The problem with having a hero is, sooner or later, they will disappoint you. I was reminded of this upon reading an excerpt from Michael Lewis’s new account of Sam Bankman-Fried titled Going Infinite and listening to the author’s comments about the disgraced FTX founder on 60 Minutes. I have long regarded Lewis as the king of business writers—Liar’s Poker, Moneyball, and The Big Short are among my favorite books—but, in the case of Bankman-Fried, he whiffed badly.

Before getting into the specific shortcomings, it’s helpful to know that Lewis has a formula of sorts: find an outsider type who possesses a blazing genius to not only see truths that others cannot, but to act on them. And so we get the story of Oakland A’s general manager Billy Beane outsmarting the much richer New York Yankees or hedge fund manager Michael Burry shorting the bubble-inflated housing market. Bankman-Fried was set to get the same treatment from Lewis until the FTX empire collapsed in a massive fraud right as Going Infinite was going to the printers—forcing the author to hastily update the story.

By this stroke of luck, Lewis was able to set the basic facts of the story straight, but, unfortunately, he appears to have been unable to let the scales fall from his eyes when it came to evaluating the true character of Bankman-Fried. Here he is on 60 Minutes: “This isn’t a Ponzi scheme…in this case, they actually had a great real business. If no one had ever cast aspersions on the business, if there hadn’t been a run on customer deposits, they’d still be sitting there making tons of money.”

This is simply wrong. You can quibble about the precise definition of a Ponzi scheme, but FTX didn’t collapse because of a run on deposits. It collapsed because Bankman-Fried stole billions of dollars of customer funds to splurge on luxury real estate, bribe the U.S. government, and promise a $55 million payment to his would-be BFF Tom Brady.

Meanwhile, an excerpt of the book in the Washington Post is stuffed with eye-popping anecdotes—including Bankman-Fried’s hilarious diss of fashion queen Anna Wintour and his plan to pay Donald Trump $5 billion not to seek reelection—but also shows how Lewis still fails to grasp the sociopathy that drives his protagonist. Over and over, Lewis paints Bankman-Fried’s larceny as driven by a higher purpose and an intellect so divine that he can perform constant feats of moral calculation while playing video games.

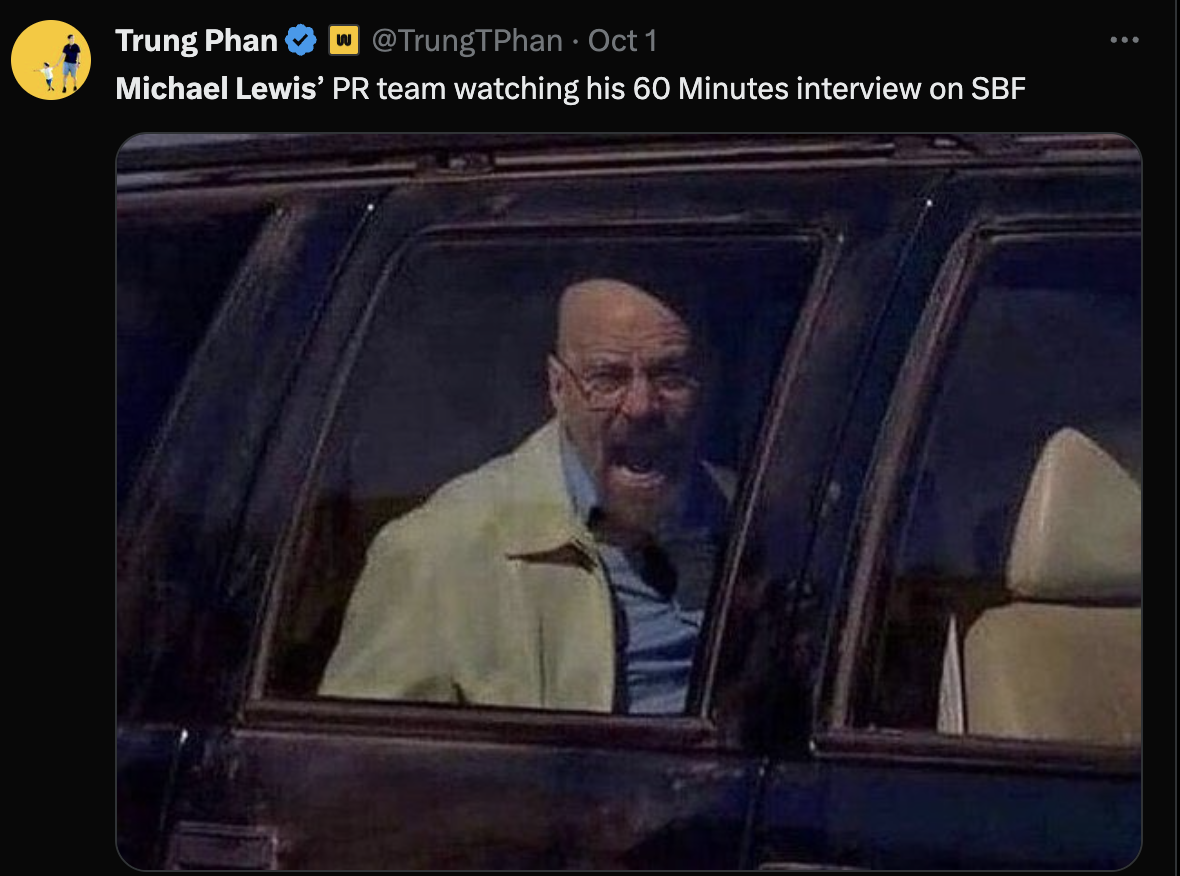

All of this has predictably led to Lewis getting skewered on social media. Jesse Eisinger, an authority on white-collar crime, ripped him for writing a “hagiography” even after learning of the “rampant and obvious fraud.” Others declared that Lewis had “discredited himself and damaged his reputation” and that he had become Bankman-Fried’s “last and most willing victim.”

As with anyone, it’s hard to know for sure what’s really in Lewis’s brain and in his heart. A few cynics have suggested his bizarre 60 Minutes take was just an attempt to juice sales of the book, which hits stands today. And indeed, Lewis himself conceded in the interview, “If I were a better person, I would have been deeply distressed by all of this. It took about a nanosecond before I thought, ‘Oh, my God. This is an incredible story.’”

He certainly has that part right. I’ve just received my advance copy and will write a proper assessment soon. For now, it’s enough to say that a longtime literary hero has delivered a big disappointment.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

New research shows Web3 startups raised $1.3 billion in Q3, down from $2 billion in the previous two quarters and a far cry from the $8 billion raised in Q2 of 2022. (TechCrunch)

Bitcoin reached a six-week high on Monday, brushing $28,600 before shedding part of those gains. (Bloomberg)

Grayscale, along with NYSE Arca, asked the SEC to convert its Grayscale Ethereum Trust into a spot market ETF. (CoinDesk)

The NFT collection Pudgy Penguins rose 241% in trading volume after Walmart announced it would sell a toy offshoot of the brand in 2,000 stores. (The Block)

Prominent crypto lawyer Jake Chervinsky has left the Blockchain Association to join the venture fund Variant. (Fortune)

MEME O’ THE MOMENT

OMG, did he really just say that?

This is the web version of Fortune Crypto, a daily newsletter. Sign up here to get it delivered free to your inbox.