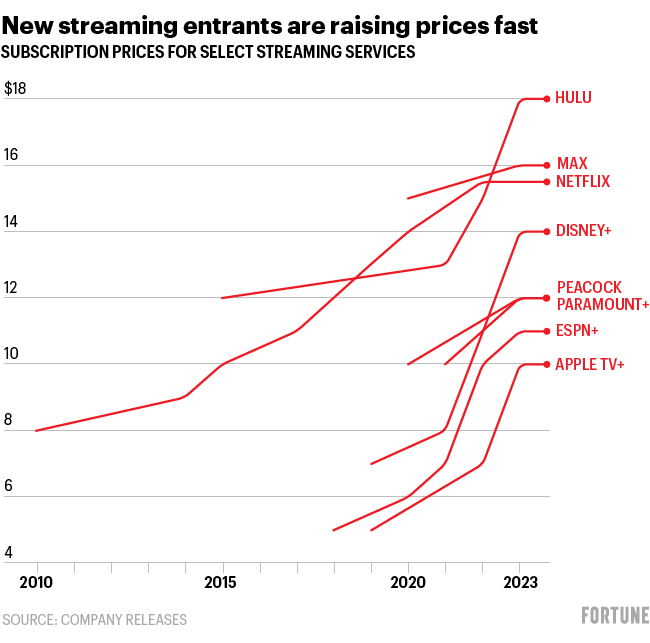

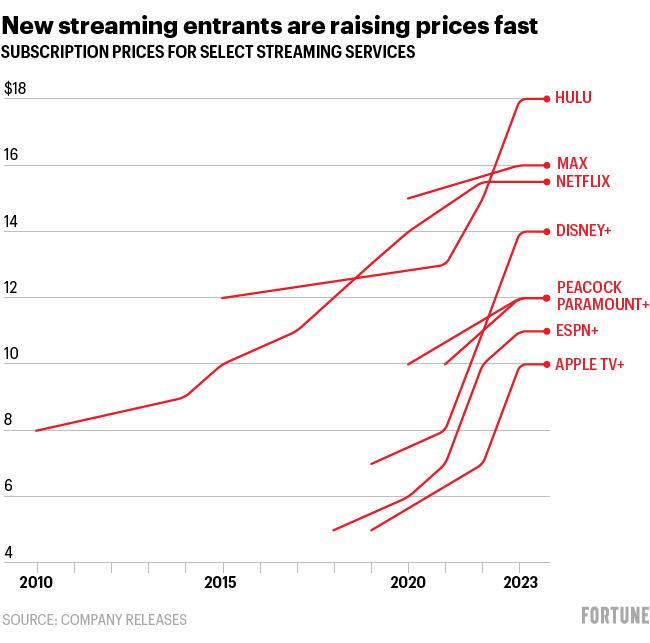

After years of inflation, Americans are used to sticker shock. But nothing compares to the surging price of streaming video.

Last week, Apple TV+ became the latest streaming service to raise its price—up from $6.99 to $9.99 per month—following the example of Disney+, Hulu, ESPN+, and Netflix, which all hiked their prices in October.

Half of the major streaming platforms in the U.S. now charge a monthly fee that’s double the price they charged when they initially came to market. And many of these streaming services haven’t even been around for 10 years.

Consumers have grumbled, but have so far been willing to keep paying up. It’s hard to say where their breaking point will be, but given that analysts believe the platforms are likely to continue raising prices even further, we’ll probably find out soon enough.

“Look at what Netflix continues to do,” MoffettNathanson analyst Robert Fishman told Fortune, referring to the company’s continued price increases despite recording profits for more than a decade. “I don’t think there will ever necessarily be an endpoint.”

Part of what’s driving the price hikes is how saturated the streaming market has become. For a company like Netflix, which has 77 million paid subscribers in the U.S. and Canada, finding new paying subscribers to keep revenue growing is not easy. Netflix has started clamping down on password sharing to boost its paid subscriber rolls, but that only goes so far. Raising prices for existing subscribers is an effective way to pump up the top line and keep investors happy.

For legacy media companies, increased streaming prices are a step toward recouping lost revenue from their slowly dying traditional television businesses. As consumers increasingly cancel their cable TV subscriptions in favor of streaming platforms, companies like Disney, Warner Bros. Discovery, Comcast, and Paramount are losing money on their once reliably profitable TV businesses.

On Thursday, Disney announced that it was acquiring the 33% of Hulu that it didn’t already own from Comcast. The deal gives Disney full control of Hulu, which, along with Disney+ and ESPN+, rounds out the media company’s lineup of streaming services. According to AllianceBernstein analyst Laurent Yoon, the incremental revenue that Disney generates from Disney+ and Hulu in 2024 will outpace the revenue decline in the company’s linear TV business.

But that’s not the case for every company. “In the near future, the next three or so years, Peacock is not going to outpace the decline of NBC,” he told Fortune, referring to NBCUniversal’s streaming platform. And Paramount+ revenue growth is not going to outpace the revenue decline of CBS, he said.

Pushing ads pushes profits

Some observers see another reason for the frequent price hikes: to push subscribers to their breaking point, and compel them to opt for a lower-priced, or even free, ad-supported plan instead.

Disney CEO Bob Iger said as much during an August earnings call: “We’re obviously trying, with our pricing strategy, to migrate more subs to the advertiser-supported tier.”

Why? Unlike a paid subscription, which brings in a fixed amount of revenue each month, there is no ceiling to advertising revenue. The number of ads displayed and the rates a streaming platform can charge marketers for the ads are constantly fluctuating, offering unlimited revenue upside.

“If you are Netflix, Hulu, and to some degree Amazon Prime and Max, you have the potential to generate advertising revenue to complement the discount on [the ad tier],” said Yoon, the Bernstein analyst.

The strategy is reflected in the numbers. While the $13.99 monthly price of the Disney+ ad-free plan is now double its 2019 launch price, the company has kept the same $7.99 price for the advertising option since introducing the tier last year. Hulu has a wider margin, costing a monthly $7.99 with ads or $17.99 without.

For the advertising strategy to pay off, however, a streaming company needs an audience that spends a lot of time on its platform watching shows, and ads. Despite being one of the newest platforms to show ads, Netflix is in a position to earn big because of its high engagement, Yoon told Fortune. Bernstein estimates that Netflix’s ad-based tier currently generates $8 per user in ad revenue each month, on top of the plan’s $6.99 subscription cost, which positions its average revenue per user for that tier roughly flush with that of its $15.49 ad-free service.

‘Someone is going to raise the white flag’

With so many streaming services, and no end in sight to price hikes, something will have to give at some point. The streaming industry is on the verge of losing some of its major players, analysts agree. “The macro, high-level view is that there are too many streaming services losing too much money, and someone is going to raise the white flag,” said Rich Greenfield, analyst at LightShed Partners.

Bundling services together is an option that provides a larger value to consumers and could drive subscriptions, but “it doesn’t fix the problem,” he told Fortune. “It can eliminate losses, but I’m not sure it makes it into a great business.”

What makes more sense, Greenfield said, is if companies shut down their streaming platforms and become “content arms dealers” to the highest bidder. Many streaming companies have been in the studio business for decades—including Disney, Warner Bros. Discovery, and Paramount—and they can continue to remain relevant in streaming by supplying films and television shows to other platforms, he said, rather than running their own.