Good morning! Defunding Planned Parenthood could hurt taxpayers, Selena Gomez’s nonprofit faces financial issues, and the Dick’s Sporting Goods-Foot Locker deal isn’t a slam dunk.

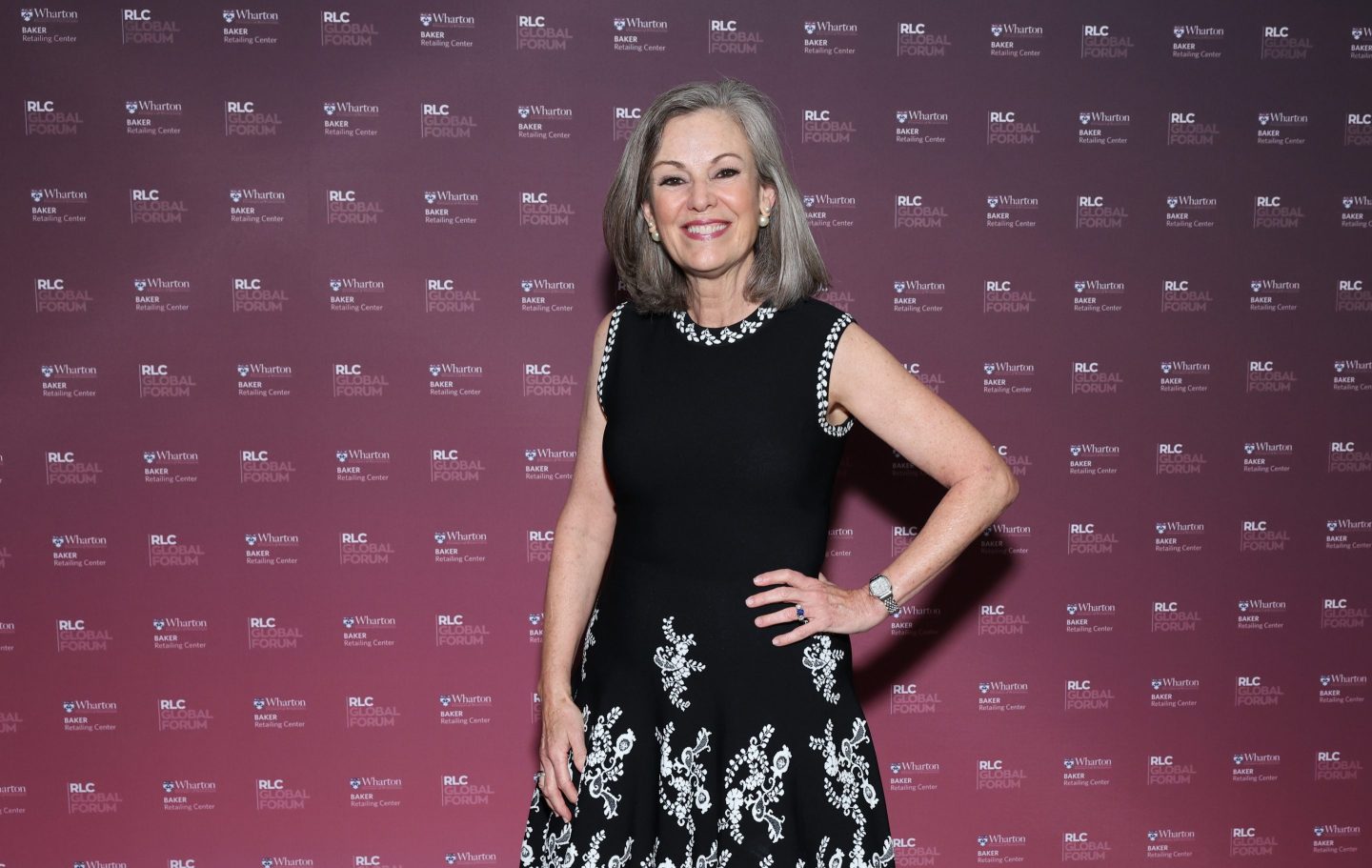

– Goal-oriented. Dick’s Sporting Goods is buying Foot Locker for $2.4 billion, the retailers confirmed yesterday. It’s the biggest acquisition ever for Dick’s—and the deal teams up two notable female CEOs, DSG’s Lauren Hobart and Foot Locker’s Mary Dillon.

My colleague Phil Wahba (a retail expert!) has a new analysis of the deal for Fortune. It may be Hobart’s “first major mistake,” he writes. Indeed, Wall Street doesn’t like the sound of the merger, either; shares fell 13% on Thursday morning.

Foot Locker has struggled, and investors worry that Dick’s lacks experience turning around outside brands. While both in the athletic-wear category, the two retailers operate very differently. Foot Locker has stores in U.S. malls and around the world, while Dick’s mainly runs U.S.-based big-box locations in the suburbs. The idea behind the purchase is that Dick’s could gain market share and go further into the sneaker boom, Phil writes. But there are a lot of question marks around whether Dick’s could do that successfully.

Dillon is known for turning around Ulta Beauty, a post she held for years before arriving at Foot Locker. Interestingly, her success is what makes Wall Street question whether this is a good idea or not. If Dillon couldn’t fix Foot Locker, they’re asking, why will Dick’s fare any better? “Can Dicks’ management succeed in improving Foot Locker’s fortunes where a respected and successful executive (Mary Dillon) was unable?” said John Zolidis of equity research firm Quo Vadis Capital.

There are other reasons the deal isn’t viewed as a slam-dunk, like both chains’ dependence on Nike. Read more from Phil here.

Emma Hinchliffe

emma.hinchliffe@fortune.com

The Most Powerful Women Daily newsletter is Fortune’s daily briefing for and about the women leading the business world. Today’s edition was curated by Nina Ajemian. Subscribe here.

ALSO IN THE HEADLINES

- Cost of cuts. Republicans’ push to defund Planned Parenthood could cost taxpayers $300 million over the next 10 years, a leaked preliminary estimate from the Congressional Budget Office reveals. The plan, which has faced opposition from some moderate Republicans, would have the largest impact on services like cancer screenings, pap smears, and birth control—not abortion. Mother Jones

- Billionaire bump. Following reports that Selena Gomez’s mental health company Wondermind laid off employees and was facing financial trouble, Forbes now estimates Gomez to have a net worth of around $700 million—meaning she has reportedly lost her billionaire status. Forbes

- Officials ousted. Tulsi Gabbard, director of National Intelligence, fired two top officials at the National Intelligence Council (NIC), citing their “politicization of intelligence.” Last week, the NIC released a report that went against the Trump administration’s claim that the regime of Venezuela's Nicolás Maduro was tied to the gang Tren de Aragua. Axios

- Encouraging economy. U.K. Chancellor Rachel Reeves said that the U.K. economy is “beginning to turn a corner,” calling its 0.7% growth from January to March “very encouraging,” as it beat the 0.6% forecast. Important to note, this period is before U.S. tariffs hit and employer taxes in the U.K. increased. BBC

MOVERS AND SHAKERS

Balenciaga named Nathalie Raynaud deputy CEO. She most recently served as the fashion house’s chief product officer.

Prenuvo, a body scan company, named Jill Woodworth CFO. Previously, she was CFO of Peloton.

PR agency Offleash named Danielle Salvato-Earl, Tanaya Lukaszewski, and Tanya Carlsson partners. Most recently, Salvato-Earl and Carlsson were vice presidents, and Lukaszewski was SVP at the agency.

Fivetran, a data movement company, appointed Monica Ohara as CMO. She previously served as VP growth marketing at Shopify.

RGP, a professional services consultancy, named Jennifer Jones CMO. She was previously the company’s SVP of brand, marketing, and sales.

Collective Health, a health benefits platform for employees, appointed Caroline Jessen as chief people officer. Jessen was most recently chief people and diversity officer at Zendesk.

ON MY RADAR

Kristen Stewart waited her whole life to direct the chronology of water Vanity Fair

WeightWatchers got one thing very right New York Times

Lorde: ‘I’m an intense bitch’ Rolling Stone

PARTING WORDS

“I think of myself more as the second CEO at IMDb than the first woman CEO, but it’s an honor.”

— Nikki Santoro, who served as IMDb’s COO before becoming CEO in January