Good morning. Consumer pricing will be top of mind for companies across sectors with the impending rollout of new tariffs.

President Trump announced late Wednesday a comprehensive package of tariffs, including a broad 10% duty on all imports and a sliding scale of “discount reciprocal tariffs,” which actually are based on trade deficits with each nation. That includes a 34% tariff on goods from China and 20% on those from the EU, plus a raft of other high percentages for Vietnam, Taiwan, Japan, India and Indonesia, Fortune reported.

“Conventional economic wisdom would say that the tariff costs will be passed forward to consumers,” Andrew Phillips, EY global government and infrastructure economics, finance and tax leader, said during the firm’s tariff media briefing on Thursday.

“I think where competition is weaker, or margins are already tight, consumers are going to see prices move upward,” Phillips said. However, companies in industries with heavy regulation, long-term contracts, product differentiation or high margins might be less likely or able to pass forward these costs to consumers, he explained.

Although there are new tariffs, it’s still uncertain whether they will change with Trump’s tendency to change or withdraw tariffs as a negotiating tactic. U.S. export-focused businesses may delay investments in hiring, waiting for tariffs to be worked out, Phillips said. And importers may not have enough confidence in the longevity of the tariffs to build facilities in the U.S. and reshore production. “It kind of ends up being a game of chess where the end is difficult to predict, and businesses may wait to see the next move before making their bets,” he said.

It becomes very tricky when tariffs are imposed on capital goods, he added. If you’re a trucker who is buying a truck this year, you’ll pay tariffs that you wouldn’t have paid in any other year, Phillips explained. “It will take you years of charging higher prices to your customers to recoup that higher cost,” he said. And, if tariffs are eliminated next year or the year after, that trucker is stuck with those costs. “So, it can be a messy business,” he said.

As a result of the tariffs, imports and exports are expected to decline, and a 1% drag on GDP growth for 2025 is projected, Phillips said.

Scenarios and strategies

Ana Maria Romero, EY transfer pricing principal, said she’s seeing tax departments of companies become much more involved in understanding the impacts of tariff mitigation strategies. The tariffs announcement on Wednesday was within the range of scenarios companies have prepared for, Romero said. Most companies have working groups assessing the supply chain footprint, she explained, answering questions like: What changes can be made? What does it mean for their operating models?

A common, short-term tariff strategy is bulking up on inventory, Romero said. For the long term, some are also evaluating potential investments in the U.S.

A 25% tariff on auto imports to the U.S. went into effect on Thursday. U.S. car sales got a boost in March in anticipation of the added costs.

Ford Motor Company also announced on Thursday employee pricing for customers through June 2. But this may only be a reprieve from potentially higher prices. The new tariffs are estimated to raise the average cost of a car imported from another country by thousands of dollars. In addition, repairs for cars that currently use foreign-made parts are expected to cost more money.

See you on Monday.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Fortune 500 Power Moves

Brice J. Poplawski was promoted to SVP and CFO of Paccar (No. 122), effective June 2. Harrie C.A.M. Schippers, president and CFO, is retiring. Schippers has been with the company for more than 30 years and CFO since 2018. Poplawski currently serves as VP and controller of the company.

Thomas J. Edwards was named COO and CFO at Macy’s, Inc. (No. 172), effective June 22. Current CFO and COO Adrian Mitchell will be leaving the company on June 21. Edwards has nearly 40 years of experience in the retail, consumer goods, and hospitality industries. He is currently the CFO and COO of Capri Holdings Limited. Before joining Capri, he was EVP and CFO of Chili’s owner Brinker International, Inc., and has held numerous finance and operations positions at Wyndham Hotel Group, Kraft Foods, and Nabisco Food Service Company.

Every Friday morning, the weekly Fortune 500 Power Moves column tracks Fortune 500 company C-suite shifts—see the most recent edition.

More notable moves this week:

Rajal Mehta was appointed interim CFO at Capri Holdings Limited (NYSE: CPRI), a global fashion luxury group. Thomas J. Edwards, Jr., EVP, CFO and COO, will be leaving the company for his new position at Macy’s Inc., effective June 20. Mehta is currently the CFO of Michael Kors. Capri has commenced a search for Edwards’ replacement.

Robyn Liska was appointed interim CFO of Sunnova Energy International Inc., an adaptive energy services company, effective March 31. Eric M. Williams will step down as EVP and CFO, effective March 30. Liska has more than 15 years of experience. Previously, she served as an executive director in J.P. Morgan’s Power and Renewables Investment Banking division, and as a director in Bank of America’s Energy and Clean Power Equity Capital Markets group.

Jay Voncannon was appointed CFO of Arq, Inc. (Nasdaq: ARQ), a producer of environmentally efficient carbon products, effective April 2. Voncannon, a veteran finance executive with over 35 years of experience, most recently served as CFO of CoorsTek, Inc. Before that, he served more than 20 years as a senior finance executive at Koch Industries and its affiliates.

Rami Hasani was promoted CFO of UWM Holdings Corporation (NYSE: UWMC), effective April 1. He will succeed Andrew Hubacker who will be moving into a senior advisor role. Hasani originally joined the company in November 2020 as VP of financial reporting and compliance. Before joining the company, he spent over 15 years at Deloitte & Touche, LLP, most recently serving as a senior manager in the advisory practice.

David Jackola was promoted to EVP and CFO of APi Group Corporation (NYSE: APG), effective immediately. Jackola has been with the company since October 2021, most recently serving as interim CFO since December 2024. Before that, he served as CFO and VP of Transformation at APi International. Prior to that role, he was VP, controller and chief accounting officer at APi.

Big Deal

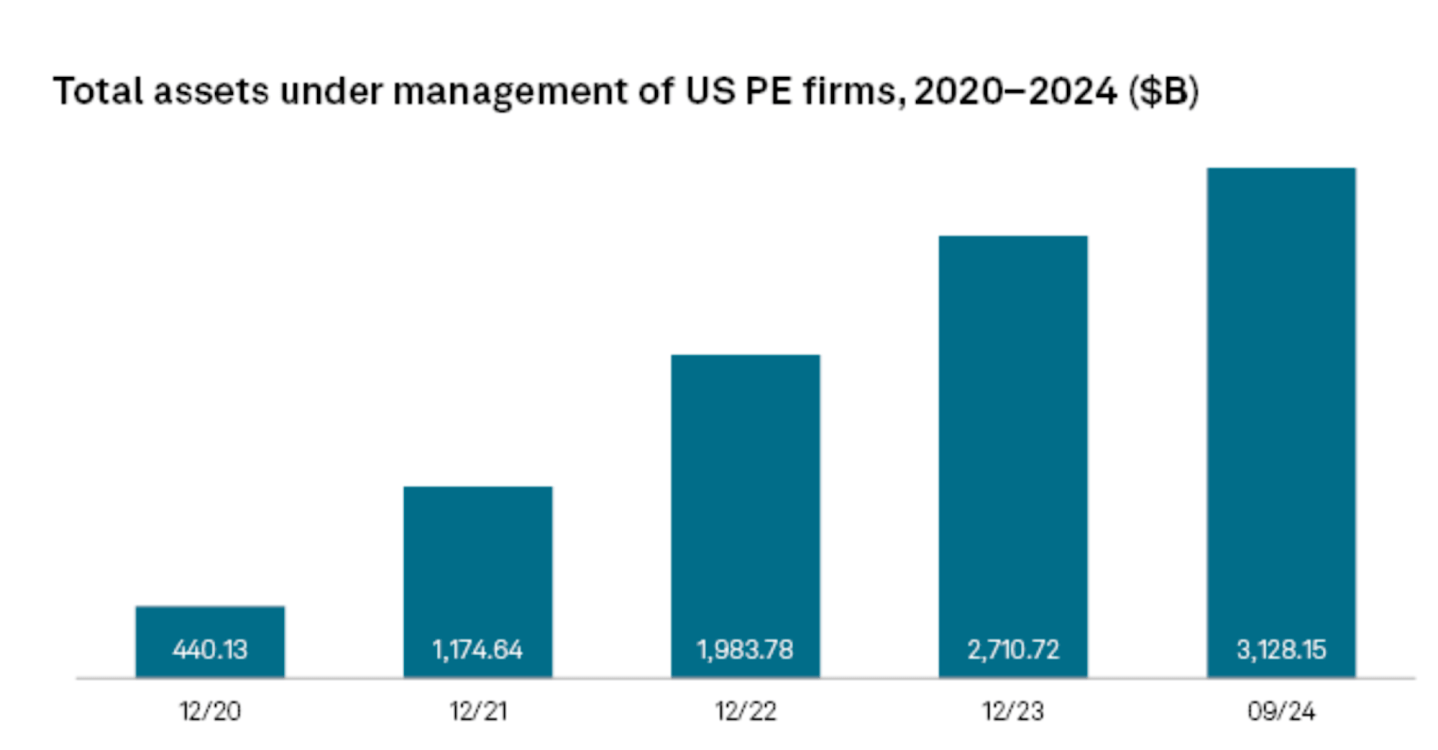

An S&P Global Market Intelligence analysis finds that assets under management (AUM) of U.S. private equity firms have grown over the past five years, reaching $3.128 trillion as of September, the highest level since December 2020.

Between 2022 and 2023, 37 U.S. private equity and venture capital firms saw AUM more than double, with median AUM growth at 8%. This analysis includes SEC-registered firms with reported AUM during this period.

Private markets AUM, overall, is expected to double over the next five to six years, according to a March 14 research note from Evercore ISI. An outsized share of this growth will accrue to “larger, scaled and established players,” according to the note.

Going deeper

Here are four Fortune weekend reads:

“The starter home is going extinct in South Florida as more homes cost $1 million or more” by Alicia Adamczyk

“Super Micro short sellers have built a position worth nearly $4 billion—and the trade recently turned ‘very profitable,’ finance expert says” by Amanda Gerut

“Warren Buffett calls himself ‘cheap’ for still living in the same house he purchased for $31,500—despite having $168 billion to his name” by Preston Fore

“Meet ‘cognitive shuffling,’ the emerging strategy for better sleep” by Alexa Mikhail

Overheard

“Bill Gates laid Microsoft’s foundation—not only articulating a bold vision but helping shape the software industry itself. He once told me, ‘Most of my decisions were wrong—I just got a few ones right and it turned out great because those few good decisions had outsized impact and influence.’”

—Soma Somasegar writes in the Fortune opinion piece, “Microsoft turns 50: How it’s remained essential, based on my 27 years there.” Somasegar previously led Microsoft’s developer division and is currently managing director at Madrona Venture Group.