Good morning,

There’s been an ongoing debate over OpenAI’s ChatGPT, from its inaccuracies to some banks banning it to those who believe generative A.I. is part of the future of finance. One CFO set out to prove the value of the technology.

“The amazing thing with these large language models like ChatGPT is they can take plain natural language queries and respond to them as a person would,” says Glenn Hopper, a startup CFO for more than 20 years at primarily private equity-backed companies, and a financial consultant. He’s also the author of Deep Finance.

I sat down with Hopper to discuss his project, “Application of ChatGPT to Build an FP&A Tool,” which resulted in 30 pages of documentation. “I consider myself a tech evangelist,” Hopper tells me. “I actually just registered the domain name Robo.CFO.AI.”

Hopper says he understands the vital role that financial planning and analysis professionals play in the CFO organization.

“I guess I had two purposes with it,” Hopper explains. “One was to show finance people, ‘Hey, we’ve all been clamoring for tools like this.’” Tech like ChatGPT not only can respond in natural language, but it could also write code, he says. “I think most FP&A people probably can write SQL (structured query language) queries at this point, and they have data science skills,” Hopper says. “But they’re not developers.”

The second purpose of the project was to create a “proof of concept,” so they could show the developers of their company and say, “‘Look, here’s what we could do, and these are the advantages if we could do it,” Hopper says.

What was the process? “I took three years of financial statements from a fictional company and prompted ChatGPT to write code that would import those financial statements into database tables,” Hopper explains. In analyzing the data, he wanted to reflect on the process of “when you do the close, and you start comparing your performance to budget and your performance to the prior month or the year before,” for example. So, he created key metrics.

“When I realized I wouldn’t be able to get ChatGPT to query the data directly, I had it write code that created a chatbot that let users ask questions in natural language about the data,” he says.

“The bot will respond to your queries as if you were talking to an analyst. You can get information from the tables without having to write SQL queries. You can just say, “Hey, what were our sales in June?’ And then it just spits out the response for that.”

“I wanted to show that this is a new tool we have in our arsenal,” says Hopper, a U.S. Navy veteran who earned a master’s degree at Harvard. “We can start building stuff like this.”

Building a case for finance tech

Exploring the capabilities of ChatGPT derived from the mindset Hopper had for most of his career—building a case for finance tech tools.

“My background has been in small and mid-size enterprises where we really don’t have much of a finance department at all.” Over the years, he’s relied on tech to help fill in the gaps.

“What I’ve done in the past, is go build something out as a proof of concept, and then hand it over to the development team when I do my report request, to show what the tool could do and how it would benefit the company,” Hopper says.

Spending his career at private-equity-backed companies has taught him to act fast. Private equity portfolio company CFOs “don’t play wait and see,” according to recent McKinsey research. It’s typically just a five-to-seven-year period in which a PE CFO has to create and manage through a value creation plan, according to the research.

Hopper thinks generative A.I. and machine learning can be especially helpful for FP&A teams at small and mid-size companies. “FP&A teams in small companies are often overwhelmed by the number of reports that are required to effectively measure business performance,” Hopper says. “Tracking down the data required to compile these reports can be time consuming if the data is not readily accessible. And they usually don’t have access to nearly as much data as larger enterprises would so they can’t provide as much detail as would be available to larger companies.”

He continues, “If an A.I.-as-a-Service company came along that could consolidate (and anonymize) industry data from multiple companies, they could train algorithms on that larger dataset and make the algorithms available to their clients.”

We’re still in the early innings of generative A.I. as it pertains to finance, so I’m sure the debate will continue.

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Sign up here to receive CFO Daily weekday mornings in your inbox.

Big deal

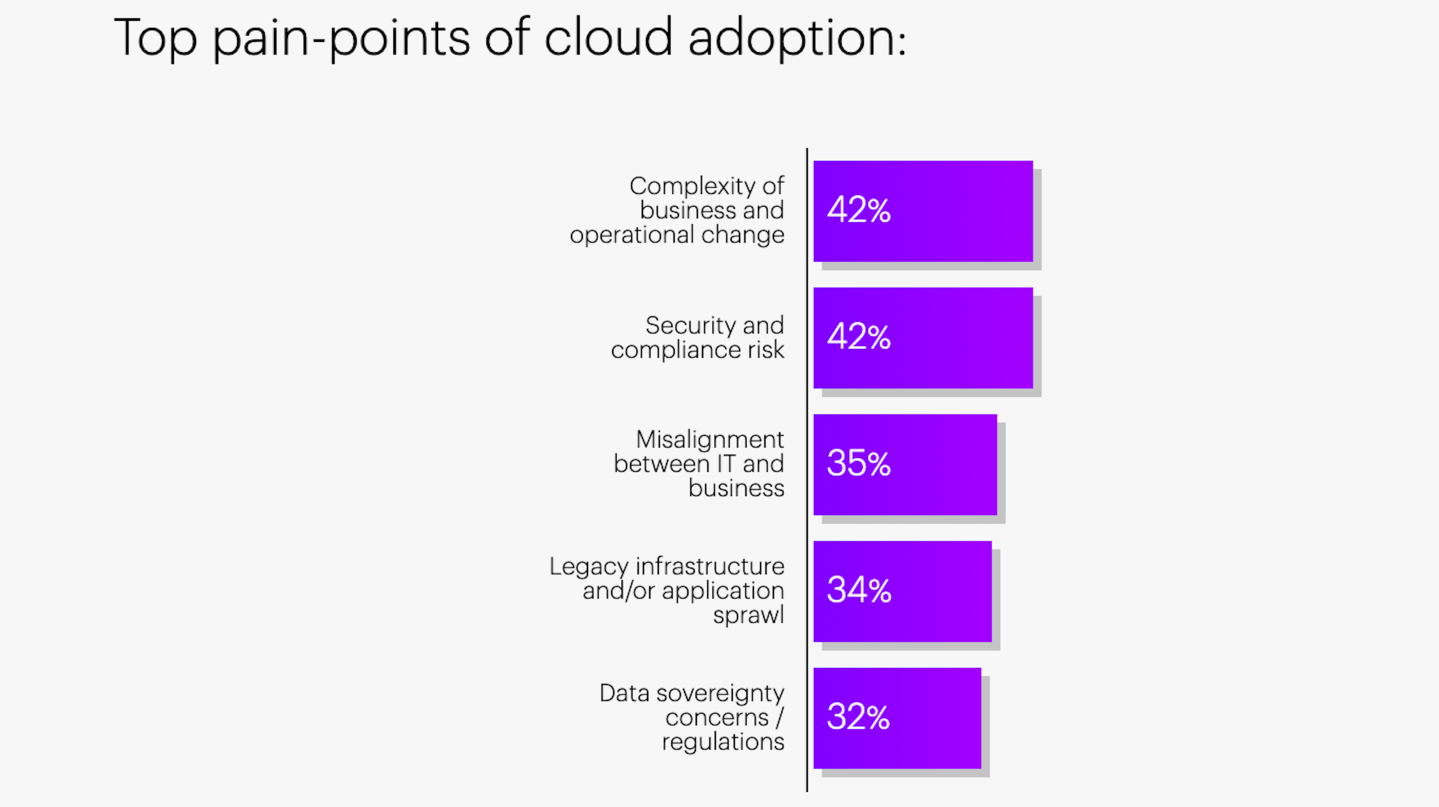

Accenture's recent cloud continuum report details the status of cloud migration across the world’s businesses. The findings are placed on a global survey of about 4,000 global business and IT leaders. Sixty-five percent of respondents saw up to 10% in cost savings, on average, from moving to the cloud. But some companies experienced obstacles to cloud adoption such as changing business and operating models (42%), security risk (42%), misalignment between IT and business (35%), legacy infrastructure (34%), and complying with regulations (32%). The findings also point to the benefits of investing in cloud technologies. "Those that are advancing their cloud engagements are leading—and even shaping—their industry transformations and pulling farther ahead of their competitors," according to the report.

Going deeper

The Economist launched on Tuesday a new guide of economic terms called the "A to Z of economics." Economic terms, from “absolute advantage” to “zero-sum games" are explained in plain English. A useful guide to share with team members who may just be starting their finance careers.

Leaderboard

Kevin Coveney was named CFO at Enveric Biosciences (Nasdaq: ENVB), a biotechnology company, effective March 13. Coveney brings more than 30 years of experience. He joins Enveric after serving as a fractional CFO to emerging life science and digital health companies, such as Progressive Therapeutics, Power of Patients, and VSI. Previously, Coveney was CFO of Memgen, Inc., and CFO of Q-State Biosciences. Before that, he was SVP of finance, HR, and IT at Vedanta Biosciences. Coveney has also held senior positions at several global accounting firms, including Grant Thornton, Marcum, Deloitte & Touche, BDO Seidman, and Ernst & Young.

Matt Malek was named CFO at Interactions, a provider of intelligent virtual assistant solutions that assimilate conversational artificial intelligence. Malek has 20 years of financial experience. Most recently, he served as COO and CFO at GenVault and DocuVault. Malek brings expertise in all aspects of business leadership—including strategy development and planning—to his new role. He will help deliver Interactions’ next phase of growth as the company "meets the rapidly rising demand for A.I.-powered customer experiences," according to the announcement.

Overheard

“In 58 years of Berkshire management, most of my capital-allocation decisions have been no better than so-so. In some cases, also, bad moves by me have been rescued by very large doses of luck.”

—Warren Buffett, CEO of Berkshire Hathaway, wrote in his annual letter to the shareholders. One of the most well-respected investors in the world, 92-year-old Buffett offered a bit of retrospective analysis, writing that his “satisfactory results” since 1965 are mostly due to a dozen or so great investments in companies like Coca-Cola and American Express, Fortune reported.