This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good evening, Bull Sheeters. Finance reporter Anne Sraders here, filling in for Bernhard with a special evening edition of the newsletter.

Markets had a mixed day, with the Dow the lone major U.S. index to close in the red, while the S&P 500 and Nasdaq managed to eke into the green. But one particularly buzzy pocket of the market dominated the headlines. That’s right: The Reddit crowd’s picks, or “meme stocks,” are once again surging higher. And this time, it isn’t just AMC or GameStop. More on that in today’s essay.

For now, let’s take a look at what markets did on Tuesday.

Markets update

Asia

- Asian markets were lower, with the Hang Seng closing fairly flat and the Nikkei down slightly, off 0.2%. The Shanghai Composite was down over 0.5%.

- The U.S. may be restarting trade and investment talks with Taiwan. That’s according to Secretary of State Antony Blinken, who told a House committee on Monday that the Biden administration was (or “soon will be”) working toward “some kind of framework agreement.”

- Japan‘s economy shrunk less than expected in the first quarter, according to revised numbers from the government, showing a 3.9% contraction versus the 5.1% estimate for GDP.

Europe

- The major European bourses were largely in the green, with London’s FTSE up nearly 0.3%, while France’s CAC 40 and the pan-European Stoxx Europe 600 were both up 0.1% for the day. Germany’s DAX was lower, off 0.2%.

- European stocks were boosted by revised data out from the European Union’s statistics office, which showed that GDP in the EU during the first quarter didn’t shrink quite as much as previously estimated, contracting 0.3% versus the 0.6% expected hit.

U.S.

- U.S. stocks were relatively flat across the board in an uneven trading session, with the S&P 500 up 0.02%, the tech-heavy Nasdaq up 0.3% higher, and the Dow down 0.09%.

- U.S. job openings, via the monthly Job Openings and Labor Turnover Summary (or JOLTS) report, smashed expectations for April, with a record 9.3 million openings. Those strong numbers come as many states are nixing the $300 weekly enhanced unemployment benefit put in place during the pandemic.

- Biogen‘s stock was a big winner on Monday, up 38% after the Food and Drug Administration approved its Alzheimer’s drug—the first new Alzheimer’s drug given the green light in almost 20 years. The stock pared only a smidgeon of those gains on Tuesday, closing down 0.1%.

- The U.S. seized much of the ransom paid in cryptocurrency to hackers behind the Colonial Pipeline hack. That’s one possible contributor to Bitcoin‘s slump.

Elsewhere

- Gold dipped, trading around $1,895/ounce.

- The dollar is modestly higher.

- Crude is up, as is Brent, around $72/barrel.

- Crypto isn’t having a great day, with Bitcoin down over 1.5% as of 7 p.m. ET to trade around $33,500, while Ethereum and Dogecoin are also lower.

***

Who’s Reddit’s favorite now?

It wasn’t long ago that the headlines (including from yours truly) were dominated by the GameStop short squeeze, the frenzy that rocked markets as retail traders on messaging boards like Reddit pumped up the stock and inflicted hefty losses on hedge funds. But the thing about the Reddit traders is that there’s always a new stock to pile into, even from day to day.

That’s exactly what seems to be happening this week.

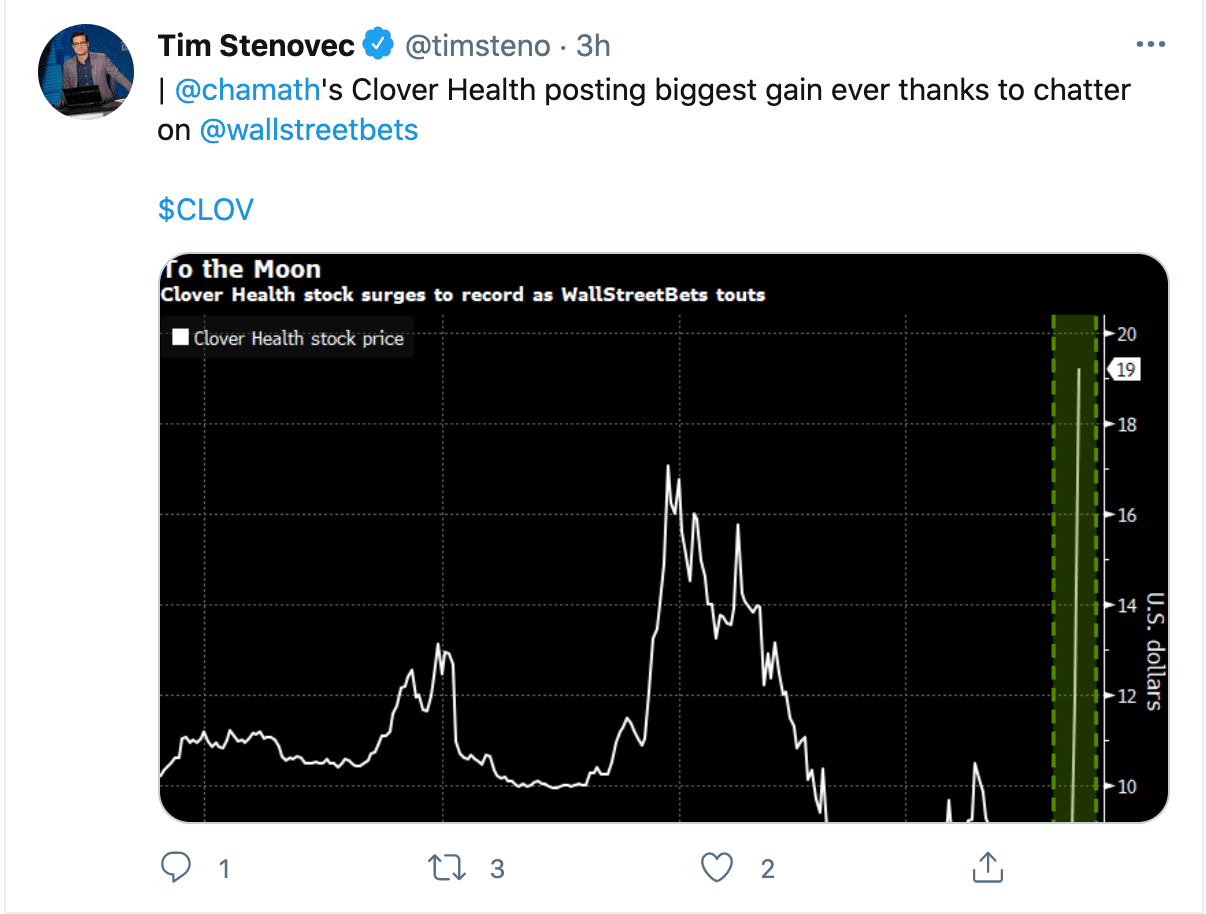

First BlackBerry took off on the r/wallstreetbets subreddit, rising 13.8% on Monday (and up 138% for the year) as retail traders bid up the stock. As Chris Morris reported for Fortune yesterday, seven of the top 20 posts on the subreddit were focused on BlackBerry as of early Monday. And today, the apples of Reddit’s eye appeared to be two other stocks: fast food favorite Wendy’s, which closed up nearly 26%, and, especially, Clover Health—a Medicare insurance startup that surged an astounding 85.8% for the day, having jumped over 100% in intraday trading. Talk about going to the moon.

.

As Fortune‘s Morris wrote Tuesday, the rise of Clover Health in the Reddit-sphere “was a fast-growing phenomenon. As of 8:38 a.m. ET yesterday, there were less than 100 comments on the stock on WSB’s popular daily discussion thread, according to Quiver Quantitative, an alternative data analytics company. By the same time today, that number was up to 2,747.”

The result of today’s massive rally for Clover? Short sellers aren’t happy. “Shorting into a rising market produces mark-to-market losses, and today’s price spike has resulted in big red numbers for short sellers,” S3 Partner’s Ihor Dusaniwsky, a managing director at the firm, wrote in a Tuesday afternoon note. In fact, he points out that shorts are “down -$502 million in mark-to-market losses on today’s +86% price move, raising year-to-date losses to -$554 million down -210% for the year.”

Ouch.

But there are a couple tidbits that make Clover Health stand out among some of the other Reddit names. For one, Clover Health went public in January via a SPAC—a special purpose acquisition company—backed by none other than venture capitalist and “SPAC King” Chamath Palihapitiya. What’s more, Clover Health’s short interest is actually much higher than that in some of the other big “meme stocks” like AMC. Short interest in Clover Health stood at 43.5% of float, per S3 Partners data. (Wendy’s, meanwhile, was only about 4%.) That level of short interest, as my colleague Morris notes, “could poise Clover for a notable Reddit-fueled run.”

Naturally, we’ll have to wait and see. The Securities and Exchange Commission, for one, is certainly going to be eyeing these Reddit rallies. The agency stated this week that it will continue to watch to see “if there have been any disruptions of the market, manipulative trading, or other misconduct.” (And as it happens, Clover itself is dealing with its own SEC investigation following a grueling report from short-activist firm Hindenberg Research earlier this year.)

That’s all for now. I have the keys to Bull Sheet until Friday, when Bernhard will be back in your inbox.

Anne Sraders

@AnneSraders

Anne.Sraders@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

The miners next door. China is cracking down on cryptocurrency mining and trading, and that's making its neighbor, Kazakhstan, look like an attractive alternative hub. As Fortune's Yvonne Lau writes, "several mine operators in Kazakhstan told Fortune that they have received an influx of inquiries from Chinese players looking to relocate." Read the story here.

"Like it's 2007". The Wall Street LBO, or leveraged buyout, is seeing a boom as private equity firms are capitalizing on the low interest rates of the COVID era. That's all putting the pace of purchases on track to be the hottest since the 2006-2007 period in the lead-up to the Great Financial Crisis, Tara Lachapelle writes in this Bloomberg Opinion piece.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

14%

That's how much Stitch Fix, the online apparel retailer and personal styling platform, popped on Tuesday following a better-than-expected earnings report on Monday evening.