This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning, Bull Sheeters.

Despite rumblings in Washington of fresh tax hikes, a risk-on atmosphere has returned to the markets. After five straight declines on the S&P 500, U.S. futures point to a solid start to the week. They’re following European shares higher.

In a further bullish sign, crude is higher. Crypto is faltering, however. That might have something to do with the Democrats proposal to slap new taxes on holders of alt-coins.

Speaking of the T-word, in today’s essay, I look at what a tax hike might mean for your portfolio.

But first, let’s see what’s moving markets. We begin out East.

Markets update

Asia

- The major Asia indexes are lower in afternoon trading with the Hang Seng down 1.5%.

- Chinese tech stocks took a tumble out of the box this morning following a Financial Times report the government is mulling the breakup of Alipay, the fintech giant run by Ant Group. Alibaba was off more than 5% in Hong Kong on the news.

Europe

- The European bourses were bouncing back with the Stoxx Europe 600 up 0.4% mid-morning.

- Britain will not go the way of Italy and France, deciding to ditch (for now) a plan to introduce vaccine passports for nightclubs, discos and large public events.

- Shares in Valneva, the French biotech firm working on a COVID-19 vaccine, fell a whopping 45% in the opening minutes on Monday after informing the markets its biggest client, the U.K. government, had pulled out of its contract.

U.S.

- U.S. futures look to start the week with a bit of momentum. That’s after the major averages finished down for the week, bringing the Big Three into the red for September.

- Shares in Apple were down 0.2% pre-market, underperforming Nasdaq futures, after the iPhone maker lost a stunning court decision on Friday that could upend its high-margin App Store business.

- What’s on tap this week? We have CPI data (Tuesday) retail data (Thursday) and a preliminary read on University of Michigan survey (Friday), which should tell us something about inflation, the health of the global supply chain, and consumer confidence.

Elsewhere

- Gold is flat, trading below $1,815/ounce.

- The dollar is a tick higher.

- Crude is climbing, with Brent above $73/barrel.

- Bitcoin is flat, trading below $45,000. It’s off more than 11% over the past seven days.

***

Four horsemen of the stockalypse

With stocks down for the month, Wall Street analysts are growing increasingly bearish on the rest of 2021. They’re concerned about Delta, Fed policy—will the central bank taper or not?—and the resulting hit on inflation/growth. Enter a fourth horseman: taxes.

Reports coming out of Washington this weekend say House Democrats are readying a number of hikes, including increases to the corporate rate, to capital gains and new measures for crypto holders to help pay for some of President Biden’s $3.5 trillion economic plan.

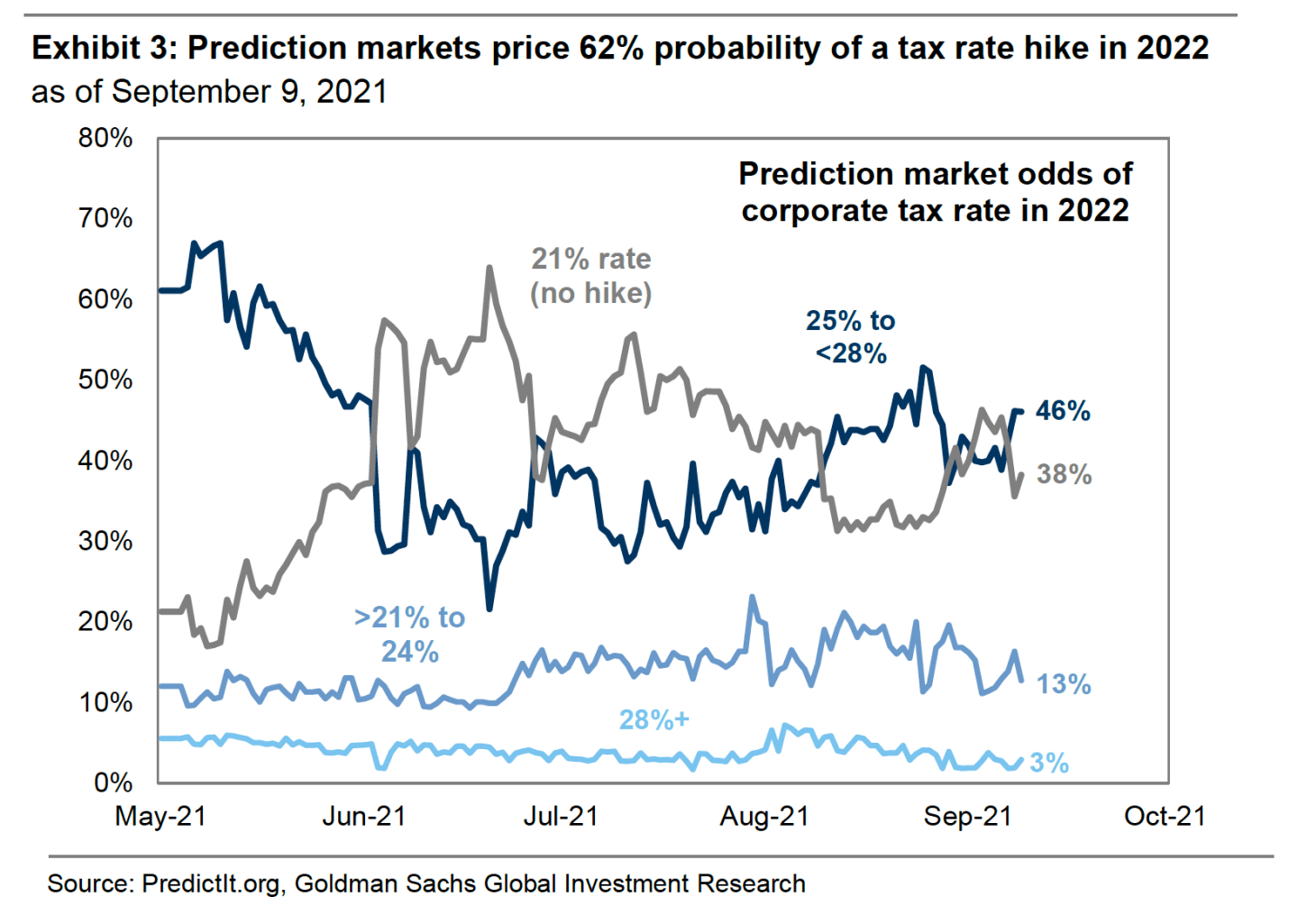

We’ve long known a tax increase (or two, or three) would be floated by year-end, and yet, according to Goldman Sachs, the markets haven’t fully priced that hit in. Any change in the tax code will drag on corporate earnings next year, and that will mess with valuations. In fact, Goldman thinks taxes now represent a bigger headwind to the markets than global growth fears.

The impact of a tax hike of course depends on the ultimate number. Still, Goldman makes the following calculation based on a 25% corporate rate:

Our 2022 S&P 500 earnings forecasts incorporate our political economist’s expectation that a scaled-down version of the tax plan proposed by President Biden will pass into law. Relative to current policy, we estimate that a hike in the domestic statutory corporate tax rate to 25% and the passage of about half of the proposed increase to tax rates on foreign income will reduce S&P 500 earnings by 5%.

House Democrats have indeed come down from Biden’s campaign-trail proposal of raising the corporate rate to 28%. They’re floating 26.5% at the moment—a bit above the Goldman number.

It appears the Democrats have done their homework. The odds suggest a rate of between 25-28% is the most likely outcome.

Quite a bit has to play out still before any change in the tax code becomes law. But, if Goldman is right, you should accept the fact that it’s becoming increasingly likely, and that it could impact your portfolio.

So, here’s their tip on how to play it: go value over momentum, they say.

“In the uncertain economic and tax policy environment, stocks with stable earnings and strong balance sheets should continue to outperform,” the Goldman team writes in an investor note.

***

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

This chart shows why the housing market may see an end-of-September shock—Fortune

Delta used this ‘negative incentive’ strategy to get employees vaccinated—Fortune

U.S. Stock Market Faces Risk of Bumpy Autumn, Wall Street Analysts Warn—Wall Street Journal

Market candy

Will Social Security be there when you retire?

In much of the rich world, state-managed pension programs are under threat of running out of dough, leaving some future retirees in doubt about whether they'll get all the money they've been promised. In the United States, lawmakers have circled 2033—that's just 12 years out—as the year in which the money coming into Social Security will not fully cover payouts. Longtime Fortune columnist Ben Carlson, of Ritholtz Wealth Management, is not worried, however. He outlines three big reasons why you shouldn't be either.

Our mission to make business better is fueled by readers like you. To enjoy unlimited access to our journalism, subscribe today.