This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. From Tokyo to London, stocks are in retreat, as are U.S. futures. Investors clearly didn’t like the Fed’s hold-the-line stance on interest rates and asset purchases yesterday. Dollar bulls, however, are smiling this morning.

Let’s check in on the action.

Markets update

Asia

- The major Asia indexes are in the red in afternoon trading, with Hong Kong’s Hang Seng down 1.5%.

- President Trump is no fan of the proposed Oracle–TikTok deal. He’s yet to sign off on it, and is said to be pushing for, among other things, a minority stake for owner ByteDance, the Wall Street Journal reports.

- Sony finally gave details of its PlayStation 5 release as the video game console wars heat up for the holiday season. Investors are unimpressed. Shares in Tokyo are off 0.8%.

Europe

- The European bourses were down out of the gates with the STOXX Europe 600 falling 1%.

- Brexit is becoming a bigger deal in U.S. politics. Democratic Party candidate Joe Biden yesterday declared on Twitter that any post-Brexit deal must honor the Good Friday agreement. House Speaker Nancy Pelosi made similar waves last week.

- Europe is doubling down on its Green New Deal pledge. European Commission President Ursula von der Leyen in her first state of the union address pushed for more stringent carbon emission cuts.

U.S.

- U.S. futures are pointing to a rough open. That’s after tech stocks sunk in the final hours of trading on Wednesday, plunging the Nasdaq (-1.25%) and the S&P 500 (-0.46%) into the red.

- That’s despite the Fed’s extremely dovish move to hold interest rates steady at near-zero (congratulations, mortgage holders; sorry, savers) for another three years.

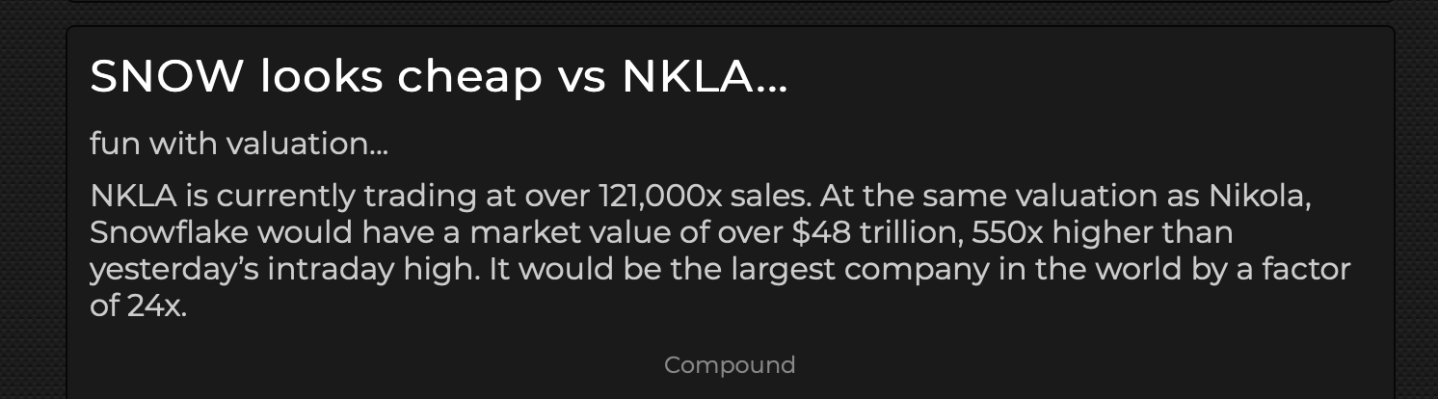

- One notable standout in yesterday’s tech sell-off was Snowflake. Ticker: SNOW soared 112% in its debut yesterday, the highest valued software IPO ever. After day one, it’s more valuable than Uber, Dell and General Motors.

- It’s expected that another 850,000 Americans filed for insurance benefits in the past week. We’ll get the update before the opening bell.

Elsewhere

- Gold is down, trading near $1,950/ounce.

- The dollar is up.

- Crude is off, sending Brent down 1%.

***

Buzzworthy

I’m going to try something different today for this space. If it works, I’ll make it a weekly feature. Let me know what you think.

Snowflake IPO

Too pricey?

Too cheap?

Just right?

A dovish Fed

Good for the dollar?

Price action reversed steadily throughout the course of Powell’s press conference, and the dollar ended broadly stronger than pre-statement release, as guidance was not perceived to be particularly forceful or binding. All in all, FX price action indicates that USD bears seemed disappointed by lack of assertive Fed communication on forward guidance. — BofA Securities

Good for the labor market?

Reflecting the sharper-than-expected decline in the unemployment rate to 8.4% in August, the median Fed forecast for the unemployment rate at year-end 2020 declined to 7.6% from 9.3% previously. The Fed expects the unemployment rate to drop to 4.0% at year-end 2023, nearing its pre-pandemic rate of 3.5%. — Berenberg Bank

Good for the stock market?

The Fed confirmed what we all thought, rates at 0% are here to stay, probably for years. That wasn’t a surprise, but what was a pleasant surprise is how much they increased their full-year GDP decline, to down 3.7% from down 6.5% in June. This helped confirm economic activity in the third-quarter has greatly surprised to the upside. A better economy and a dovish Fed, that is a nice combo. — Ryan Detrick, Chief Market Strategist for LPL Financial.

Bad for society?

The main beneficiary of monetizing the debt has been the stock market, which is a de facto requirement at the Fed. Since 2009, the growth of the Fed’s balance sheet has had an 82% correlation with the S&P 500. The upshot is this continued policy is the driving factor behind the increasing inequality divide, which Fed officials never seem to be capable of recognizing. — Danielle DiMartino Booth, CEO and chief strategist of Quill Intelligence.

***

Have a nice day, everyone. I’ll see you here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Is Big Tech overpriced? Or is the recent pullback a mere temporary stumble? Fortune's Shawn Tully does one of his famous deep-dives—this time into tech stock—to highlight a number of worrying metrics. One that jumped out at me: the combined market cap of the Nasdaq's top ten hit $9.42 trillion at Tuesday's close, a 58% increase in the past year. By contrast, earnings dropped 8%. Even if you're not a traditionalist P/E investor, that's not a good sign.

Wine futures. Wildfires. Droughts. Freaky weather. These have become standard risks for winegrowers these days. Even so, 2020 could go down as one of the most troubled harvests ever. Here in Italy, the familiar refrain among winemakers is "reduced quantity = increased quality." That's probably PR spin. Climate change is wreaking havoc on winemaking. When you hear winemakers saying that they've had to harvest the grapes weeks earlier than normal, that's a sign they either have to change where they grow the grapes, or change the grapes they grow, scientists in Bordeaux explained to me last year.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quote of the day

Sure, we could have pushed higher on price, but then the quality of our investor group would have steadily deteriorated... Our whole game was to develop a shareholder base that we could live with for the next five-to-10 years. We discover where they are in price and we don't push it to the point where everybody starts to squeal.

That's Snowflake CEO Frank Slootman. He got a lot of questions yesterday, including from Fortune's Aaron Pressman, on whether he left money on the table by pricing the IPO at a mere 120 bucks a share.