Good morning,

Here’s what happened this week:

In-person conferences are back … finally! I shared my experience attending Fortune’s Most Powerful Women Summit (MPW) in Washington, D.C., my first in-person conference in more than 18 months. As safety was top of mind, the CLEAR Health Pass app was used to provide employees and attendees a way to upload proof of vaccination and negative COVID-19 tests. Technology has definitely allowed us to collaborate during this time. But having occasional in-person interaction offers another layer of connection with the team. Many CFOs are in support of hybrid work for that reason. It was exciting to meet finance leaders I’ve interviewed on video calls, like Maria Ferraro, CFO and chief inclusion and diversity officer at Siemens Energy AG. I shared insight from leaders involved in the world of finance.

“CFOs estimate that supply chain woes have reduced revenue growth by about 3 to 5 percentage points on average,” John Graham, a finance professor at Duke University’s Fuqua School of Business, told me. Graham is a founder and director of The CFO Survey, conducted in partnership with Fuqua and the Federal Reserve Banks of Richmond and Atlanta. The Q3 2021 report found availability of materials, production and shipping delays, and increased materials prices were reported by three-quarters of the firms surveyed. At the same time, 74% of CFOs said that their firms are having difficulty filling open positions. “On average, CFOs tell us they expect these supply chain woes to last for another year, and my prediction is that labor shortages will last even longer,” Graham says.

Bank of America (BofA), the second largest bank in the U.S., believes that “crypto-based digital assets could form an entirely new asset class,” according to an inaugural report. Digital Assets Primer: Only the first inning, released this month, launched the bank’s foray into crypto and digital asset research. “With a $2 trillion-plus market value and 200 million-plus users, the digital asset universe is too large to ignore,” according to the report. And it’s not just Bitcoin, even though it’s important with a market value of $900 billion, BofA noted. Within the “digital asset ecosystem,” there are hundreds of companies providing services such as infrastructure support, the bank explained. In the first half of 2021, venture capital funding jumped to approximately $17 billion, compared to $5.5 billion in all of 2020, the report found. Digital asset-related M&A, year to date, increased to $4.2 billion, up from $940 million in 2020, and $2.5 billion in 2019.

Have you heard of an academic area of study when it comes to investing called behavioral finance? In his latest article for Fortune, Avoiding these 4 psychological investing ‘traps’ can improve your portfolio’s performance, Larry Light examines how investors can protect themselves from themselves based on recent research. When it comes to the balance sheet, CFOs know how to mitigate risks. However, there is a psychological pitfall that involves the use of data—confirmation bias. Larry writes: Some people find it easier to glom on to data that supports their hard-and-fast viewpoint and dismiss whatever doesn’t. And in his article, Value stocks are unloved, unsexy, and poised to make a killing over the next decade, Shawn Tully explores a new paper from Research Affiliates, a firm that fashions investment strategies for over $171 billion in mutual funds and ETFs. The upshot? “We’re about to witness the revenge of the dogs,” he notes.

Thanks for reading. Have a great weekend.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

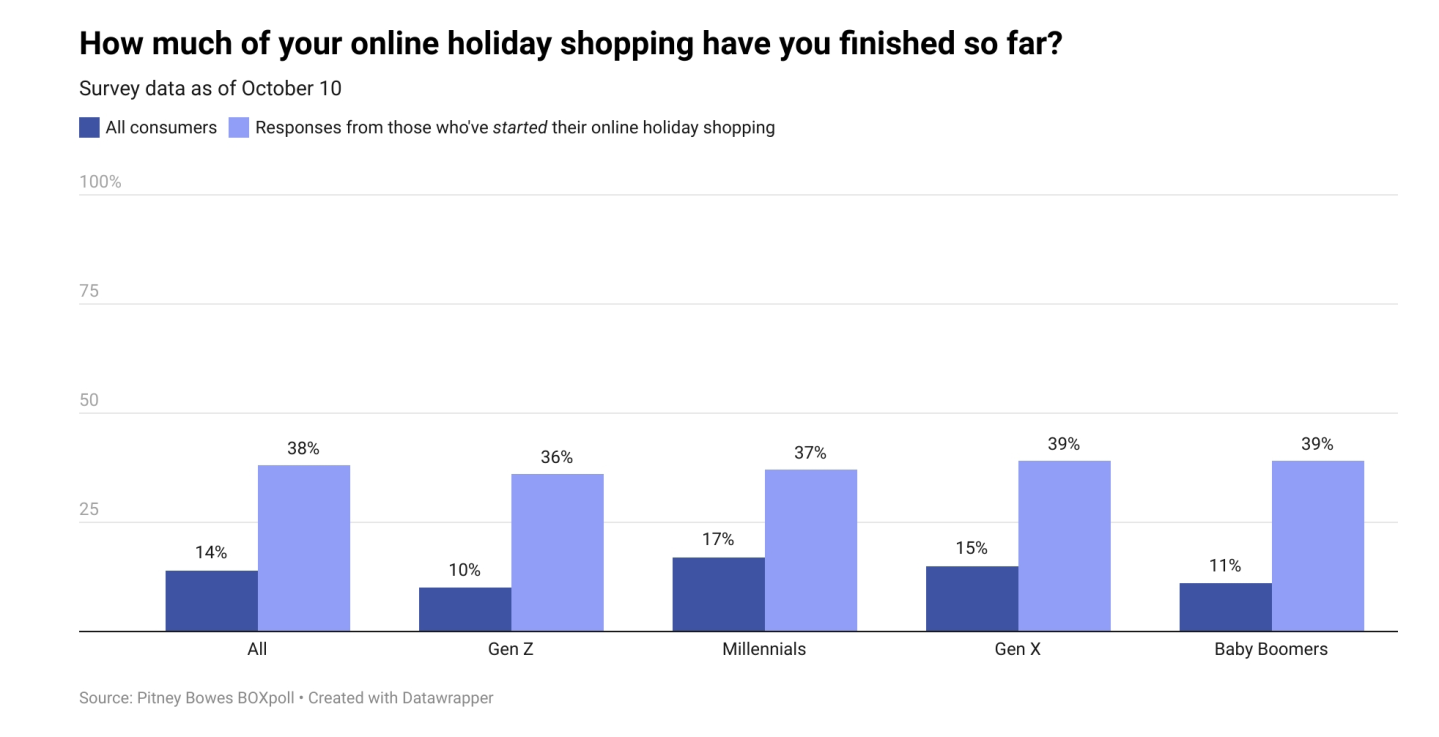

Amid ongoing global supply chain issues panic buying may potentially create a vicious cycle of shortages, according to a Fortune report. U.S. consumers are beginning to act on warnings of retailers, shippers and supply chain managers to shop early for the holidays, according to Pitney Bowes (NYSE:PBI), a global shipping and mailing company. Its BOXpoll consumer survey released on October 21 found that between mid-September and early October, the number of respondents who started holiday shopping increased from just one-in-four to 42%. In total, American shoppers surveyed have completed buying 14% of the items on their holiday shopping lists. The insight is based on a national sample of more than 2,000 online shoppers.

Courtesy of Pitney Bowes

Going deeper

Here are a few Fortune reads for the weekend:

New IPO demonstrates why Bitcoin mining is the most stupendously profitable business on the planet right now by Shawn Tully

Is acquiring Pinterest a smart move for PayPal? by Anne Sraders

The global chip shortage is driving demand for this London startup’s software by Jeremy Kahn

Why investors dumped $1 trillion in Chinese equities—and what comes next by Jessica Mathews

Leaderboard

Some notable moves from this past week:

Brittany Bradrick was named CFO at Neurelis Inc. Prior to joining Neurelis, Bradrick was COO and CFO at ViaCyte. She also previously served in strategy and corporate development positions for 10 years at Insulet and Abbott Diabetes Care, and was an investment banker to the life science industry for 10 years at Piper Jaffray, Credit Suisse, and Chase Securities.

Jessica Fischer was promoted to CFO at Charter Communications, Inc., effective immediately. Fischer succeeds Charter’s current CFO Chris Winfrey, who was elevated to Chief Operating Officer. Fischer most recently served as EVP of finance. She now adds oversight of Charter’s accounting, reporting and corporate budgeting and planning functions to her current responsibilities. She joined Charter in 2017 as a group vice president. Previously, Fischer was a partner in the National Tax Department at EY.

David M. Gray was named SVP and CFO at Aviat Networks, Inc., a wireless transport solutions company, effective October 18. Gray will work closely with the company’s departing CFO Eric Chang, who will remain with the company in an advisory capacity for a period of time, according to Aviat. Before joining Aviat, Gray was CFO and treasurer at Superior Essex. Prior to that role, he served as VP of finance at Cooper Industries. Gray has also held a variety of executive finance and accounting positions at Newell Brands, Philips Electronics, and Autoliv.

Andre Mancl was named CFO at ChowNow, a platform powering online ordering and marketing for independent restaurants. Mancl joins ChowNow from Credit Suisse, where he served as the global co-head of Internet Investment Banking. He has more than 15 years of experience in technology investment banking. Mancl has worked on more than 100 investment banking transactions, including the IPOs of Lyft, LegalZoom, AppLovin, Snap, TheRealReal, GoDaddy, Wix, Eventbrite, and Upwork, according to ChowNow. Prior to his investment banking career, Mancl was an officer and helicopter pilot in the United States Navy.

Travis Matthiesen will transition from the CFO to the role of Chief Transformation Officer at GoHealth, Inc, a digital health company. GoHealth has started a search for a new CFO. Matthiesen will continue to serve in the role until his replacement is hired, according the company.

Overheard

“Bitcoin has 90% annual volatility, so that takes its use on balance sheets off the table."

—Cam Harvey, a professor at Duke University who’s an expert in decentralized finance, on the Bitcoin debate, as told to Fortune.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get it delivered free to your inbox.