Monday wasn’t pretty.

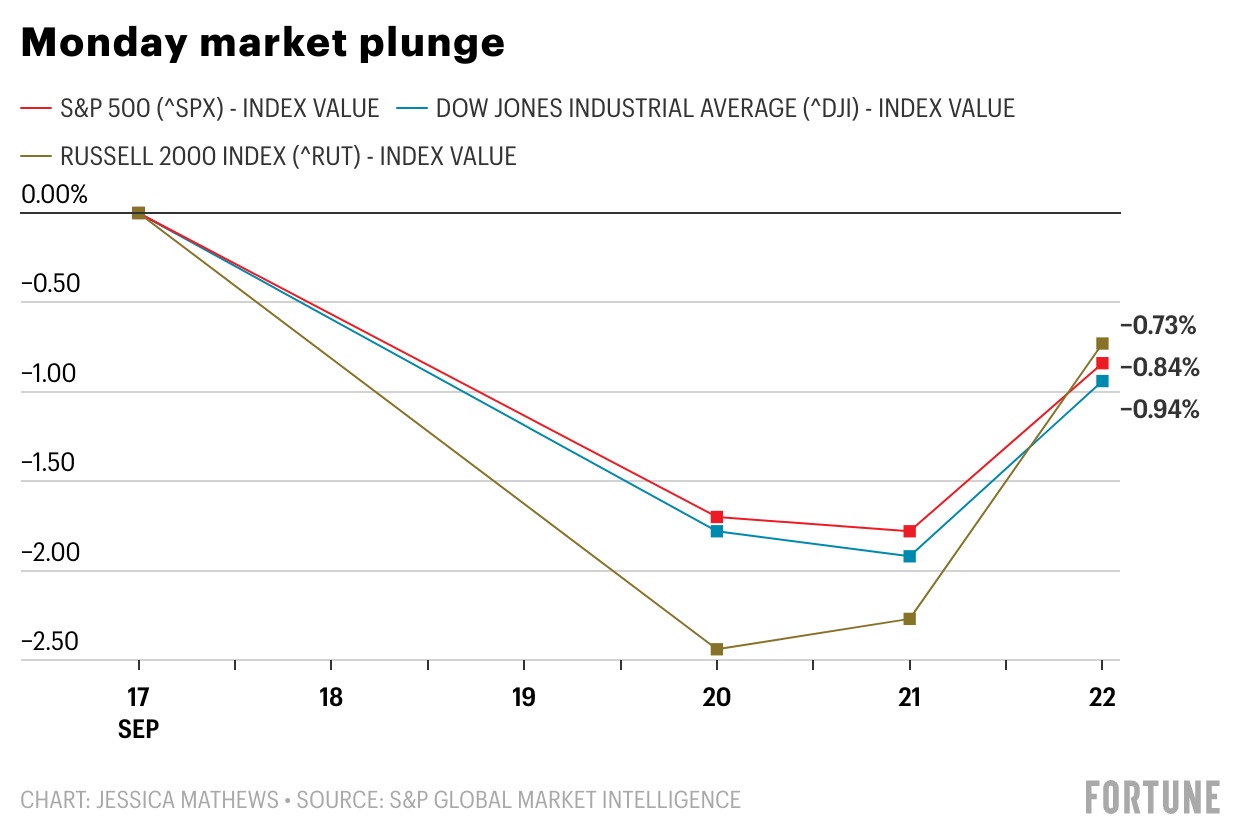

The Dow Jones Industrial Average slid 1.7% by the end of the trading day after dipping slightly on Friday. The Russell 2000, which tracks small-cap stocks, fell 2.44% on Monday. Those numbers aren’t awful by any means, but it’s the largest drop we’ve seen in what has been an extraordinarily quiet summer in the markets. As a reminder: The last time the S&P 500 closed below its 50-day moving average for two consecutive trading days was in Nov.

Analysts had started flashing warning signals in the last few weeks that the market is overvalued. Then there’s the looming implosion of the Evergrande Group—China’s real estate giant that owes more than $300 billion in outstanding bonds—which is threatening a ripple effect across the global markets. Closer to home, on Sep. 22 the Fed gave more details on plans to soon scale back its own debt purchases, which could begin as early as Nov. That “tapering” has historically led to volatility in the past and lifted mortgage rates. Oh, and of course there’s there’s the threat of a government shutdown, and the risk the U.S. government defaults on its debt.

“Markets are clearly having a bit of angst,” says Cliff Hodge, chief investment officer of $1 billion wealth management firm Cornerstone Wealth.

The U.S. equity markets have nearly fully recovered since Monday, but it’s not clear we’ve seen the worst of it. Morgan Stanley equity strategist Mike Wilson is pondering whether markets are headed towards a 10% market correction—or perhaps even a 20% correction. “The mid-cycle transition will end with the rolling correction finally hitting the S&P 500,” Wilson wrote in a research note earlier this week.

A correction could be temporary, but the market may take a couple weeks to recover. “We believe the capital market stress could take 1-2 weeks to wash through the system, and could be rather ‘gappy,’” Wells Fargo Securities head of equity strategy Christopher Harvey wrote in a note Sep. 21.

Good luck pinpointing exactly when a correction will occur. But here’s what we do know: It will eventually happen—it always does. Here’s are some methods—some of them a bit surprising—to help correction-proof your portfolio.

Take a second look at….

Top-performing large caps: It’s safer to weight a portfolio in larger companies when the market is suffering, as well-capitalized companies tend to be more geographically diverse and have better access to credit markets. Particularly companies that operate across country borders will be less reliant on the conditions of the local economy. While it may be easy to assume that top performers today have the most to lose, a look back at the last 30 years of market corrections shows that this isn’t the case, Derek Horstmeyer, a finance professor at George Mason University, tells Fortune. Companies performing well going into a correction usually do better than their peers coming back out (“That went against my intuition,” he says). Some top winners this year have been NVIDIA CORP (NVDA), Alphabet (GOOG), and Microsoft (MSFT). Microsoft and Google are held by more than 6 out of 10 large cap funds available; Nvidia is only held by about 30%, according to RBC equity research. Here are a couple popular large cap ETFs: The SPDR S&P 500 ETF Trust (SPY) is up more than 18% year-to-date. The Invesco S&P 500 Momentum ETF (SPMO) is up more than 19%.

Financials: Financial companies tend to perform well when interest rates rise: Interest rate income goes up and investors trade more; a plump economy means that individuals are better able to pay back their loans. Compared to their historical valuations and the broader indices, Hodge says financial company valuations are currently attractive, which will make financials decent bets should there continue to be rising inflation. The Fidelity MSCI Financials Index ETF (FNCL) and the Financial Select Sector SPDR Fund (XLF) are both up more than 28% this year.

Travel and leisure: While this sector is subject to the spread of COVID and its variants, the travel industry has come back swinging after a long, painful hiatus. Approximately 64% of Americans have received at least one dose of the vaccine, and many consumers seem willing to keep their travel plans intact. Morgan Stanley equity strategist Wilson expects travel-related business to benefit from this, even if consumers have somewhat scaled back their airline and hotel purchases more recently. Two ETFs that track this sector: The SPDR S&P Transportation ETF (XTN), which tracks the transportation sector and focuses on airlines and trucking, is up about 23% year-to-date. The Invesco Dynamic Leisure and Entertainment ETF (PEJ), is up nearly 28%.

European markets: Europe is a step behind the U.S. in re-opening its borders and businesses, meaning there’s an opportunity to get exposure to its economic awakening. The Franklin FTSE Europe ETF (FLEE) and JPMorgan BetaBuilders Europe ETF (BBEU), which are both up around 12%, offer exposure to the European equity markets.

Alternatives: Investments like real estate, cryptocurrencies, fine art, or private businesses can offer portfolio diversity to investors and help them find return in assets apart from the traditional markets. Since alternatives are generally not tied to stocks and bonds, they can offer a respite in a market plunge. Investors should be careful to choose investments they fully understand and should be wary of high fees, Hodge warns.

ESG: Companies with good environmental and social scores tend to fare better during periods of market instability, according to Horstmeyer. “They don’t crash as much during a during a downturn,” he says. The iShares ESG Aware MSCI USA ETF (ESGU) and the Vanguard ESG U.S. Stock ETF (ESGV) are up more than 18% since Jan.

Gold: If we’re discussing a correction, we have to mention gold: It’s a popular haven for investors during a downturn, as it’s widely considered to be a good place to store value over the long-term and a means to hedge against inflation. The SPDR Gold Trust (GLD) is one of the most popular funds for retail investors to get exposure to gold. It was down about 8% from the beginning of this year on Fri. morning.

Be wary of…

Consumer discretionary: This is the sector of non-essential goods companies. Sales are still surging across the U.S., despite a Delta variant that has shuttered events yet again, but all that could change. Government stimulus checks are disappearing and prices for some goods are surging due to supply chain issues, which could threaten margins, according to Morgan Stanley’s Wilson. While services companies in this sector have been performing well, they only make up about 17% of its market capitalization, according to Wilson.

Small cap stocks: Small cap companies have a tendency to underperform during a market correction. “When you have a downturn, they plummet the most,” says George Mason’s Horstmeyer. This is because small companies rely on credit more than their larger cap counterparts, and that credit can dry up during a downturn, according to Horstmeyer. Small caps are also more centralized in specific geographic regions, which makes them more risky than international or large national companies, he says.

While they took a tumble earlier this week, small public companies have been having a good year. The S&P 600, which tracks small-cap stock performance, is up more than 21% since Jan. “Most small cap core and growth funds have been outperforming in 2021, blunting the impact of rising market nervousness,” writes Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, in a research note. But in an extended downturn, they may be more at risk.

China: The ongoing regulatory crackdown on the technology and tutoring sectors is worrying investors. Offshore investments in China have suffered this year due to the invigorated focus on big tech and VIEs, and China Evergrande’s looming default is throwing the real estate sector for a loop. You can read more about the impact of China exposure in your portfolio in one of my earlier columns here.

Restaurants: Restaurant bookings have begun drying up in late August in most states, according to Calvasina’s RBC equity note, which poses questions over this sector’s ongoing success. The S&P 500 Restaurants, a sub-index, is doing well so far this year, up nearly 16% from Jan.

It may be a little early for a correction—or it might be right around the corner, but it’s never too late to do a little portfolio prep work.

WEEKLY CHART

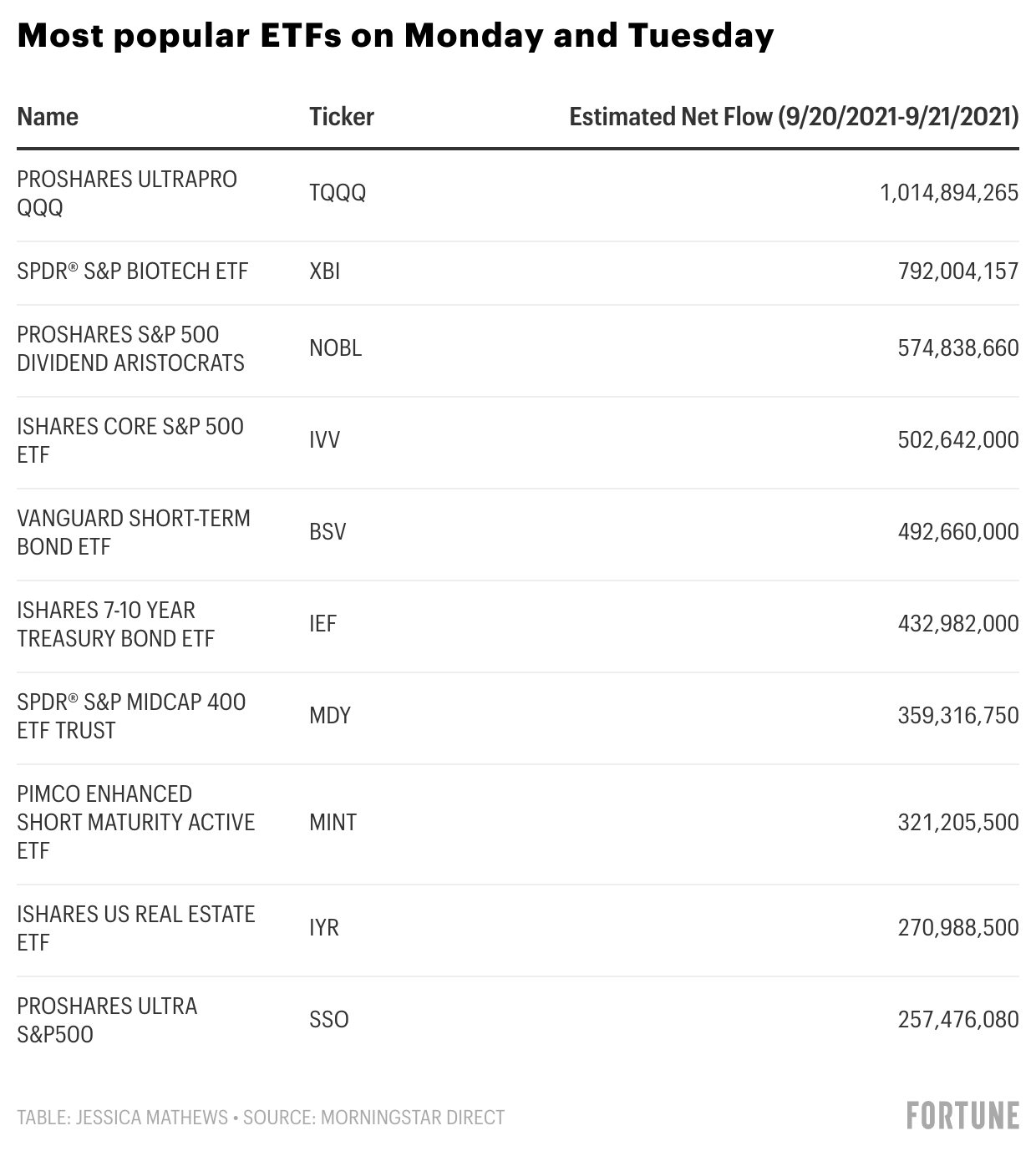

Enough of the analysis. Let’s take a look at how investors actually moved their money during the market dip. Here are the ETFs with the most flows at the beginning of this week. Note: Since most mutual funds only report their assets on a quarterly basis, we’re focusing on ETFs.

JARGON, EXPLAINED

“Small cap”— Small caps are the publicly-traded companies with the smallest market valuations, generally ranging from about $300 million to $2 billion. The most popular index to look at small-cap stocks is the Russell 2000, which tracks the 2,000 smallest companies in the Russell 3000. However, there’s debate that this index underperforms due to transaction costs. Here are three others that track the U.S. small-cap market: the S&P SmallCap 600, the MSCI USA Small Cap, and the Dow Jones U.S. Small Cap index.

DON’T MISS THIS

Michael Burry—yes, that Michael Burry from The Big Short—hopped back on Twitter this week to criticize passive investing and indexing and warn that it is leading to an overvaluation in the markets. Vanguard’s late Jack Bogle would certainly have disagreed, but haven’t we learned our lesson not to ignore Burry? You can read more about his thoughts here.

Liking this column? Have an investing query you’d like to see addressed? Send me your thoughts and feedback below. Thanks for reading.

Jessica Mathews

Twitter: @jessicakmathews

Email: jessica.mathews@fortune.com

More finance coverage from Fortune:

- What are stablecoins? Your guide to the fast-rising alternative to Bitcoin and Ethereum

- Americans’ credit scores hit another high point amid the pandemic

- Pandora’s sparkling comeback powered by stimmy checks and lab-grown gems

- Procter & Gamble has a brand problem

- Why the “unloved” U.K. stock market is still singing the Brexit and COVID blues

Welcome to The Dividend, Fortune’s new weekly investing column, available exclusively to subscribers. Each week we’ll dig into an area of the market that’s making headlines and help you figure out what deserves a place in your portfolio—and what doesn’t.