Power is precarious: The more of it you possess, the more competitors you attract, gunning for your customers, star employees, and market share. We drilled down on five of the biggest rivalries in business, across chips, AI, EVs, investing and finance, and energy. And though these incumbents and rising rivals are fierce, never count out the dark horses who are hungry for a spot at the top.

Check out the 2025 Fortune Most Powerful People list here.

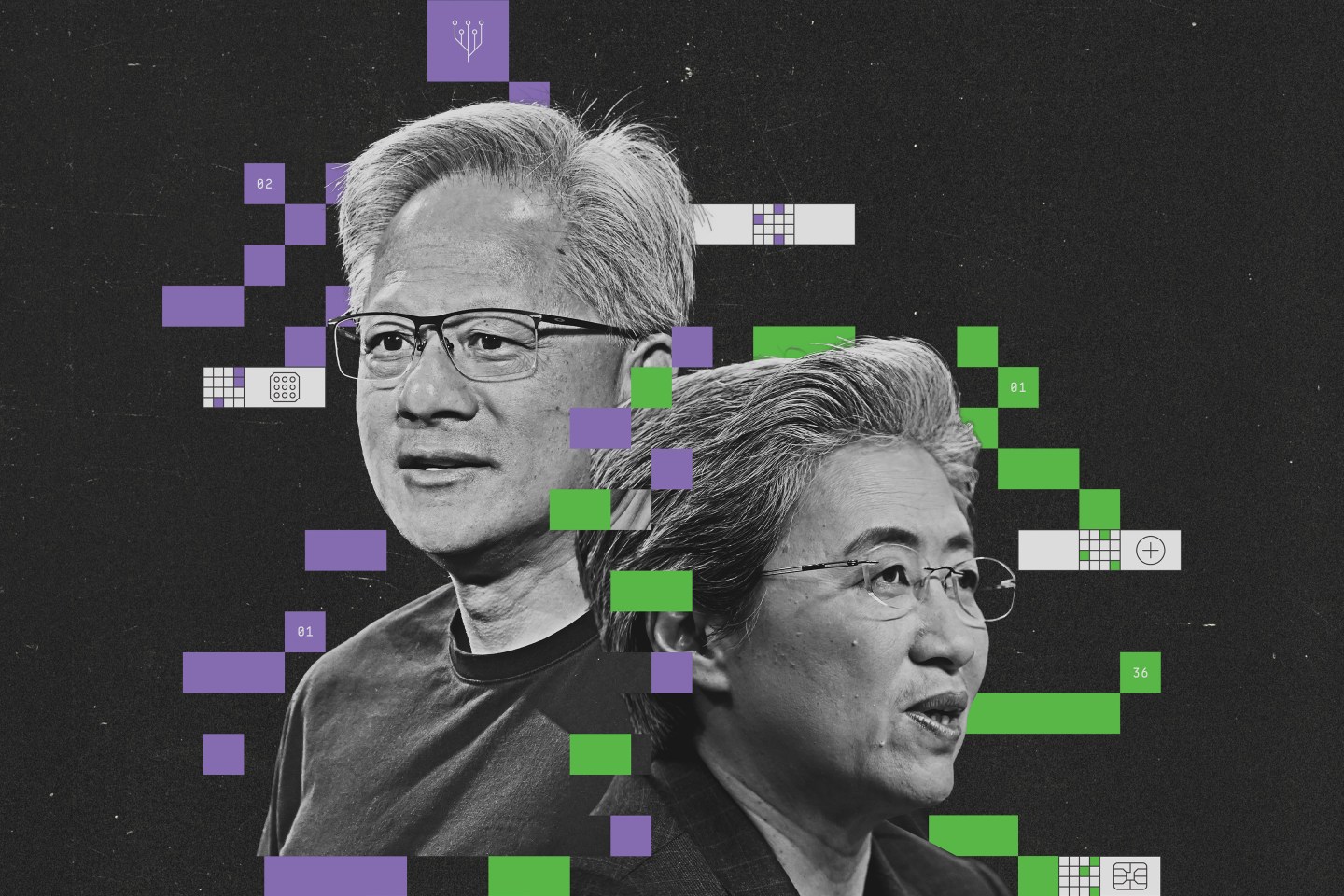

AI chips

Jensen Huang

CEO, President, and Cofounder, Nvidia — U.S.

Nvidia CEO Jensen Huang might be forgiven for taking a moment to savor his company’s meteoric rise to the top of the stock market, driven by soaring demand for its high-performance chips that power generative AI. Now the most valuable company in the world, Nvidia controls over 90% of the market for the specialized chips used to train and run AI systems—cementing its dominance in the hardware race fueling the AI boom. Still, Huang is keeping an eye on the horizon. AMD is positioning itself as a viable alternative, while startups like Groq, Cerebras, and SambaNova are betting on custom chips designed to accelerate AI inference. None pose a serious threat to Nvidia’s dominance—yet.

Lisa Su

CEO and Chair, AMD — U.S.

AMD CEO Lisa Su never met her first cousin once removed, Jensen Huang, until both had risen to lead two of the most powerful chipmakers in the world. “There were no family dinners,” Su said in a recent interview. “It is an interesting coincidence.” But the two can’t avoid each other now. With corporate headquarters just miles apart in the same Silicon Valley town, AMD is pushing hard to establish itself as a viable second source for AI chips amid surging demand. The company has secured wins from major players like Microsoft and Meta—both eager to diversify their supply chains and reduce dependence on Nvidia’s tightly controlled hardware and software ecosystem. —Sharon Goldman

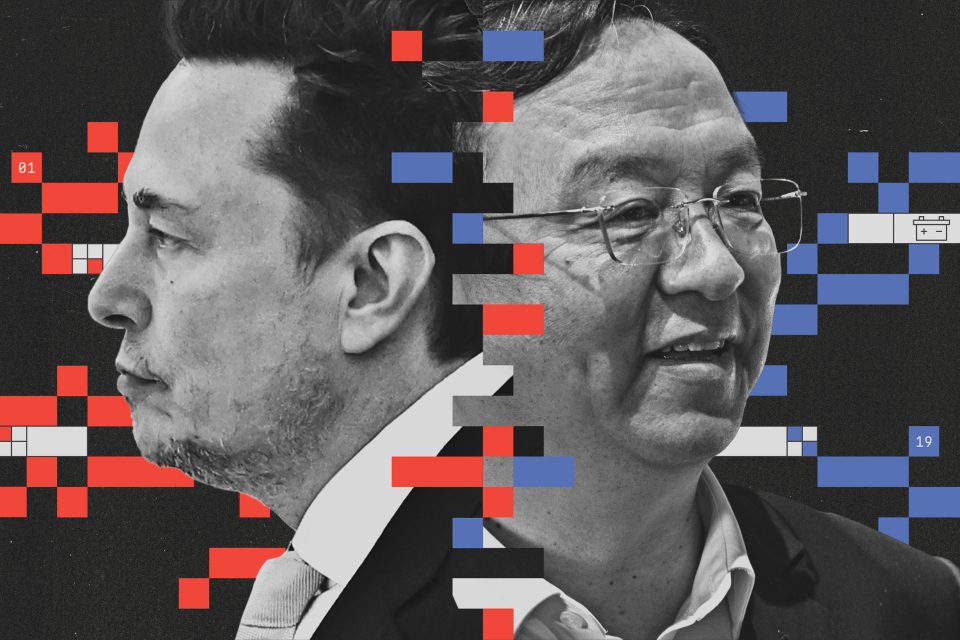

Electric vehicles

Elon Musk

CEO, Cofounder, and other roles, Tesla, SpaceX, xAI, and others — U.S.

Elon Musk, the man who brought EVs to the masses, has seen Tesla’s fortunes erode as he gets entangled in social media and politics. Tesla’s annual deliveries in 2024 declined for the first time ever, and have continued to decline year over year each quarter since. Musk has bet the future on Tesla’s AI and camera-only self-driving system, with a soft robotaxi launch in June and the ongoing development of its humanoid robot. Critics argue the company’s self-driving tech is well behind that of competitors like Alphabet’s Waymo and BYD. While Tesla is still the most valuable auto company in the world, it’s not clear it will keep the top spot.

Wang Chuanfu

CEO, Chairman, and Founder, BYD — China

The late Charlie Munger, one of the most successful investors of all time, described Wang Chuanfu, founder and CEO of BYD, as a hardworking “genius.” In 2023, when BYD began dueling with Tesla for the top spot in EV sales, the U.S. auto industry started paying attention. BYD’s affordable models, ultrafast charging technology, and complimentary driver assistance systems have helped the company garner 20% of the global EV market. BYD is also the world’s second-largest EV battery manufacturer to date, with its innovative Blade Battery using iron and phosphate to help keep prices low. —Jessica Mathews

Artificial Intelligence

Sam Altman

CEO and Cofounder, OpenAI — U.S.

Altman’s leadership of OpenAI has made him one of Silicon Valley’s most powerful, and polarizing, figures. The AI company is rapidly ascending to tech’s top table, with more than 780 million weekly ChatGPT users, big corporate and government customers, and expansion plans in areas ranging from office productivity software to a new hardware device being built by former Apple designer Jony Ive. Valued at almost $300 billion in a venture capital round led by SoftBank in March, OpenAI is on track to generate more than $10 billion in revenue this year (while still losing billions of dollars annually).

Mark Zuckerberg

CEO, Chairman, and Founder, Meta — U.S.

Altman’s meteoric rise has made him plenty of enemies. He fell out with Elon Musk years ago and has clashed recently with Meta’s Mark Zuckerberg, who has been poaching OpenAI staff with multimillion-dollar comp packages. Google DeepMind competes with OpenAI to build the most capable AI models, and ChatGPT also poses an existential risk to Google’s dominance of internet search. Meanwhile, there’s no love lost between Altman and the Anthropic cofounders, who defected from OpenAI in 2021 in part because of concerns about Altman’s leadership and commitment to AI safety. —Jeremy Kahn

Finance

Jamie Dimon

CEO and Chairman, JPMorgan Chase — U.S.

As he closes in on his 20th anniversary as CEO of the country’s biggest bank, Jamie Dimon is the undisputed dean of Wall Street and is poised to go down in history as one of the greatest bankers of all time. In times of crisis, the markets turn to Dimon as a source of clear and unvarnished authority. His stature grew in 2024 when he led JPMorgan Chase to record profits of $58.5 billion on $278.9 billion in revenue. Dimon has also responded to growing competition from the private equity world by having JPM establish private credit facilities of its own—and issuing a warning shot to Apollo and others to stop poaching junior bankers.

Marc Rowan

CEO, Chair, and Cofounder, Apollo Global Management — U.S.

Marc Rowan, a onetime corporate lawyer, has emerged in recent years as the dominant figure in the fast-growing world of private equity. In 2021, Rowan became CEO of Apollo, which he cofounded, and carved out a bold strategic shift revolving around private credit, a field that has doubled over the past five years to around $2 trillion. The pivot was highly lucrative, helping Apollo notch $1.49 billion in profits in Q4 of 2024. Rowan’s private credit charge poses a growing challenge to traditional banks like JPMorgan Chase, as Apollo and others become the go-to lending venues for large companies and institutions. —Jeff John Roberts

Energy

Darren Woods

CEO and Chairman, Exxon Mobil — U.S.

Having missed out on the U.S. shale gas boom, Exxon Mobil was playing catch-up when Darren Woods took over as CEO in 2017. While it was the largest publicly traded company by market cap as recently as mid-2013, Exxon bottomed out amid the pandemic in 2020 when it was kicked out of the Dow, and archrival Chevron briefly surpassed it in value for the first time ever. But Woods’ focus on capital discipline, shareholder returns, and M&A has Exxon back on top of the industry, where it leads shale output in the booming Permian Basin. Its oil discoveries in offshore Guyana are the envy of the energy world.

Mike Wirth

CEO and Chairman, Chevron — U.S.

A Chevron lifer who joined as an engineer in 1982, Mike Wirth took over in 2018—one year after Woods at Exxon Mobil. After serving as the energy darling of investors for a few years, Chevron now faces a revitalized Exxon. They’re rivals in the Permian Basin. They just settled a long arbitration rivalry over a dispute in Guyana. They’re even rivals in the burgeoning U.S. lithium business. Both stayed focused on fossil fuels and related low-carbon ventures while Europeans BP and Shell struggled to grow green energy. Meanwhile, TotalEnergies is the only oil major doubling down on a renewable energy focus. —Jordan Blum

This article appears in the August/September 2025 issue of Fortune.