After the high-profile failures of Silicon Valley Bank and Signature Bank last month, U.S. officials have assured Americans that the financial system is sound, and that depositors will get their money back. But one seasoned investor who predicted 2008’s great financial crisis thinks that more chaos will unfold.

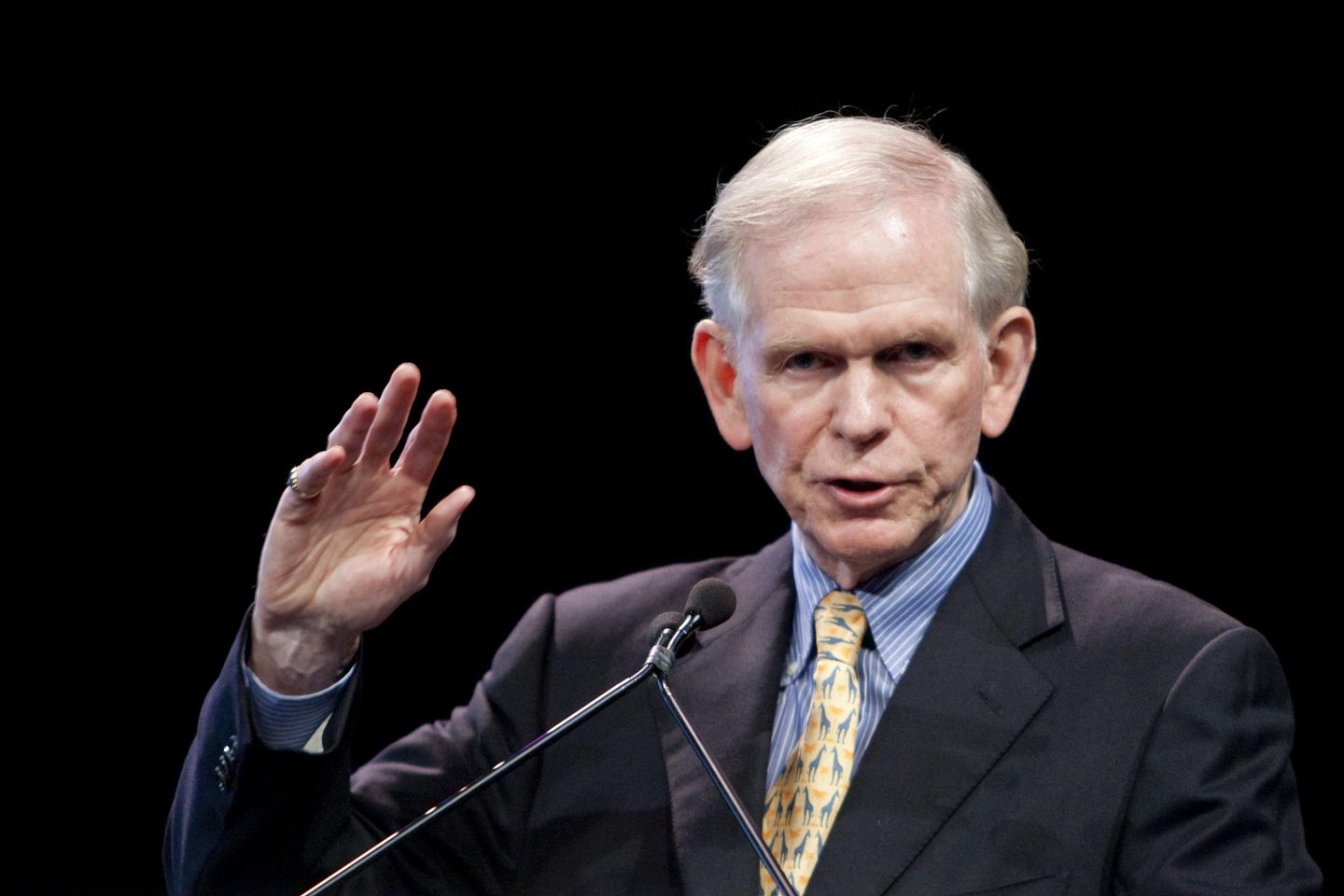

“Other things will break, and who knows what they will be,” Jeremy Grantham, the co-founder and chief investment strategist at asset management firm GMO, told CNN in an interview Thursday. “We’re by no means finished with the stress to the financial system.”

SVB collapsed in part because it had placed big bets on longer-term bonds, the value of which plunged amid the Fed’s persistent rate hikes to battle inflation. And while some market players thought the bank failures may lead the Fed to temporarily halt its interest rate increases, the central bank hiked rates about a week later by 25 basis points.

Grantham believes that the Fed’s low interest rate and easy money policies over the past several years have contributed to an “everything bubble” in which investors pursued risky investments and untenable businesses. And he believes that the Fed’s low interest rates during the pandemic created a major financial bubble. So he isn’t against the Fed’s interest rate hikes—which is what he says the economy needs right now.

He points to former Fed Chair Paul Volcker’s tenure as a model for current Fed Chair Jerome Powell. Volcker served two terms—from 1979 to 1987. To cool down high inflation, he instituted a series of aggressive interest rate hikes, which hit 19% at one point (today, the rate is between 4.75 and 5%). Those rate increases were succeeded by a double-dip recession.

“If Powell could just channel a little bit of Volcker, that would be a distinct improvement,” Grantham said.

So far, the Fed has raised rates nine times since early 2022, marking the fastest pace of rate increases in history. The inflation rate has gone from a 40-year high last June of 9.1%, to the current rate of 5%.

The Fed, a banking crisis and the interest rate saga

The central bank has been criticized by many industry experts for not doing more to avert bank failures and for addressing inflation without considering other factors.

JPMorgan Chase CEO Jamie Dimon told shareholders in a letter earlier this month that he blamed the Fed for not stress testing banks to prepare them for high interest rate scenarios. Dimon said the banking crisis was “hiding in plain sight” and that its ripple effect would unfold for years.

In March, Larry Fink, CEO of asset management behemoth BlackRock, called Fed’s interest rate hikes the “first domino” that fell and the SVB implosion the second such domino. A third domino could still fall, Fink said, in which the sudden tightening of financial conditions could lead to more bank closures.

Not everyone blames the Fed or thinks there will be a domino effect falling on U.S. banks. But sharp interest rate increases fuel a credit crunch. The impact of the banking crisis could affect banks’ lending activities, leading to fewer loans and therefore, less money in the hands of companies and individuals. According to a Fed survey this week, a majority of Americans think credit is somewhat or much harder to come by now than a year before.

But despite how the Fed addresses inflation, if a full-blown banking crisis were to unfold, veteran investor Warren Buffett, who runs Berkshire Hathaway, said depositors will continue to remain safe.

Bubbles don’t burst, they go ‘boom’

When the Fed lowered interest rates to nearly zero during the heights of the pandemic, Grantham called the stock market boom that ensued as “one of the great bubbles of financial history” at the time, in 2021. The legendary investor thinks that the next bubble in the market could burst now, and the banking crisis caused by the Fed would be part of that chaos and it will have far-reaching consequences in the financial markets.

“When the great bubbles break, they do impose a lot of stress on the system,” Grantham told CNN. “It’s like pressure behind a dam. It’s very hard to know which part will go.”

But a market crash may not even be the worst part, according to Grantham, who thinks more pain may follow for the economy in the aftermath.

“Every one of these great bursts of euphoria, the great bubbles with overpriced markets … has been followed by a recession,” Grantham said. “The recessions are mild if everybody does everything right and there [are] no complications. They are terrible if people get everything wrong.”

In January, Grantham was bearish about the year ahead, owing to a “long list” of headwinds. Looming economic uncertainties, potential overcorrection in asset valuations, a “pretty brutal” market decline and the burst of a real estate bubble were some of the factors he named in a GMO letter. But Grantham reassured investors that it won’t mean “the end of the world.”

Update, April 14, 2023: This story has been updated to reflect that Paul Volcker served as chair of the Fed from 1979 to 1987.