- Goldman Sachs forecasts gold could reach $5,000 if Trump’s attempts to undermine Federal Reserve independence triggers an investor flight from bonds, stocks, and the dollar. Separately, labor data remains mixed or weak, and Wall Street thinks a September Fed rate cut is virtually locked in. Global markets are mostly positive in early trading.

President Trump’s war against the Fed’s independence could cause so much damage to the bond, stock, and dollar currency markets that investors might flee further into gold, Goldman Sachs said today in a research note seen by Fortune. This in turn could push the price up to $5,000 per troy ounce. Gold is currently priced at $3,596 on the Comex exchange, up 36% year to date and near its all-time high.

The White House clearly wants more of its own people on the Federal Open Market Committee. Trump and his allies have asked for criminal investigations into U.S. Federal Reserve Chairman Jerome Powell (accused of misleading Congress) and Fed governor Lisa Cook (accused of false claims on mortgage documents). He has tried to fire Cook, and has made it clear Powell will be replaced with someone more politically aligned with his desire for lower interest rates.

With investors questioning the security of the Fed’s independence, that changes the game for safe-haven assets, Goldman’s Samantha Dart and her team told clients.

“A scenario where Fed independence is damaged would likely lead to higher inflation, higher long-end rates (lower bond prices), lower stock prices, and an erosion of the dollar’s reserve currency status. In contrast, gold is a store of value that doesn’t rely on institutional trust,” she wrote.

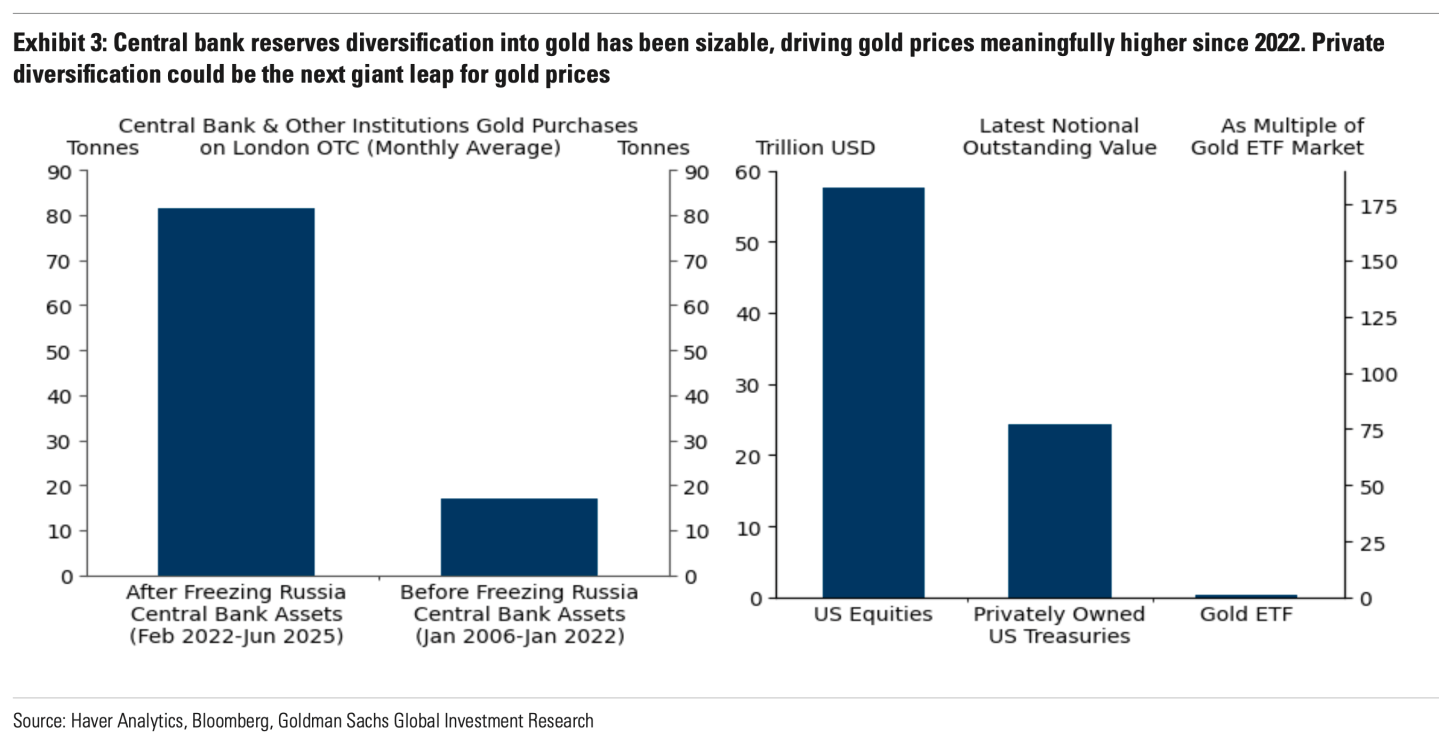

Dart forecasted a “tail risk scenario” of $4,500, but noted that it would not require a very large shift in demand to push gold over $5,000. The gold ETF market is only 1% of the size of the market for Treasuries, she said. And, vice versa, “we estimate that if 1% of the privately owned U.S. Treasury market were to flow into gold, the gold price would rise to nearly $5,000/[troy ounce], assuming everything else constant.

“As a result, gold remains our highest-conviction long recommendation in the commodities space.”

Meanwhile, in the jobs market, ADP will report private payroll numbers today. That survey is only a slice of the labor market and is not considered a reliable guide to the jobs economy as a whole, but a weak number is expected given yesterday’s job openings (JOLTS) number.

“Job openings fell more than expected to 7.2 million; it’s the uptick in layoffs to 1.8 million that’s more concerning,” ING’s Francesco Pesole said in a note this morning. “The Fed’s hawkish dissenter (and chairman front-runner) Christopher Waller said the weekly reports received from ADP showed continued deterioration. Consensus is for a slowdown from 104K to 68K today.”

Nonfarm payrolls—the big jobs number—comes out tomorrow.

And Fed cuts are being baked in. According to CME’s FedWatch tool this morning, there’s a nearly 98% probability of a September base interest rate cut. The only disagreement among Wall Street analysts is how many cuts the Fed will deliver and when.

“Atlanta Fed president Raphael Bostic said Wednesday that rising inflation presents a greater risk to the Federal Reserve’s dual mandate than a deteriorating labor market even as hiring has slowed, and a single 25 bp rate cut this year would appropriately reflect the rising risk to the Fed’s full employment goal. Minneapolis Fed president Neel Kashkari said inflation is still too high and he is not yet in the camp that tariff-driven inflation will be a short-term phenomenon,” RBC’s Peter Schaffrik told clients.

At Deutsche Bank, Jim Reid and his team noted that Fed governor Christopher Waller “reiterated his expectation that the Fed should cut at the next meeting and favored multiple cuts over the next few months. In addition to the JOLTS release, his labor market concerns got some support from the Fed’s latest Beige Book, which saw seven of the 12 Fed districts report that ‘firms were hesitant to hire workers because of weaker demand or uncertainty.’”

Here’s a snapshot of the markets globally this morning:

- S&P 500 futures were up 0.22% this morning. The index closed up 0.51% in its last trading session.

- STOXX Europe 600 was up 0.61% in early trading.

- The U.K.’s FTSE 100 was up 0.23 in early trading.

- Japan’s Nikkei 225 was up 1.53%.

- China’s CSI 300 was down 2.12%.

- The South Korea KOSPI was up 0.52%.

- India’s Nifty 50 was flat before the end of the session.

- Bitcoin sank to $110.7K.