Not only does deforestation contribute to climate change, it’s also the leading cause of species extinction. That’s why activists and some environmentally conscious investors are turning up the heat on CEOs to take a stand against it. In their eyes, businesses are a key to stemming the destruction.

But what are the results?

This isn’t something polling can answer. That’s why Fortune Analytics reached out to Boston Consulting Group (BCG), who in partnership with the World Wide Fund for Nature (WWF) has been researching the topic. The WWF gave us exclusive access to their data and their joint Deforestation and Conversion Free Supply Chains report, which also explores the role that businesses can play in halting deforestation.

Here are some of the findings.

The numbers to know

31%

- …of the Earth’s surface is covered by forests. Eight thousand years ago, that figure was 50%.*

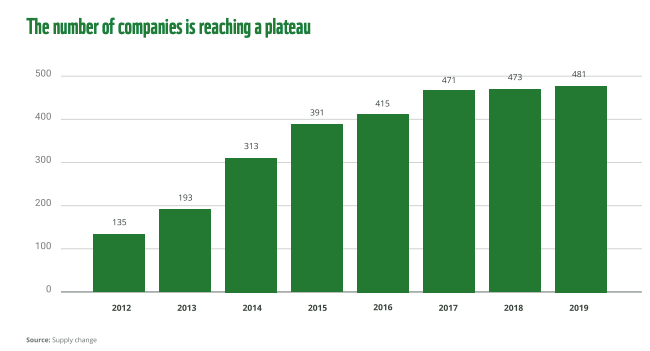

481

- …the number of global companies that have pledged to eliminate deforestation from their supply chains. In 2012, that figure was 135 companies.**

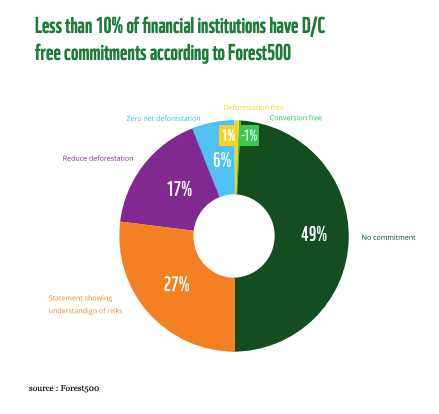

6%

- …of financial institutions have zero-net deforestation commitments, while 49% of financial firms don’t have any anti-deforestation commitments.

37%

- …of agriculture-driven deforestation is attributable to cattle, making cattle the largest contributor to the problem, followed by palm oil (9%) and soy (7%).

The big picture

- The private sector is making a lot of verbal progress—while real deforestation results are evasive. Over the past decade, the number of companies committing to zero-net deforestation has boomed. However, virtually none of those commitments were achieved by 2020.

A few deeper takeaways

1. Deforestation continues to rage on.

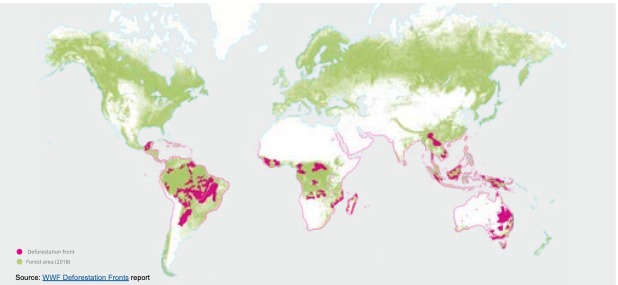

Between 2000 and 2018, the Amazon in South America alone lost 51 million hectares of forest. That’s an area greater than all of Spain. The BCG and WWF authors were blunt in their assessment: “Despite the vital nature of the world’s natural ecosystems, deforestation and conversion continue at an alarming rate.”

Almost all of the deforestation (see the chart above) is occurring near or below the equator.

2. A decade of progress—well, kind of.

In 2010, corporate members of the Consumer Goods Forum pushed to achieve zero-net deforestation in their supply chains by the end of the decade. By 2019, 481 companies had joined in on that pledge.

But as the 2010s came to an end, none of those companies were ready to declare they had met their “zero” deforestation goal. Simply put, they discovered the goal was more challenging than they first thought.

Here’s the BCG and WWF authors’ take on it: “Current commitments have had a limited impact and completely failed to meet targets, with deforestation and conversion continuing at alarming levels. It is clear that progress to date related to voluntary business commitments is not enough.”

3. Financial institutions are applying more pressure. But the industry is still timid.

The BCG and WWF researchers urge banks to take a tougher stance: “Financial institutions should eliminate deforestation and conversion of all natural ecosystems from their investments and portfolios.”

To date, only 6% of financial firms have a net-zero deforestation commitment.** Another 17% have a commitment to reduce deforestation, and 27% have put out statements showing they understand the risks of deforestation. On the flip side, 49% of financial firms have done nothing.

It’s obvious why activists are hungry to target financial institutions: If you get banks to cut off funding to companies that commit or benefit from deforestation, you create a real stick to force companies to change their behavior. But it’s also obvious why financial firms are cautious: They’d lose a lot of business.

Side note: This week we’re doing two Fortune Analytics issues. Next week, we’ll be back to our normal one per week schedule.

I’d love to know what you think of the newsletter. Email me with feedback at lance.lambert@fortune.com.

Lance Lambert

@NewsLambert

Data sources: *United Nations **Supply Change

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.