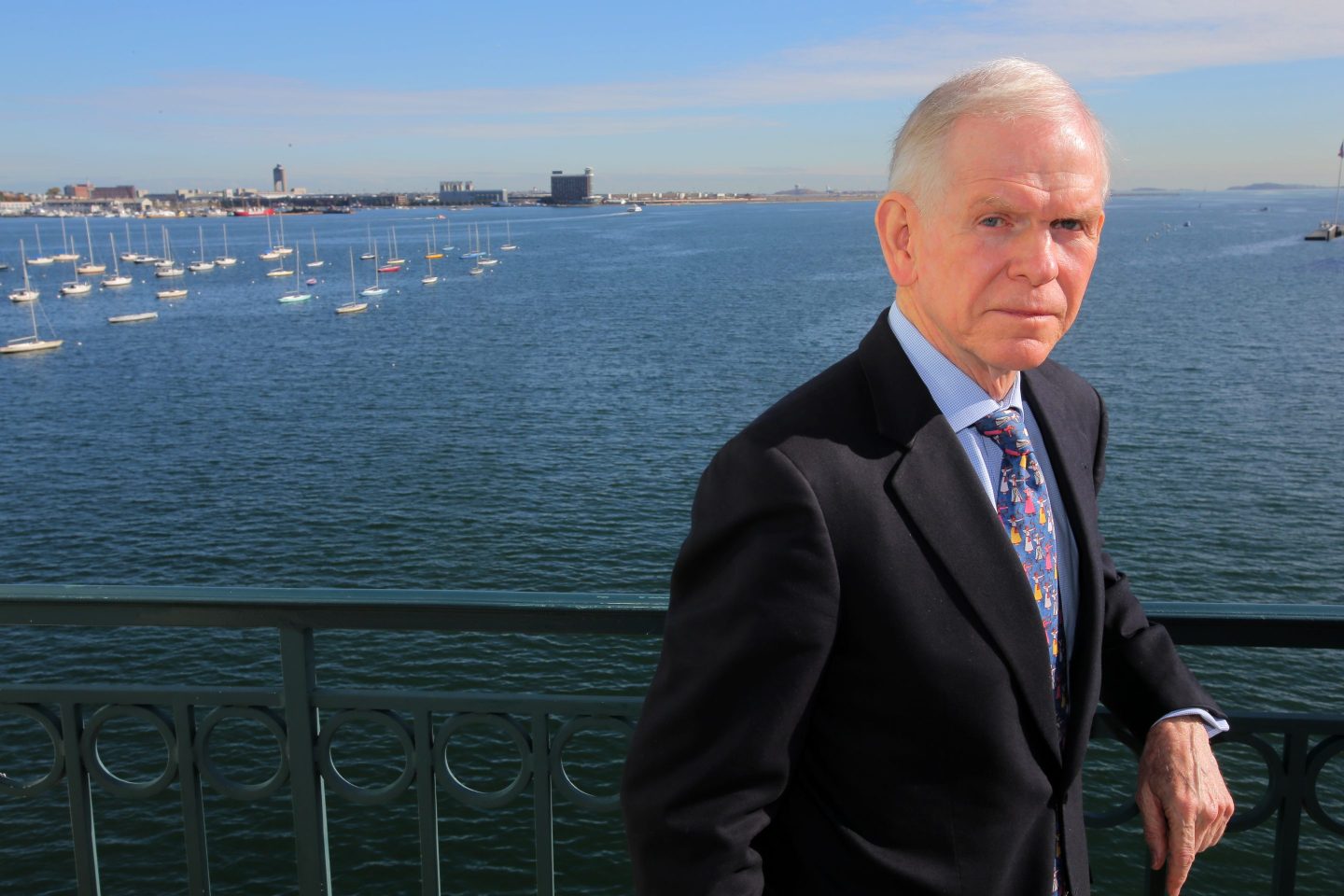

Wall Street titan Jeremy Grantham said this week that even after the S&P 500’s poor start to the year, he expects more declines ahead for the stock market.

“It’s likely that there will be considerably more pain before this is finished,” he said in a Monday interview with the Associated Press, arguing that the S&P 500’s fair value is “pretty close to 3,000,” as opposed to the 3,970 the index traded at on Wednesday.

If Grantham, the chief investment strategist of the asset management firm Grantham Mayo Van Otterloo, is right, it means the S&P 500 has another 25% drop ahead of it from current levels.

And things could get even worse from there.

“There is absolutely nothing to stop the market from going below fair value. It’s certainly entitled to spend several months below 3,000,” Grantham said.

As far as when Grantham expects the market downturn to end, he argued it’s hard to tell.

“This can be quick, like six months. Or it can be drawn out like in 2000, which took almost three years. You can’t really know if it’s going to be quick or long,” he said.

What is guaranteed, in Grantham’s view, is that corporate earnings will fall as recession fears and interest rates rise, leading stocks to take a hit.

The ‘superbubble’

Grantham has argued since last year that U.S. stocks and the housing market are in a “superbubble” created by an era of rampant speculation in risky assets.

“We have been through one of the great speculative periods,” he said this week, reiterating his point that a mix of aggressive fiscal stimulus and loose monetary policy combined to create “a perfect environment for speculating” in 2020 and 2021.

Grantham made the case that this speculation will turn out to be “very expensive” for investors who bought in, as once high-flying stocks continue to retreat to more reasonable valuations this year.

“People were at home, bored out of their minds and getting a check from the government, so why not speculate? They found on the web many ways of doing it, superficially cheaply, but that kind of investing has always turned out to be for most people incredibly expensive,” he said. “In the end, the money tends to transfer from the amateurs to the professionals.”

Grantham also noted that mid-career professionals are likely to be hurt the most by the bursting economic “superbubble” as retirees have already benefited from the rise in the stock and real estate markets, while also collecting Social Security, and younger workers will have time to watch their portfolios rebound.

“If you have another 30 years, you should welcome lower prices because the compounding effect will be greater than the pain on your portfolio. And maybe a lot bigger. The younger you are, the more you should welcome a market decline,” he said.

Why you might want to listen

Grantham is well known on Wall Street for his consistently pessimistic economic views, but the British investor has become famous for some prescient predictions as well.

In September 2007, Grantham wrote an article for Fortune titled “Danger: Steep Drop Ahead” in which he detailed how an international credit crisis would cause the U.S. housing market to break, corporate profit margins to sink, and stocks to collapse.

He turned out to be right. The U.S. housing market did break, and just six months after his Fortune article was published, the Great Financial Crisis began taking its first victims as the investment banking powerhouse Bear Stearns collapsed.

Some Wall Street analysts argue that even a broken clock is right twice, and that Grantham is nothing but a “permabear”—investor lingo for someone who is always pessimistic about the economy.

But the legendary British investor has been right more than often enough to lend weight to his predictions. He also foresaw Japan’s 1989 asset bubble and the dot-com bubble in 2000. And this time, he says the stock market’s “superbubble” is even worse than what was seen in tech stocks in 2000.

Sign up for the Fortune Features email list so you don’t miss our biggest features, exclusive interviews, and investigations.