The U.S. Justice Department is probing allegations that Anheuser-Busch InBev (BUD) is seeking to curb competition in the beer market by buying distributors, making it harder for fast-growing craft brewers to get their products on store shelves, according to three people familiar with the matter.

In the past few months, the world’s largest brewer has rattled the craft beer world by striking deals for five distributors in three states. Many states require brewers to use distributors to sell their product, and once AB InBev buys a distributor, craft companies say they find that they can’t distribute their beer as easily and sales growth stalls.

Antitrust regulators are also reviewing craft brewers’ claims that AB InBev pushes some independent distributors to only carry the company’s products and end their ties with the craft industry, two of the sources said, noting that the investigation was in its early stages. AB InBev’s purchase of several craft beer makers in recent years means that it is in a position to offer a greater variety of products itself.

State regulators in California, where AB InBev announced wholesaler purchases in Oakland and San Jose in September, are also looking into the matter, the people familiar with the matter said.

The beer giant confirmed that it was talking to regulators. “Anheuser-Busch has been in communication with the Department of Justice and California attorney general’s office about the transactions. We are working cooperatively to address any questions they have,” an Anheuser-Busch spokesperson said in an email.

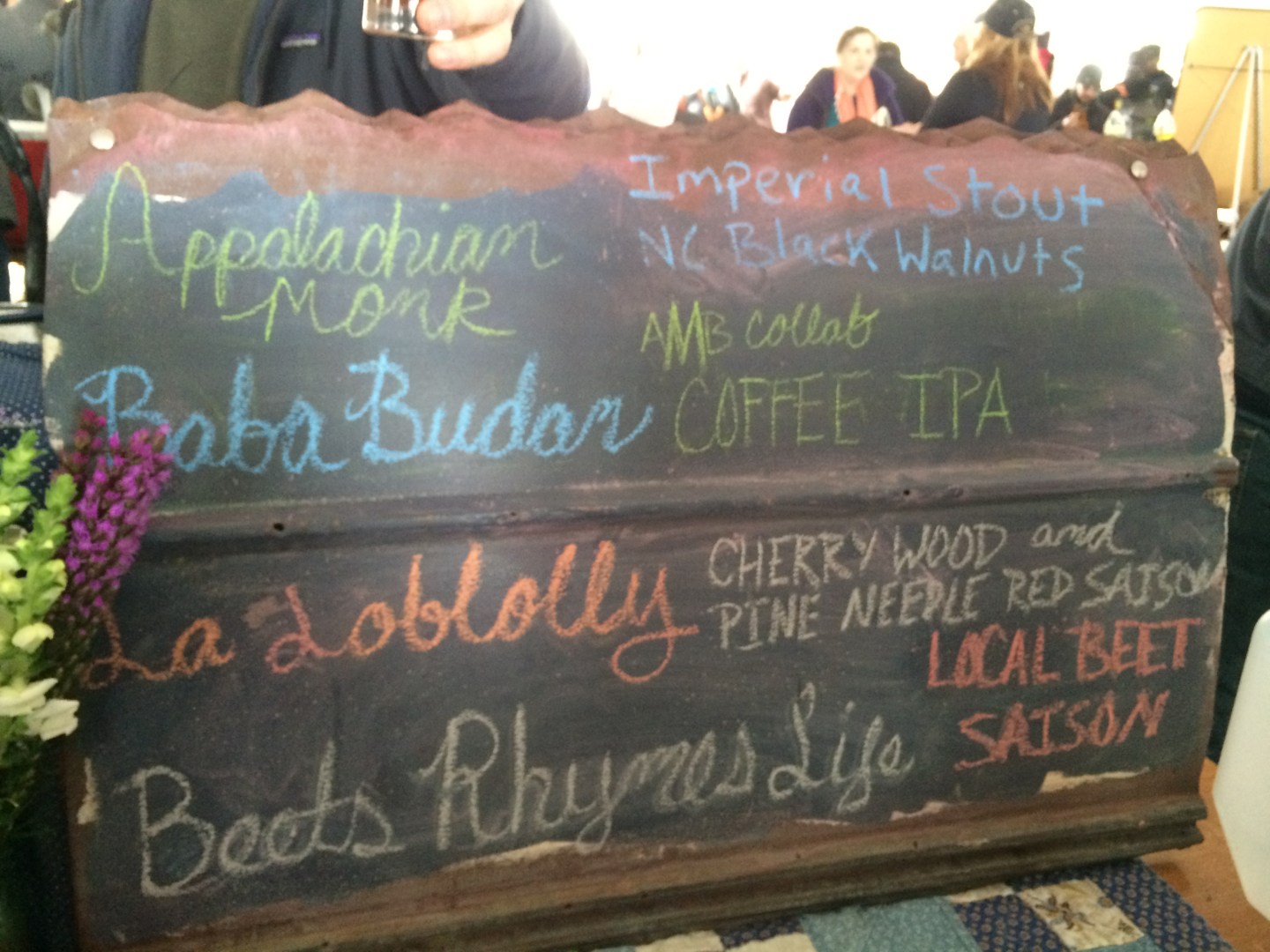

Craft brewers, who produce everything from well-crafted classics to odd flavors such as pumpkin or raspberry beer, have been a bright spot in an otherwise dull U.S. beer market. While beer sales rose 0.5% in 2014, craft beer sales rose by 17.6% to capture 11% of the U.S. market.

The Justice Department review comes at an awkward time for AB InBev as it is seeking to buy No. 2 SABMiller (SBMRY) for more than $100 billion in what would be the biggest-ever merger of brewers. AB InBev is widely expected to sell SABMiller’s stake in U.S.-based MillerCoors if the merger goes through, leaving its U.S. market share unchanged at 46.4%.

Small craft brewers have already been rattled by AB InBev’s purchases of craft beer makers, including Golden Road in September, Blue Point Brewing in 2014 and Goose Island Beer Co in 2011.

As AB InBev also snaps up distributors, craft brewers have expressed concern that the company would push distributors to only carry its products.

To retain the craft title, a brewery must make less than 6 million barrels annually. That means those that get taken over by a big brewer like AB InBev lose that identity even if they still make small batches with distinctive flavors.

It was not clear if other state regulators were looking at the recent purchases of two distributors in Colorado and one in New York as well.

The Justice Department declined comment. The attorney generals’ offices for California, New York and Colorado did not respond to requests for comment.

Quickly stalled

Nikos Ridge, CEO of Ninkasi Brewing Co in Oregon, said that when two of his distributors were bought by AB InBev in 2011 and 2012, he saw what had been healthy sales growth quickly stall until it found alternative distributors.

“Our feeling was that we weren’t getting the same level of representation,” said Ridge. “We saw our trends drop and we have seen improvements since we’ve switched.”

An executive at a second craft brewer, who asked not to be named, said that AB InBev had recently bought one of its distributors. “It (the distributor) is slowly but surely divesting itself of everything that is not ABI. And we’re one of the last ones,” said the executive, who noted that its other options for distribution were limited. “We’re at the mercy of a lot of big players.”

Their experience is not unique. Conversations with at least four other craft brewers told the same story.

There were some 4,000 craft beer companies as of September, brewing everything from artfully made classics like Dale’s Pale Ale, Brooklyn Lager and Gordon Biersch Hefeweizen, as well as quirky brews like Breckenridge Vanilla Porter, and the super hoppy Palate Wrecker from Green Flash Brewing Co.

A handful of antitrust experts say that craft brewers have a case, albeit not an easy one.

The authorities could step in if AB InBev bought so many distributors that craft brewers lost significant access to a local market, said Jonathan Lewis, an antitrust expert at the law firm Baker Hostetler. He estimated that the breaking point could be when AB InBev owned some 50% of distributors in a given area.

Andy Gavil, a former head of the Federal Trade Commission’s Office of Policy Planning who now teaches antitrust law at Howard University Law School, said he believes the problem could be resolved by scrapping a requirement for alcoholic beverages to go through liquor distributors in most U.S. states. That would allow the craft brewers to go directly to the supermarkets, liquor stores and bars.

“There are some older justifications that it’s about preventing underage sales but since the ultimate sale is done by a retailer, that’s a bogus argument,” Gavil said.

(Editing by Soyoung Kim and Martin Howell)