Coinbase reported a big upswing in transactions for Q4 on Thursday, while posting its first profit in two years. Those results far surpassed analysts’ expectations, leading the company’s share price to soar almost 16% in Friday trading. Meanwhile, Coinbase offered an upbeat outlook for the rest of the year, while at the same time showing that expenses are under control, and that it is investing in a growing suite of new revenue-generating services. This is all good news. So what’s not to like?

Quite a few things, unfortunately. Even as Coinbase is executing better than it has in years, and the end of Crypto Winter brings new hope to the sector, the industry’s flagship company faces fundamental challenges to its business that will be hard to overcome.

Since launching in 2012, Coinbase has lived a feast-or-famine existence. During bull markets, revenue has come flooding in, letting the company invest in the future and amass a financial cushion to hang on during the wreckage of Crypto Winter. In theory, this pattern should be playing out again as the price of Bitcoin soars and the carnage of FTX and other recent scandals recedes.

The problem this time around is that the crypto landscape is very different than it has been in the previous bull markets of 2013 or 2017 or even 2021. For starters, crypto trading has become a commodity—everyone from Robinhood to PayPal to Block lets customers buy and sell Bitcoin and Ethereum. This means Coinbase is no longer the default choice for novice investors, and that trading fees—where the company has made a killing during past booms—are being driven ever lower.

There is also the fact that the current rally is being driven by institutional investors, while the retail customers who have historically been Coinbase’s bread and butter have been slow to return to the market. And of course there is the success of Bitcoin ETFs, which finally launched in February. While these products have been a boon for crypto as a whole, they also risk gobbling up a share of the Bitcoin action that would have belonged to Coinbase.

As for the company’s efforts to diversify revenue streams by offering new services, those are beginning to pay off as Coinbase now makes more of its money from offerings like custody, staking, and its new Base blockchain. The problem is that a big chunk of its “services” revenue is actually interest from the USDC stablecoin, and that is likely to diminish significantly when the Federal Reserve begins to cut rates.

A final challenge for Coinbase is that, unlike previous crypto booms, the federal government has become deeply hostile to the sector and appears more interested in killing off the domestic industry rather than helping it flourish on U.S. shores. This is a poor policy choice for which Coinbase should not be blamed, but it doesn’t change the reality that it’s hard to grow when regulators have their foot on your throat.

The upshot here is that shareholders may be ready to reward Coinbase’s strong performance in the short term, but that doesn’t change the fact the company is facing powerful headwinds over the long term.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

The Justice Department is on the cusp of approving law firm Sullivan & Cromwell to be the monitor tasked with overseeing Binance's efforts to comply with last year's massive settlement. (Bloomberg)

Crypto money laundering dropped in 2023 while criminals also shifted their tactics, including relying more on cross-chain bridges. (Chainalysis)

As the Bitcoin market continues to grow, the banking lobby is pushing regulators to change accounting rules that force them to treat crypto stored for customers a balance sheet liability. (Bloomberg)

A startup called Witness, which raised a $3.5 million seed round led by Haun Ventures, seeks to build out a service that aims to reduce or eliminate blockchain gas fees through data compression. (Fortune)

The SEC fined Van Eck for failing to disclose it had hired a "well-known and controversial social media influencer" to help promote its Bitcoin ETF. (SEC)

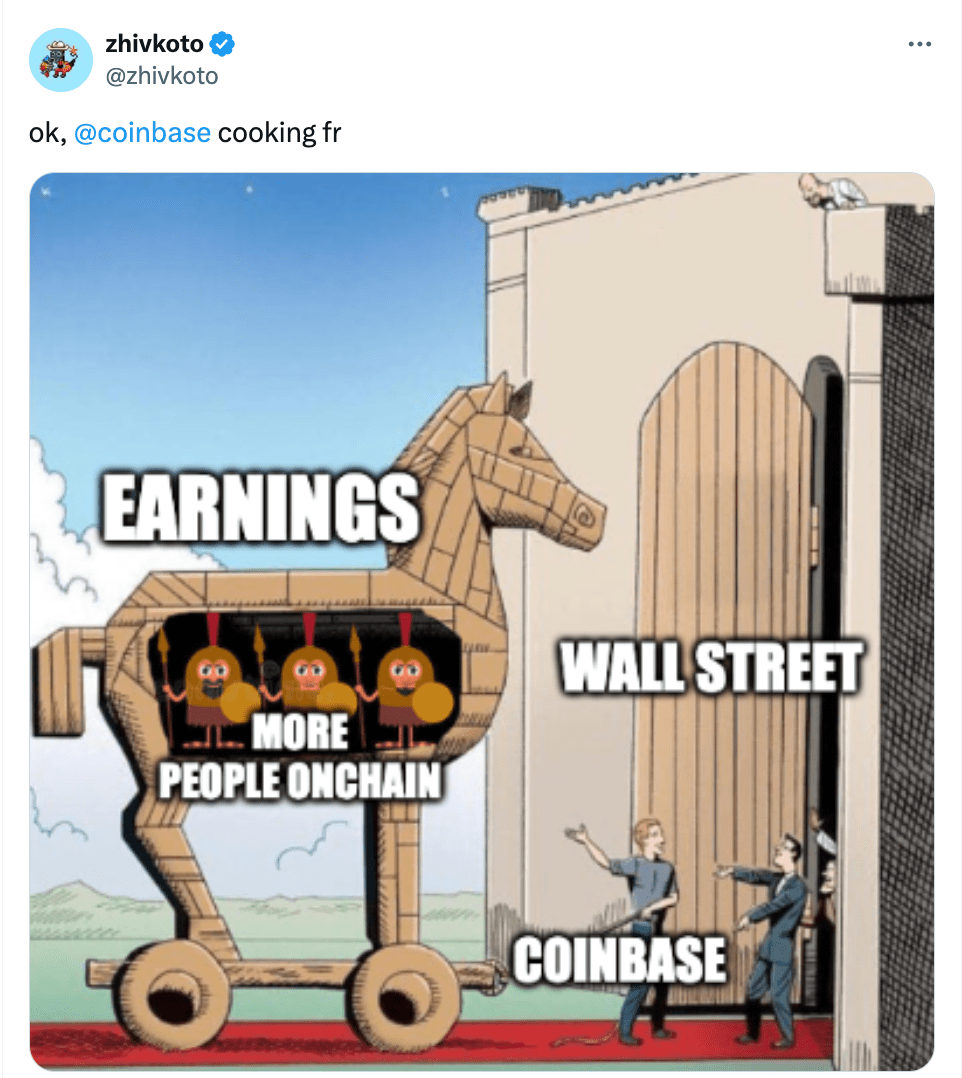

MEME O’ THE MOMENT

A more positive take on Coinbase:

This is the web version of Fortune Crypto, a daily newsletter on the coins, companies, and people shaping the world of crypto. Sign up for free.