There are surprises in earnings reports—and then there’s what chipmaker Nvidia announced after the market close on Wednesday.

The chipmaker forecast sales of $11 billion in the coming quarter, over 50% higher than what analysts expected. The rosy forecast sent the chipmaker’s shares up by almost 25% in extended trading.

The surge would boost Nvidia’s market capitalization to over $940 billion, up from $755 billion at market close. That’s twice as much as the market cap of leading chipmaker Taiwan Semiconductor Manufacturing Co., and almost three times that of Korean firm Samsung Electronics. Nvidia is now nearing the $1 trillion market capitalization threshold held by just four other U.S. companies: Apple, Microsoft, Alphabet, and Amazon.

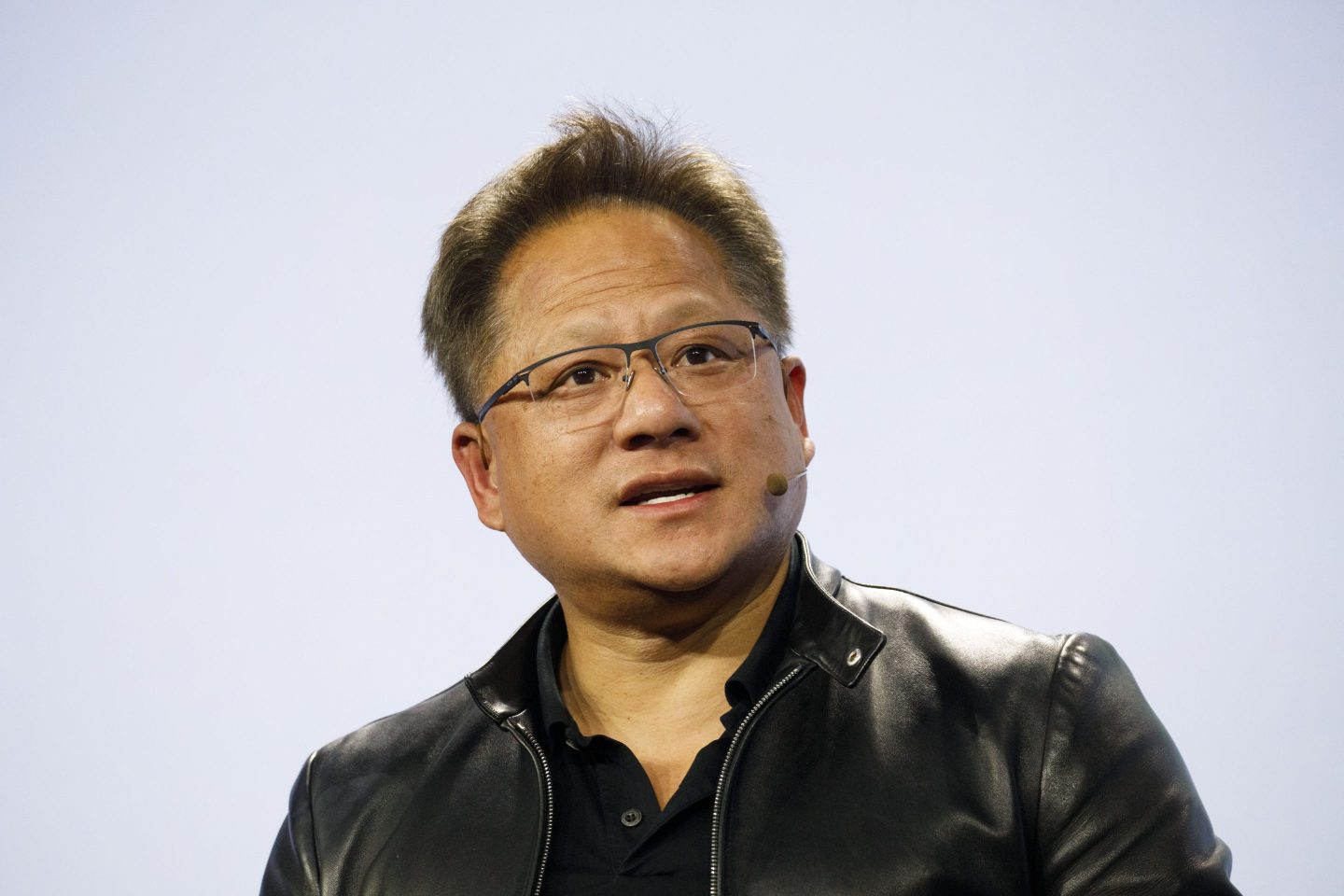

“We’re seeing incredible orders to retool the world’s data centers,” CEO Jensen Huang said on a call with analysts, predicting that companies will upgrade a trillion dollars’ worth of data centers to become A.I. capable.

Nvidia reported $7.1 billion in revenue for the most recent quarter, a 13% year-on-year decline, yet still ahead of expectations. Data center revenue, which corresponds to Nvidia’s chips used for machine learning and A.I., hit a record $4.28 billion.

Nvidia shares are now at a record high, surpassing their previous peak from November 2021, which occurred during the chip shortage. Shares fell from those heights last year when the chip shortage turned into a glut. Retailers stocked up on excess inventory, and post-pandemic consumers bought fewer electronics, hitting chip demand.

That correction in the electronics market can still be seen in Nvidia’s earnings, as the company reported a 38% year-on-year decline in its gaming division.

‘Enormous damage’

Yet while Huang was ebullient with analysts, he was far more subdued in another context yesterday.

In an interview with the Financial Times, Nvidia’s CEO highlighted a major threat to Nvidia and the broader U.S. chip industry: the Biden administration’s export controls on sales to China. Huang argued that new U.S. measures were forcing Nvidia and its peers to work with “our hands tied behind our back.”

The U.S. is limiting the sale of chips and chipmaking equipment to China to preserve its advantage in key technologies, including A.I. The government asked Nvidia to stop selling some of its chips to China to ensure they weren’t diverted to military purposes, the company revealed in a stock filing last year. Nvidia was forced to develop a less powerful chip for the China market.

The lack of chips is a constraint on Chinese A.I. development. The country only has about 40,000 units of Nvidia’s A100 processor, used in machine learning and subject to U.S. export restrictions, Megvii CEO Yin Qi estimated earlier this year in an interview with Caixin.

“China is a very important market for the technology industry,” Huang told the Financial Times. “There is no other China, there is only one China,” he said, warning of “enormous damage to American companies” if the trade in chips stopped.

The Nvidia CEO even suggested that closing off the China market would undercut the U.S. effort to bolster its own local chip manufacturing through the $52 billion in subsidies offered through the CHIPS and Science Act. The drop in demand would mean that “no one is going to need American fabs; we will be swimming in fabs,” he said. (“Fabs” is shorthand for semiconductor fabrication plant, or the factories that produce chips.)

Tech tensions between Washington and Beijing also open a door to non-U.S. competitors. On Sunday, Chinese regulators barred a wide range of entities from buying chips from U.S.-based Micron Technology. While regulators cited cybersecurity risks, analysts believe the ban is retaliation for U.S. chip controls.

The ban spurred a rally in Chinese chip stocks, as investors bet that local companies will eventually be able to replace imported semiconductors. And South Korea, home to major chipmakers Samsung Electronics and SK Hynix, hinted that it would not stop its own companies from filling the hole left by Micron.

If China can’t buy chips from the U.S., “they’ll just build it themselves,” Huang told the Financial Times.