When the internet went mainstream in the mid-1990s, it created a spate of novel intellectual property (IP) issues that forced courts to decide how rules designed for the era of books and industrial machines should apply to things like web domains, online mashups, and smartphone technology. The IP rules of the internet eventually became a little clearer, but often it took years of waiting until the Supreme Court could get involved.

Now, something similar is playing out in the world of crypto and Web3. The latest example is a high-profile case in the news this week involving Hermès, which claims an entrepreneur selling versions of its iconic Birkin bags violated the fashion house’s trademark rights. The entrepreneur claimed he should be off the hook since his digital wares were protected by free expression in the same way as Andy Warhol’s paintings of Campbell’s soup cans. But the judge wasn’t buying it—in part because text messages described him telling others the plan was to “pump” and “shill” the bags to “whales.”

The Hermès case turns on trademark law, which is intended to protect brands, but the other two major pillars of IP law—patents and copyright—have also become battlegrounds as crypto players fight over who gets to own and control other aspects of Web3. In the case of patents, which grant 20-year monopolies for new inventions, banks and others are seeking to own aspects of blockchain technology. And recently, a key player in the emerging Web3 domain name industry told me they fear a rival is seeking to abuse patent rights to bar competitors from using common technology—a valid fear for anyone familiar with patent trolls or with the ruinous multibillion dollar patent litigation between Apple and Google over the iPhone.

Then there is copyright, which protects artistic expression and, thanks to lobbying by Disney, can now last for over a century. Anyone following the NFT scene has likely heard of the ongoing litigation between Yuga Labs and an artist over who controls the rights to thousands of Bored Apes. Yuga claims it owns the underlying copyrights even as it lets Ape owners engage in a broad range of commercial activities through a broad licensing scheme. But the artist claims the company did not employ the requisite level of creativity to qualify for copyright when it minted the Apes, while Yuga also faces the problem that it never registered the digital creatures—a prerequisite if you want to sue someone.

I’ve offered only the most basic description of all of these cases—there are obviously other legal subtleties at play. But the point is that the world of crypto, which is barely a decade old, is slowly getting engulfed in IP issues in the same way earlier eras of the internet did before. As a casual observer, I can only be struck by the fact that it was not long ago I could count the number of crypto attorneys on one hand, but now there are hundreds—and at this rate, it won’t be long until lawyers start building their practice around crypto IP. Already, there is no shortage of work.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

Coinbase’s CEO warned the SEC intends to ban staking, a move he says would drive an important element of the crypto industry offshore. (Decrypt)

Kraken is reportedly on the cusp of a major settlement with the SEC over its alleged sale of unlicensed securities. (Bloomberg)

Robinhood’s Q4 crypto revenues dropped significantly compared with a year ago, but overall revenue was up slightly. (Fortune)

Longtime crypto exchange Local Bitcoins, which helped people meet up to swap crypto in person, is closing down. (CoinDesk)

The CFO of Binance.US said the company doesn’t comingle deposits with its larger parent company and that a bank run would be “impossible.” (WSJ)

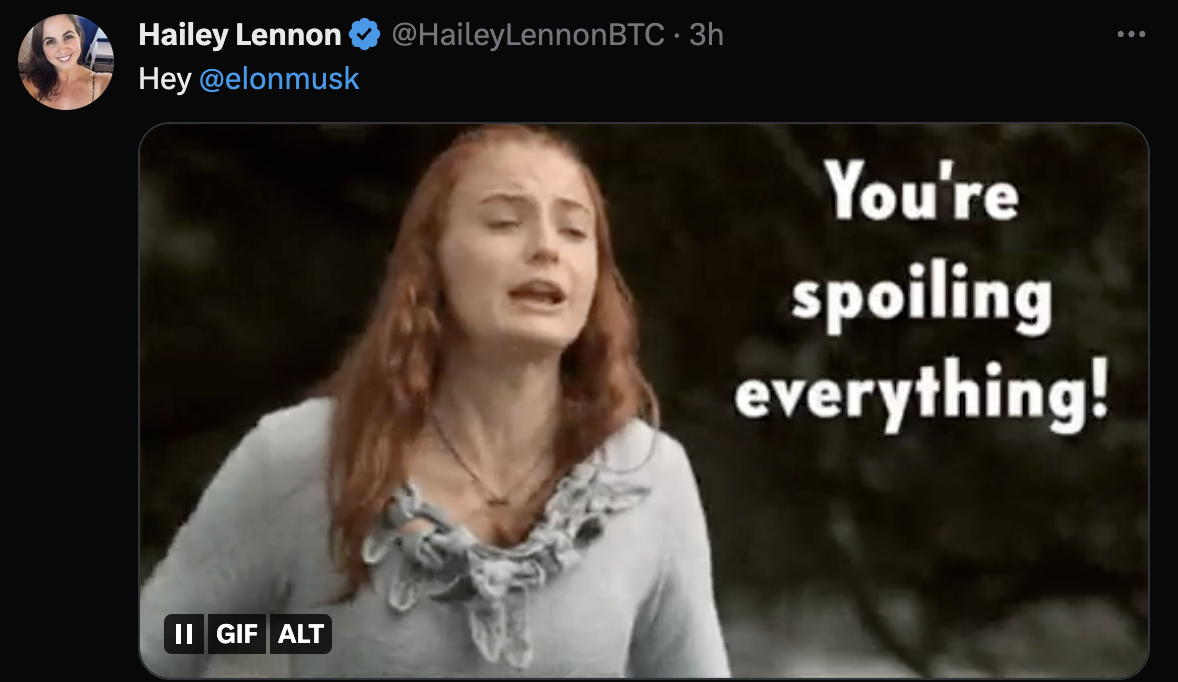

MEME O’ THE MOMENT

Crypto Twitter, like everyone else is, is fed up with Twitter

This is the web version of Fortune Crypto, a daily newsletter. Sign up here to get it delivered free to your inbox.