Convenience stores are known as purveyors of slushies, cigarettes, and day-old roller hot dogs. They’re less known for being inexpensive retail stalwarts during inflation when their low-priced but high-margin assortments offer shoppers a haven from soaring prices and provide brands an oasis of steady consumer demand.

However, the industry reached a tipping point in recent months when shoppers cut back on purchases at one of the last bastions of affordability.

By the end of 2022, consumers purchased 10.3% fewer items each time they visited a convenience store, while dollar sales declined a marginal 0.3%, indicating that the same budget now buys far fewer products.

”If we see people buying fewer items overall to save money, that means they’re pulling back on impulse purchases,” says Emily Moquin, food and beverage analyst at market research company Morning Consult.

That’s a potential catastrophe for an industry built on small impulse purchases made across thousands of stores: a candy bar here, a bag of chips there, a soda just because. Retailers now face the arduous task of convincing shoppers to place more items in their shopping cart—even though rising prices mean they can afford fewer of them—by overhauling a proven, decades-old merchandising playbook and rejiggering their product assortment toward fresh food and private-label items, which deliver higher margins while remaining affordable.

Higher prices don’t offset ballooning costs

Convenience store operators saw costs rise 14.8% from January to October, according to data from the National Association of Convenience Stores (NACS), the industry’s trade organization.

| Per Store/Per Month | Jan–Oct ’21 | Jan–Oct ’22 | % Chg |

| Wages & Benefits | $33,618 | $38,250 | 13.8% |

| Card Fees | $9,448 | $12,159 | 28.7% |

| Utilities | $3,574 | $4,068 | 13.8% |

| Repairs & Maintenance | $5,005 | $5,822 | 16.3% |

| Total Direct Store Operating Expenses (DSOE) | $61,258 | $71,170 | 16.2% |

| Facility Expense | $15,477 | $16,950 | 9.5% |

| Total DSOE & Facility Expense | $76,735 | $88,120 | 14.8% |

It might seem counterintuitive, but higher sticker prices don’t offset cost increases at convenience stores the same way they do at, say, grocery or big-box stores. Instead, they cause consumers to balk at prices and reduce indulgences, a devastating blow for corner stores, which amassed some $185 billion in total sales in 2022, excluding fuel sales, per Circana data.

Because convenience store prices “start at a much higher place, every percentage point you go up in convenience feels more punitive than other channels,” says Scott Love, senior vice president of retail client solutions at Circana.

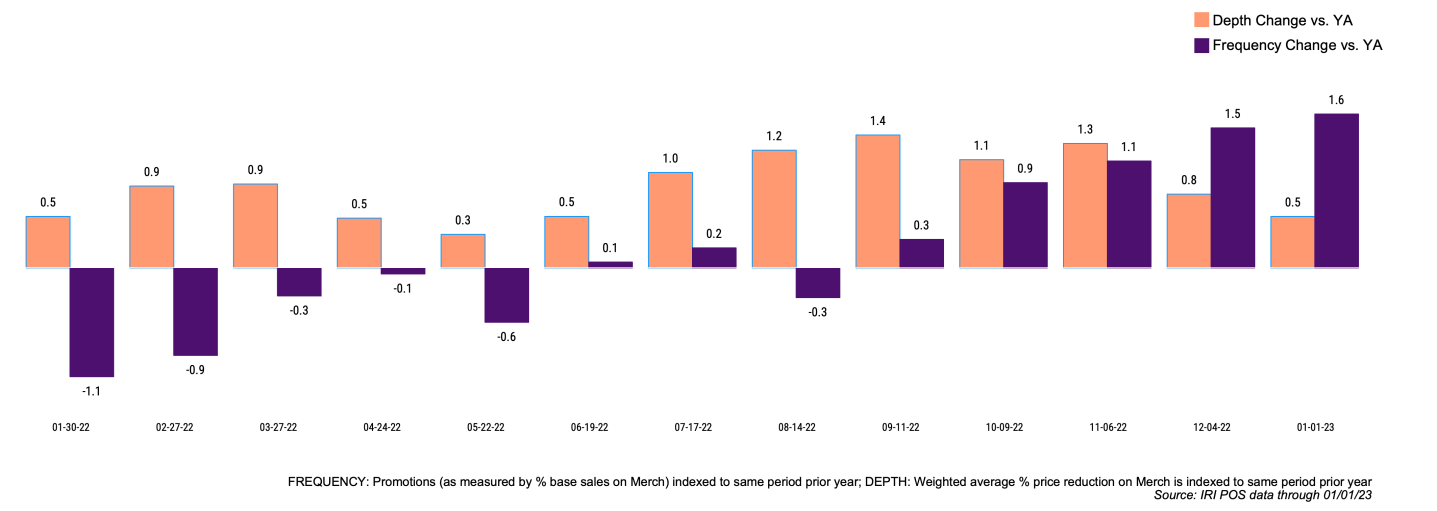

To make matters worse, the average price of convenience store staples like candy and salty snacks has risen 16.7% and 14.4% this year, respectively, according to Circana data. That’s more than double the current rate of 6% inflation. Love thinks the price increases have been so drastic because stores are offering fewer discounts, forcing more consumers to buy those items at full price.

That sets up a showdown between retailers, hesitant to pass all cost increases to consumers, and brands, desperate to raise prices to protect profit margins.

Retailers are “feeling a squeeze on their margins. As the cost to purchase goods has gone up, they’re also doing their best not to put the squeeze entirely on the consumer,” says Rich Donahue, chief marketing officer of digital coupon company Ibotta. “They’re putting pressure on their suppliers accordingly. Ultimately, ousting some of those brands in a way they might not have if not for the inflationary environment.”

To keep prices low for already cash-strapped consumers, convenience stores have drifted away from deep discounts on select products to frequent but smaller discounts on high-margin items to ensure they end up in consumers’ shopping carts, according to Love. But the changes to long-standing merchandising practices are not without growing pains for retailers.

“They’re scrambling, frankly, because all their methodology is built on a certain pattern” that used to have longer intervals between promotions before inflation, he says.

Driving shoppers toward foodservice

Savvy retailers understand the need to push shoppers toward fresh food offerings, among the highest margin items in convenience stores, says Lori Stillman, NACS’s vice president of research and education.

Skyrocketing prices have accelerated a decade-long trend that’s seen convenience stores shed the gas station food stigma and transform into fast-food restaurants, as they aspire to be affordable one-stop shops for everything from gas to lattes to chicken bacon ranch pizzas.

“The operators in the convenience industry who are more evolved in their food service offerings are straddling best-demonstrated practices of promotions in quick service restaurants and traditional retail,” Stillman says. “They’re the one and only place where they get to put it all together and take what works in a Walmart, Kroger, or McDonald’s.”

Recent examples include the Pennsylvania-based Sheetz, which offers everything from salads to scrambled eggs, while East Coast cult favorite Wawa features three varieties of avocado toast.

“If you think about a McDonald’s,” Stillman says, “you buy a burger, and the fries and the drink come in the bundle. Convenience store operators are starting to do that as well, and that’s typically not how most operators have sold in the past.”

Loyalty programs reach valuable shoppers

As retailers build out increasingly sophisticated menus with increasingly favorable margins, they’ve also developed cutting-edge marketing to go alongside them. Most are built around loyalty apps that allow them to harness first-party consumer data to deliver hyper-personalized ads, says Michael Bloom, chief marketing and merchandising officer at GPM Investments, which owns about 1,400 convenience stores across the mid-Atlantic.

The data these apps capture have evolved loyalty programs from the old-fashioned keychain cards of the past.

“A loyalty program is not the card,” Stillman says. “It’s what you do with the data and the affinity that you build with the shoppers as a result of having those programs.”

The 1.3 million users of GPM’s loyalty rewards program visited stores an average of nine times a month, according to a press release earlier this month announcing the launch of its app. That’s exactly double the average of 4.5 trips per month the industry saw in 2022, per Circana data. Bloom says rewards members spent 9% to 14% more on each store visit than those not enrolled in the program.

The general belt-tightening of an inflationary environment means retailers are “not going out and trying to grab new consumers right now. [They’re] not grabbing market share because that is really tough and really expensive to do,” says Meredith Meyer Grelli, a professor at the Tepper School of Business at Carnegie Mellon University and former brand manager at Kraft Heinz.

Instead, they’re focused on their most loyal consumers, allowing them to re-recruit lapsed shoppers with greater ease and more effectively upsell them items frequently bought together, like coffee and a doughnut, Bloom says.

Inflation means more store-brand products

Retailers consider their portfolio of store-brand items a seamless way to sell products with more favorable margins, albeit ones with lower brand equity and consumer pull. Consumer goods companies see them as a threat, further exacerbating lingering tensions with stores, but one they can’t readily compete with for fear of irritating the retailers carrying their products.

Dollar sales of private-label products in convenience stores grew 15% in 2022 compared to the previous year, while national brands grew only 8%, according to Circana. Not surprising, considering 83% of respondents in a January Morning Consult study reported buying store-brand products to save money.

“Private-label brands are doing a good job of securing space that telegraphs to the shopper that there is a different price point than perhaps they’d noticed in the past,” Stillman says.

Interestingly, that approach is even making headway among wealthy consumers, who spent 16.6% more on store brand products in 2022 than in 2021, according to Circana data. It’s yet another indication that some changes to consumer behavior fly in the face of orthodoxy and could lead to long-lasting, even permanent, changes.

“The behavioral changes we’re seeing both amongst the consumer and brands are here to stay,” says Ibotta CMO Donahue.

Correction, April 18, 2023: A previous version of this article misstated 2022 sales for the convenience story industry. The sector saw $185 billion in total sales, not $45 billion.