Pity the Bud Light marketing staffers who hired Dylan Mulvaney. This spring, the brand sent the transgender influencer a can of beer with her face on it for a jokey 60-second Instagram video promoting a March Madness giveaway. Cue the culture-war panic: a strikingly effective right-wing boycott, followed by anger at the brand’s response from the LGBTQ community. Nearly $400 million in sales—and Bud Light’s 22-year supremacy as the bestselling U.S. beer—vanished in weeks.

It was one of the more public, and painful, recent implosions of socially conscious branding, but it’s far from the only one.

Just in recent months, the Bud Light boycott has shared headlines with similar customer backlash against Target and Kohl’s for selling LGBTQ Pride-related merchandise; ongoing skirmishes between Disney and Gov. Ron DeSantis over the company’s tortured opposition to Florida’s “Don’t Say Gay” legislation; and a fast-growing wave of legal challenges to companies and investors over their diversity, equity, and inclusion policies.

With the 2024 elections just a year away, “it’s going to get harder before it gets easier,” warns Tom Lyon, an economics professor who runs a sustainability-focused program at the University of Michigan’s Ross School of Business.

AB InBev’s seemingly innocuous Bud Light marketing ploy ended up breaking the unspoken first commandment of corporate gospel in this awkward, politically divided era: Thou shalt embrace social and environmental causes—especially if doing so helps sell more stuff—but that embrace shalt absolutely not cost the company money.

It’s harder than ever to follow. The violent conclusion of Donald Trump’s presidency (and his return as a candidate in the 2024 election), the wrenching pandemic, a growing awareness of the devastating effects of climate change, and the sweeping reckoning over systemic racism are among the factors that have contributed to a hyper-partisan, post-factual landscape.

Companies find themselves stumbling down a rapidly narrowing path between the razor-wire fences of heightened consumer expectations and well-organized political trolling.

“This is an unbelievably weird moment in American politics,” says Lyon. “And for companies, it’s really, really hard to deal with.”

Presidential candidates declare war on “woke” corporations, and wealthy donors quietly funnel money into lawsuits and organized online campaigns against businesses and civil institutions alike.

“There isn’t anything anyone can do to fend off these attacks, particularly regarding litigation,” says Atinuke Adediran, an associate professor at Fordham University School of Law who studies race, law, and corporate diversity efforts. “You can be doing nothing and still get sued.”

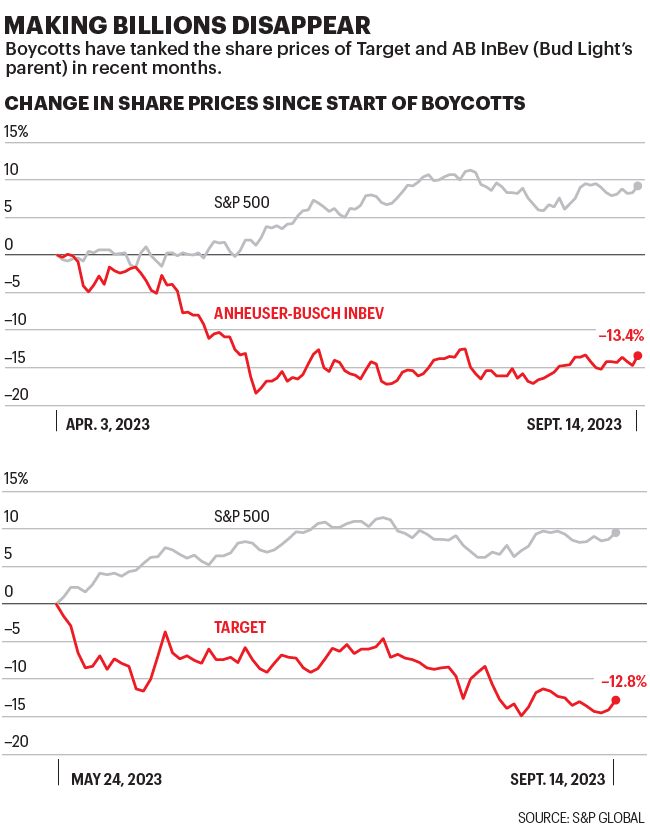

None of this is easy to navigate. And the financial effects are real: Target lost $9.25 billion in market value from May through mid-September, Fortune calculates, and AB InBev lost $16.36 billion since the boycott over the Mulvaney video began.

But in the midst of this relentless blowback—in the media, popular opinion, and the market—some companies have responded by quickly softening or walking back their public embraces of social and environmental principles.

Now the companies that haven’t truly incorporated the convictions they tout into their operations—including making preparations for how to respond to pushback—are being seen as weak-spined, and criticized by the left and the right.

“Shallow commitments get companies into trouble,” Lyon says. “People will try to hold them to it—and they get caught in the middle, and just kind of buffeted around.”

AB InBev responded to the boycott by declaring that it would stick to advertising around sports or music. Two of its marketing executives also went on leave, the company said in April. Target, which blamed a sales slump on the boycott and cited threats to stores and employees, removed some of its LGBTQ-themed merchandise from stores and in August told investors it would celebrate Pride more quietly in the future, by selling a “more focused assortment” of related merchandise. (Spokespeople for AB InBev and Target declined to comment.)

Meanwhile, companies including Netflix, Disney, and Warner Bros. Discovery have parted ways with high-level diversity, equity, and inclusion executives.

Widen the discussion beyond consumer-facing companies to the field of ESG investing—a growing sector long championed by powerful figures such as BlackRock CEO Larry Fink—and the retreats are similar. As are the attacks: Republican attorneys general from more than 20 states are suing or otherwise pressuring asset managers, individual companies, and the Biden administration over various ESG-related matters.

Now even Fink is embracing the oil-producing, autocratic regime of Saudi Arabia, naming the CEO of Saudi Aramco to BlackRock’s board.

So it’s worth asking: Did corporate America have courage in its socially conscious convictions in the first place?

Stakeholder capitalism’s fundamental flaw

The research on the rise of so-called stakeholder capitalism is pretty damning.

The concept goes back decades, but it really broke through in 2019, when the influential association of CEOs known as Business Roundtable declared (and elaborated in a Fortune cover story) that it would ditch its long-standing prioritization of the interests of stockholders above all else. Instead, it said, its members would “commit to deliver value to all” stakeholders.

Companies would still pursue the profits expected by investors, of course, but they insisted that they could simultaneously do more to invest in employees, customers, and their broader communities, and to promote diversity, inclusion, and sustainability.

Just one year later, however, Harvard researchers found that the Business Roundtable’s commitment was “mostly for show.”

And in 2022, a Brookings survey of 22 large companies that employed frontline workers during the pandemic, including 18 that signed the BRT pledge, found that most didn’t consistently pay a living wage.

“Stakeholder capitalism and ESG investing both had this narrative of ‘win-win,’ and that there’s no trade-off between doing well financially and doing good socially,” says Denise Hearn, a resident senior fellow at Columbia University’s Center on Sustainable Investment. “The problem with that is that profits have to come from somewhere,” she adds, “and they are increasingly coming from undermining stakeholders and their well-being.”

That “win-win” rhetoric caused some awkward corporate contortions. Executives and corporate entities made the vaguely pro-environment, pro-diversity pronouncements and promises that their employees and customers expected, and hired staff focused on DEI and sustainability—while also asserting that these moves wouldn’t disrupt business at all. They could serve stakeholders, they argued, and keep making money hand over fist.

That approach has led to some cognitive dissonance: oil and gas producers signing pledges to “protect the environment”; brands that tout their ethical stances while continuing to run their supply chains through regions notorious for human rights abuses; companies that promised to “invest in our employees” laying off thousands or opposing labor movements at their facilities.

No wonder, then, that terms like “greenwashing,” “pinkwashing,” “rainbow washing,” and “performative allyship” entered the lexicon. (Hey, it costs nothing to post a black square on Instagram!)

Many companies simply didn’t reckon upfront with the financial costs of carrying out their big stakeholder capitalist ideas, says Paul Washington, head of the ESG Center for the Conference Board, a business think tank. Companies were making their pledges in an “ESG echo chamber,” he says, “where they didn’t necessarily have the critical discussions” first.

As an example, Washington singles out the environmental promises many companies have made, particularly around “net-zero” pledges to reduce carbon emissions.

“Those commitments actually have real-world implications for the business. Carbon neutrality costs money, net-zero costs money,” he says. “You have to recognize that, yes, in the long run, all of this will benefit everyone. But in the short run, there are indeed trade-offs.”

The path forward for companies

Maybe this status quo could have endured in a less polarized era. But in this particularly toxic moment in U.S. politics, the mismatch between much of corporate America’s empty efforts and its feel-good rhetoric has left many companies vulnerable.

So what are company leaders to do now that they find themselves in this predicament?

It’s tempting to recommend an all-or-nothing stance for future pledges of corporate “values.” For companies that really want to embrace ideological causes, there are models of coherent—if sometimes extreme—strategies on both sides of the political aisle.

On the left, there’s the outdoor-apparel maker Patagonia: Founder Yvon Chouinard and his family last year transferred ownership of his company to a trust and nonprofit focused on funding environmental causes. On the right, there’s a growing ecosystem of explicitly conservative startups promising consumers “anti-woke” services.

But realistically, very few for-profit enterprises are going to follow Patagonia’s lead. Nor are large companies likely to become even more explicitly partisan and risk alienating wide swaths of customers.

Another path, University of Michigan’s Lyon argues, is for companies to either set themselves stronger, clearer rules on when and how to engage—or to pull way back on the vocal corporate activism. That’s a complicated path too, of course, and could look like walking back the halting but real progress some companies have made in diversity and sustainability.

But on a customer-facing level, at least, maybe brands should shut up about their so-called values.

As New York Times columnist Lydia Polgreen recently pointed out, describing how she had chosen a toothpaste brand simply because it was the easiest to get from the pharmacy shelf: “Consumers make choices for many reasons: price, convenience, and marketing. Maybe politics.”

In other words: Even the most bleeding-heart liberals or anti-woke conservatives don’t have time to Google every single brand at the grocery store.

Of course, many people—especially millennials and Gen Z—do want to work for or buy stuff from a company that shares their values and beliefs. In the case of Bud Light, acknowledging that trans people exist and like to drink beer, too, should not have been particularly controversial. But as Dylan Mulvaney herself later pointed out in an online video, companies can’t have it both ways.

“For a company to hire a trans person and then not publicly stand by them is worse, in my opinion, than not hiring a trans person at all,” Mulvaney said.

Maybe it’s time to hold companies accountable to higher standards than those of “stakeholder capitalism.” The movement was designed, in part, to head off outside regulation, to show that companies could take responsibility themselves, without being forced to.

But today, few on the left or the right have been won over by corporate America’s arguments that its relentless pursuit of profits (and its consolidation in tech, health care, and other vital industries governing every aspect of our lives) is also serving the public interest.

“It’s completely illogical in so many cases,” says Columbia’s Hearn. “It’s difficult to make corporations the arbiters of social and public good. Because ultimately, they’re going to need to make the decisions that earn them the highest profit.”

It’s going to take more than polished promises of corporate “values” to break that centuries-old imperative.

Companies that believe they can combine profit and purpose need to show real results—and stand by them.

This articles appears in the October/November 2023 issue of Fortune with the headline, “The trolling of corporate America.”

Clarification, Oct. 3, 2023: This article has been updated to clarify a change that Patagonia founder Yvon Chouinard made in the company’s structure.