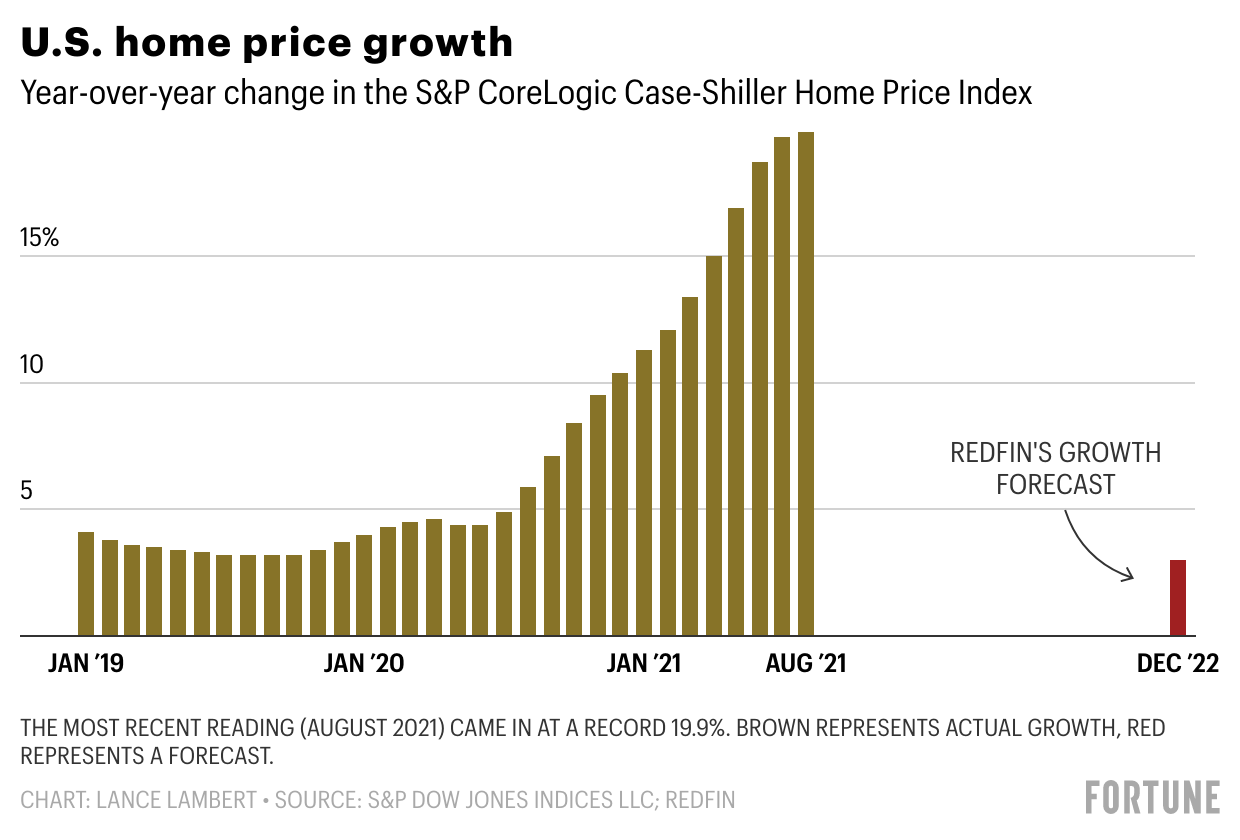

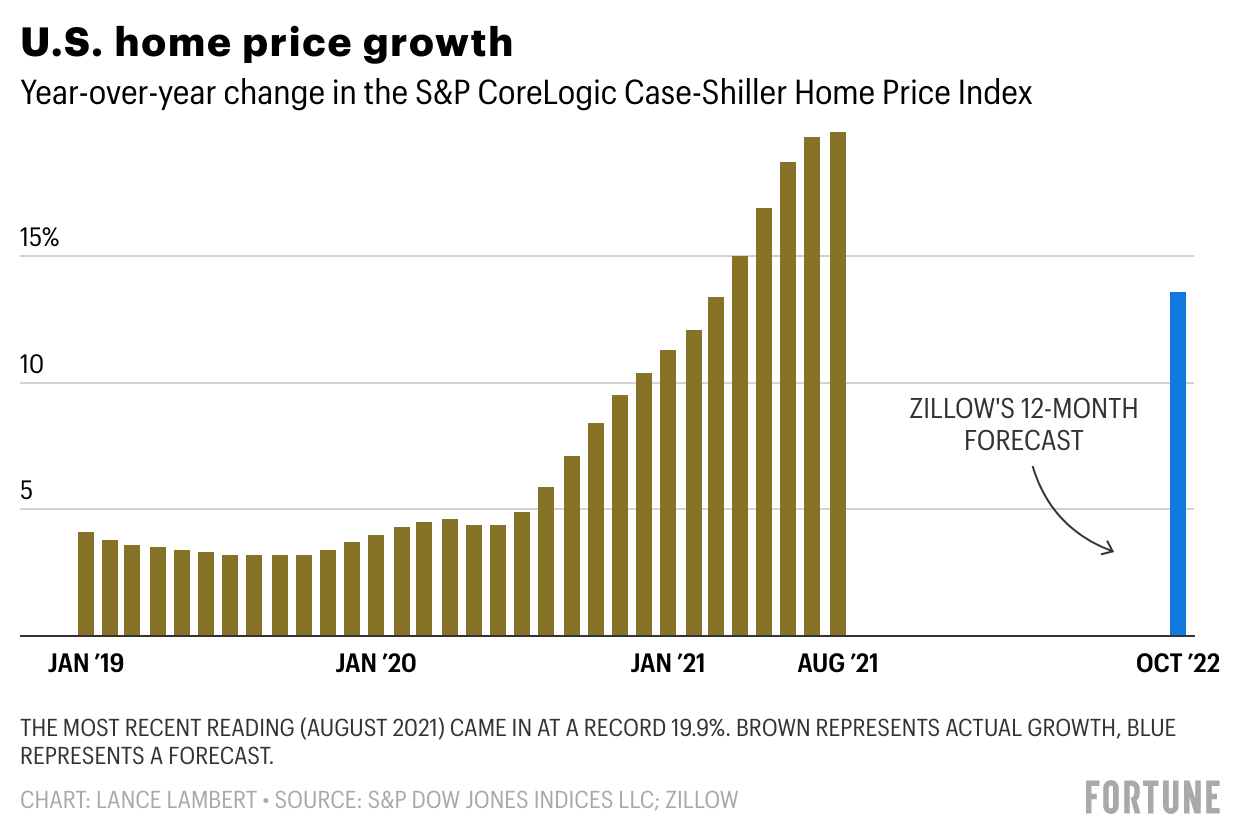

It’s understandable that some sidelined home shoppers think this unprecedented housing market is set to pop. They see an ongoing real estate run—which has sent U.S. home prices soaring 19.9% over the most recent 12-month period—that echoes the last frenzy, which ultimately culminated in the 2008 housing crash and subsequent foreclosure crisis.

But not only does a housing crash in 2022 look very unlikely, prices could actually go even higher. At least that’s according to Redfin’s 2022 real estate outlook, which foresees prices continuing to climb next year.

That said, Redfin does forecast that the rate of home price growth will slow—by quite a bit. By the end of 2022, the real estate brokerage predicts 12-month home price growth will be at 3%. If that rate comes to fruition, it’d mark a 16.9 percentage point drop from the current level of price growth. It’d also mean the housing market would shift from a historic housing boom into a more normalized market where would-be buyers might actually have some time to think through their purchase.

“If annual price appreciation falls to 3%, it would only be the second time it will have fallen so low since the end of the housing crash in March 2012. This low price growth will likely discourage speculators from entering the market and allow more first-time buyers to have a chance at winning a home,” writes Daryl Fairweather, chief economist at Redfin.

As far as 2022 price forecasts go, Redfin’s outlook is relatively bearish. So are the predictions by real estate firm CoreLogic, which foresees just a 1.9% price rise next year, and the Mortgage Bankers Association, which predicts the median price of existing homes will drop 2.5% by the end of 2022.

Meanwhile, Goldman Sachs and Zillow remain fairly bullish. Goldman Sachs sees prices rising 16% by the end of 2022. While Zillow predicts home prices will rise 13.6% between Oct. 2021 and Oct. 2022. (Fannie Mae and Freddie Mac are right in the middle, predicting home price growth of 7.9% and 7%, respectively, next year).

The reason these 2022 housing forecasts vary so much can be attributed to two big unknowns that loom over the market.

The first of those is a combination of supply chain woes, material price hikes, and labor shortages that threatens to hold back homebuilding. In a historically tight—and competitive—housing market like the one we’ve seen during the pandemic, every single new home is critical. If homebuilding slows, we simply won’t be able to dig out of the supply and demand mismatch that’s driving prices higher.

However, that uncertainty pales in comparison to the risk posed by shifting mortgage rates. At the onset of the pandemic, the Federal government helped to drive rates lower as a way to incentivize borrowing. It worked: Historically low mortgage rates combined with a demographic wave of first-time millennial homebuyers, helped to set the housing market ablaze. But if inflation fears translate into the Federal Reserve upping rates, it could lock some buyers out of the market altogether and create market cooling.

When it comes to rates, Redfin foresees the average 30-year fixed mortgage rate climbing to 3.6% by the end of 2022 (up from the current 3.1%). That’s a bit higher than Fannie Mae’s 3.4% rate forecast for the same period, and lower than the 4% rate predicted by the Mortgage Bankers Association.

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.