Good morning!

Retirement is a fraught subject for many American workers. Longer life spans, the rise of gig work, and soaring inflation are all reasons to make people fret about whether or not they have enough saved up for their golden years.

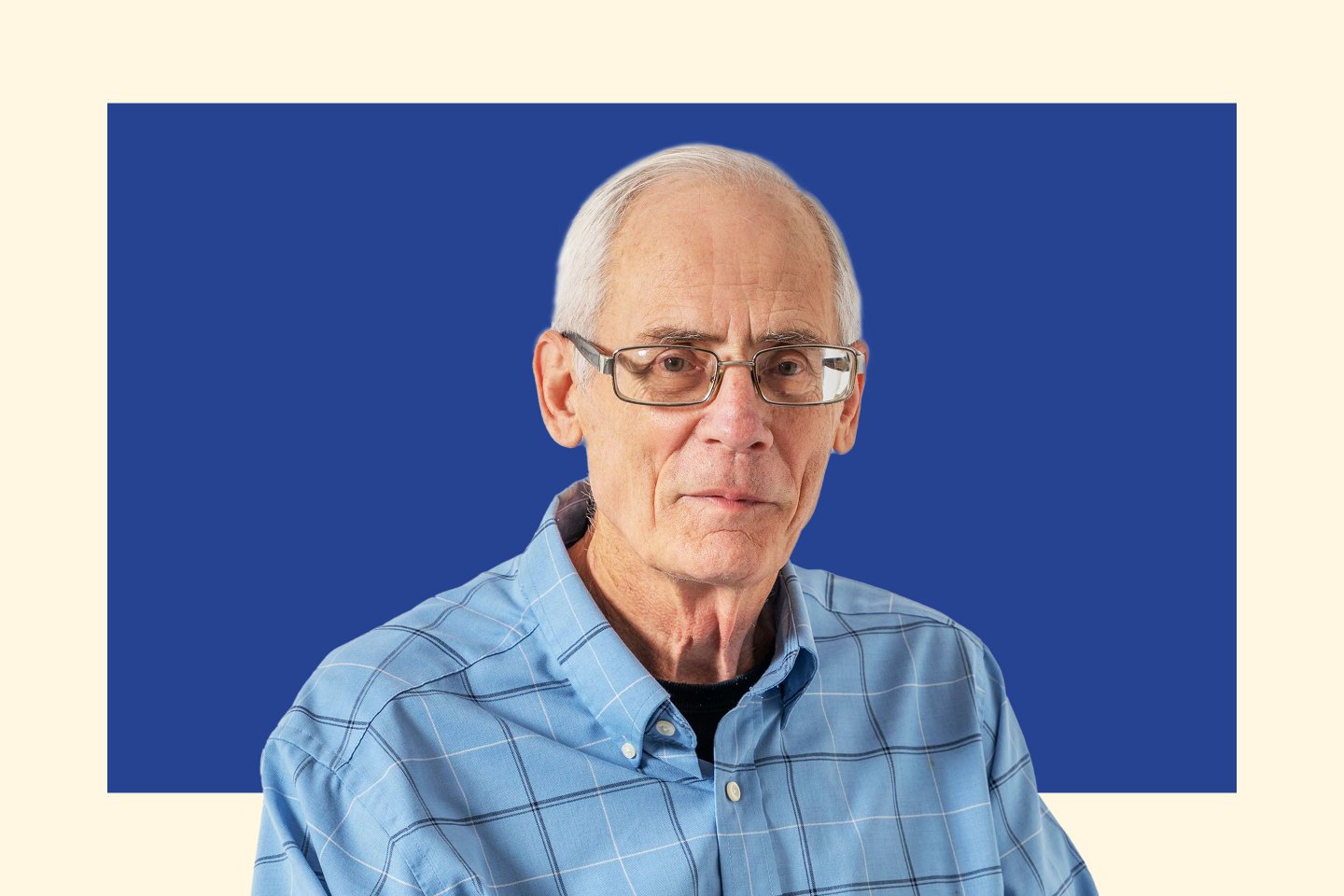

The death of pensions means that most Americans (if they’re saving for retirement at all) try to put money into their 401(k). About 35% of working Americans currently have 401(k)s, making it the most utilized retirement option, according to a 2020 census report. But that investment vehicle, beloved by employers across the U.S., is still a relatively new invention and a political “fluke,” according to Ted Benna, and he should know—he invented it.

Commonly referred to as the “father of the 401(k),” Benna told me he has no regrets about creating a plan that has turned so many “spenders into savers.” But he adds that the 401(k) has also turned into something he never intended it to be, particularly when it comes to fees he thought would be covered by employers, and have instead been pushed onto workers.

“It was never designed to be what it is today,” he told me. “I became very disturbed by what happened with investment expenses.”

Benna also had some ominous warnings about what retirement might look like in the future.

“We definitely need a healthy economy and robust stock market forever,” he said. “The question is, will we have them forever?”

Read all about what kind of businesses he thinks the 401(k) is really right for, his concerns about tensions between retirees and workers, and what he would do if he had to do it all over again.

You can read my full interview with him here.

Emma Burleigh

emma.burleigh@fortune.com

Around the Table

A round-up of the most important HR headlines.

Scammers are targeting job-seeking college students by falsifying professor emails and encouraging them to apply to open positions, only to steal their personal information. Wall Street Journal

Tesla’s top HR executive has bowed out of her role at the company as the car manufacturer continues layoffs. Bloomberg

The U.S. labor market cooled a bit in March, as employers struggled to fill 8.5 million open positions and the number of workers who quit their jobs fell to 3.3 million. New York Times

Watercooler

Everything you need to know from Fortune.

Prep school. A London college is piloting a 12-hour school day, featuring public speaking and other etiquette lessons, in an effort to prepare Gen Z students for the job market. —Orianna Rosa Royle

Kid funding. Southern states are expanding child care options for employees in order to keep parents with a job in the workforce. —Ariel Gilreath, AP

New playing field. The applications for H-1B visas, which are designed for highly-educated workers, dropped 40% this year after the federal government instituted a limit of one application per person. —Elliot Spagat, AP

This is the web version of CHRO Daily, a newsletter focusing on helping HR executives navigate the needs of the workplace. Sign up to get it delivered free to your inbox.