This is the web version of The Ledger, Fortune’s weekly newsletter covering financial technology and cryptocurrency. Sign up here to receive future editions.

All of a sudden, Big Tech is rushing into financial services.

Google plans to offer “smart” checking accounts, powered by Citigroup and Stanford Federal Credit Union. Apple released a credit card with Goldman Sachs. Facebook yet clings to Libra, its audacious digital payments dream.

Should financial tech startups, or “fintechs,” fear the encroachment of much larger, lavishly funded tech giants?

“Fintechs should be very concerned,” says Avivah Litan, an analyst at research firm Gartner, noting Big Tech’s penchant for crushing competitors. These bigger rivals—with their phones, app stores, digital wallets, and billions of users—“own the user interface,” she says. She pointed to Apple Pay and Apple Card as a success story for Apple, but a threat to other card issuers.

Tim Chen, CEO of NerdWallet, warns, “Fintechs who compete on price should absolutely fear Big Tech—anyone who’s in a race to the bottom with them is going to lose.” Perks that once attracted customers, like higher interest rates on savings accounts or no-fee stock trading, are no longer going to be enough. For startups that rely on providing such benefits, he says, “it will be nearly impossible for them to compete with tech companies who have unlimited access to money and direct relationships with billions of consumers.”

Instead, fintechs are going to have to rethink their relevance, says Matt Harris, a fintech investor at Bain Capital Ventures. He believes the competition is going to “raise the bar,” making it that much harder for startups to add value. “If you were a fintech that was just selling a debit card with an app—effectively making the argument that your app is better than a bank app,” Harris says, “then I don’t think you’re long for this world.”

Other fintech leaders don’t appear fazed. David Hijirida, CEO of Simple, an online bank acquired by Spanish bank BBVA in 2014, describes Big Tech’s fintech invasion as “a natural evolution” for his industry. Chris Britt, CEO of Chime, a bank upstart reportedly nearing a $5 billion private valuation, tells Fortune the trend is “validation that alternatives to traditional banking are in high demand.”

Some fintech founders are even enthusiastic about Big Tech’s banking push. “I celebrate it. I think it’s awesome,” says Brandon Krieg, CEO of Stash, a digital investing startup based in New York. He drew a comparison to the retail coffee industry, which he views as not a zero-sum game. “Starbucks doesn’t get mad when another coffee shop opens down the block,” he says.

All this debate might be somewhat premature. It isn’t even a surefire bet that Big Tech will prevail. Google has struggled for years to make inroads in financial services (though Google Pay has been a recent bright spot, particularly in India). Facebook continues to stumble in its attempt to roll out payments. And Amazon has decided, notably, to put its own checking account plans—rumored to have involved JPMorgan Chase—on ice, as The Information reported.

“Are we going to see a mad rush of people leave their checking accounts to go with Google? There’s no way, no way in hell,” says Ron Shevlin, director of research at bank consultancy Cornerstone Advisors. “There’s got to be some superior value proposition,” he says, doubting that Google can offer anything radically different from what’s already available on the market. And others have pointed out that the regulatory battle against Big Tech—plus many questions related to consumer trust and data privacy—could hold them back.

I wouldn’t count the fintechs out.

Robert Hackett

WE NEED YOUR HELP

Know a standout female leader at your company or another? Tell us about her! We’re taking nominations for Fortune’s upcoming Most Powerful Women Next Gen Summit, where we convene ascending leaders to converse about business, share advice, and connect with one another. It’s Dec. 10-11 in Laguna Niguel, Calif. Submit your nominations to MPWNextGen@fortune.com. They can register here.

THE LEDGER'S LATEST

Fintech Regulation Needs More Principles, Not More Rules - CFTC Chair Heath P. Tarbert

Paypal CEO Dan Schulman Reveals Why He Withdrew from Facebook's Libra - Polina Marinova

Exclusive: Compound Raises $25 Million to Expand Crypto Lending - Jeff John Roberts

The OECD says Taxes on 'Digital Companies' are Coming - Jen Wieczener

Greylock Partners' Asheem Chandra Tackles a Surging Type of Financial Scam - Robert Hackett

Robinhood Expands with Plans to Offer Free Stock Trading In the U.K. - Adrian Croft

DECENTRALIZED NEWS

To the Moon…

The Federal Reserve is evaluating creating a central bank digital currency, but says the benefits are still unclear. Meanwhile, cash is surging in popularity - at least, the American kind. Digital bank Chime will quadruple its revenue this year. BlueVine raises $102.5 million for banking services for small businesses. DAI, a cryptocurrency stabilized against deposits of other cryptocurrencies, adds more collateral options.

Rekt…

Bruce Bagley, a Miami-based academic authority on money laundering, is . . . charged with money laundering. HSBC closes an account being used to fund protests in Hong Kong. Amazon quietly abandoned plans to offer checking accounts. Crypto exchange Binance and smart-contract platform Tron were both blocked on Chinese microblogging service Weibo for 'violations of laws.' Amazon will reportedly pay $0 in corporate taxes on $11.2 billion in profits. For the second year in a row.

FOMO NO MO'

“You know what, it’s who I am, and nobody would tell me not to play golf,” Solomon says now. “And why shouldn’t I—because I’m a CEO?”

Goldman Sachs CEO David Solomon, on his side-gig as DJ D-Sol, from Jen Wieczener's all-encompassing profile of Solomon and the big changes he's making at Goldman Sachs.

MEMES AND MUMBLES

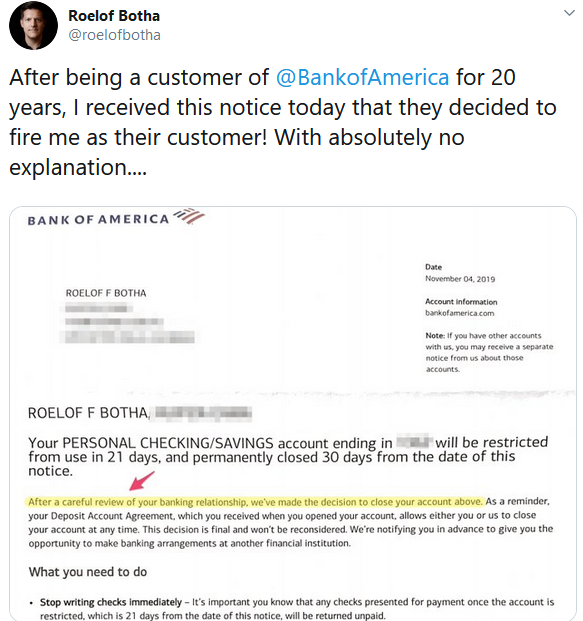

Roelof Botha, early Paypal CFO turned investor at Sequoia Capital, found himself on the wrong end of financial censorship when Bank of America abruptly closed his account. This came the same week that Paypal itself abruptly closed the accounts of over a hundred thousand adult performers.

BALANCING THE LEDGER

Jason Brown, Founder and CEO of the automated finance and savings service Tally, told Fortune's Robert Hackett and Jen Wieczner that he's not trying to compete with banks by offering better interest rates. Instead, the focus is on convenience.

MEMES AND MUMBLES (Part Deux)

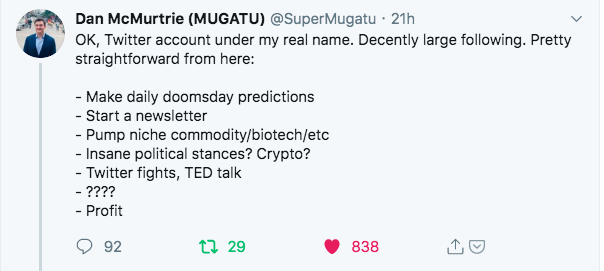

A long-notorious Finance Twitter figure known only as SuperMugatu - after Will Ferrell's nefarious fashion mogul in the Zoolander movies - came out from behind the curtain this week. SuperMugatu, in the real world, is Dan McMurtrie, the Millenial founder of Tyro Capital Management. A twentysomething naming his fund "tyro" - meaning novice or beginner - is a sterling example of the brazen smarm with which SuperMugatu tackled topics in finance and investing. Hopefully he'll keep that edge under his real name.

IF YOU LIKE THIS EMAIL . . .

Share today’s Ledger with a friend.

Did someone share this with you? Sign up here. For previous editions, click here.

For even more, check out Term Sheet, Fortune's daily newsletter on the biggest deals and dealmakers. Sign up here.