Tuesday was a busy day at Netflix. In the morning, the streamer inked its first major live sports deal when it signed a 10-year, $5 billion agreement with pro wrestling outfit World Wrestling Entertainment, a bombshell curtain raiser the same day it was due to release its fourth-quarter and full-year earnings for 2023.

Co-CEO Ted Sarandos demurred on the topic of live sports broadcasts in October, on the last quarterly earnings call. With Netflix’s stock up 40% since that last report, on the back of blistering subscriber growth, this year-end report and call was already hotly anticipated. In January, Netflix’s ad chief Amy Reinhard said its ad-supported tier had 23 million subscribers, up from 15 million in November, crushing analyst expectations. Though some on the Street believe that strong performance is already priced into the stock, meaning there can’t be much room to grow—right? The WWE deal is an indication that Netflix is looking for that growth in new places.

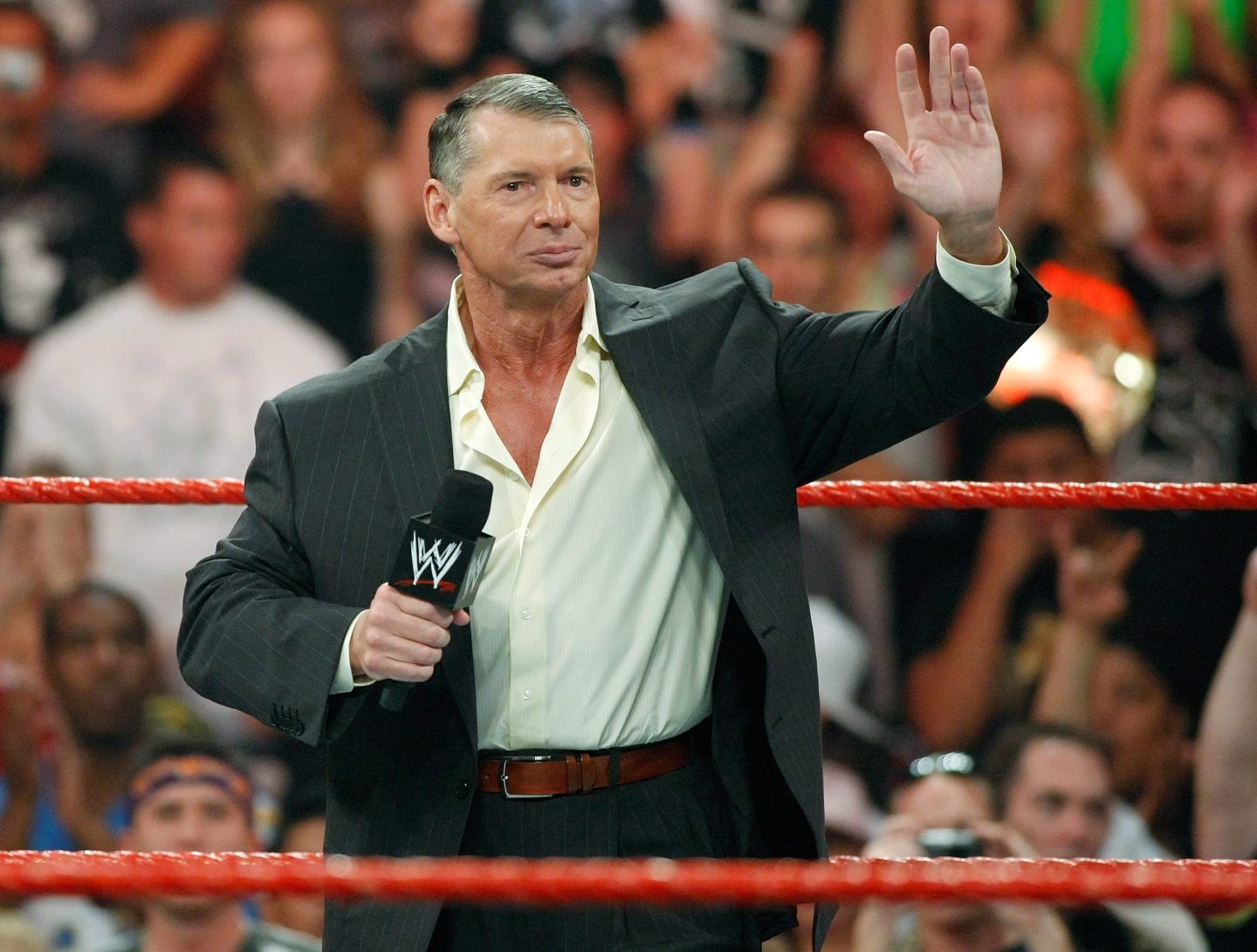

Netflix’s new deal will see it air WWE’s weekly show Raw in the U.S., the U.K., Canada, and Latin America. In every other market, Netflix will air Raw and the other two weekly shows, SmackDown and NXT, plus all of its major showcases, including WrestleMania and SummerSlam. WWE executives cited Netflix’s global reach as a key reason for the deal. WWE is owned by TKO Holdings, which was formed when the talent agency Endeavor engineered a $21 billion merger between the pro wrestling circuit and MMA championship UFC. Shares of TKO were up as much as 24% in premarket trading after the news was made public, before settling in for a still impressive boost of 15%.

Adding live programming, like ad-supported programming before it, is a natural extension of a media company’s trajectory, especially one as dominant as Netflix. Widely considered the winner of the streaming wars and with just under 240 million global subscribers, Netflix’s move into live programming was long anticipated—but why the WWE?

1. Why WWE instead of another sport?

While it certainly doesn’t have the vice grip on American sports fandom of the NFL, or the “cool factor” of the NBA, the WWE is still a ratings powerhouse on cable. Raw was the No. 1 show on USA Network, its former home, according to a press release from Netflix and WWE. The show had 17.5 million unique viewers over the course of 2023.

It also has surprisingly high brand awareness, with 82% of Americans saying they’ve heard of WWE. As of June, WWE had 90 million fans, according to market research firm SSRS/Luker, first noted by The Hollywood Reporter.

WWE fans also tend to be more loyal subscribers than the average viewer, according to data from Antenna.

Also, sports fans, and this very much includes WWE fans, defy the reigning industry convention that says users unsubscribe when they finish watching the show or movie that got them to sign up to begin with. WWE live programming is viewed by about 11 million fans in the U.S. according to its website.

It’s of course no guarantee that all of those fans will become Netflix subscribers (or that they aren’t already), but at this point, let’s face it: Everyone has heard of Netflix. All of WWE’s fans will know exactly where to find the next fight—on the most popular streaming service in the world.

There’s also the simple explanation that the media rights for WWE just happened to be available, while those for other sports weren’t. The NBA’s deal with Disney and Warner Bros. Discovery is on the horizon, but won’t expire until 2025. The NFL, MLB, NHL, and MLS all signed deals in the past three years that lock them up for the foreseeable future. So Netflix is really sending a message to the market before it gears up for its rumored interest in the NBA’s rights at the end of next season: Live events are all of a sudden very much part of what it’s offering.

2. Streamers are turning to live sports to grow their subscribers

Live sports remains one of the most surefire ways to attract viewers, both to streaming and linear television. Last year, live sports made up 98 of the top 100 broadcasts on television.

Streamers have long eyed the rights to live sports. Apple TV+ carries MLB games and MLS games. Warner Bros. Discovery has started putting some of its NBA games on Max. Amazon made waves when it signed a 10-year, $1 billion a season agreement to stream select NFL games on Prime Video. And then there’s the Peacock bombshell.

This past month, Peacock shelled out a reported $110 million for exclusive rights to air the NFL’s AFC Wild Card game, and the results were industry-shaking, as NBC recorded a reported 28 million viewers. Apple TV+ also saw a dramatic spike in subscriptions when Argentine soccer ace Lionel Messi made his U.S. debut with MLS team Inter Miami in July.

How much of that viewership turns into long-term subscribers is still a question. In its annual report on the state of sports, streaming research firm Antenna cautioned against trying to replicate the Messi phenomenon. “There is only one Lionel Messi, so midseason acquisition spikes are not likely to be the norm for sports services in the future,” the report reads.

Netflix has an ace up its sleeve, though: creating shoulder content like miniseries and documentaries about sports, which it already considers a strength. It’s nearly single-handedly responsible for turning Formula 1 car racing into a huge trend off the back of its hit show Drive to Survive. Indeed, WWE president Nick Khan told Bloomberg News that he sees a WWE version of Drive to Survive as a major possibility arising from this Netflix deal.

“We are in the sports business, but we’re in the part that we bring the most value to, which is the drama of sport,” Sarandos said on the October investor call, during which he also said he anticipated “no core change in our live sports strategy or licensing live sports.”

3. Live programming can make an ad-supported tier more appealing

Live sports, whether on streaming or cable, are a plum opportunity for ads. Time-outs create natural lulls in the action, there’s a built-in interval at halftime, and pre- and post-game studio shows can be jam-packed with sponsorships—from branded segments to product placement.

“This will be a monster impact player for their AVOD platform,” TKO Holdings president Mark Shapiro told Reuters, referring to the industry acronym for ad-supported streaming.

Despite the cheaper price, the economics of an ad tier are still favorable because they allow streamers to make money from both subscription fees and ad sales. And as the number of subscribers, and therefore viewers, goes up so does the price for ads, creating a virtuous circle in which growing one begets the other. In July, Netflix got rid of its $10-per-month Basic plan, a subtle move meant to nudge consumers who could afford it toward its $15.49 a month Standard plan or the more price conscious subscriber toward its $6.99 ad-supported plan.

Among streamers, the ad tier remains relatively small compared with overall subscriptions. In the U.S. only two streamers—Hulu and Peacock—have more subscribers to their ad-supported tiers than their ad-free version, according to data from market research firm Morning Consult.

WWE represents an appetizing foray into live sports for Netflix. So while it’s natural to wonder why Netflix decided to buy the rights to WWE, it’s also worth asking why WWE chose Netflix. That’s because ad-tier or not, it can offer an immediate audience like virtually no other streamer.

“We cracked the code with Netflix,” Shapiro said. “We’re now a neighbor of the best premium programming slate you’re going to find in the universe of content.”