Warren Buffett likened the stock markets to a “gambling parlor” at this weekend’s annual Berkshire Hathaway shareholders conference. If that’s true, this is one lousy casino.

The day before the Oracle of Omaha spoke, April closed with a thud. Friday’s selloff, in which the Nasdaq Composite fell 537 points and the Dow Jones Industrial Average took a 939-point haircut, pushed markets into the record books. Even Buffett’s Berkshire Hathaway, which had been outperforming most blue chips this year, couldn’t escape the carnage. It fell 3.8% last week.

Zooming out, the Nasdaq fell a whopping 13% in April, the tech-heavy exchange’s worst monthly performance since the autumn of 2008, at the height of the global financial crisis. It’s now down 21% for the year, solidly in bear territory. As for the S&P 500, it’s off to its worst start to a year since 1939.

But stocks weren’t even the worst-performing risk asset last month. The “worst of” award goes to crypto king Bitcoin, which fell 17.8%.

A bevy of headwinds are dragging down stocks, including inflation, supply-chain woes, growth concerns, and war in Ukraine. Not even earnings season can restore investor fortunes.

Investors continue to give earnings beats a muted cheer. For those companies that deliver a miss, the punishment is severe. On Friday, the markets pounded Amazon for posting a big bottom-line dud.

Apple, too, last week failed to give shareholders the knockout report card they've grown accustomed to. With the company seeing supply-chain challenges ahead, it again declined to furnish investors with future guidance. Apple shares fell 3.7% on Friday, adding to the collective gloom around stocks.

"Disappointing guidance from technology giants Amazon and Apple ha[s] exacerbated concern that a decidedly more hawkish Fed, coupled with still intractable supply chain issues, and rising energy prices, may make the hope of a 'soft landing' from the Fed more elusive," Quincy Krosby, chief equity strategist for LPL Financial, said after the close on Friday.

Roughly 80% of S&P 500 firms have reported results, and those results should give investors some reason to worry. Overall, earnings growth is faltering. According to FactSet, S&P firms are expected to deliver, on aggregate, earnings growth equivalent to a 7.1% gain year-on-year. That comes in below the five- and 10-year average, FactSet calculates.

The macro picture doesn't look much better. Just as central banks on both sides of the Atlantic begin to raise interest rates to cool off runaway inflation, growth is beginning to slow. We saw that last week with the U.S. GDP falling unexpectedly in Q1.

That forced economists to review their full-year forecasts and begin to revise down their projections. The latest dose of bad news comes from the German investment bank Berenberg. It cut its growth-rate forecasts for the United States, Eurozone, and the United Kingdom in its latest research note.

The U.S. should expect the biggest pullback of the trio. "Near-term, the drag from elevated inflation on real household incomes may restrain growth. In addition, the Russian invasion of Ukraine may hurt consumer confidence. We also need to watch the impact of Fed rate hikes," writes Mickey D. Levy, Berenberg's chief economist for the U.S., the Americas, and Asia.

The glass-half-full take

Even with elevated inflation and lower growth in the forecast for much of the current quarter, there are signs of hope for investors. If there is a rebound for stocks in the making, it will come from free-spending corporates, Goldman Sachs forecasts.

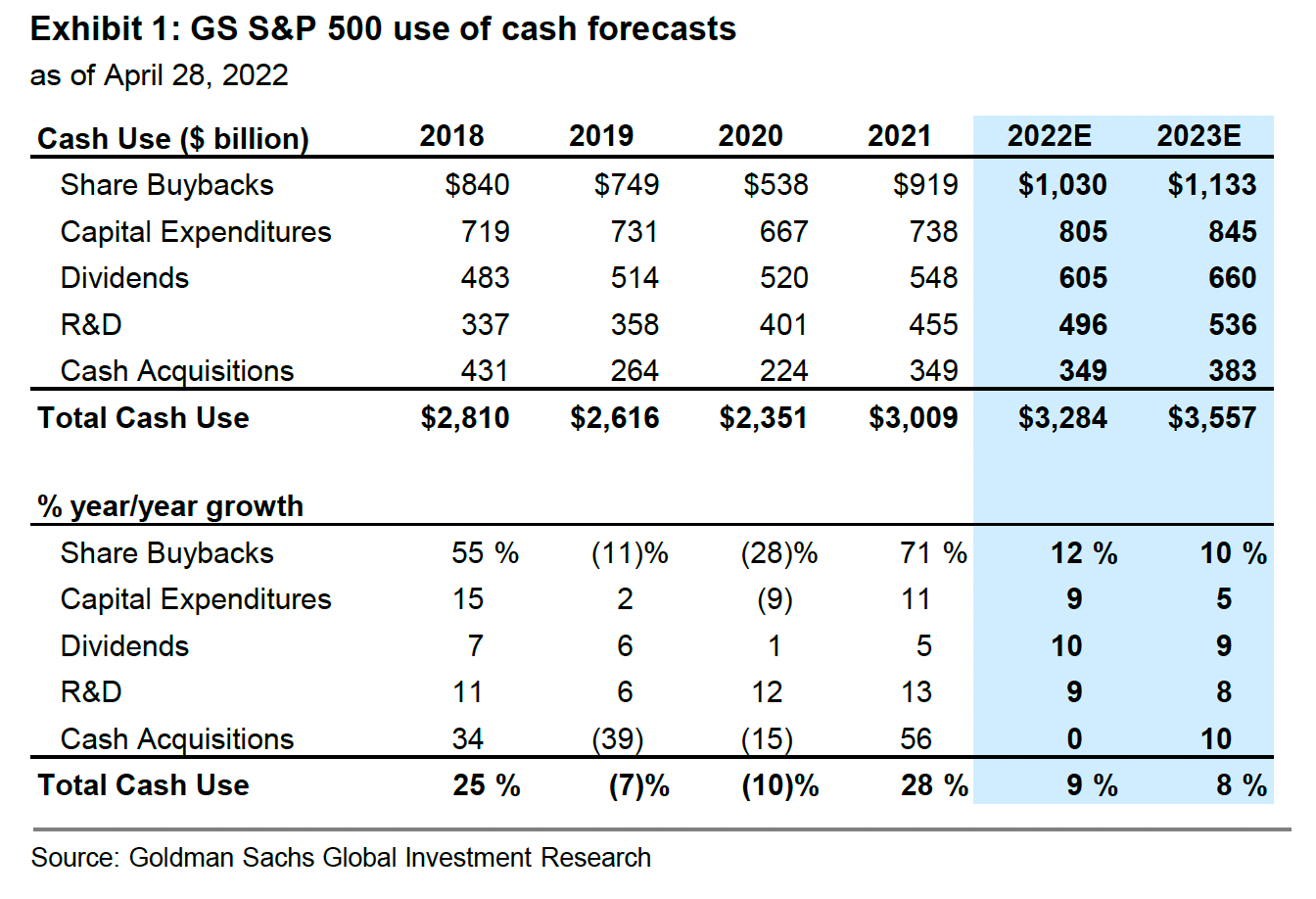

"We expect S&P 500 buybacks will grow by 12% year/year in 2022, and remain the largest source of demand for U.S. equities," Goldman's equities research strategists, led by David J. Kostin, wrote in an investors' note. Corporates are also expected to splash out on dividends, as well as trigger a surge in M&A deals (all those battered-down stocks make acquisitions all the more appealing), and fund further R&D and Capex spending, both of which tend to drive profits in future years.

Here's the full Goldman breakdown of where S&P 500 giants will be putting their money.

As for Buffett, for all his misgivings about the markets, he sees big opportunities to come out of the recent equities carnage. Berkshire Hathaway bought up more than $51 billion in the first quarter, one of the firm's biggest buying sprees ever.

Berkshire shares were up 0.7% in pre-market trading at 5 a.m. ET.

Check out this Fortune must-read: “Oil is entering a New World Order. Here are the big winners and losers”