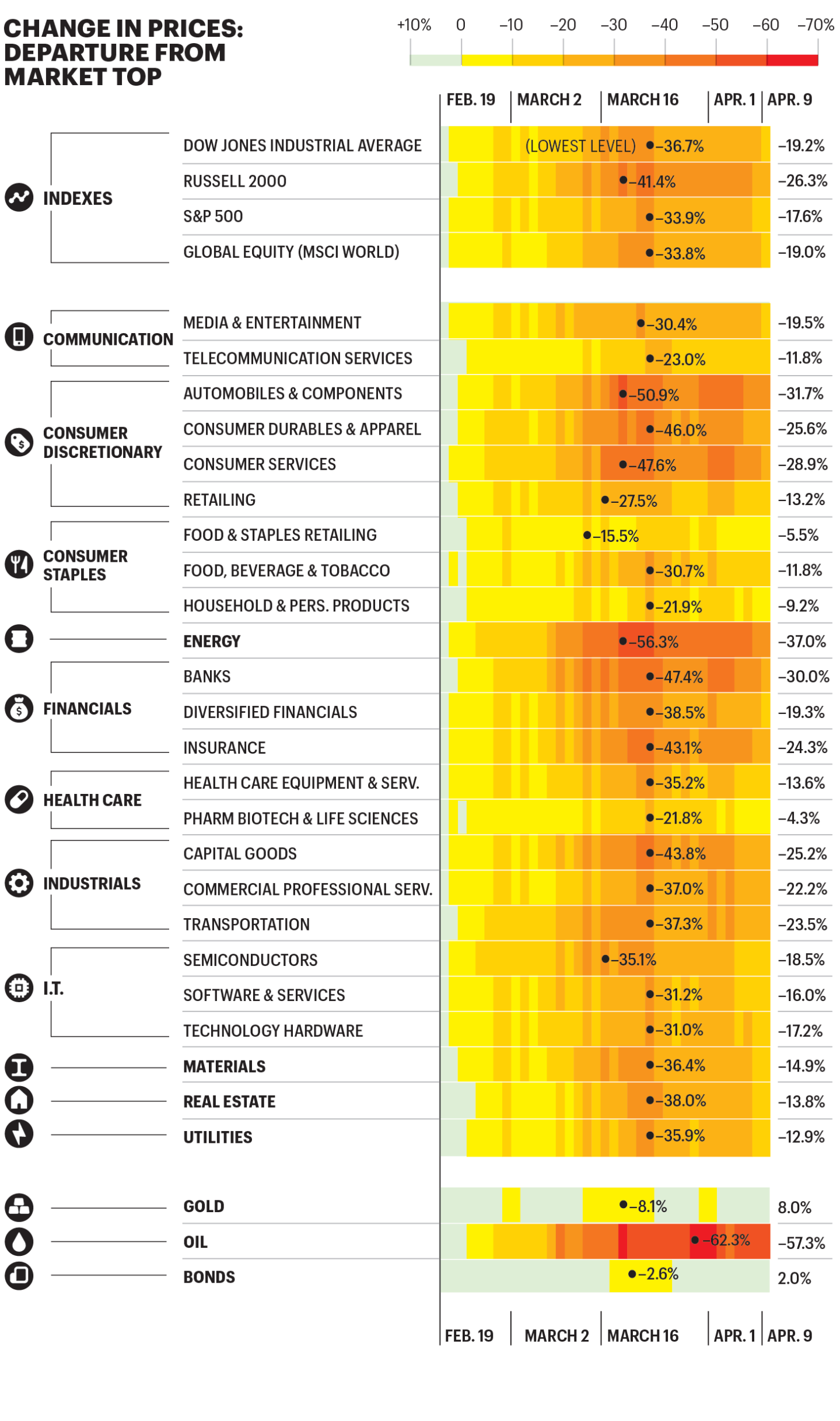

How every sector of the S&P 500 has been impacted by the coronavirus selloff

This article is part of a Fortune Special Report: Business in the Coronavirus Economy—a look at the impact of the pandemic on more than 50 industries.

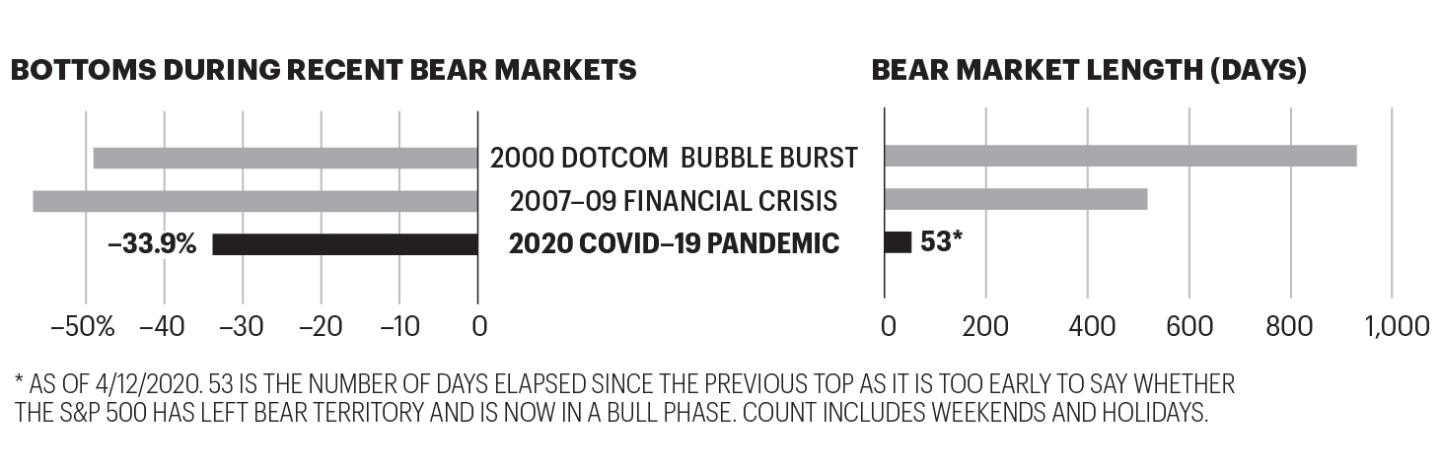

So far, this year has already featured the worst month for stocks (March) since October 2008 and the best week (early April) since 1974. But as chaotic and painful as the market swoon has been, it hasn’t yet surpassed the last major meltdown. Only one industry has plunged further from its high than it did during the Great Recession of 2007 to 2009—energy, thanks to an oil price war this spring between Russia and Saudi Arabia. Stock valuations, as measured by price/ earnings ratios, have stayed relatively buoyant too. Of course, it could be early days. The bear market that began in 2007 lasted 517 days. And it took 929 days to start a new bull market after the dotcom bubble burst. The good news: In both cases, stocks eventually soared again.

Sources: Bloomberg; Yardeni Research

A version of this article appears in the May 2020 issue of Fortune with the headline “A selloff, sector by sector?”

More must-read finance coverage from Fortune:

—Are SBA small business loans running out? What we know so far

—CEOs David Solomon and Brian Moynihan stand alone on Wall Street—literally

—College educated investors may be more likely to fall for coronavirus scams

—Stocks have gained 25% since their March lows—but the math doesn’t add up

—How Fortune 500 companies are utilizing their resources and expertise during the pandemic

—Listen to Leadership Next, a Fortune podcast examining the evolving role of CEO

—VIDEO: 401(k) withdrawal penalties waived for anyone hurt by COVID-19

Subscribe to Fortune’s Bull Sheet for no-nonsense finance news and analysis daily.