Lumber markets were a harbinger of big economic shifts early on in the pandemic, and today’s slumping prices could be just as telling about the economy’s future.

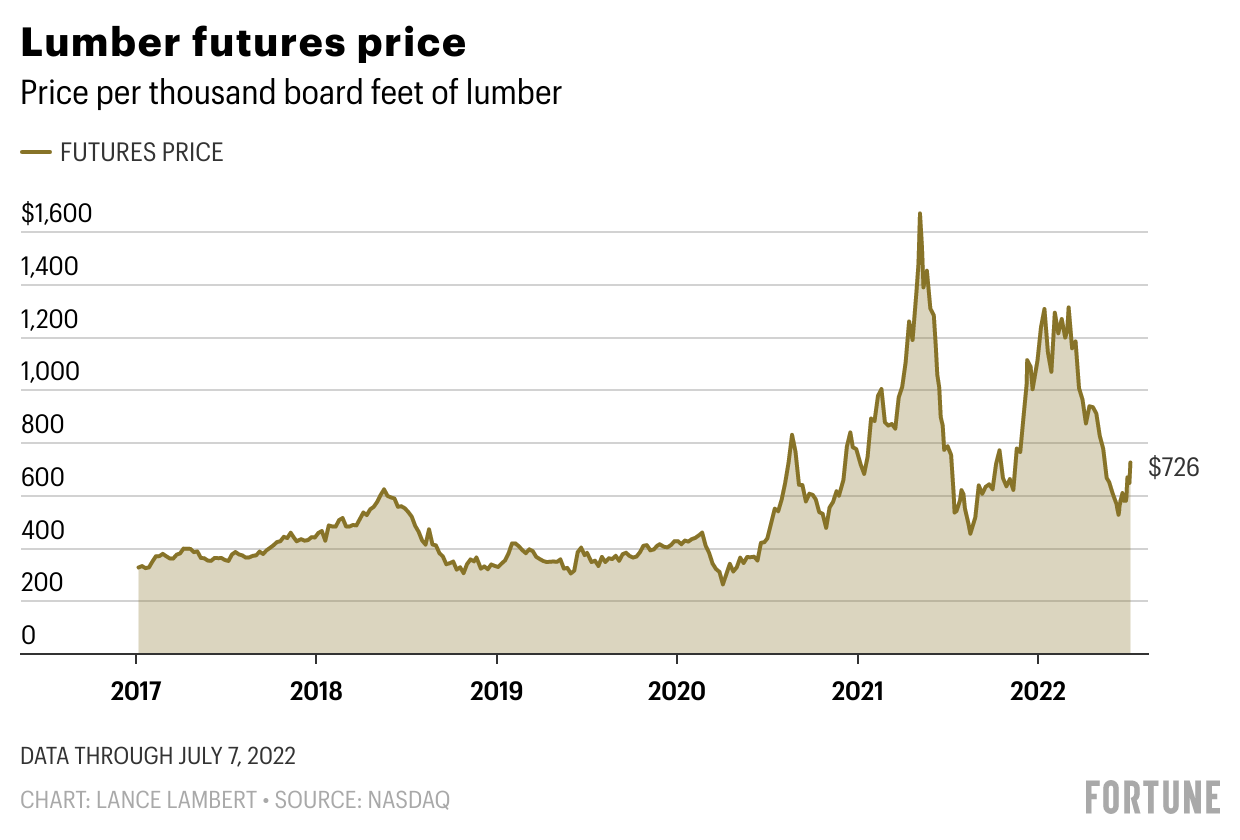

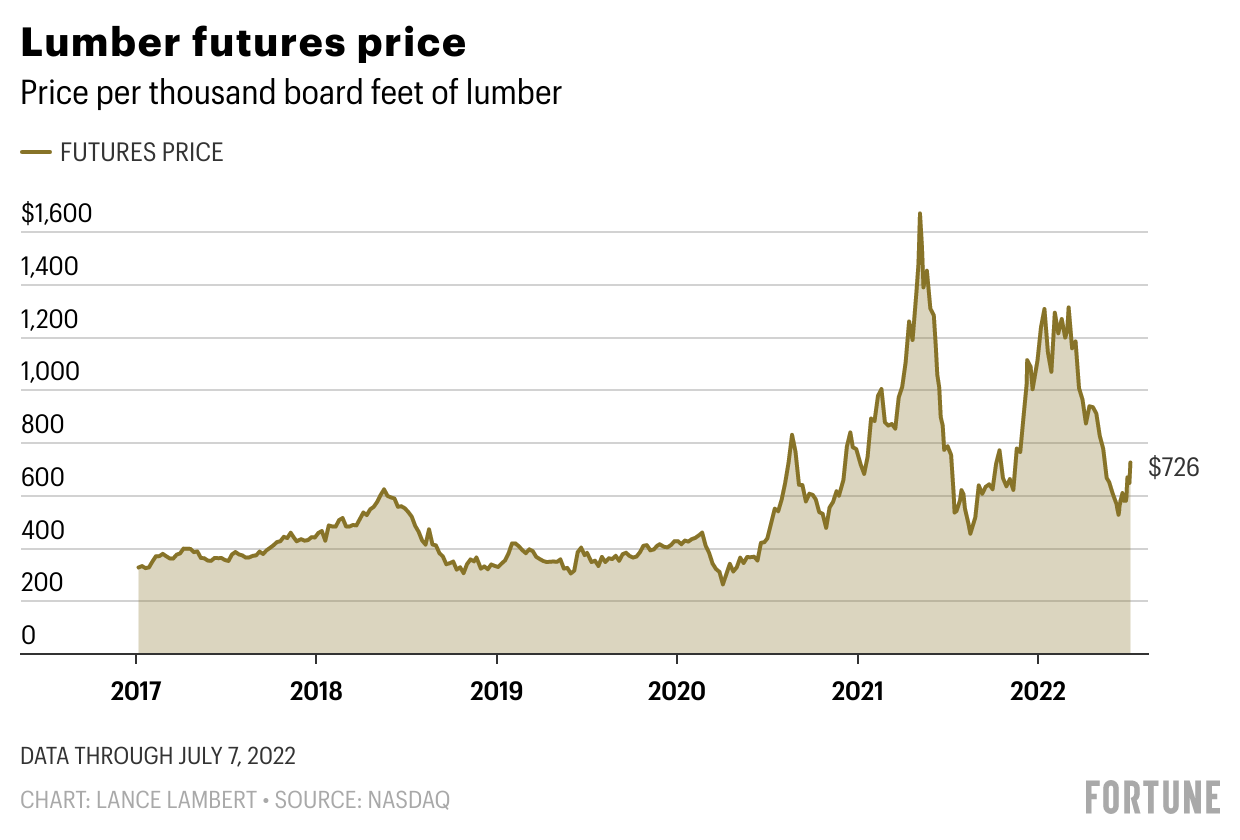

Lumber prices hit a record $1,607 per thousand board feet in May 2021, due to soaring demand for new homes, a boom in DIY home renovation activities, and production and supply chain issues stemming from the pandemic.

Twelve months later, lumber prices have collapsed, now going for $648, a more than 50% decrease from $1,464 in March.

High lumber prices in 2020 and 2021 were an early indicator that construction—and the economy in general—was set to go through some profound inflationary changes. Today’s slumping prices, and where lumber markets go over the next few months, could be an equally important indicator of where the economy is headed. The plummeting price of lumber might be telling us that inflation has peaked.

“Lumber was kind of the canary in the coal mine that told us something was coming,” Darin Newsom, president and founder of the eponymous market analysis firm, told Fortune. “From April 2020 through May 2021, [lumber] basically led the inflation charts.”

The lumber bubble(s)

It’s been a wild ride for lumber prices over the past two years, as wood products became one of the most volatile commodities on the market throughout the pandemic.

In May 2021, lumber’s year-on-year prices had surged by 300% in response to low supply mixed with high demand for new homes and a boom in home renovation projects. Lumber markets didn’t keep rising predictably, though, seeing a seesaw of soaring prices and sudden plummets.

The first bursting “lumber bubble” occurred last summer—when prices fell 47% in June alone. However, by late last year, lumber prices spiked once again. Homebuilders were looking to secure supply for what looked like a strong 2022 building season. Between August 2021 and January 2022, prices shot up from around $400 to over $1,400. But that lumber bubble 2.0 also popped. That bursting bubble was unlike the one that that occurred in 2021. This time, traders were offloading lumber futures based on fears that spiked interest rates would put downward pressure on housing demand.

Part of the reason behind low lumber prices right now is the seasonality of lumber markets, Newsom said.

“There is a seasonal pattern,” Newsom said, adding that lumber prices tend to go up during the fall and winter when more homes are being renovated or built, while prices go down during summer, when people tend to have other expenses such as fuel.

But even lumber’s seasonality cannot explain the wild price swings the market has been through over the past year. “It’s way out of the norm,” Newsom said. “It’s been wild to watch what has happened to lumber prices.”

Our next economic signal

The unpredictability of lumber means that there is no guarantee prices will stay low. But given how prescient the market has been over the past few years, and with fears of an economic contraction and possible recession looming, it will remain an important signal.

“[Lumber] was an indicator that we were going to see this rapid expansion in the overall economy last year and that once it peaked, we were going to start seeing it contract,” Newsom said.

“It is certainly an indicator of expansion and contraction,” he added.

The first signs of economic contraction tied to lumber prices may be in housing. After its red-hot streak over the past year, the housing market has “started to slow down,” Newsom said, with the housing market already showing clear signs of cooling. And that cooler demand for real estate is an indicator that inflation could begin coming down soon as well, given that rising housing costs accounted for 40% of June’s core inflation numbers.

The way lumber behaves in the fall—when the commodity’s prices traditionally rise—could also be a big signal as to how bad an economic contraction will be.

“It will be interesting to see if [lumber] starts to move back up,” Newsom said. “It would tell us that the U.S. economy is starting to sift through all the interest rate hikes and the inflation, and that the economy may not be as bad as what many people think it will be.”