While voters are conflicted about who came out on top in the presidential debate between Trump and Biden, Wharton professor Jeremy Siegel says the markets have chosen their victor—if only by a fine margin.

“The presidential debate was the big story of the week and revealed a mild market preference for former President Trump,” Siegel wrote in his weekly commentary on WisdomTree.

A senior economist for WisdomTree, Siegel added: “Notably, during the 90 minutes of the debate when there was no other market news, S&P 500 Futures rose 10 points, due to Trump’s business-friendly policies despite his higher-policy unpredictability.”

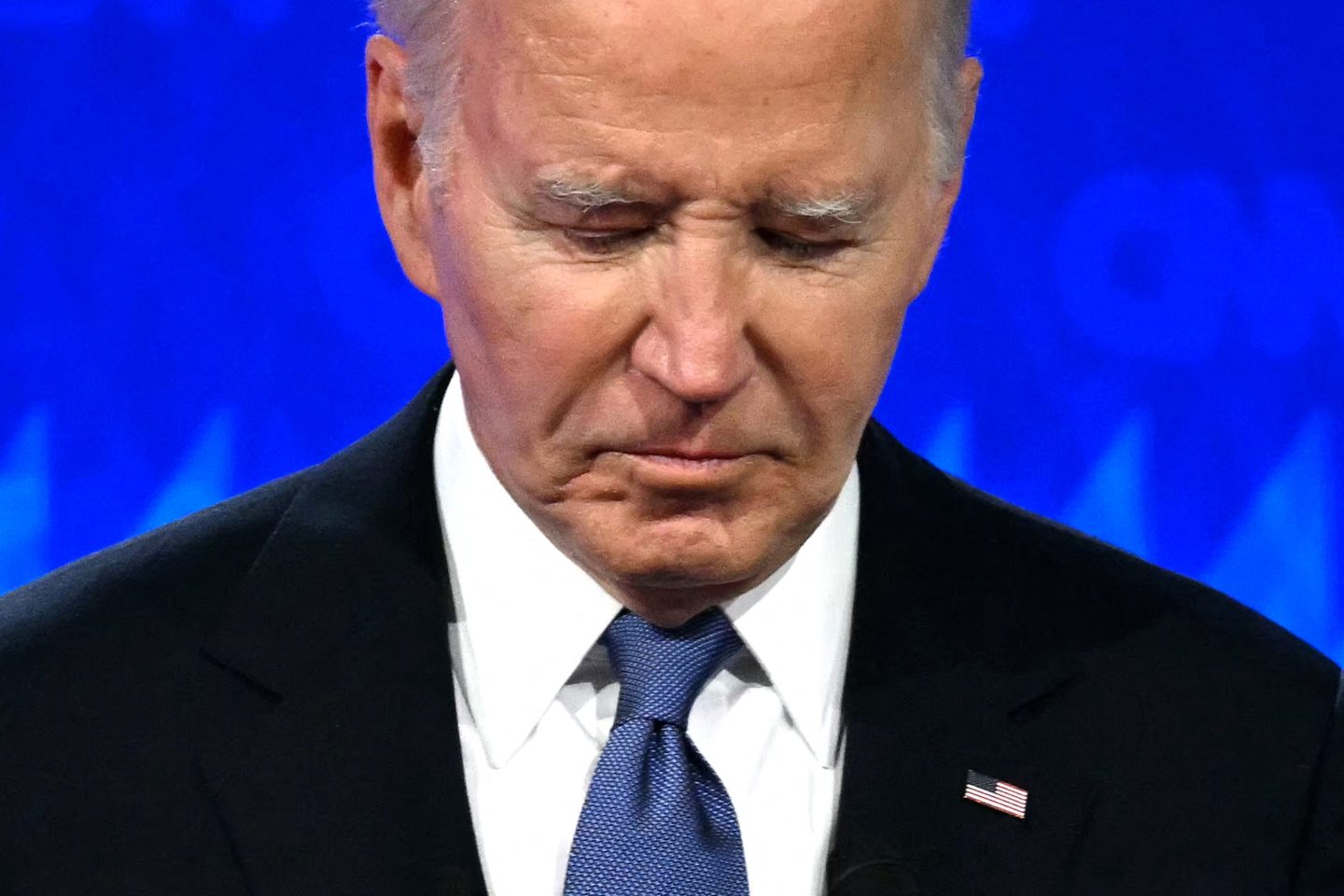

Per polling by the economist, Trump is slightly ahead after Biden gave a shaky performance on Thursday night. During the televised debate Biden appeared to lose his train of thought a number of times, meanwhile Trump—though more energetic—was criticized for inaccuracies.

Siegel’s take—though defined by a small margin—was echoed by a Goldman Sachs note released yesterday.

“Polling over the last several weeks has shown a close presidential election, with President Biden narrowly but consistently trailing former President Trump in national polling and, more importantly, in the key swing states likely to deliver the marginal electoral votes to the winner,” wrote Goldman’s chief U.S. political economist Alec Phillips and U.S. economist Tim Krupa.

“Markets generally reacted as expected to shifting probabilities of the outcome, with moves higher in equity futures, Treasury yields, and the dollar. While the moves were generally modest, the relative magnitudes are intuitive,” the note continued.

Among the changes Goldman noted was a rise in 10-year Treasury yields, which rose one basis point in the implied probability of a Republican win. The marginal move—only a shift of six percentage points—the note goes on to add, is because fiscal policy implications from a change in presidential party is less clear-cut than it might otherwise be, given the matter of control of Congress still hanging in the balance.

Broadly the S&P 500 Futures Index reacted positively—also in the event of a Trump win—rising 0.17% during the debate with a potential 1.2% if the former president was reelected to the White House.

“More interestingly, sectors that might benefit from an easier regulatory environment generally saw relative strength at the open of trading following the debate, which in most cases persisted until the close on June 28,” Phillips and Krupa added. “Consumer discretionary, which would face higher tariffs under a Trump administration, and renewables, which could be at risk of losing IRA subsidies, both declined.”

How will election uncertainty impact markets?

Six months ago when Fortune spoke to analysts from the likes of JPMorgan Chase, UBS, and Vanguard, the advice was clear: Portfolios should not be based on politics.

“One cardinal rule investors ought to follow: Don’t let how you feel about politics overrule how you think about investing,” wrote J.P. Morgan global market strategist Meera Pandit in a note supplied to Fortune.

Indeed, with the race far from over, investors will not yet be counting their chickens and planning their asset strategy accordingly.

As a result, Goldman added: “In the past, we have found that policy uncertainty rises in election years and that policy uncertainty has a dampening effect on economic activity and sentiment.”

While the polls and markets may show a marginal inclination toward the right side of the fence since the presidential debate, the event did also throw up two new platforms of uncertainty for investors. Firstly, will President Biden stay on as the Democratic nominee, and how will far will an unpredictable Trump push his policies if elected?

“While prediction markets imply somewhat less uncertainty regarding the election outcome as the race stands today, multiple sources of uncertainty remain,” the Goldman note adds.

Citing data from specialists policyuncertainty.com, Phillips and Krupa point out that election-related economic uncertainty is higher than in previous periods (barring 2008 and 2020 for their exceptional circumstances). In 2024 the uncertainty index stands at circa two points, while in the past it has settled at around –1.2 index points in this part of the year. This uncertainty is also likely to increase in the coming months, they wrote.

More questions than answers

According to analysts at UBS, the debate left the public and markets alike with more questions than answers about how the campaign will shake out for the Biden camp moving forward.

As Tom McLoughlin, chief investment officer for the Americas, told the UBS Investor’s Club webcast: “The President was really compelled to go ahead and assuage concerns regarding his physical frailty and his ability to withstand another four years in office.

“The most important aspect of this debate was to alleviate the concern of many Americans that his age was going to interfere with his ability to complete his term of office. And he was not able to do that.”

McLoughlin pointed out that Biden overwhelmingly won the Democratic primaries race across the States, meaning any plot to replace the president without his consent would be near-impossible to achieve.

“Right now [Biden] has the commanding position in the delegate camp,” McLoughlin explained. “So it will have to be a voluntary decision on his part. After [the] performance I believe that there are a number of people in the Democratic Party who are considering whether or not, and how, to go about debating or discussing with him whether or not he should step aside.”