Good morning.

CEOs and CFOs are strategic partners. But If a company has a succession plan on the books for its CEO, must it have one for the CFO as well?

There have been some recent CFO transitions at Fortune 500 companies where a permanent successor wasn’t immediately announced.

For example, Uber Technologies announced on Tuesday in its Q2 2023 earnings report that its CFO, Nelson Chai, will leave the company on Jan. 5, 2024, and a search for his replacement is underway.

Alphabet announced on July 25 that its CFO Ruth Porat was promoted to the newly created role of president and chief investment officer, effective Sept. 1. A successor wasn’t named, but Porat will continue as CFO of Alphabet and Google while the company searches for and selects the next finance chief. However, since Porat joined the company, she has brought on several former CFOs of public companies—like Palo Alto Networks, HP, and BlackRock.

Chewy, Inc., an online retailer of pet food and other pet-related products, announced on July 20 that its CFO Mario Marte has decided to retire from the company, effective July 28. Stacy Bowman, chief accounting officer, has been appointed interim CFO while the company continues its search for a permanent CFO.

In June, The Walt Disney Company announced Christine McCarthy, CFO, would be stepping down from her role and taking a family medical leave of absence, and Kevin Lansberry, EVP and CFO of Disney Parks, experiences and products, began as interim CFO on July 1. The announcement said that McCarthy will assist in the process of identifying a long-term successor. (At Disney, Bob Iger returned as CEO in November 2022, when his successor Bob Chapek, stepped down).

I contacted the companies to ask about their succession planning process for CFOs. But there was no further comment other than the announcements.

‘There is more emphasis placed on CEO succession’

In general, choosing a CFO successor is a tricky business, says Clem Johnson, president of Crist Kolder Associates, an executive search firm, “especially when unforeseen circumstances force a CFO change outside the original succession timeline,” he says. “Sometimes, internal successors disappointingly wilt under the glare of the board and public spotlight, or the chemistry with the CEO and former CFO just isn’t there. Or an interim CFO position is established while a search is conducted, ‘just to be sure’ a better alternative isn’t available,” he says. Also in “today’s incredibly dynamic landscape,” experienced CFOs have “unprecedented leverage and options,” Johnson says.

“A robust succession process generally includes at least an external scan of the market if not some active recruitment of specific individuals,” says Jeff Constable, who leads Korn Ferry’s Financial Officers Practice in North America and coleads it globally. “You can look at recent larger company CFO announcements and see a mixture of external candidate hires as well as internal candidate promotions.” Each situation may depend on the specific circumstances of the company, he says.

“There is more focus and emphasis placed on CEO succession, which makes sense given that the rest of the C-suite roles report to the CEO,” Constable says. “So succession in the C-suite cascades down from CEO succession.”

“There is no ‘set’ timing in terms of naming a successor, but most companies seem to minimally name someone four to six months prior to the change,” he says. Constable also notes that succession scenarios are dynamic. “They have to be continually revisited as there are changes to the business and talent landscape, or if there are changes to the individual situations of potential successors,” he says.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

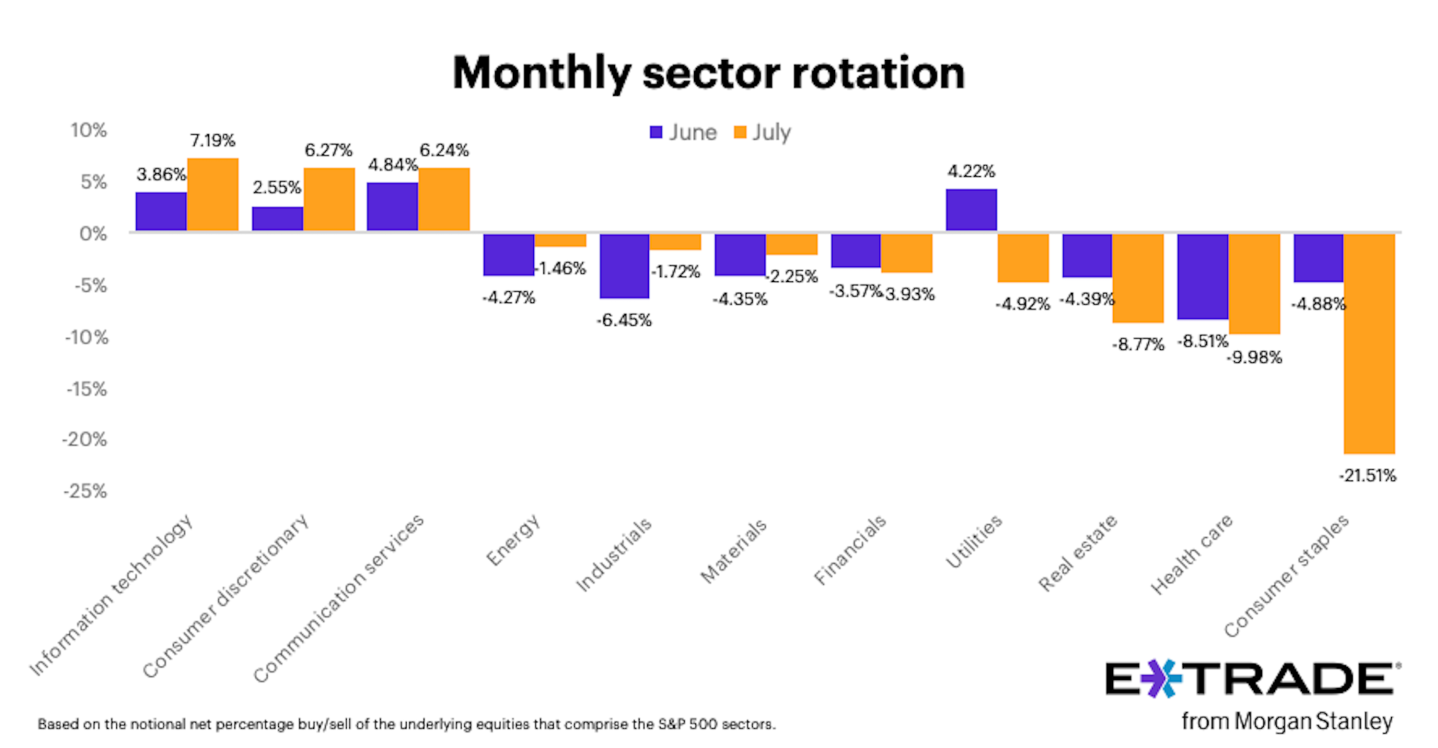

Morgan Stanley’s E-Trade released data from its monthly sector rotation study. The top three sectors in June and July were information technology, consumer discretionary (nonessential goods and services, like cars and entertainment), and communication services. The results are based on the trading platform’s customer notional net percentage buy/sell behavior for stocks that comprise the S&P 500 sectors.

"While the market may not have kept up the red-hot pace it logged in June, the second half of the year still kicked off with solid gains," Chris Larkin, managing director of trading and investing at E-Trade from Morgan Stanley, said in a statement. "To that, we saw fairly disperse profit-taking with net selling in 8 of the 11 sectors in July. For net buying, traders are gravitating toward big names like NVDA, AMZN, GOOG, and NFLX amid an earnings season that’s still in full swing. That said, with buying concentrated in areas like tech and communications services and selling in defensive sectors like consumer staples and health care, traders are continuing to lean risk-on."

Going deeper

A special series of Wharton's Ripple Effect podcast features leading Wharton faculty authors in conversations about their research and latest business books. In this episode, Professor Mauro Guillén talks about closing the generational gap. He explains the harmful effects of generational labels and why it's time to move past them.

Leaderboard

Jami Rubin was named CFO at Boundless Bio, a clinical-stage, oncology company. Rubin brings more than 30 years of leadership experience in the biopharma industry. She was most recently CFO of EQRx, where she led the organization through a go-public process that raised $1.35 billion. Rubin spent the majority of her career as a biopharma equity analyst, including as a partner at Goldman Sachs. She also served as a partner at PJT Partners.

Tim Stone has was named CFO at Farfetch Limited (NYSE: FTCH), a global platform for the luxury fashion industry, effective Sept. 1. Stone succeeds Elliot Jordan whose departure was announced in February. After a transistion period, Jordan will leave the company on Aug. 31. Stone spent more than 20 years in senior finance roles at Amazon.com, including as CFO for the AWS, Devices and Digital Content businesses. In addition, he was CFO for Ford Motor Company.

Overheard

“This is definitely heading in the Goldilocks direction. We still have a long way to go, and we still have a very high number of openings, especially as compared to where we were pre-pandemic. But we’re heading in the right direction and we’re doing so in a calm manner, which is what we want to see.”

—Rachel Sederberg, senior economist at labor analytics firm Lightcast, told CNBC in regards to the direction of the labor market. In June, employment openings totaled 9.58 million, edging lower from the downwardly revised 9.62 million in May, according to the Labor Department's monthly Job Openings and Labor Turnover Survey.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get CFO Daily delivered free to your inbox.