This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, Bull Sheeters. U.S. future are mixed ahead of a gusher of Q3 earnings reports, beginning later today. Yesterday, the markets rallied, with the Nasdaq notching its best trading day in a month. Investors are watching Amazon (it’s Prime Day), Apple (it’s new iPhone day) and Johnson & Johnson (bad news on the COVID vaccine front).

Let’s see what’s moving the markets.

Markets update

Asia

- The major Asia indexes are higher in afternoon trading with Hong Kong’s Hang Seng soaring again, up 2.2%, and up more than 6% over the past two weeks.

- “Time is on China’s side and it’s not on the United States’ side,” says hedge fund king Ray Dalio. He points to China’s methodical handling of the coronavirus, its steady monetary policy and the excitement over Chinese IPOs as reasons why investors see big potential in the world’s No. 2 economy.

- Last week OPEC gave a glum assessment of the oil market. Now it’s IEA saying oil demand won’t rebound to pre-pandemic levels until 2023 at the earliest and that we will almost certainly hit peak oil by the end of the decade.

Europe

- The European bourses are down with the Europe Stoxx 600 off 0.4% a half-hour into the trading session as concerns grow over a series of new lockdown measures introduced across parts of Europe. The euro and British pound are down too.

- Pubs and bars will be shut in the hardest hit parts of England under Boris Johnson’s latest efforts to corral COVID, moves that are creating further rifts between the British PM and his allies.

- U.K. banks stocks fell on Monday after the BOE sent out a fact-finding letter to lenders inquiring, How would you fancy negative interest rates? BOE Governor Andrew Bailey had to later clarify the central bank is merely collecting input on sub-zero rates, not drawing up plans. Tough crowd.

U.S.

- Dow and S&P futures point to a weak open. That’s after the Nasdaq, Dow and S&P 500 powered to big gains on Monday, putting the tech-heavy index within two percentage points of its all-time high.

- Big cap tech stocks led yesterday’s rally with Amazon shares up nearly 5%. The retailing giant kicks off its Prime Day shopping bonanza with estimates it will generate close to $10 billion over the two-day event.

- Shares in Johnson & Johnson are down 2.4% in pre-market trading on news its COVID-19 vaccine trial has been suspended after a mysterious illness of a participant. It reports later today so the drug giant may have more of an update then.

Elsewhere

- Gold is down, trading around $1,920/ounce.

- The dollar is up.

- Crude is up, with Brent trading around $42/barrel.

***

The season of big beats

Yesterday in this space we looked forward to the reporting season. Reminder: JPMorgan Chase, Citigroup, BlackRock and Johnson & Johnson are among the big names to report today.

The expectation is we’re in for a quarter of big beats. How big?

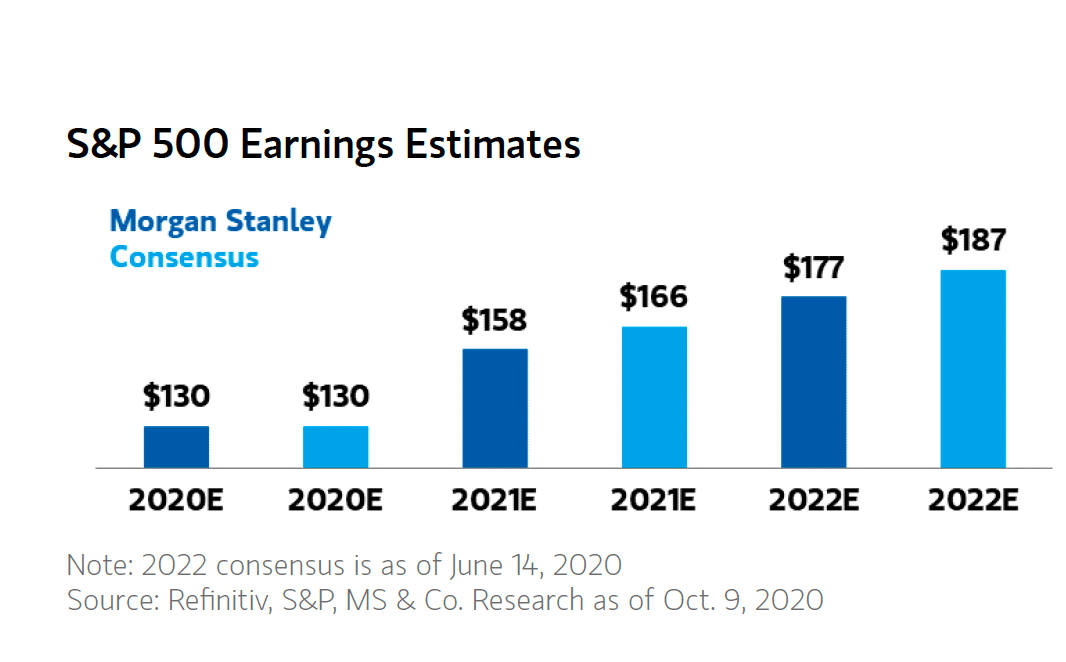

The consensus estimate is that S&P 500 Q3 earnings will come in around $33 per share. That would put full-year EPS at about $130, says Morgan Stanley, with even bigger bottom-line jumps in 2021 and 2022.

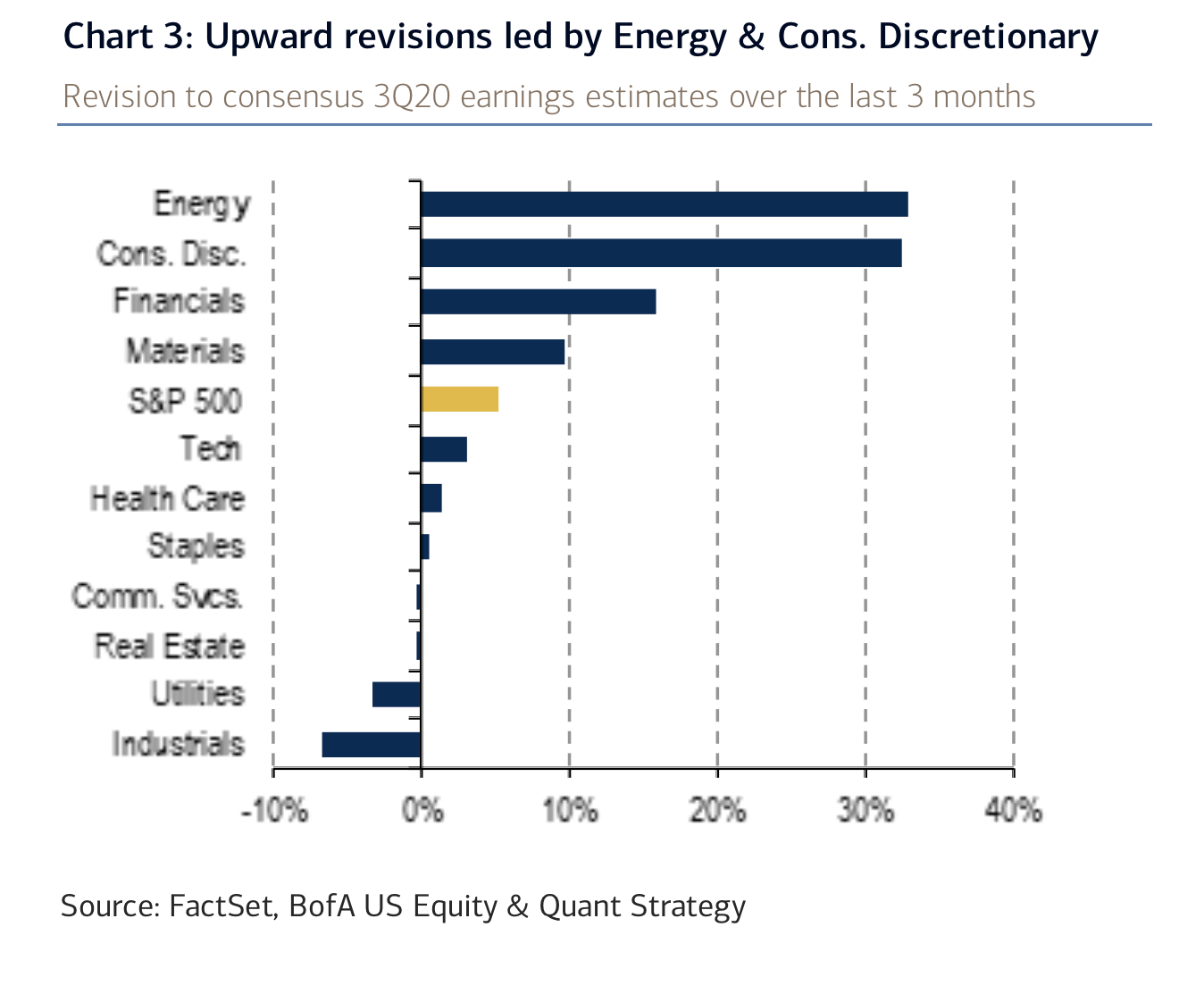

Basically, all the banks have been recalculating EPS estimates after companies solidly beat their expectations last quarter. According to BofA, its biggest upward revisions come courtesy of some of the most beaten-up sectors this year: energy, consumer discretionary and financials.

As I mentioned yesterday, finance stocks have been soaring in recent weeks. They traded higher yesterday again, closing up 1.1%. Yes, tech stocks drew most of the attention yesterday, but this rally feels a bit different. Other sectors are contributing this time around.

That’s probably because the macro signs show the economic recovery is well on its way, and we’re likely to see more granular evidence of this during earnings calls over the coming weeks. As BofA notes, “a 46% bounce in average oil prices from 2Q, strong consumption and manufacturing trends, and a weakening USD all point to a healthy recovery in earnings in 3Q.”

At the very least, earnings season should give investors something to focus on that’s a bit more orderly and illuminating than stimulus talks and presidential polling data. And for that we should be thankful for the distraction.

***

Have a nice day, everyone. I’ll see you here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

$16 trillion. It might seem a bit premature to put a price tag on COVID, but that's not stopping former U.S. Treasury Secretary Lawrence Summers and fellow Harvard University economist David Cutler. The duo say the full impact of COVID-19 will cost the United States $16 trillion, or four times the damage done by the Great Recession. Why so high? They take into account the toll from premature deaths and health losses as well as the economic toll of the shutdowns.

Calling the election. Every presidential election cycle, Wall Street looks to a variety of indicators to determine who might win the White House. Fortune's Rey Mashayekhi goes through this year's big indicators—the stock market, the dollar, manufacturing data, etc—to determine what it might mean for the U.S. balance of power, and for your portfolio.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quiz time

What percentage of S&P 500 companies have provided investors with some level of guidance for how their businesses are operating during these COVID-rattled times?

- A) All

- B) Most

- C) Roughly half

- D) None

The answer is C. According to Fortune's Shawn Tully, just 48% of S&P 500 companies have given investors something—anything—to go on as they continue to manage this crisis. "Given the big valuations Wall Street is awarding their stocks, it's worrying that the giants of the S&P are a lot less confident about where earnings are headed than investors appears to be," he writes.