Good morning,

Here’s what happened this week:

A new study released by the London School of Economics and Women in Banking and Finance (WIBF), a nonprofit organization, explores some of the barriers to advancement for women working in financial and professional services in London. The study found that half of the women who participated in personal interviews “explicitly” mentioned “mediocre” men in management as an obstacle to their career advancement. A number of women in communications, compliance, and front office positions said there were fewer “mediocre” male managers in roles where they had P&L responsibility. WBIF created a Good Finance Framework with recommendations on how companies can become more inclusive and retain talented women.

“CFOs now more than ever are being asked to help develop and champion the coherent data strategy,” said Barbara Larson, SVP of accounting, tax, and treasury at Workday. A report based on the findings of a Harvard Business Review Analytic Services pulse survey of financial leaders found 90% of respondents said the volume of data collected and used has increased over the past two years. And 77% of respondents relied on manual processes to collect and use data. To combat the data deluge, firms like hers are turning to technology that can integrate and manage internal and external data with automation.

There’s a global semiconductor chip shortage underway as the demand has skyrocketed beyond supply capacity. Supply and demand dynamics are part of the “cycle of the business,” said Chris Stansbury, SVP and CFO at Arrow Electronics, a distributor of semiconductor and electronic component products. “We try to minimize how deep and long they are, but we can see them coming,” he said. Stansbury explained how the company actually improved financially during the COVID-19 pandemic and continues to grow. He also shared some advice: “I think being nimble is key to success. You can’t fight cycles. You just have to figure out how you operate differently in an up cycle or down cycle, and that’s part of what we do.”

Bitcoin and other forms of crypto aren’t widely embraced by financial professionals. A recent survey of CFOs by Fortune and NewtonX found just 1% of respondents accept crypto as a form of payment, and just 2% will adopt it this year or next year. Some CFOs view the digital currency as too volatile. And the market has been shaky for Bitcoin. “Just before 9 a.m. on June 22, Bitcoin’s price sank to $29,511, its lowest level since the early hours of January 2, and 55% off its all-time record of $64,863 achieved just 10 weeks ago,” writes my Fortune colleague Shawn Tully. He explains why the sinking price of Bitcoin may saddle Tesla with a loss in the next quarter, even if the cryptocurrency rebounds. Read the story here.

See you on Monday.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

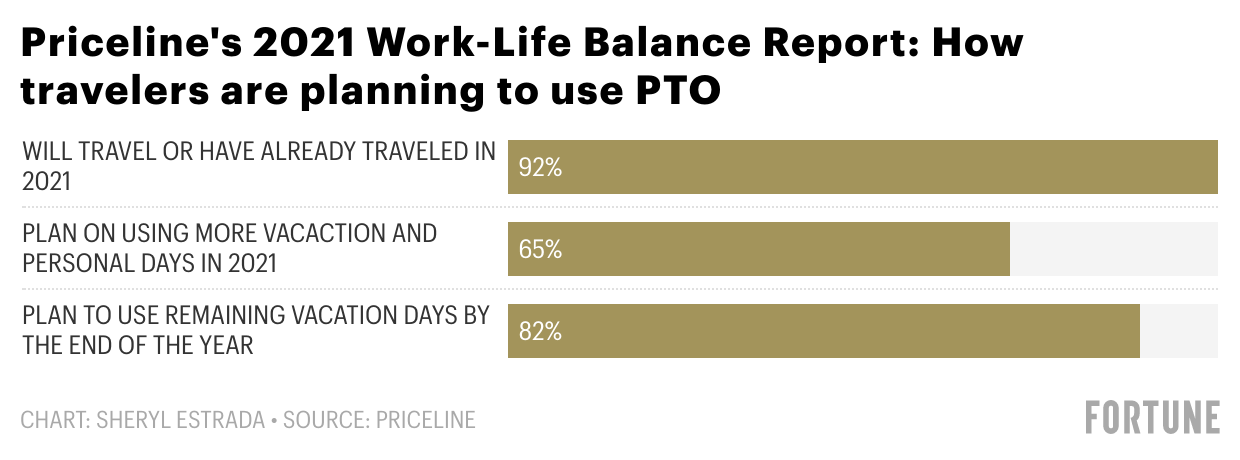

Priceline's 2021Work-Life Balance Report takes a look at how travelers are using PTO based on a survey of 1,000 full- or part-time employees in the U.S. The majority of respondents (92%) said they will travel, or already have, in 2021. Last year, only 21% of Americans used all of their PTO, down from 30% in 2019, according to the report. But that may change this year. More than half (65%) of respondents plan on using their vacation and personal days.

Going deeper

Here are a few good Fortune weekend reads:

The importance of stimmies, capital gains tax, and a killer meme—day traders reveal their investing secrets by Bernhard Warner

Indra Nooyi: Women are ‘one of the biggest emerging-market opportunities’ for corporate America by Jessica Mathews

How business leaders are designing for inclusion in the post-pandemic workplace by Alyssa Newcomb

Hot stock: Occidental Petroleum surges as gas prices climb by Chris Morris

Leaderboard

Some notable moves from this past week:

Ronald Bain was named CFO at VAALCO Energy, Inc., a Houston-based, independent energy company, effective June 21, 2021. Bain was previously CFO at Eland Oil & Gas Plc.

Richard Cheung was named CFO and treasurer at PennantPark Floating Rate Capital Ltd., a business development company, effective June 21, 2021. Cheung most recently served as senior managing director and head of alternative investment accounting at Guggenheim Partners, LLC.

Vishal Chhibbar was named CFO at Brillio, a digital technology consulting and solutions company. Prior to joining Brillio, Chhibbar served as president and CFO at EPIQ Global service and as the EVP and CFO at EXL.

Tim Frommeyer was named the next CFO at Nationwide. Current CFO Mark Thresher has announced his plans to retire in September after serving in the role since 2009. Frommeyer began his career with Nationwide in 1986 as an actuarial student and advanced to leadership positions. He most recently served as chief financial officer for both financial services and property and casualty under Thresher.

Melissa Lee was named CFO at Daiya, a plant-based foods company. Lee most recently served as vice president of corporate FP&A at Walmart Inc.

Overheard

“As leases lapse over the coming year or two, we need to watch how companies renew their contracts. If we see a push to offload some square footage, as surveys suggest, landlords could feel the pinch. Segments of the office space remain an unknown risk to the economy.”

—Ali Wolf, chief economist at Zonda, on office space cutbacks, as told to Fortune.