If Ellen Kullman was worried, she wasn’t showing it.

In fact, as the CEO of DuPont (DD) prepared to sit down for dinner in late January at the Steigenberger Grandhotel Belvedere, the main hub for evening festivities at the World Economic Forum in Davos, Switzerland, she was radiating confidence.

Never mind that just a few weeks earlier, the billionaire investor Nelson Peltz had launched a very public proxy battle against her company. Peltz, the 72-year-old co-founder of the $11 billion hedge fund Trian Fund Management, is one of the most high-profile and accomplished of Wall Street’s growing hoard of so-called activist shareholders. And he wasn’t pulling any punches.

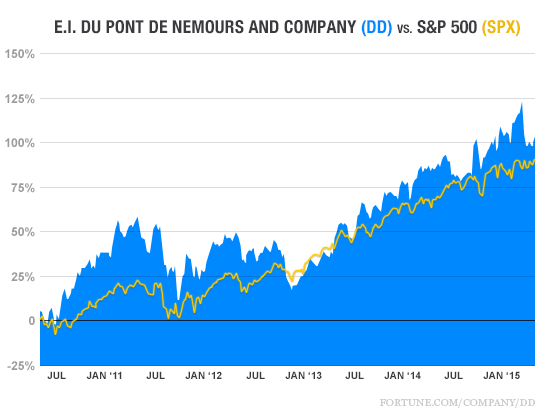

Kullman, 59, was frustrated that Peltz was trying to paint her giant chemical company, the inventor of wonder fabrics such as nylon and Kevlar as well as one of the biggest players in the business of providing hybrid seeds to farmers, as an underachiever. But she was upbeat about the prospect of rallying shareholders to side with her. Why wouldn’t investors be supportive, given DuPont’s stock performance since Kullman had stepped into the CEO job on Jan. 1, 2009? For the six years through the end of 2014, according to FactSet, DuPont had produced a total return for shareholders of 266% vs. 243% for the average S&P 500 chemical company and 159% for the broad S&P 500 index.

“We are a great company,” the DuPont CEO told me. “And we have a strong story.”

Three and a half months later, however, it appears that Peltz’s narrative about DuPont could be on the verge of winning out. After a bruising public and private battle with the activist, Kullman has suffered a series of setbacks in the days leading up to the proxy vote, set for DuPont’s annual shareholders meeting on May 13.

If Kullman doesn’t cut a deal before then with Peltz, who is seeking four seats on DuPont’s board and would like to see the company broken up into parts, she is in danger of suffering a deflating defeat.

In late April, influential proxy service Institutional Shareholder Services (ISS) advised DuPont shareholders to vote for Peltz and another Trian nominee, former GE executive John Myers, to join DuPont’s board. Another major proxy service, Glass Lewis, backed Peltz for the company’s board as well. And Egan-Jones, a third proxy advisory, recently recommended that DuPont’s shareholders elect all four of Trian’s nominees to the board. Perhaps even more damaging for Kullman is the fact that shares of the company rose 5% on the ISS news—an indicator that Wall Street believes Peltz’s presence on the board will boost the value of DuPont.

Sources close to the company say the vote is close. It’s essentially down to four major shareholders—large mutual fund and asset management companies. In case one of those flip, sources close to DuPont say the board has been contemplating a settlement offer with Trian that might include putting Peltz or another principal of the hedge fund on the company’s board, something Kullman has fought to avoid for nearly two years. As of Monday morning, there was no sign of a settlement.

But Kullman, the former captain of her high school basketball team and a fierce competitor, isn’t giving up. “You know me,” she said last week, before heading out to meet with large investors on the West Coast. “I give it 100% until the buzzer sounds.”

Just this past Thursday, Kullman scored a major victory when California pension giant Calpers said it would vote its 6.15 million shares with DuPont’s full slate of board nominees.

The battle over future of the almost 213-year-old DuPont, the fourth oldest company in the Fortune 500, demonstrates how hard it is these days for companies to fend off activists. DuPont seemed like an unlikely target when Peltz first showed up in mid-2013. It is one of the largest companies in the U.S., with some $35 billion in sales. And Kullman is by many accounts a well-regarded, tough-minded CEO who has already taken aggressive steps to cut costs during her tenure, and shift the company’s focus to its more profitable product segments. Excluding the businesses it has closed or is getting out of, DuPont’s operating margins rose from 9.5% in 2008 to 16.5% last year, according to the company.

What’s more, Kullman has done the type of deals that Wall Street usually likes. She got praise for selling off DuPont’s coatings division (essentially car paint), a cyclical business, to private equity firm Carlyle Group in 2013 for $5 billion. (Trian now says Kullman should have demanded much more; Warren Buffett’s Berkshire Hathaway recently bought nearly 9% of the company, now called Axalta, for $560 million.) And DuPont is close to spinning off another large division, which makes specialty chemicals.

None of that, however, was enough to protect DuPont from being targeted by Peltz.

In that sense, the story of DuPont is the story of Wall Street and corporate America today. Activist hedge funds now manage more than $120 billion. With such heft, they are growing increasingly aggressive in their demands from senior management—and often getting their way. Warren Buffett, at this year’s Berkshire Hathaway annual meeting, expressed concern that activists were causing companies to do share buybacks that made little sense.

“I am not against activists,” says Bill George, a Harvard professor, who has been critical of activists. “But what I don’t get is why they are increasingly going after good companies. DuPont is a well run company that never should have come under attack.”

The fight over DuPont, one of the largest companies yet to face a proxy battle from an activist, is likely to have an impact on how companies react to the hedge fund aggressors in the future. Influential lawyer Martin Lipton, who has been called the dean of the activist defense bar, in a thinly veiled critique of DuPont and its management, recently sent a memo to clients suggesting more companies should consider settling rather than going through a long, drawn-out fight with an activist. DuPont was offered many chances over the past two years to settle with Trian, and decided to stick it out and fight.

The size and breadth of today’s activist funds make these battles increasingly fraught for CEOs and corporate directors. For instance, the California State Teachers Retirement System, or CalSTRS, has long been a large shareholder of DuPont. Kullman says she’s generally had a congenial working relationship with the pension fund. Nonetheless, CalSTRS co-signed an early letter to the company supporting Trian. As it turns out, CalSTRS also happens to be a major investor in Peltz’s hedge fund. Ties like that have made it harder for companies like DuPont to argue that siding with activists isn’t in the interest of shareholders.

To tell the inside tale of DuPont’s defense in the face of an all-out activist assault, Fortune conducted extensive interviews with Kullman, other top DuPont managers, and advisers to Kullman over the past few months, and analyzed the many documents that have been filed by both sides with the SEC as part of the fight. Peltz declined numerous requests to comment directly for this story.

Even as the clock ticks down and Kullman continues pressing her case with shareholders, the fight over DuPont offers important dos and don’ts for other companies under attack, as well as a window into whether shareholder activism is making corporate America better, or crippling it.

Kullman is DuPont through and through. She grew up not far from the company’s headquarters in Delaware and is a 27-year veteran of the chemical giant, which was originally founded in 1802 as a gunpowder manufacturer. She feels passionately that her plan for DuPont is the right one. “I’ve known Ellen for decades and she is clearly a very strong and very capable leader,” says JPMorgan Chase CEO Jamie Dimon, who was undergraduate classmates with Kullman at Tufts University.

But that certainty may have initially blinded her to the realities of the activist game.

DuPont’s first and perhaps biggest mistake was not realizing early on that, to a large extent, the contest with Trian would be waged in the court of public perception.

For example, in December DuPont announced that it was planning to move out of its historic headquarters in downtown Wilmington and step up its effort to find a buyer for the Hotel du Pont. This came shortly after Peltz highlighted the hotel and a DuPont-owned golf club as signs of corporate excess, and may have been a tactical mistake, a number of observers said. The move won’t save much money, and the hotel was profitable. Instead, these observers say, the move seemed to validate Peltz’s contention that DuPont has a bloated cost structure. It also likely hurt the public opinion of DuPont’s management in Delaware, where there are many DuPont ex-employees and shareholders. DuPont said the timing of the move had to do with the company’s coming spin-off and not Peltz.

Kullman has largely conducted her campaign in private—though she has conducted more interviews lately—and sometimes suffered for it. Shortly before the proxy fight officially started, Kullman designated an internal team that would lead DuPont’s response to Trian. In theory, that allowed Kullman to remain focused on running DuPont. But it also meant that Kullman was not always front and center in the proxy fight. In mid-March, Peltz won points in an interview on CNBC in which he highlighted his knowledge of DuPont’s financials. That interview likely won Trian votes early on, say some proxy experts. Kullman has not done any similar interviews. “Proxy fights are campaigns, and the candidate is the CEO,” says an advisor who often works with companies under attack.

Then there was the fact that Kullman exercised $80 million worth of stock options shortly before the proxy fight got under way. (What Kullman actually made from the sale, after deducting taxes and the cost of the options, was a much smaller figure.) The stock sales were made under a so-called 10b5-1 automatic plan set up years before.

But several observers with knowledge of the plans say Kullman could have called off the planned sales, and should have. Kullman says changing the plan would have broken company policy, and that she had material information precluding her from doing so anyway. But some observers say she should have done so anyway. Peltz has used the stock sale to say Kullman doesn’t believe in the company. Kullman, who says she still has two-thirds of her net worth invested in DuPont, says that’s ridiculous.

Kullman says she has always put what’s best for the company first ahead of making what might have been the ideal strategic move in the proxy fight.

But it has often appeared to be a battle of wills between Kullman and Peltz. At one point, DuPont offered a settlement that would have put a Trian nominee on the board, as long as it wasn’t Peltz. Trian quickly rejected the offer.

“In the end, both sides made the fight personal,” says a source who has known Kullman for years, and has watched the proxy fight closely. “I think that was the big mistake.”

Whatever the outcome, the fight appears to have taken a toll on DuPont. In the first quarter of 2015, DuPont reported its biggest quarterly drop in earnings in more than two years. The company blamed the disappointing results largely on a global slowdown and a strong U.S. dollar hurting international sales. In March, Moody’s downgraded the company’s credit rating because it feared Peltz would force the company to take on more debt, something he has said he would like it to do.

The proxy battle has proved to be a tremendous expense for DuPont. There is a growing list of professionals who are rolling out services for companies under attack from activists. Early on, DuPont retained investment banks Goldman Sachs and Evercore as well as law firm Skadden Arps. Evercore’s chairman and Wall Street big-wig Roger Altman, who was Deputy Secretary of Treasury in the Clinton administration, has personally been involved in the fight. DuPont also hired proxy solicitor Innisfree and public relations firm Joele Frank Wilkinson Brimmer Katcher to work the phones in the fight against Trian, in addition to Kekst, which has long done DuPont’s outside public relations.

Sources say CamberView Partners, a firm which was started a few years ago to specialize in activist defense, has also been advising the firm. In its latest proxy statement, DuPont said defending itself against Trian has cost the company $15 million. But some observers say a fight like this could cost several times that.

Kullman says the tangle with Peltz has been the hardest thing she’s ever had to go through in her career. A recent Trian presentation on DuPont included a PowerPoint slide headlined “Management’s Strategy.” There were no other words on the slide, just a big question mark. Given how many times Kullman says she has explained her strategy to Trian and other investors over the past few months, that slide is hard to take.

“The activists can make any assertion they want,” Kullman said to Fortune recently. “It’s frustrating. If I say something, as the CEO of a public company, it has to be true or I go to jail. I was told that the first day on the job and it sticks with you. I don’t think activists are held to the same level of scrutiny.”

In mid-January, at DuPont’s annual leadership meeting, Kullman spoke to 120 of the company’s top executives. In past years, she had done a recap of the past year. But this year’s speech was bigger. She spoke for 90 minutes, outlining her vision for the future of the company.

A large part of the fight with Trian is how big DuPont should be. Trian has advocated for a three-way break up, essentially splitting the company’s seed business from its plastics and materials business and from its Chemours chemical business, which the company is nearing spinning off. Peltz has recently backed away from the split-up plan somewhat, saying he is open minded. But he argues that a break-up will lower the company’s costs and focus its divisions. Kullman believes Peltz is still intent on breaking up the company.

Kullman feels strongly that would be the wrong move. And while she didn’t name Trian by name, in her January speech she aggressively made the case for her own strategy over Peltz’s. Kullman said the world’s growing population is an enormous opportunity. The seed business is a big part of that, creating a more sustainable food supply.

But the real growth for DuPont would be in innovations found at the intersection of the company’s many businesses to create a safer, healthier world. That, asserted Kullman, is DuPont’s reason for being. Few companies are big enough to tackle the world’s problems. And almost none have the commitment to science that DuPont has. DuPont is unique in its ability to build a better future, she said. “That’s why I am here,” Kullman concluded. “Why are you here?”

Kullman says she made the speech because “you have to show your workers the hill to climb.” But she also knew what was coming, and she wanted to inspire her executives to tell the story of DuPont.

According to Kullman, DuPont first learned that Peltz’s Trian Partners had taken a stake in the company from CNBC in mid-2013. Peltz was asked about it by Andrew Ross Sorkin in an interview from a hedge fund conference. Kullman knew who Peltz was, but at first she didn’t know what his investment would mean. The current wave of shareholder activism was still gaining momentum at the time.

Since then, Kullman and other DuPont executives and board members have had more than 20 in-person meetings or phone calls with Trian representatives. The first was in late July of 2013 in a conference room in a midtown Manhattan hotel. Peltz didn’t attend the meeting. Instead, when Kullman and DuPont CFO Nick Fanandakis got there, they were greeted by Ed Garden, who is both Trian’s chief investment officer and Peltz’s son-in-law, and Matthew Peltz, Nelson’s son. That was the first Kullman learned that Trian wanted to break up her company. The original plan called for the company to be broken up into four parts. Kullman says the meeting took two hours and she mostly listened. “I was just trying to understand their plan,” says Kullman. “My first response to anything is to listen.”

Kullman wasn’t completely against spin-offs. That July, shortly before meeting with Trian, Kullman had announced that the company was going to break off a good portion of its chemical business, include the company’s titanium dioxide business, which Kullman herself had previously run for four years. But she felt that the split-up Trian was proposing wasn’t the best course for DuPont. Nonetheless, she gave Trian’s proposal to the board to study. Shortly after, DuPont hired Goldman and Evercore.

In September, DuPont’s newly appointed bankers met with Garden and the younger Peltz in Evercore’s office. According to sources who were at the meeting, the bankers told Garden and Peltz that their cost-saving numbers didn’t add up. The group decided to meet again in mid-October.

According to Trian’s proxy filing, Garden tried to call Kullman numerous times in early October. DuPont’s head of investor relations said he was free to talk, or that Garden could speak with Fanandakis. On Oct. 14, two days before the follow-up banker meeting, Garden called again and said he had to speak immediately with either Kullman or DuPont’s lead director, Alexander “Sandy” Cutler. The next day Kullman and Garden talked.

Up until that point, all of the company’s interactions with Trian, besides Peltz’s initial disclosure of the investment, had been private. Garden said he wanted to avoid a public confrontation. Then he told Kullman that she had three choices: break up the company; put Garden and one other mutually agreeable industry executive on the board; or face a proxy fight.

Trian’s proxy filing claims that Kullman responded by hanging up the phone. Kullman says it’s unlikely she would have been that rude. She recalls saying that she would get back to him. Either way, given the ultimatum, after the call Kullman canceled the meeting between her bankers and Trian. Ten days later Kullman and Fanandakis called up Garden again to tell him the board had rejected Trian’s break-up proposal and had decided not to nominate him to the board.

About two weeks later, DuPont got a letter from CalSTRS requesting the company meet again with Trian to see if they could find common ground. Kullman agreed. On the way to the meeting, this time in the Washington, D.C. offices of Skadden Arps, DuPont’s law firm, Kullman was feeling optimistic.

In the six months since Trian had made its investment, DuPont had announced it would spin-off a portion of its chemical business, announced $1 billion in cost cuts, and said it would buy back as much as $5 billion in stock. She thought these moves were good for DuPont, and she also thought they were the types of things Trian would be looking for.

But her mood quickly sank after she arrived. At the meeting, Trian presented a new white paper. This time the proposal was to split the company into three parts. According to Garden, at some point in the meeting he said he had evidence that DuPont’s costs were out of control. He said Carlyle had already cut hundreds of millions of dollars in costs out of the coatings business it had bought from DuPont less than a year ago. In Garden’s account, Cutler, DuPont’s lead director, turned to Kullman in surprise and asked her if that was true.

But both Cutler and Kullman say that never happened. Cutler said he was well aware of the coatings businesses performance. And Kullman doubts Garden would have known the coatings businesses financials at the time, since the sale was so recent. At the end of the meeting, Garden issued the same ultimatum as he had earlier: break-up the company, add Garden and another executive to the board, or face a proxy fight. Kullman and Culter left without giving an answer, and began bracing for a proxy fight in early 2014.

And then nothing happened. The deadline for Trian to file a proxy nominating Garden and another candidate for 2014 passed. DuPont’s board reviewed Trian’s second break-up plan and rejected it. Meanwhile, the relationship between the company and the investors appeared to improve. In early May, Garden praised Kullman in a speech at conference for institutional investors. Kullman, Garden said, “has basically been an activist within DuPont.” He said she was working to get DuPont’s “operating metrics” up. Kullman thought she had dodged a bullet.

A little over a month later, Kullman and Fanandakis called Garden to talk about the company’s earnings. Fanandakis had told analysts that a weaker global economy meant that DuPont was not going to make as much in 2014 as it had earlier projected. On the call, Garden reverted to his earlier refrain: break-up, accept Garden on the board, or expect a proxy fight.

In mid-September of 2014, Trian went public with its break-up plan for DuPont. In a white paper, Trian claimed that DuPont’s earnings growth had been the slowest of all its competitors. And that it had $4 billion in excess costs. The paper claimed that if DuPont was split into parts it would be worth $120 per share, compared to around $65 at the time. DuPont’s shares rose to over $70 on the news.

Kullman was scheduled to leave for a trip to Asia the next day. She considered canceling, and talked to some of her advisors. Everyone agreed she should go as planned. The next morning, Kullman called a conference call of DuPont’s top management to discuss Trian’s white paper. About sixty of DuPont’s top executives called in as Kullman led the call from a mobile phone in the airport. Many of the executives still had no idea that Trian wanted the company broken up.

Kullman explained that the board had reviewed the plan and rejected it. The company was not going to be broken up, she reassured them. She also said she and the board believed the plan they were executing was the right one. She then got on the plane to Asia.

In part, the dispute between DuPont and Trian, about whether the company should be broken up, comes down to how well the chemical giant has done under Kullman. DuPont says the company’s operating earnings per share have risen 19% a year under Kullman. Trian says the company’s earnings have recently been flat.

Part of the difference is the starting point. DuPont starts counting from the end of 2008 when Kullman became CEO. Trian starts at the end of 2011, which was a cyclical high for the chemical business that will be spun-out with Chemours. Trian has never explained why it picked 2011.

But another big part of the difference comes down to what Trian and DuPont are measuring. Trian says you have to look at DuPont’s total profits. DuPont says for a company in transition that’s unfair. In the past few years, DuPont has sold off a number of profitable, but slow-growth cyclical businesses, including its coating division. A cyclical dip at Chemours has hurt earnings as well. So it’s not a surprise that the company’s earnings have suffered. But that’s the old DuPont. What investors should be looking at is the profits DuPont is getting from the businesses it has stayed in, or will be in after the spin-off. That’s where it has been concentrating. And those profits are up substantially, proving Kullman’s transition strategy is working. (For more on how well DuPont has done under Kullman, click here.)

As for the break-up plan, analysts are split on whether it makes sense. Frank Mitsch, an analyst at Wells Fargo, says it could cost the company $20 billion in lost research and operating synergeries. But analysts at Bank of America recently cheered the ISS conclusion that Peltz should join DuPont’s board, saying it would move the company one step closer to a break up. There don’t appear to be any analysts, though, who say a break-up could result in the $120 stock price that Trian claims it will. Most analysts put DuPont’s potential break-up value around $90 a share—significantly higher than its recent price of $75. But is splitting the company up a better way to get to $90 than letting Kullman execute her strategy?

DuPont argues that splitting up the company would cost at least $4 billion, and could potentially hurt sales. For instance, DuPont currently sells a lot of plastic to Toyota for car parts such as the dashboard and air conditioning vents. Kiyotaka Ise, a senior managing officer at Toyota who is based in Toyota, Japan, says, his company values its relationship with DuPont because the company has a long-term approach and is dedicated to research and development, which, he says, has led to innovative products for Toyota in the past. “From our standpoint, what we have heard about the activist investor’s plan sounds very short-term focused,” says Ise. “We would have to evaluate working with DuPont in the future if it were split up.”

At a recent investor conference, Robert Zatta, a chemical industry executive who is one of Trian’s proposed board members, said that if he were running DuPont, he would cut the money DuPont spends on its central R&D and give the money to its individual businesses. In general, Trian says DuPont appears to get very little out of its research spending.

DuPont spends about 30% of its $2 billion annual R&D budget at The Experimental Station, a leafy 150 acre corporate research campus located about a fifteen minute drive outside of Wilmington which is a national security site. It’s where the company invented nylon, Kevlar, Teflon and other products. But the company stresses that two-thirds of what is spent at the EX Station, as it is nicknamed, is budgeted through the company’s business units, meaning 90% of the company’s overall R&D spending decisions are made by DuPont’s division leaders, and not its executive suite.

Some recent projects in the DuPont labs appear to be the equivalent of high-tech marketing, such as the high-performance golf balls it has produced for Nike. But others seem to have a lot of revenue-generating potential. For example, DuPont has recently engineered soybean seeds to produce an industrial quality oil called Plenish that is being marketed to food producers as significantly healthier than the traditional soybean oil that was long used to fry potato chips and other snacks. Some food producers, though, have already made the switch to other non-soybean based oils. Plenish has no trans fats, and is lower in saturated fats than other oils. DuPont has produced prototype potato chips cooked with the healthier oil that hold their own with regular chips. DuPont describes Plenish as a “several hundred million dollar opportunity.”

Another product created with DuPont R&D that’s already on the market is Tide Coldwater, a version of Procter & Gamble laundry detergent that uses an enzyme developed by DuPont. It washes clothes just as well in cold water as traditional Tide does in hot water, making it less energy-intense and therefore more environmentally friendly than regular detergent. The product hit shelves late last year and DuPont says it is already bringing in substantial revenue.

“DuPont’s research lab in terms of chemistry, is one of the few corporate labs that is left,” says Harvard Business School professor Jay Lorsch. Bell Labs and the laboratory of Eastman Kodak, he points out, are long gone. Right now, Lorsch says, in America in terms of large scale research labs its just DuPont and Dow, which last year came under attack by hedge fund manager Dan Loeb. “If it was up to the activists there would be none,” says Lorsch.

Last October, Cutler, DuPont’s lead director, got a call from Peltz for the first time. Peltz told Cutler the stakes had gone up. Now Trian wanted the company to put two Trian partners on DuPont’s board, as well as one industry executive selected by Trian. If Cutler and the board said no, Peltz said Trian would launch to throw the majority of DuPont’s board members out.

Two weeks later, Kullman and Peltz met for lunch at Aretsky’s Patroon, a Midtown Manhattan restaurant that’s a favorite of Peltz. They sat at a round table in a back, cramped corner of the restaurant. Peltz had a large salad. Kullman had sole.

Over lunch, Kullman says, Peltz told Kullman she didn’t want to get into a proxy fight with him. According to Kullman, Peltz told her that he had been in proxy fights before and that it would make Kullman’s life miserable. He said she would never see her family. “If we go to a proxy fight you will lose and I will win,” said Peltz, according to Kullman. He also said Trian would go through Kullman’s life and DuPont’s board members’ lives. He said he would find things and embarrass them.

Kullman says that Peltz then pivoted, and asked her if she would support him and Garden as board members. He asked Kullman if she could personally make the case to the rest of the board that they should nominate Peltz and Garden.

Through a spokesperson, Peltz “categorically denies” threatening to embarrass Kullman or other DuPont board members.

James Gallogly, CEO of chemical company LyondellBassell, says he started getting calls from Trian in the fall of 2014. The first one came from Garden, who said that Trian was preparing to enter a proxy contest with DuPont’s management and was putting together its own slate of directors. “We think you would be perfect,” Garden said. Gallogly, who had just led Lyondell out of bankruptcy to good reviews, said no thanks. He was leaving Lyondell at the end of the year, but wasn’t ready to think about what he was going to do next.

A few weeks later, Gallogly got a recruiting call from Peltz. He gave Peltz the same answer he had given Garden. Peltz said he was going to be in Houston, where Lyondell was based, soon. How about grabbing a cup of coffee? Not wanting to be rude, Gallogly said maybe, if the opportunity arose.

A few days later, says Gallogly, he looked on his calendar and there was a breakfast scheduled with Peltz. Gallogly asked his assistant how it had gotten there. His assistant said Peltz called and said Gallogly wanted to schedule a meeting.

Gallogly and Peltz met for breakfast the following Monday at the Four Seasons. Peltz told Gallogly that he wanted him to join Trian’s team. “Do you want to be CEO of DuPont?” asked Peltz, according to Gallogly. “We can arrange that.”

According to Gallogly, Peltz said what he wanted to do was break up DuPont and split off the agricultural business. Gallogly says it didn’t sound like Peltz had an open mind. Gallogly told Peltz that he really wasn’t interested in the activist thing, but thanks anyway.

Gallogly says Peltz called him a few more times after that. Garden called once more as well, also offering the CEO job. The last Gallogly heard from Peltz was in an e-mail he got while he was on a plane. It said Peltz was offering one last chance to be on his team. Gallogly did not reply.

Peltz has since said that it was Gallogly who insisted he be named CEO. Gallogly says that’s untrue.

Shortly after the last message from Peltz, Gallogly got a call from a recruiter. How would he like to be a board member at DuPont? Gallogly responded that he had already told Peltz no directly. The recruiter said he was calling on behalf of Ellen Kullman. Now Gallogly was interested.

In late January, Kullman and her team thought they had come up with a compromise that could put an end to the proxy fight. DuPont was planning on shifting two of its board members to newly spun-off Chemours. That would leave two seats open on DuPont’s board. Kullman had been interviewing board members and settled on Gallogly and Ed Breen, another well regarded executive who had led a turnaround at Tyco.

Kullman wanted to tell Peltz the company would offer board spots to Gallogly, who Trian had wanted on its slate, as well as another nominee. Kullman told the board, and DuPont’s executive team signed off on the potential deal.

On the morning of Feb. 4, Kullman flew in DuPont’s private jet to Cleveland to pick up Cutler. The two were excited that they might be able to make a deal. They flew to Chicago to meet Peltz in an airport conference room. Peltz was already there when they arrived, sitting at the far end of the rectangular table in the center of the room.

Kullman told Peltz that DuPont had reviewed all of his nominees and determined that none had the right skills to join the board. However, the company was willing to accept one of his proposed nominees as well as another nominee the board felt he would accept (Gallogly) as long as Peltz called off the proxy fight.

Kullman said DuPont was more than willing to use appropriate language in announcing the deal that gave Peltz and his team partial credit for coming up with a compromise. A proxy contest didn’t serve either side, she said. Kullman said she would be willing to tell Peltz the nominees as long as he agreed to keep it confidential.

Peltz asked if he would be one of the board nominees. Kullman said no. Then Peltz said he didn’t need know who the nominees were. “Any compromise that doesn’t include me personally going on the board is unacceptable,” Peltz said, according to Cutler and Kullman. Cutler asked him to think about it overnight. Peltz said he didn’t need to. There was no deal.

The whole meeting lasted around 20 minutes. Kullman and Cutler got back on the plane. It looked like there was no way out of the proxy fight. Kullman dropped Cutler off in Cleveland, and headed home.

Two days later, Kullman announced her two new board nominees: Gallogly and Breen. Kullman earned praise in the press for the quality of the board members she had been able to attract in the midst of a proxy fight. Even Peltz put out a press release praising the choices. The New York Times ran a piece from Reuters Breakingviews that said with the combined moves Kullman had checked, “if not checkmated,” Peltz in the proxy fight.

Then came the news of Kullman’s stock sales. According to the Wall Street Journal, which first published the story, “Trian and other investors” were raising questions about the fact that Kullman back in September, on the eve of the Trian proxy fight, had dumped a large portion of her shares. One fund manager in the piece called the sales “alarming.”

Kullman hit the road in February and started meeting with investors. The first meetings were good. Kullman said one large investor wanted to know why Kullman was there. You’ve been doing great, he said, according to Kullman. You didn’t have to come. Other investors weren’t as convinced. And Peltz was on the road doing his own lobbying. In the office lobby of one large investor Kullman and her team ran into Peltz and Garden. They awkwardly shook hands and moved on.

On March 11, Peltz, according to Trian’s proxy filing, got a call from a large investor, later revealed to be Fidelity, telling him to try to settle. Peltz called Kullman immediately, and when he couldn’t reach her, dialed up Cutler. Peltz said he needed to see Kullman immediately in New York. However, Kullman had appointments scheduled in Philadelphia and Connecticut, and was already on her way.

Cutler told Peltz that an in-person meeting was impossible. So the three set up a conference call. On the call, Peltz said he had a compromise. How about DuPont put him and one other nominee on DuPont’s board, and Trian’s two other nominees on the new Chemours board? Two and two, Peltz argued, was a compromise from four. Cutler and Kullman said they thought they had made a pretty good deal before, and that was still on the table. Peltz said he wasn’t interested. Cutler and Kullman said they would take Peltz’s offer to DuPont’s board, but thought it was unlikely they would go for it.

The next day Peltz went on CNBC touting the fact that this time he had made a compromise deal and that Kullman had rejected it.

A week later, Trian hosted a lunch for fellow DuPont shareholders at the swanky St. Regis Hotel in Midtown. The hotel’s top floor conference room was packed with about 120 people. Peltz said he had invited his fellow investors there to give them the “unvarnished truth about DuPont.” Peltz said that DuPont used to be the most valuable company in the world. Now, he pointed out, the coatings business that DuPont had cast aside a few years ago commanded a higher valuation than DuPont itself did.

DuPont could be great again, Peltz said, but it needed Trian’s help to do it. It was hard to find someone in the room who disagreed with Peltz.

Kullman has spent pretty much every day over the past couple of weeks on the road meeting investors, catching up on work for her day job on the plane, trains, or late at night. She has put off all nonessential meetings or business reviews until after the proxy vote.

Kullman says the reception of investors has been generally good when she makes her case about her performance, and they are getting a better understanding of her strategy for the future of the company. But what she gets a lot from investors is, “Why not?” Why not put Peltz on the board? How much damage could he do?

That response surprises Kullman. “I don’t think you put someone on the board based on the criteria of, What will it hurt? That seems like a very low bar,” she says. “I think you put someone on the board because they have particular skills that will help the company.” Kullman says if Trian wins she is going to have to replace two directors with deep backgrounds in science, and one with experience as a regulator, with a group of finance guys.

As for criticism that she somehow misplayed the proxy fight with Peltz, Kullman says she’s okay with that. “Maybe I could have done better in this fight if I had if I had done some other things,” says Kullman. “But I did the things that I thought were in the best interests of the shareholders. That was my focus.”

Harvard’s George says if Peltz does end up wining its fight with DuPont, it’s just going to encourage other activists. “Research and strategy,” says George. “These are the things that take time, and these are the things that activists attack.” George says he doesn’t know a CEO who isn’t worried about activists.

For now, though, Kullman doesn’t have time to worry. There are still shareholders to lobby, and only two days left to do it.