- The S&P 500 closed the day at 6,092, just 51 points off its all-time high of 6,144 from February. Oil prices recovered from, rising 1.4% today, as tensions in the Middle East settled. Across the board other macro issues from tariffs to the looming spending bill also sat in limbo, easing uncertainty for markets.

Despite little change in the U.S. stocks on Wednesday, investors watched the markets closely.

The S&P 500 closed the day just 51 points off from its all-time high closing price of 6,144 on February 19.

The Dow Jones closed the day down about 106 points, but still higher than its mid-afternoon lows on Monday. Meanwhile, the tech-heavy Nasdaq finished up 0.3%, closing Tuesday at 19,974. It is also flirting with a return to its all-time high of 20,173 points from December 16, 2024.

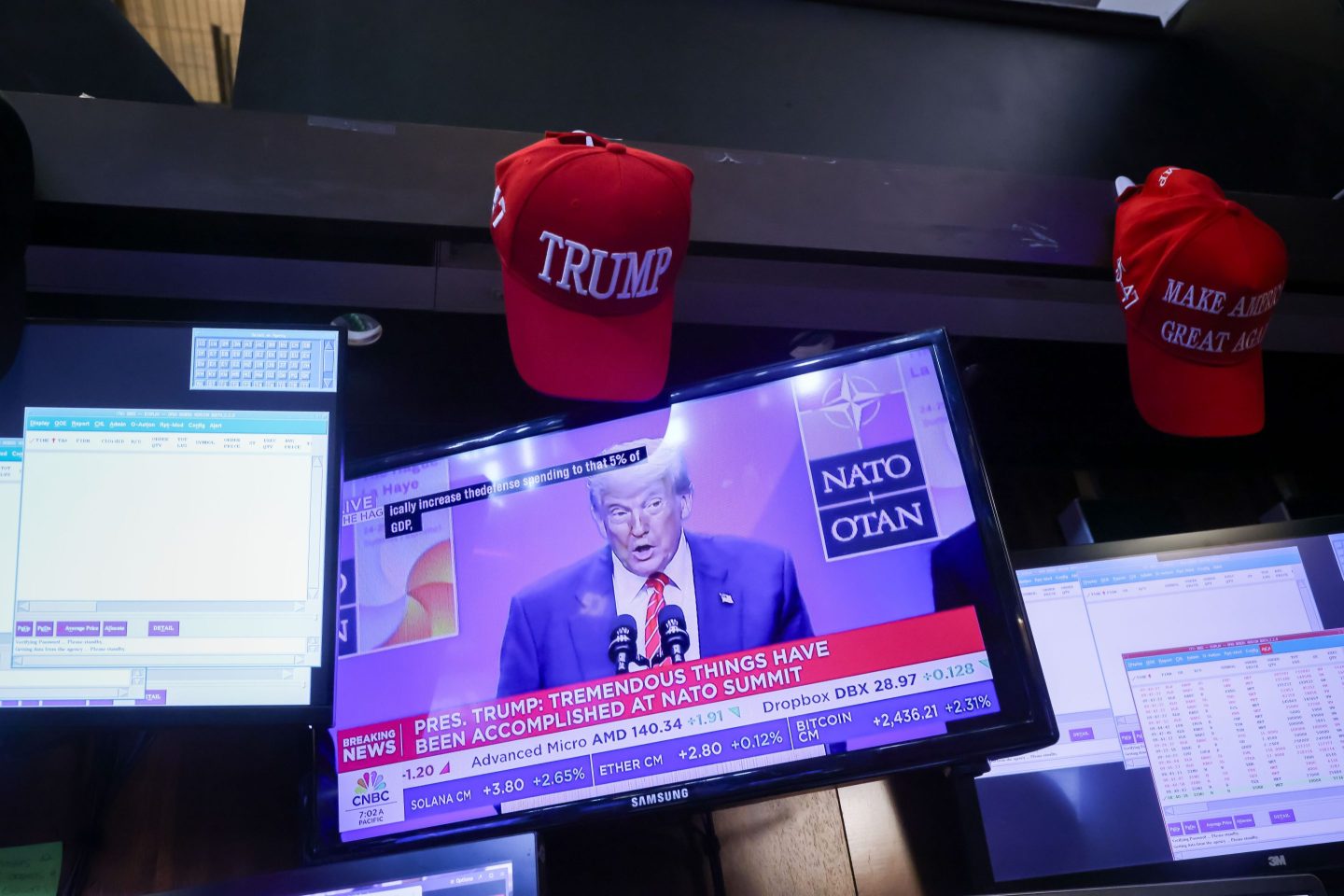

The fact U.S. equities are not just recovering from their April rout, but rebounding to the record highs they saw before President Donald Trump’s tariff policies, indicates markets may have started readjusting to the era of increased uncertainty investors find themselves in.

Overall levels of market uncertainty have declined compared to their peaks in the immediate aftermath of Trump’s on-again, off-again tariff policy. (A point reiterated by Federal Reserve chair Jerome Powell during congressional testimony on Tuesday). But market conditions have not returned to the humdrum routine that investors welcome.

On the other hand, the many issues that could roil markets—from the Middle East, to the looming inflationary impacts of tariffs, to an unprecedented government spending bill—are in a holding pattern. Yes, they haven’t been solved but neither have they worsened.

The U.S. announced a ceasefire between Israel and Iran. Trump stopped removing and reinstituting tariffs on a daily basis like he had been just a few weeks ago. The U.S. and China appear to be working on a trade deal but, there is nothing concrete other than the removal of the more than 100% tariffs they’d placed on each other. The spending bill, which would send the deficit skyrocketing, is for now, mired in the sandpits of the American legislative branch.

This week started with slumps in the equities market over fears the conflict in the Middle East would disrupt oil flows. But what a difference a couple of days can make.

On Wednesday oil futures were up 1.4% after falling earlier this week.

Stocks also saw a similar drop earlier this week. After Monday’s initial shock, a muted and fairly surprising reaction followed, noted Jake Schurmeier, portfolio manager at Harbor Capital and a former member of the Federal Reserve Bank of New York’s Markets Group.

“The risk premium in markets lasted all of five hours,” Schurmeier told Fortune. “I think the answer could be that markets are becoming more efficient in getting used to these geopolitical blips.”

The ups and downs of the last few days pointed to a reactionary market, Schurmeier said.

“The broader point is we’ve become so short term,” he said. “It all strikes me as very cynical and short-term thinking at this point.”

With choppy markets, including in intraday trading, some investors keep an eye on the long game. Bob Robotti, president and chief investment officer of asset manager Robotti & Company, said he’s focused on the structural risks facing the economy rather than short-term geopolitical volatility.

For instance, several major forces are going to drive inflation higher, he said. Key inflationary pressures such as “all the aspects of tariffs, changing supply chains, extra frictional costs” aren’t temporary but represent fundamental shifts in how the global economy operates, Robotti said. He sees the outcome from those shifts resulting in permanently higher prices.

“If inflation is a persistent event and higher interest rates are required, that means lower multiples on everything in the investable world,” Robotti told Fortune. “This is particularly concerning given the concentration of capital in growth assets and private equity that have benefited from the low-rate environment, making the entire system more vulnerable to an inflationary regime change.”