- The formula used to calculate President Donald Trump’s new batch of tariffs announced Wednesday is based on dividing the U.S.’s trade deficit with a given country divided by their total exports to the U.S. A memo from the office of the U.S. trade representative acknowledged this was the methodology used because it was too “complex, if not impossible” to calculate the full extent of each country’s U.S. trade policies.

The Trump administration implemented widespread reciprocal tariffs on countries all over the world Wednesday in an effort to fight back against what it said were unfair trade practices that hurt American businesses and the economy at large.

To calculate the tariffs it decided to impose on countries around the world, the White House used a formula that focused on trade deficits and total exports. The formula didn’t include an assessment of tariff rates for specific products in individual countries, or take into account other trade barriers that weren’t tariffs.

Instead, the reciprocal tariff rate applied to each country was: their trade deficit divided by exports to the U.S., divided by two.

If the country has a trade surplus with the U.S., or the number resulting from the above formula was less than 10%, then a flat rate of 10% was applied.

For example, the U.S. has a $235.6 billion trade deficit with the European Union, which exports a total of $605.8 billion to the U.S. Based on the White House’s formula, $235.6 divided by $605.8 equals 0.388, which divided by half is 0.194. That number gets rounded up to 0.2, which leads to a 20% tariff rate.

“The blind application of such a simple formula ignores so much nuance,” Dominic Pappalardo, chief multi-asset strategist at Morningstar Wealth, told Fortune in an email.

Journalist James Surowiecki first pointed out this was the formula the Trump White House was using in an X post published a little over two hours after the tariffs were announced.

When reached for comment, a White House spokesperson pointed Fortune to a statement from the office of the U.S. trade representative explaining the formula.

The U.S. trade representative’s office, which played a major role in Trump’s tariff policy, said this was the formula it used. It also acknowledged the difficulty of calculating reciprocal tariff rates based on a detailed analysis of each country’s trade barriers.

“While individually computing the trade deficit effects of tens of thousands of tariff, regulatory, tax and other policies in each country is complex, if not impossible, their combined effects can be proxied by computing the tariff level consistent with driving bilateral trade deficits to zero,” the statement from the trade representative’s office read.

“Reciprocal tariffs seem to be entirely based on the size of the bilateral trade deficit in goods in 2024. It is not obvious that anything else made a difference,” Deborah Elms, head of trade policy at think tank the Hinrich Foundation, told Fortune earlier.

Using this methodology to calculate tariffs that will be imposed on other countries risks hitting them with rates that are higher than those they currently have for American goods. The countries subject to the highest tariff rates were those that have the largest trade deficits with the U.S., not necessarily those with the most trade barriers. For example, Taiwan, a major U.S. trading partner, now faces 32% tariffs on all goods. However, the trade deficit the U.S. has with Taiwan is due, in part to, the large number of semiconductors and advanced technologies it sells to the U.S. In a statement released Thursday, Taiwanese officials said it was essentially being penalized for selling products American companies want to buy.

“The shift of Taiwan’s supply chain back to Taiwan and an increase in U.S. demand for Taiwan’s information and communications products, reflecting the huge contribution of Taiwan to the U.S. economy and national security,” Taiwan’s cabinet said.

(Semiconductors are excluded from Trump’s new tariffs.)

This measure is also backward-looking and doesn’t take into account any preemptive efforts certain countries may have taken to balance trade with the U.S. “The calculation represents a single point-in-time snapshot,” Pappalardo said.

For example, Vietnam had promised to further cut any customs duties on U.S. goods and to buy more of them in an effort to stave off any tariff hikes. Instead, the southeast Asian country, which is a hub of manufacturing, got slapped with 45% tariffs. The U.S. is Vietnam’s largest export market and a tariff of that size would cripple its ability to sell goods in the country.

A blanket formula that doesn’t take into account the specifics of each country’s trade policy—which is often a series of complex, interlocking regulations that include highly detailed rules for each sector of the economy—risks upsetting global trade by stymying the flow of critical goods countries can only access through their trading partners. Instead, they create roadblocks for other countries to enter the U.S., which is the world’s biggest economy.

“There are strong fundamental and economic reasons to import certain goods from outside the U.S.,” Pappalardo said. “This formula totally ignores that concept. These reasons include local availability of natural resources, cost of production and skill gaps among others. In other words, certain countries are much better suited to produce some goods than others, but all goods are treated the same in the blanket application of this approach.”

These new policies would raise the U.S’s tariff rate across the board by almost 10%, which could tilt the global economy toward recession, according to a research note from Fitch Ratings.

“The U.S. tariff rate on all imports is now around 22% from 2.5% in 2024. That rate was last seen around 1910,” Fitch wrote in its report. “This is a game changer, not only for the US economy but for the global economy. Many countries will likely end up in a recession. You can throw most forecasts out the door, if this tariff rate stays on for an extended period of time.”

Implementing a trade policy based on tariffs rather than free-trade agreements was a major campaign promise Trump ran on during last year’s election. Trump has long viewed the U.S.’s role as a net importer as a sign of weakness that represents other countries’ unwillingness to buy American products. Most economists consider it a function of the fact the U.S. is the wealthiest country in the world and therefore can buy more goods than its trading partners, thus resulting in a trade deficit.

Markets have not reacted positively to Trump’s announcement of tariffs. The S&P 500 fell 4% on Thursday, the Dow Jones slipped 3.5%, and the NASDAQ composite dropped 5.3%. The stock market rout was rather expected, given that most economists considered the U.S.’s entry into a global trade war to be bad for the economy. However, the reality of the situation hit investors hard.

“Previously announced measures had increased the U.S. average tariff rate to 11%, the highest since the 1940s,” Seema Shah, chief global strategist at investment firm Principal Asset Management, wrote in an email. “Yesterday’s announcement raised the tariff rate even further to around 24%, the highest since 1908, and was meaningfully more aggressive than the broad market had expected.”

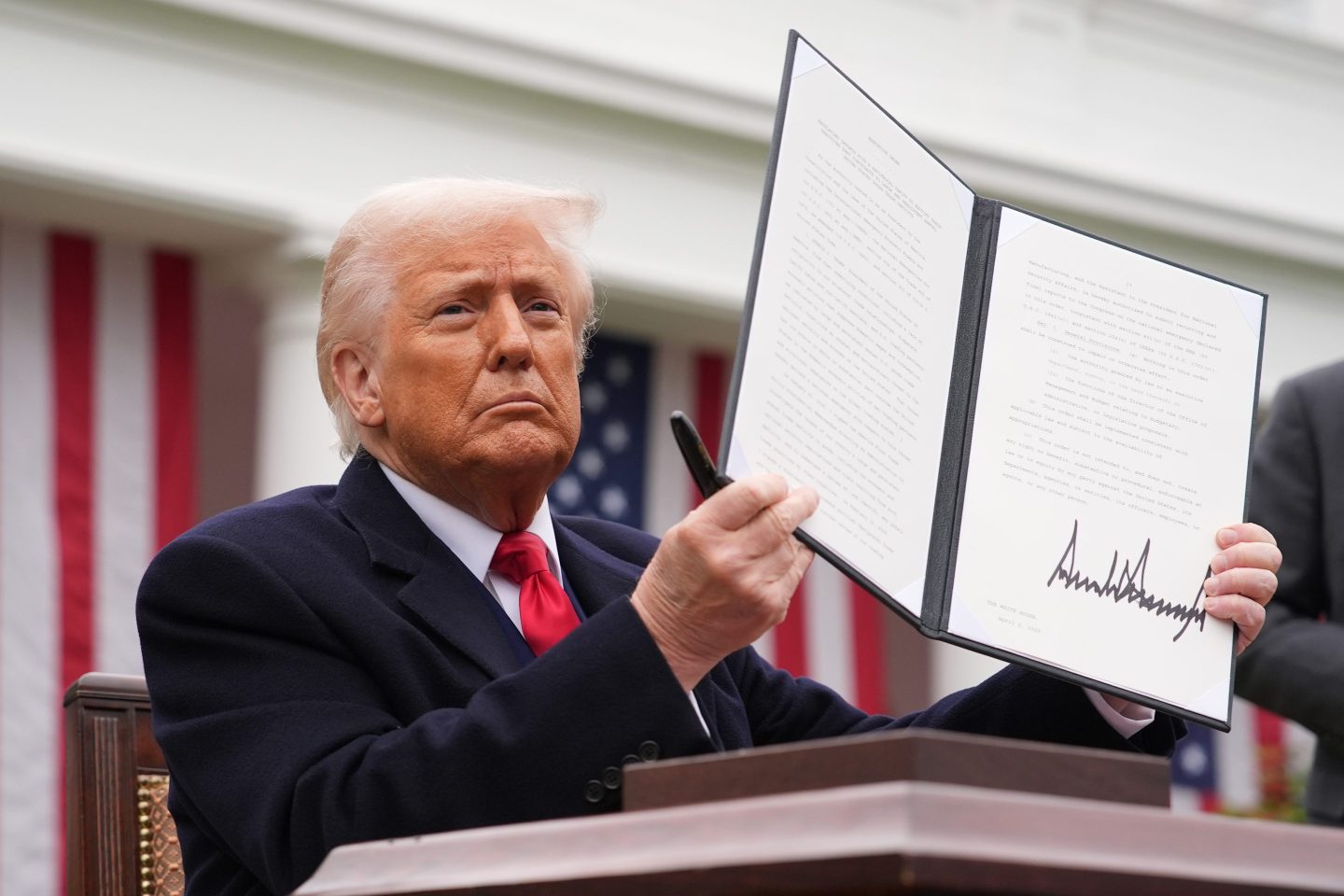

During his speech in the White House’s Rose Garden on Wednesday, Trump said he was being “kind” by only hitting countries with half the tariffs he believes they impose on the U.S. However, since the tariff rates are based only on a calculation of the U.S.’s trade deficit with a given country and do not include other trade barriers, even the halved tariff rate represents an extraordinarily high levy on foreign goods. One that will almost certainly have knock-on effects for the U.S., as the rest of the world retaliates.

“Expectations [are] that tariffs will hurt the US economy more than the rest of the world,” according to a Capital Economics note published Thursday.