Good morning. Inflation in the U.S. remains slightly hotter than expected, but as far as its effect on tech stocks, at least one top analyst still expects AI to “hands down” boost the whole sector.

The Labor Department’s report released on Tuesday indicated that the consumer price index rose 0.3% from December to January, up from a 0.2% increase the previous month, and that over the last 12 months, prices rose 3.1%. That’s certainly lower than the 9.1% inflation peak in mid-2022, and even less than the 3.4% figure in December, but core prices, a closely watched metric that excludes food and energy categories, rose faster than anticipated, up 0.4% in January. Driven by costs for shelter, transportation, and medical care, core prices remained up 3.9% year over year.

The Fed’s favored supercore CPI measure (core services excluding shelter costs) “rose a hot 0.85%” in January, according to EY Chief Economist Gregory Daco. However, he added in a statement, January CPI readings are “always volatile, so this reading should be taken with a pinch of salt.”

“While this report will undoubtedly spark a wave of inflation pessimism,” he added, “five key elements should still form the perfect mix for disinflation through 2024: cooler consumer demand growth, declining rent inflation, narrower profit margins, moderating wage growth, and stronger productivity growth.”

The tech effect

The central bank’s Federal Open Market Committee said on Jan. 31 that it doesn’t expect to reduce interest rates until it has gained greater confidence that inflation is moving toward 2%.

But some tech analysts remain bullish on AI in the face of inflation. Gene Munster, managing partner and cofounder at Deepwater Asset Management, said that the AI revolution marches onward.

Munster wrote in a X post on Tuesday: “Nasdaq is down 2% today, which begs the question: Which force will win the battle for tech stocks? Inflation or AI? On the one side, today’s hot CPI number is a headwind for tech stocks. Rates higher for longer have a negative impact on higher multiple companies.

“On the other side, AI companies will see increased growth rates and margins in the years to come. Putting those two forces together, the AI tailwind is going to win hands down. We’re at the start of a three- to five-year tech bull market.”

Daniel Ives, a managing director at Wedbush Securities, also is doubling down on AI, writing—with a nod to Microsoft and Sunday night’s Super Bowl—in a note to investors on Tuesday: “Tech earnings season so far has delivered in Kelce-like fashion as the jaw-dropping monetization and Copilot success seen at Redmond is the tip of the spear for AI across the broader tech industry, as we predict $1 trillion of incremental tech spending over the next decade.”

We’ll see if AI growth is inflation-proof.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Noémie Heuland was named SVP and CFO at Moody's Corporation (NYSE: MCO), effective April 1. Heuland brings nearly 25 years of financial leadership experience. She joins Moody’s from Dayforce where she has served as EVP and CFO since 2020. Before Dayforce, Heuland spent 12 years with global enterprise application software provider SAP.

Jenny Osterhout was named CFO at OneMain Holdings, Inc. (NYSE: OMF), effective March 31. Osterhout joined OneMain in January 2020 and has served as chief strategy officer since November 2020. Before joining the company, she held a number of positions at BNY Mellon, including as CFO of its Investment Management Group, as well as head of all BNY Corporate Development.

Big deal

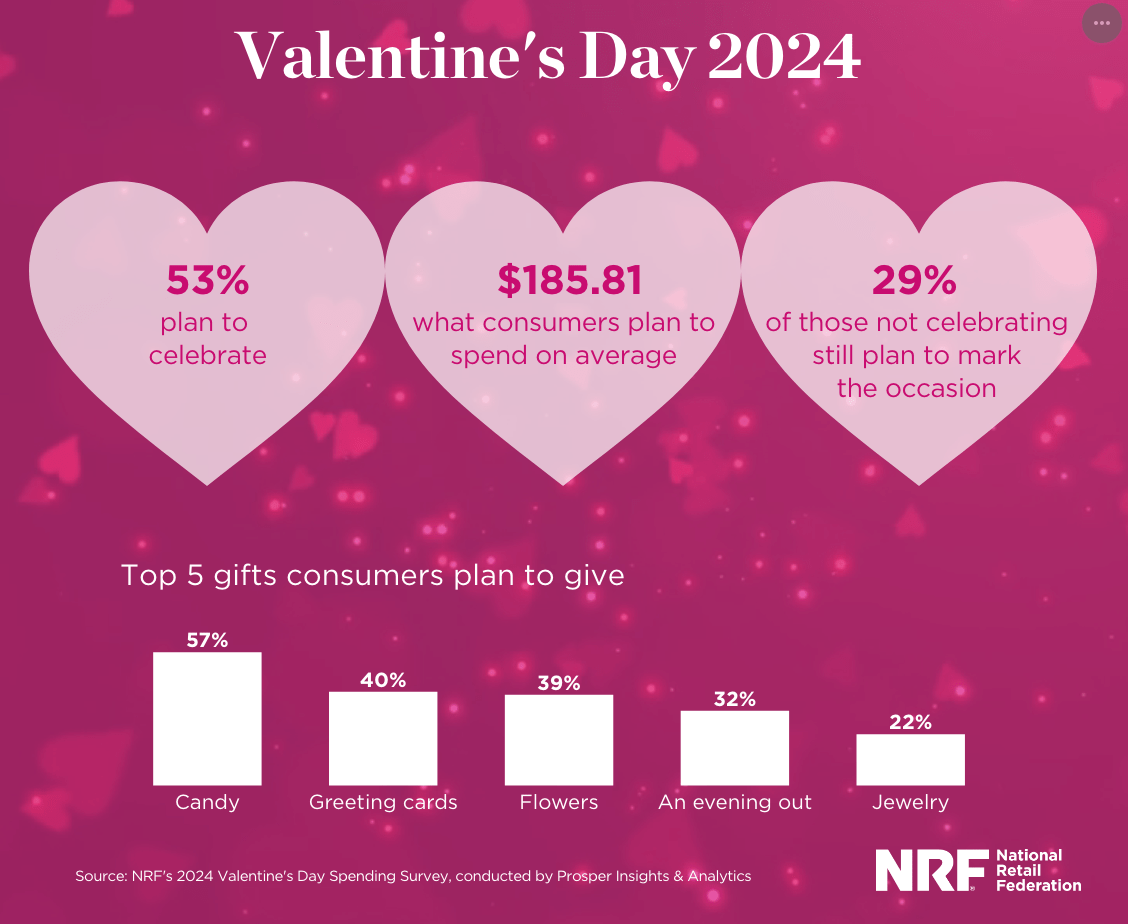

It's Valentine’s Day and people are prepared to buy chocolates and much more, according to the annual survey released by the National Retail Federation and Prosper Insights & Analytics. Total spending on significant others for the holiday is expected to reach a record $14.2 billion.

The top three gifts include candy (57%), greeting cards (40%), and flowers (39%). And new spending records are expected for jewelry ($6.4 billion), flowers ($2.6 billion), clothing ($3 billion), and an evening out ($4.9 billion), according to the report.

Going deeper

A new report from global consulting firm RGP is based on a survey of over 200 financial decision-makers who shared their priorities for 2024. Eighty percent said they're currently planning to increase investment in workforce development. Most are prioritizing reskilling and upskilling current employees (37%), according to the report. Respondents were asked what they'd prioritize if a lower interest rate environment were to unlock new capital. More than half (58%) said they would invest new capital in digital transformation and AI. However, another key finding is 42% said their finance function is currently facing a skills gap in AI and automation.

Overheard

"I think what you’re going to see as you head into 2024 is probably more attention to what I would describe as affordability."

—McDonald’s CEO Chris Kempczinski said during the company's 2023 fourth quarter earnings call last week. Kempczinski alluded to high prices as a reason why the company missed sales expectations for the first time in four years, Fortune reported.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.