- Steve Jobs before his death spoke with Warren Buffett about what to do with Apple’s extra cash on hand, but didn’t take his advice. Buffett suggested Jobs buy back Apple stock, but Jobs “just liked having the cash.” Buffett had suggested Jobs do this because he thought Apple stock was undervalued.

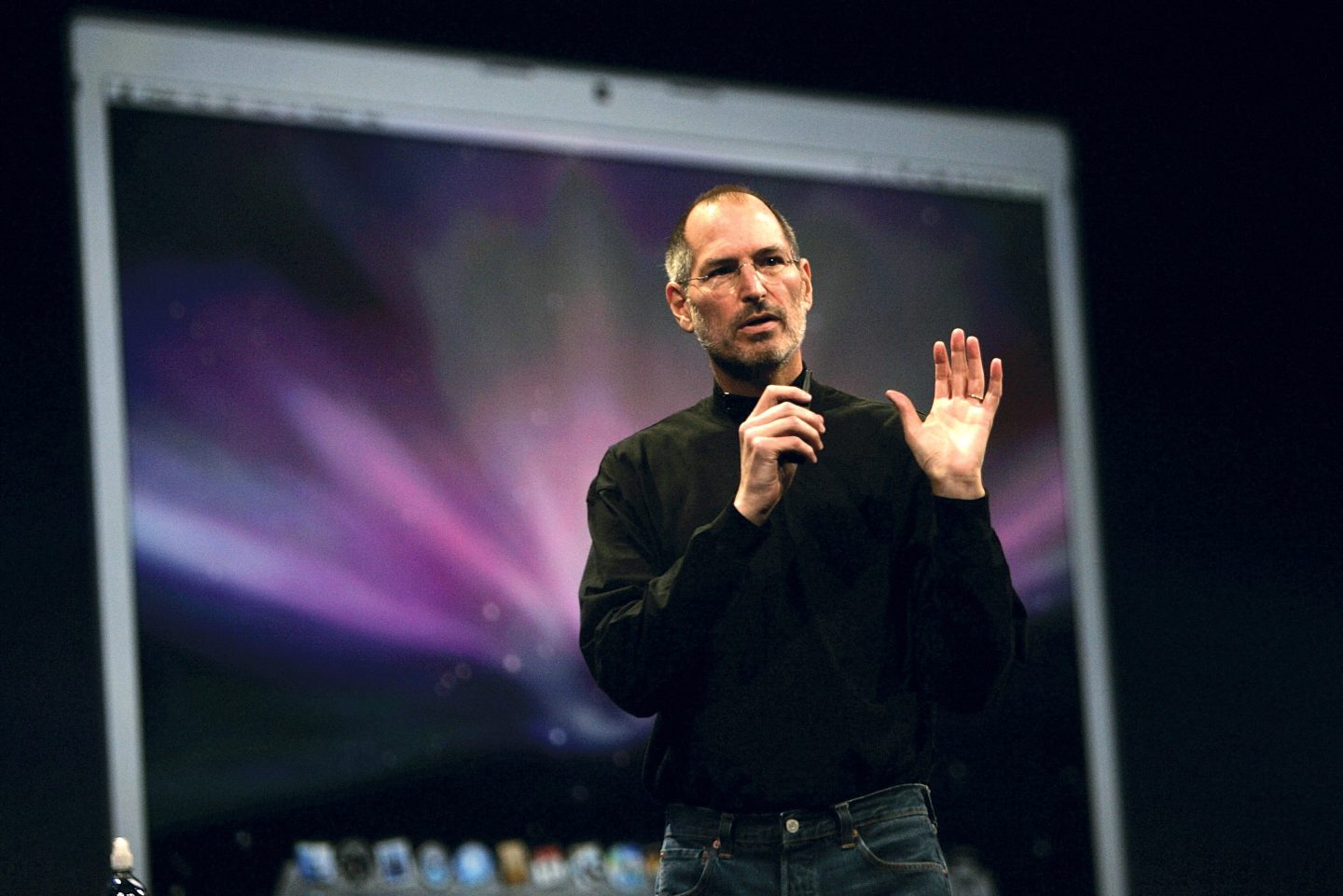

Steve Jobs, the former CEO and cofounder of Apple, is revered for bringing to life one of the most successful tech companies in history, but he also had a will to do things his own way.

Jobs, who died in 2011 at age 56 from pancreatic cancer, ran a tight ship during his time with Apple. He was a “unique, once-in-a-lifetime” leader, former Gap CEO Mickey Drexler told Yahoo Finance, yet was “a difficult person, mercurial, incredibly creative, and made sure the screws on all the products were horizontal.”

Jobs’ micromanaging practices and “no bozos” policy aside, he also sought out advice from other business leaders while Apple was growing. In a 2012 interview with CNBC, Warren Buffett recalls Jobs calling him a couple years prior to discuss what to do with the extra cash Apple had on hand.

“It was an interesting conversation because I hadn’t talked to him for a long time, and he said, ‘We’ve got all this cash, Warren,’ and he says, ‘What should we do with it?’” Buffett said. “So we went over the alternatives, and it was kind of interesting.”

Buffett said he laid out four options for Jobs: stock buybacks, dividends, acquisitions, and sitting with it. At the time, Jobs had “many, many, many, many billions” sitting around, Buffett said.

So the two discussed the logic of each of the four scenarios. But Jobs told Buffett he wouldn’t have the chance to make “big acquisitions that required lots of money.” Buffett then suggested Jobs use it for stock repurchases if he felt the stock was undervalued, which Jobs said he thought it was. In 2010, Apple stock was worth about $7.40 per share, and its current share price is more than $245.

“Well, you know, what better can you do with your money?” Buffett said he recalled asking Jobs. And while Jobs acknowledged he thought Apple stock was undervalued at the time, “he didn’t do anything,” Buffett said.

Stock buybacks are typically used to increase the value of remaining shares and can be a tax-efficient way to return money to shareholders. With fewer shares in circulation, each shareholder gets a bigger stake in the company and a higher return on future dividends, according to financial services company Santander.

“He just liked having the cash,” Buffett said. “It was very interesting to me because I later learned that he said that I agreed with him to do nothing with the cash. But he just didn’t want to repurchase stocks, although he absolutely thought his stock was significantly underpriced.”

One could argue Jobs’ stubborn decision to ignore Buffett’s advice matched the way the former Apple CEO approached leadership. He forged his own path instead of taking advice from others.

“When it came to getting his way, [Jobs] could be demanding, acerbic, and imperious, just as his reputation holds,” Shalini Govil-Pai, vice president and general manager of TV at Google and the board director at YouGov, wrote in a 2024 Fortune commentary article. Govil-Pai had previously worked with Jobs.

Buffett didn’t always follow his own advice to Jobs

While stock buybacks can be a boon for companies, they’re discouraged for a variety of reasons as well, including starving the business of money for other investments like research and development. Plus, stock buybacks could deprive a company “of the liquidity that might help them cope when sales and profits decline in an economic downturn,” according to Harvard Business Review.

And although Buffett had suggested a stock buyback to Jobs, he had previously steered away from them. But in Berkshire Hathaway’s 2000 annual report, the company announced it would buy stock back.

“I’ve always said buying stock back makes great sense when you’re buying it at a significant discount,” Buffett said, but also warned of an “ethical question” about buying stocks back from your partners.

“We want to be sure if we’re buying it back from our partners at a discount from what it’s worth, that they understand what it’s worth and why we’re doing it,” Buffett said, citing IBM’s success with stock buybacks.

Between 2009 and 2018 alone, IBM bought back nearly $83 billion worth of stock, according to S&P Dow Jones Indices buyback data.

“One of the things I like about IBM is the fact that they have aggressively bought their stock back over time,” Buffett said. “That’s made their shareholders richer.”

In 2024, however, Buffett announced Berkshire Hathaway would halt its six-year streak of stock buybacks for the company, saying it was too expensive. But Buffett’s move only solidified his general stance on buybacks: to only do it when he sees it as a bargain.

“It’s a signal that they feel cautious about where the market is,” Aswath Damodaran, a corporate finance professor at NYU Stern School of Business, told CNN. “They’ve become cautious because they think the market is richly priced.”

A version of this story ran on Fortune.com on February 24, 2025.

More on Warren Buffett:

- Legendary investor Warren Buffett marks 3 straight years as a net seller of stocks with a new CEO about to take charge at Berkshire

- Billionaire Warren Buffett made his first million by 32—now he’s telling Gen Z the key to getting rich isn’t just hard work, but the company you keep

- Warren Buffett and top CEOs say a college degree doesn’t matter. Here’s what really counts in hiring