American companies had a huge year in 2021.

Together, the corporations on this year’s Fortune 500 list generated a record $1.8 trillion in profits on $16.1 trillion in revenue.

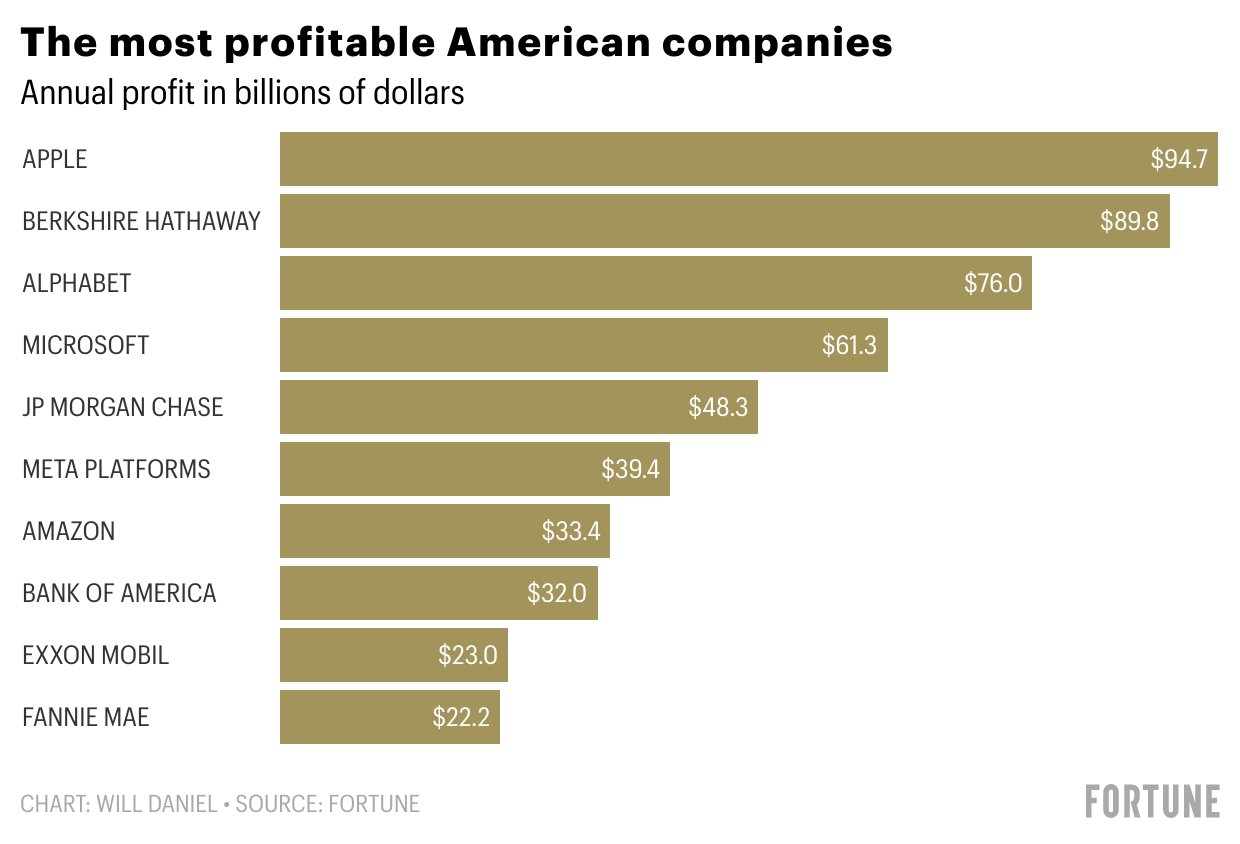

The story of the top 10 most profitable U.S. companies reveals some major trends in the current American business landscape: Tech continues to dominate, energy companies remain in a secular decline despite a rebound in 2021, and a strong economy lifts all boats.

Tech remains dominant

Apple once again took the top spot on Fortune’s list of the most profitable American companies in 2021. The tech giant raked in $94.7 billion in profits last year on revenues of $365.8 billion.

In the past, oil producers and even car companies like Ford were common sights at the top of the most profitable companies list, but these days, tech companies reign supreme. Tech giants represented three out of the top five most profitable companies in the U.S. in 2021 and half of the top 10.

Apple has also taken the top spot on the Fortune 500 most profitable list for seven out of the last eight years, only being eclipsed once by Warren Buffet’s Berkshire Hathaway in 2019.

Other tech profit generators in the top ten included Meta Platforms, Amazon, Microsoft, and Google’s parent company Alphabet.

Fossil fuel’s secular decline continues

The waning dominance of fossil fuel companies has been an ongoing trend over the past decade, and only one company, Exxon Mobil, nabbed a top spot in the most profitable list.

But that doesn’t tell the whole story.

Rising oil and gas prices lifted many energy companies to new heights in 2021, increasing the sector’s presence in this year’s Fortune 500.

Still, from 2000 to 2015, Exxon Mobil earned the top spot as the most profitable U.S. firm 12 times, while this year it only managed the number nine slot. It was also the only company that didn’t post a double-digit year-over-year increase in profits compared to 2020.

A strong economy lifts banks, mortgage lenders

A strong economy and a record year for stocks meant big business for America’s banks and investment managers in 2021.

U.S. banks pulled in $279.1 billion in profits last year, a $132 billion jump compared with 2020, FDIC data shows. Both JP Morgan Chase and Bank of America made it on this year’s top 10 most profitable U.S. firms list, while Citigroup, Goldman Sachs, and Wells Fargo came in at the 13th, 14th, and 15th spots, respectively.

Low-interest rates and a strong housing market in 2021 also pushed the Federal National Mortgage Association, a.k.a Fannie Mae, into the list of most profitable firms. The mortgage lender nearly doubled its profits compared to 2020 as the red-hot housing market raged, but with the market showing signs of a slowdown as mortgage rates rise, 2022 may be a different story.

Finally, Warren Buffet’s Berkshire Hathaway saw a record year in 2021, bolstered by rising stock prices in two of its largest holdings, Apple and Bank of America. Increasing profits in the conglomerate’s railroad, utilities and energy businesses and a turnaround in its insurance-underwriting operations also helped boost results.

Here’s a look at the top 10 most profitable firms in the U.S.

Apple

Revenue: $365.8 billion

Profit: $94.7 billion

Year-over-year change in profit: 64.9%

Berkshire Hathaway

Revenue: $276.1 billion

Profit: $89.8 billion

Year-over-year change in profit: 111.2%

Alphabet

Revenue: $257.6 billion

Profit: $76 billion

Year-over-year change in profit: 88.8%

Microsoft

Revenue: $168.1 billion

Profit: $61.3 billion

Year-over-year change in profit: 38.4%

JP Morgan Chase

Revenue: $127.2 billion

Profit: $48.3 billion

Year-over-year change in profit: 65.9%

Meta Platforms

Revenue: $117.9 billion

Profit: $39.4 billion

Year-over-year change in profit: 35.1%

Amazon

Revenue: $469.8

Profit: $33.4 billion

Year-over-year change in profit: 56.4%

Bank of America

Revenue: $93.8 billion

Profit: $32 billion

Year-over-year change in profit: 78.7%

Exxon Mobil

Revenue: $285.6 billion

Profit: $23 billion

Year-over-year change in profit: 0%

Fannie Mae

Revenue: $101.5 billion

Profit: $22.2 billion

Year-over-year change in profit: 87.9%

Sign up for the Fortune Features email list so you don’t miss our biggest features, exclusive interviews, and investigations.