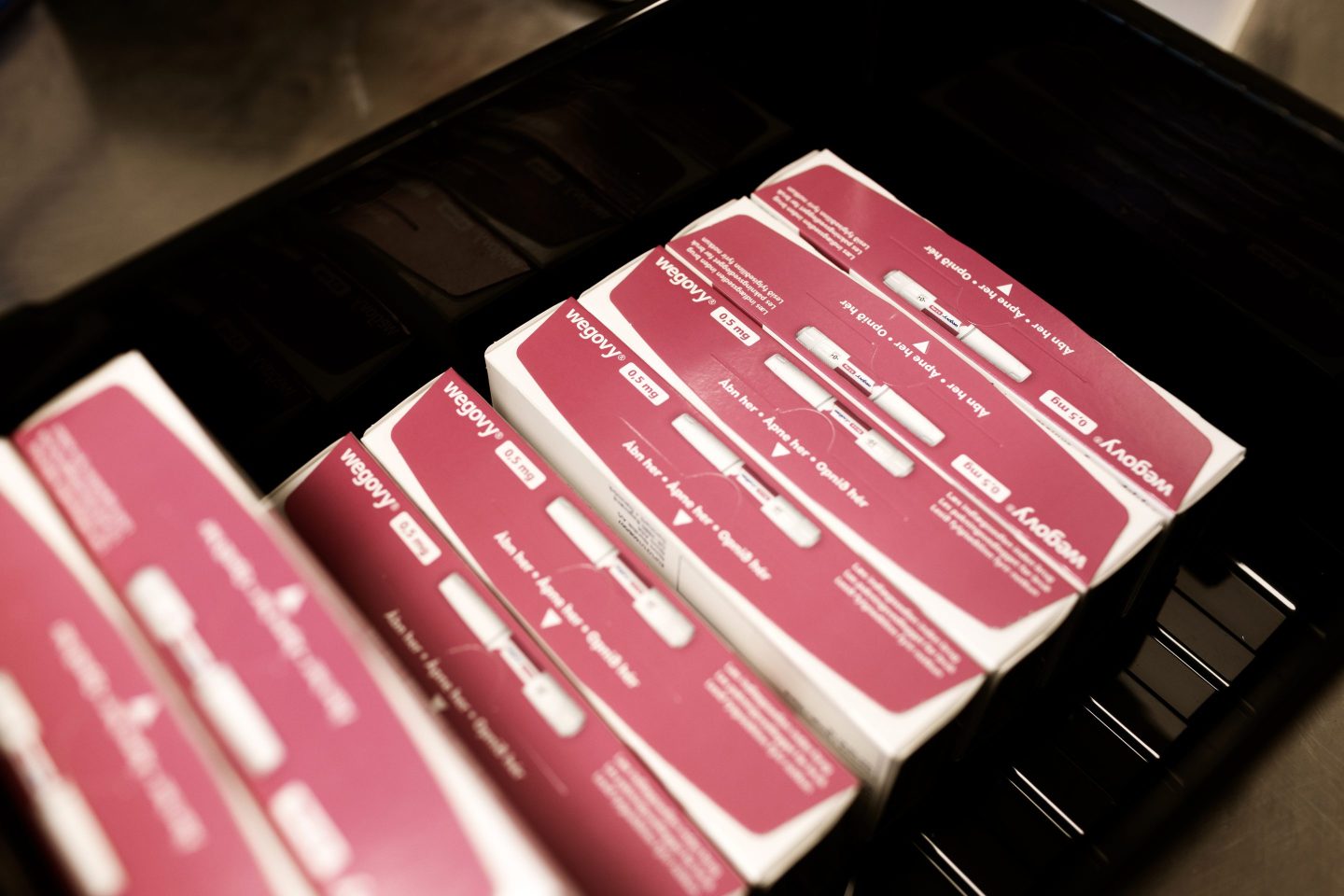

Novo Nordisk has been riding a wave of success following the hit of its weight-loss drug Wegovy, overtaking the Denmark economy’s GDP with its more than $420 billion market cap. It also boosted the pharma firm to winning the title of Europe’s most valuable company.

There’s a new kid on the block now. Zealand Pharma, also Danish like Novo, could pose competition for the Wegovy-maker as a drug it’s developing to fight obesity reported “groundbreaking” mid-stage trial results on Monday.

The trial on the survodutide drug, which Zealand is developing along with German pharma group Boehringer Ingelheim, helped treat a fatty liver and “demonstrated efficacy” in those with obesity, the companies said in a statement.

Zealand’s stocks surged about 35% on Monday—its shares are up over 67% since the start of the year and 158% in the past 12 months.

Weight-loss drugs have been a subject of interest since the success of Novo’s diabetes injectables Ozempic (which has been used off-label for weight loss) as well as Wegovy yielded success in shedding weight and cutting the risk of other related health events such as strokes (it helped that Wegovy was endorsed by the likes of Elon Musk).

The weight-loss drug industry also promises to be highly lucrative, with its valuation expected to hit $100 billion by 2030. All the buzz has sent shares (and profits) of Novo and its American rival Eli Lilly to stratospheric highs, and Zealand has benefited from the rising tide as it closed out 2023 as one of the most successful pharma stocks.

Representatives at Novo and Zealand didn’t immediately return Fortune’s request for comment.

Zealand’s recent success and beyond

In Phase II results for one of its trials, the companies said that 83% of adults who were treated with survodutide reported a marked improvement in a form of liver inflammation, called MASH, that’s linked to excess fat cells.

Survodutide is currently in Phase III clinical trials to test the medication’s impact on people who are obese or overweight—regardless of whether they have diabetes or other heart or kidney conditions. It has a fast-track designation with the U.S. Food and Drug Administration.

Even though Zealand’s market cap is only a fraction (about 7%) of Novo’s, as the race for weight-loss drugs heats up amid skyrocketing demand, it could well become a challenger to the pharma companies behind Ozempic, Wegovy, and Mounjaro.

Analysts at investment bank Jefferies said that Zealand’s “position as a key player in the next wave of obesity therapeutics is underappreciated,” while those at Nordea Bank called the trial’s results an “unequivocal win for survodutide,” according to CNBC.

Novo and Eli Lilly’s first-mover advantage could make them the most dominant players for the next few years, though, as Zealand and Boehringer’s drug might not be available to patients till 2028.

Zealand reshaped its strategy in 2022 to home in on obesity drugs—four of which are in the pipeline along with survodutide. Last year, the companies reported a nearly 19% drop in weight in the drug’s Phase II trial.

The 25-year-old Danish pharma company announced blockbuster annual results on Tuesday with a revenue increase of over 200% from the 2022 financial year and achievements in expanding its obesity drug portfolio.

“2023 was an extraordinary year for Zealand,” the company’s CEO, Adam Steensberg, said in a statement, adding that the company was “well positioned to achieve significant milestones in 2024.”