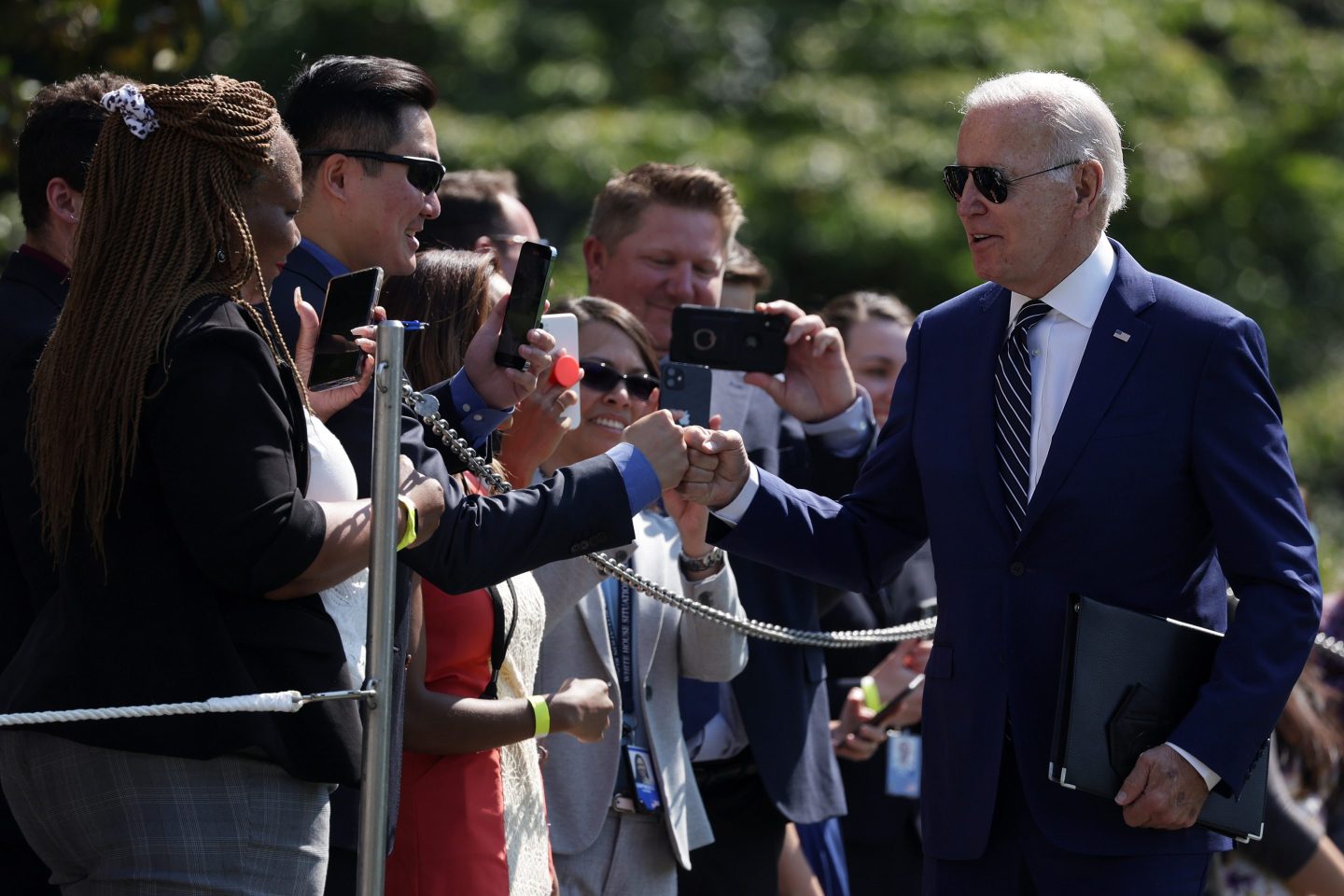

What once seemed like a pipe dream for borrowers is now a reality. President Joe Biden announced Wednesday that his administration will forgive $10,000 in student loan debt per federal borrower earning under $125,000 per year during the pandemic.

That will erase an estimated $300 billion of debt, according to an estimation by the Penn Wharton Budget Model, and benefits would go disproportionately to working- and middle-income households, while almost excluding the richest Americans. One-third of borrowers will have their debt completely eliminated, according to data from the U.S. Department of Education.

Biden also announced that Pell Grant recipients who earn less than $125,000 per year during the pandemic—$250,000 for married couples or heads of household—will have up to $20,000 in debt erased. That forgiveness was not part of the earlier calculations, but expands the benefits of the proposal significantly for low-income borrowers.

Democrats have been pushing for student debt cancellation for years as one way to address ballooning balances, racial inequities, and a debt load that has been found to hinder the economic prospects of an entire generation. It wasn’t until Biden won the 2020 election, though, that the measure seemed like a possibility.

“Potentially millions of people are going to see their entire balance wiped out or cut in half,” says Jacob Channel, an economist at Student Loan Hero. “So while it might not seem like a lot to some, either way you look at it, it’s a really big gift for many people. I think it will have a profound impact in the long term.”

Biden tweeted that relief was coming, and said he would announce more details Wednesday afternoon.

There will be an application for borrowers to submit, according to the Department of Education, which will be available “no later” than when the federal payment pause ends at the end of the year.

Nearly 8 million borrowers may be eligible for automatic relief because “relevant income data is already available” to the Department of Education.

Biden campaigned on canceling $10,000 in debt per borrower, but his administration has been slow to take action, reportedly debating for the past few months how much student loan debt should be forgiven and who should qualify.

How much student loan debt will be forgiven?

Borrowers with federal undergraduate and graduate student loans will have up to $10,000 from their total balance forgiven.

Additionally, those with Pell Grants—an estimated 60% of borrowers—will receive up to $20,000 in forgiveness. And an estimated 27 million borrowers will qualify for up to $20,000 in relief, according to the Department of Education.

Who qualifies for student loan forgiveness?

Biden’s plan limits forgiveness to individuals earning under $125,000 per year during tax years 2020 or 2021. The Department of Education estimates that nearly 90% of relief dollars will go to those earning less than $75,000 a year. No one in the top 5% of households by income in the U.S. will qualify for relief.

Students currently in school with loans also qualify for forgiveness. If they are dependents, the Department of Education will use their parents’ income to judge eligibility. Loans must have been originated before July 1, 2022, to qualify.

Forgiveness will primarily help those under 40, according to the New York Fed. Those over 60 benefit the least.

How will student loan forgiveness work?

According to the White House and the Department of Education, many borrowers will need to apply for forgiveness. A form will be made available before the end of the year.

That said, the Department of Education says it already has the income information for an estimated 8 million people. They may receive forgiveness automatically.

How many people will be eligible for forgiveness?

The White House reports that if “all borrowers claim the relief they are entitled to,” 43 million people will receive student debt forgiveness.

That includes 20 million people who will have their balance completely eliminated.

Will recipients owe taxes on the forgiven debt?

Thanks to a provision of the American Rescue Plan (ARP), the economic stimulus bill passed in 2021, any student debt forgiven this year (and any forgiven through 2026) will not be taxed.

Typically, canceled debt is treated as income, meaning recipients of student loan forgiveness would pay income tax on it. That can lead to surprise tax bills for many who weren’t expecting it. While those borrowers are still likely better off in the long run, that can put a damper on cancellation in the short term.

That said, it is possible borrowers might owe state income tax, depending on where they live. They should be on the lookout for state governments to make an announcement of how the taxes would work.

When will the debt be forgiven?

It is not clear when the debt will actually be forgiven. So far, the White House has said that it will “work quickly and efficiently to set up a simple application process for borrowers to claim relief,” which will be available by the end of the year. It could take longer than that for the forgiveness to be reflected in borrowers’ accounts.

What else did Biden announce?

Biden announced a bevy of other changes, including reducing the amount of money borrowers must pay on income-based repayment plans and making some of the temporary changes his administration made to the Public Service Loan Forgiveness program permanent.

He also announced that the federal student loan payment pause will be extended through the end of the year. Federal borrowers have not had to make a student loan payment since the start of the COVID-19 pandemic.By the end of April, the moratorium had cost the federal government an estimated $102 billion in unmade interest payments, according to a report from the Government Accountability Office.

An historic effort

Even before Wednesday’s announcement, Biden had forgiven more student loan debt than any other president. Most of that debt was held by borrowers who were defrauded, or already in an existing loan forgiveness program. That the vast majority of student loan borrowers will qualify to have $10,000 of debt forgiven is historic, says Suzanne Kahn, managing director of research and policy at the Roosevelt Institute.

In particular, it’s a “win” for making higher education more equitable in the future, she says.

“Part of what canceling student debt is is an acknowledgement of the racially and inequitable ways that student debt played out,” says Kahn, noting that canceling $10,000 would “zero out the debt of 2 million Black borrowers.” Forgiving debt is one way to help close the racial wealth gap in the U.S.

There is no shortage of critics of cancellation. Republicans say forgiveness benefits wealthier individuals and those who “need” forgiveness the least.

Some progressives argue Biden isn’t going far enough. Many politicians—including Massachusetts Sen. Elizabeth Warren, New York Sen. Chuck Schumer, and New York Rep. Alexandria Ocasio-Cortez—and organizations like the NAACP have been pushing for $50,000 in student debt forgiveness, which they say would have a bigger impact on the student loan crisis.

Moreover, canceling some debt doesn’t solve the underlying issues of college financing in the U.S. The Committee for a Responsible Federal Budget estimates that with $10,000 in forgiveness, it would take just four years for outstanding debt to return to its current level of $1.6 trillion.

But the Roosevelt Institute’s Kahn is hopeful that this is a first step “toward repairing our very broken higher education system.”

“The power of the cancellation, in addition to it being a tremendous help to millions and millions of borrowers—it’s a moment to think about how we reform higher education,” she says. “It’s an admission that we’ve done it wrong.”

This is a developing story. Check back for more details.

How will student loan forgiveness affect you and your finances? Please email reporter Alicia Adamczyk to be featured in a future article.