It was fun while it lasted. For nearly three weeks, crypto enthusiasts have been riding high following a federal judge’s decision to side with Ripple over the Securities and Exchange Commission on the question of when a digital asset—XRP in that case—is a security. But now comes the cold water.

On Monday, a second federal judge in New York took up the same question in another digital asset case—this one involving the failed Terra stablecoin—and came to a very different conclusion. Actually, said U.S. District Judge Jed Rakoff, selling tokens on secondary markets like exchanges does not change their status. They are still securities. And yes, he was aware of the Ripple ruling, writing, “The court rejects the approach recently adopted by another judge of this district in a similar case.”

Awkward. In his writing, the 80-year-old Rakoff showed little delicacy as he sought to kick out the logical stool on which his much younger colleague and office mate based her decision in SEC v. Ripple. So what does this mean?

At the very least, the new ruling is a boost for the SEC, which has been on its back foot since Ripple’s unexpected victory. The agency and its attention-hungry chair, Gary Gensler, will also be rubbing their hands over the fact that the ruling came from Rakoff, who is no ordinary judge but a celebrated jurist and securities law expert. What’s more, Rakoff also rejected Terra’s attempt to assert the major questions doctrine (which says courts must leave matters of big economic significance to Congress), saying it “would ignore reality to place the cryptocurrency industry and the American energy and tobacco industries…on the same plane of importance.”

If you have no use for crypto and want someone on the bench who shares your views, Rakoff is probably your guy. His ruling, of course, is far from the last word on the “when is crypto a security” question—as evidenced by the fact that XRP’s price dropped only slightly after it came out. Rakoff’s decision also has no bearing on his colleague’s conclusion that XRP is not a security in most cases, so Ripple is still in the clear for now.

Unsurprisingly, Ripple’s heavyweight lawyer Stu Alderoty was quick to pipe up on Twitter, pointing out that the new case was at a preliminary stage and without a full body of evidence. “Let me be clear about some confusion going around—the ruling in the Terra case changes nothing about the Ripple ruling that XRP is not a security,” he wrote.

In other words, it’s early in the game, and the crypto industry won’t really know where it stands until a federal appeals court—or perhaps the Supreme Court—weighs in. In the meantime, the conflicting rulings from the same district provide a new spur for Congress, which has been more active than ever before on the crypto front, to finally pass some laws to clear all this up.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

Tether published an attestation from accounting firm BDO Italy that says the stablecoin giant had a Q2 profit of $82 million, and reserves that include $72 billion in cash and T-bills, and a $3 billion surplus. (CoinDesk)

A German privacy watchdog is leading a European Union investigation into the iris-scanning crypto project Worldcoin, and is looking into consent and data security issues. (Reuters)

The SEC sued the founder of “blockchain certificate of deposit” outfit Hex for selling unregistered securities, alleging he spent $5 million for the world’s largest black diamond. (Fortune)

An emerging FTX bankruptcy plan would partially repay customers in U.S. dollars and wipe out the value of FTT tokens. (Bloomberg)

Brian Armstrong says the SEC told the company to cease offering all assets except Bitcoin, a move the Coinbase CEO says would mean the end of the crypto industry in the U.S. (Fortune)

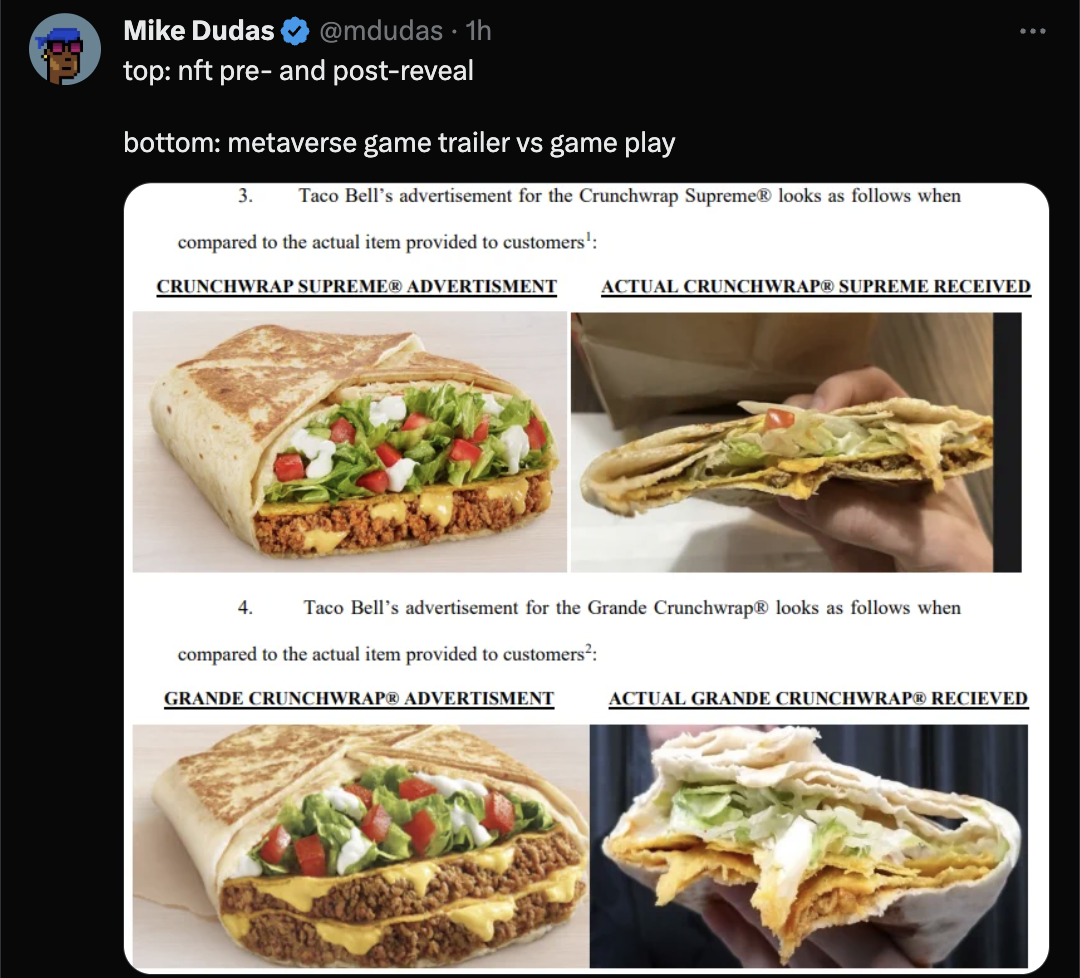

MEME O’ THE MOMENT

NFT and metaverse hype vs. reality:

This is the web version of Fortune Crypto, a daily newsletter. Sign up here to get it delivered free to your inbox.