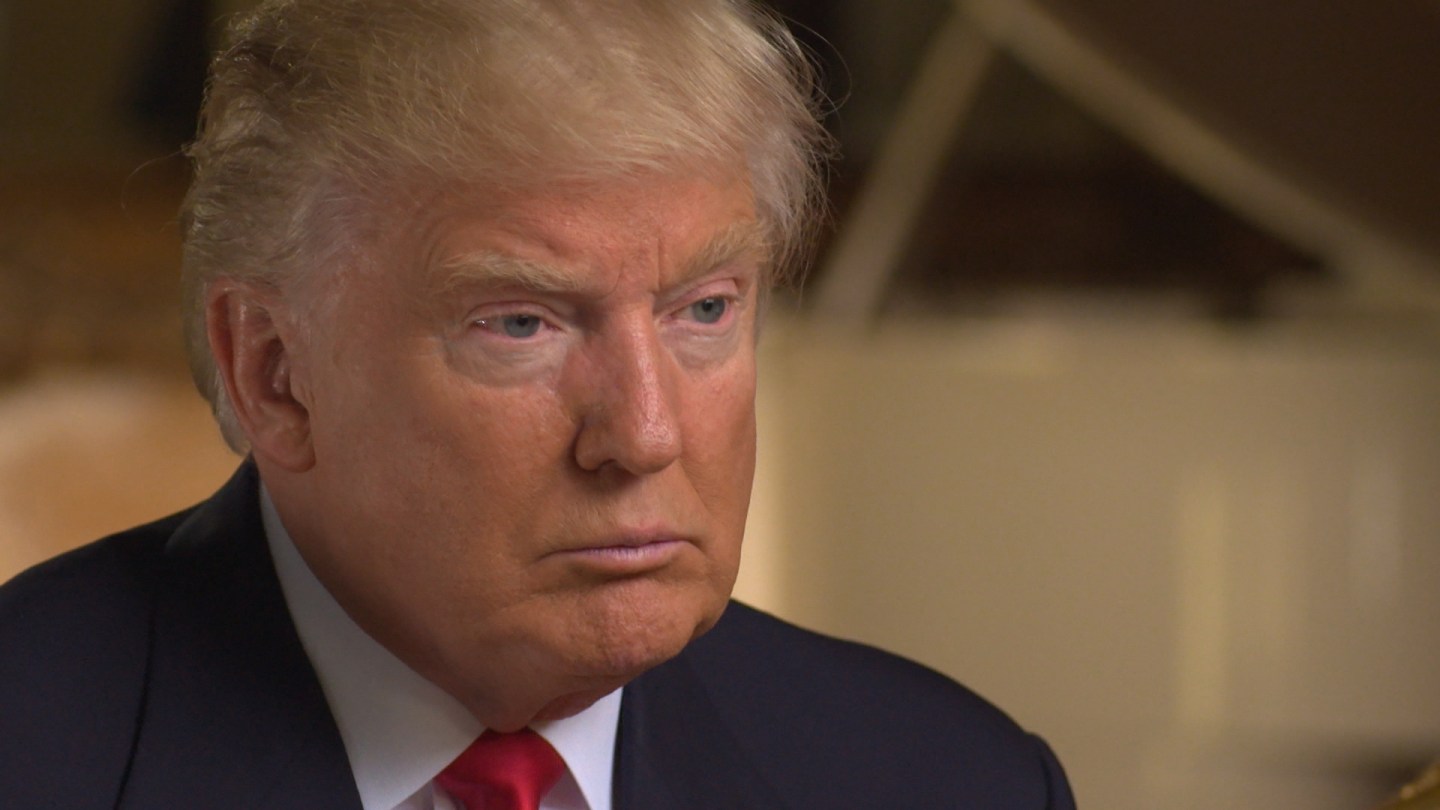

Some retail stocks have been among the biggest winners since Donald Trump won the White House Tuesday night.

Stocks including Kohl’s (25%), Urban Outfitters (20%), Bed Bath & Beyond (17%), Staples (16%), Nordstrom (15.8%), Gap (14%), and Macy’s (12%) have logged in some of the biggest increases in prices on the S&P 500 since Tuesday’s close.

The uptick began following election night, when several retailers reported their third quarter earnings with mixed results. While department stores Kohl’s (KSS) and Nordstrom (JWN) beat expectations, Macy’s (M) fell below projections while heading into the all-important holiday season.

In a Monday note to clients, Citi analyst Paul Lejauz noted that one reason for this increase in retail and department stores stock prices could be Trump’s win. According the Lejauz, Trump’s plan to lower taxes for corporations and the wealthy could increase spending—a boon for speciality retailers.

“We cannot ignore the likelihood that tax reform (both personal and corporate) provides a bump that many of our retailers need. Whether on the right side of the Trump win or not, with tax reform consumers are likely to find more money in their pockets (creating a rising tide),” wrote Lejuez in a Monday note to clients, as first reported by CNBC.

Lejuaz upgraded shares of Boot Barn (BOOT), Chico’s (CHS), Kohl’s (KSS), and L Brands (LB) to “Buy” in the same note, adding that companies with a customer base largely based out of the U.S. are likely to benefit from Trump’s more protectionist trade policies and a stronger dollar.

Other retail stocks including Kroger (12.5%), Ralph Lauren (12%), Signet Jeweler (12%), and Whole Foods Market (11%) also seem to have shaken off any market uncertainty coming out of the elections, and have steadily risen since Tuesday’s close.

An ETF tracking retail stocks, the SPDR S&P Retail ETF, continued its upward rise Monday, pushing up 1.9% after rising 10% since Tuesday’s close. The financial sector has also kept the Dow rally going and left the S&P 500 level, as the tech sector slid. The Technology SPDR ETF has slid 3% since Tuesday, while the S&P 500 has risen 1.3% in the same period.