The stakes in the bitter war between the Securities and Exchange Commission and the crypto industry just got higher. As Fortune reported on Wednesday, the agency is going after Ethereum, issuing subpoenas to U.S. companies that require them to supply all records of their dealings with the foundation that oversees the blockchain. This is a big deal since so much of the crypto industry is built atop Ethereum—not just applications but entire secondary blockchains like Polygon. If the SEC goes ahead with its plan to declare that all of Ethereum is subject to its securities laws, it will have broad and unpredictable consequences.

The most curious thing about the SEC’s gambit is not so much why the agency is doing this, but why it’s doing it now. Leave aside the hypocrisy of Gary Gensler stating back in 2018, before he was SEC chairman, that Ethereum is not a security (you can see it on video here). Consider instead that the Ethereum network will be a decade old next year, and that the time to regulate it would have been during the ICO mania of 2017, when grifters used it to launch a wide variety of scams. Every year since then, the network has become bigger and more disbursed, and for the SEC to exert control over it today is like trying to stuff the proverbial toothpaste back in the tube.

People familiar with the investigation told me they suspect the timing has to do with Ethereum’s switch to a proof-of-stake model in late 2022. For anyone not fluent in crypto, this entailed switching to a different mechanism for confirming the legitimacy of blockchain transactions that relies on a disbursed network of validators. Previously, Ethereum had relied on the Bitcoin model, which entails guzzling tremendous amounts of energy to solve random math problems. The change meant that Ethereum cut its carbon emissions by over 99% but, as proof no good deed goes unpunished, it appears to have invited legal trouble. The new argument is that the validator model means Ethereum is now a series of stock-like investment contracts. Or something.

This argument is not a strong one, it doesn’t help the agency’s case that numerous people have relied on the SEC’s earlier signals that Ethereum is not a security. If push comes to shove, the agency will almost certainly lose in court. And yet the SEC, rather than walk away or help devise a new regulatory framework for decentralized blockchains, is heating up an investigation. Why?

The best answer is politics. Justin Slaughter, one of the more astute crypto watchers in D.C., has pointed out that Gensler is taking heat from hard-core progressives—who are every bit as fanatical as the worst crypto loon. Slaughter points to an editorial in the lefty touchstone Prospect that takes the step, unusual for them, of denouncing Gensler for letting Bitcoin ETFs go ahead in January. Even though a unanimous appeals court all but ordered the SEC to approve the ETFs, Prospect says Gensler should have kept “fighting and let the chips fall where they may.”

Such language suggests an ideological fixation, but these are key allies of Gensler’s de facto boss, Sen. Elizabeth Warren (D-Mass.). Some of their concerns about crypto are legitimate, but it’s a losing battle when it comes to trying to exert control over Ethereum. That horse left the barn long ago.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

Crypto VC giant Haun Ventures named Anchorage founder Diogo Monica as its first new general partner. (Bloomberg)

Bitcoin rebounded above $67,000 and other currencies surged on dovish remarks by the Fed chairman. (CoinDesk)

A new Ethereum layer-2 project called Morph, which offers a "developer-friendly" way to build finance and gaming apps, raised a $19 million Series A from Dragonfly Capital. (Fortune)

Robinhood made its crypto wallet available to all Android users, one year after it released the iOS version. (The Block)

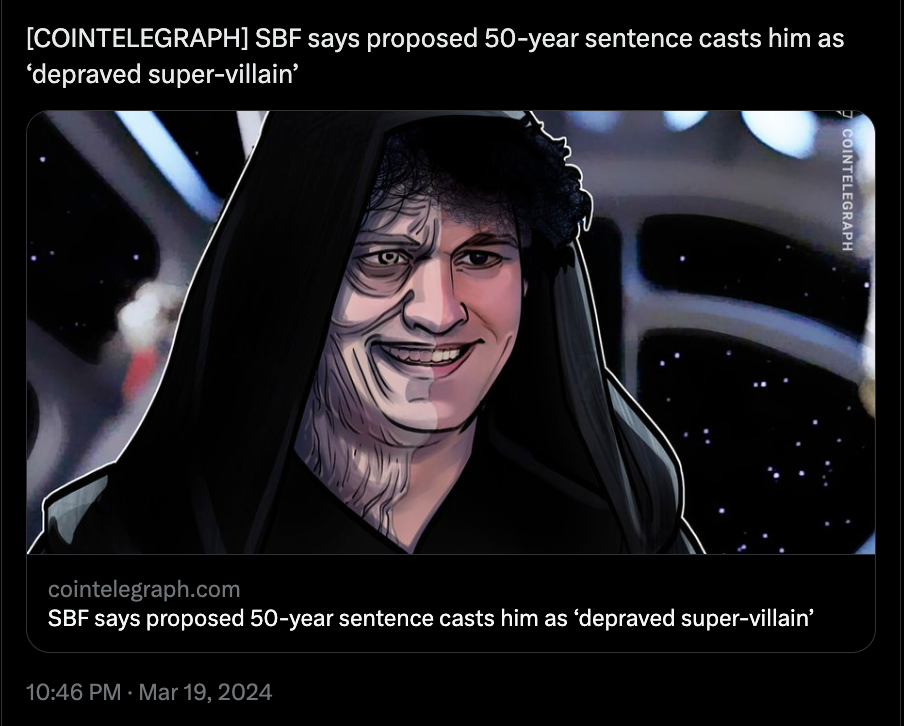

Sam Bankman-Fried's lawyers say prosecutors have unfairly portrayed him as a "depraved super-villain" and complained their proposed 40- to 50-year sentence is a "medieval" death sentence. (Fortune)

MEME O’ THE MOMENT

Sam "I'm no super-villain" Bankman-Fried:

This is the web version of Fortune Crypto, a daily newsletter on the coins, companies, and people shaping the world of crypto. Sign up for free.