This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning, Bull Sheeters.

U.S. futures have been trading up and down all morning as the week gets off to a choppy start. European and Asian stocks aren’t faring much better. And crypto and commodities—namely, gold and crude—are in retreat.

In other words, it’s shaping up to be a risk-off day.

If last week was all about jobs, this one is all about inflation. In today’s essay, I dig into the data on which sectors are best positioned to withstand rising prices.

But first, let’s check in on the rest of the markets action.

Markets update

Asia

- Asia is mixed with the Hang Seng up 0.3% in afternoon trade.

- There’s more trouble in China for the crypto crowd as worries of a further crackdown pushed down the price of Bitcoin and other alt coins over the weekend.

- Speaking of crackdowns from Beijing… The number of new listings in Hong Kong has plunged this year as jitters about China’s clampdown on Big Tech linger.

Europe

- The European bourses are lower out of the gates with the Stoxx Europe 600 off 0.2% in the opening minutes. Autos and banks were the leaders; tech and energy the laggards.

- Germany, the engine of the euro zone economy, saw monthly factory orders dip, another sign that global supply chain disruptions continue to interrupt the recovery story in major economies.

- The pound sterling is sliding this morning after the U.K. government said this weekend it’s too early to say whether the country will phase out COVID-19 restrictions as planned on June 21.

- On the calendar: Thursday’s ECB meeting. Investors will be watching for any clues on inflation and the central bank’s asset-purchasing program—what’s called PEPP in these parts.

U.S.

- U.S. futures have been edging lower all morning. That’s after all three major exchanges finished the week in the green, lifted by Friday’s “Goldilocks jobs report.” The S&P 500 is up 12% so far this year.

- FAANGM shares—namely Facebook, Apple, Amazon, Microsoft and Alphabet’s Google—are trading lower in pre-market. That’s after the G-7 finance chiefs this weekend struck an historic accord to tax multinationals locally wherever they do business. The so-called global minimum tax rate of no less than 15% still has to clear many hurdles, but passage could hit Big Tech the hardest.

- On the calendar this week we have CPI data on Thursday and the University of Michigan consumer sentiment survey (Friday), which will tell us a bit more about the inflation picture. The consensus estimate on CPI is that prices rose 0.4% in May, which would mean inflation is at its highest since 2008. On an annual basis, you’d have to go back to the early 1990s to see prices rising this quickly.

Elsewhere

- Gold is losing a bit of its shine. It’s trading below $1,890/ounce.

- The dollar is a tick higher this morning.

- Crude is down, but Brent trades above $71/barrel.

- Crypto bulls descended on Miami this weekend for the pump-fest that is Bitcoin 2021, lighting up social media with rah-rah-rah price projections. The result: Bitcoin is trading down, around $36,000 this morning.

***

Jobs, inflation and your portfolio

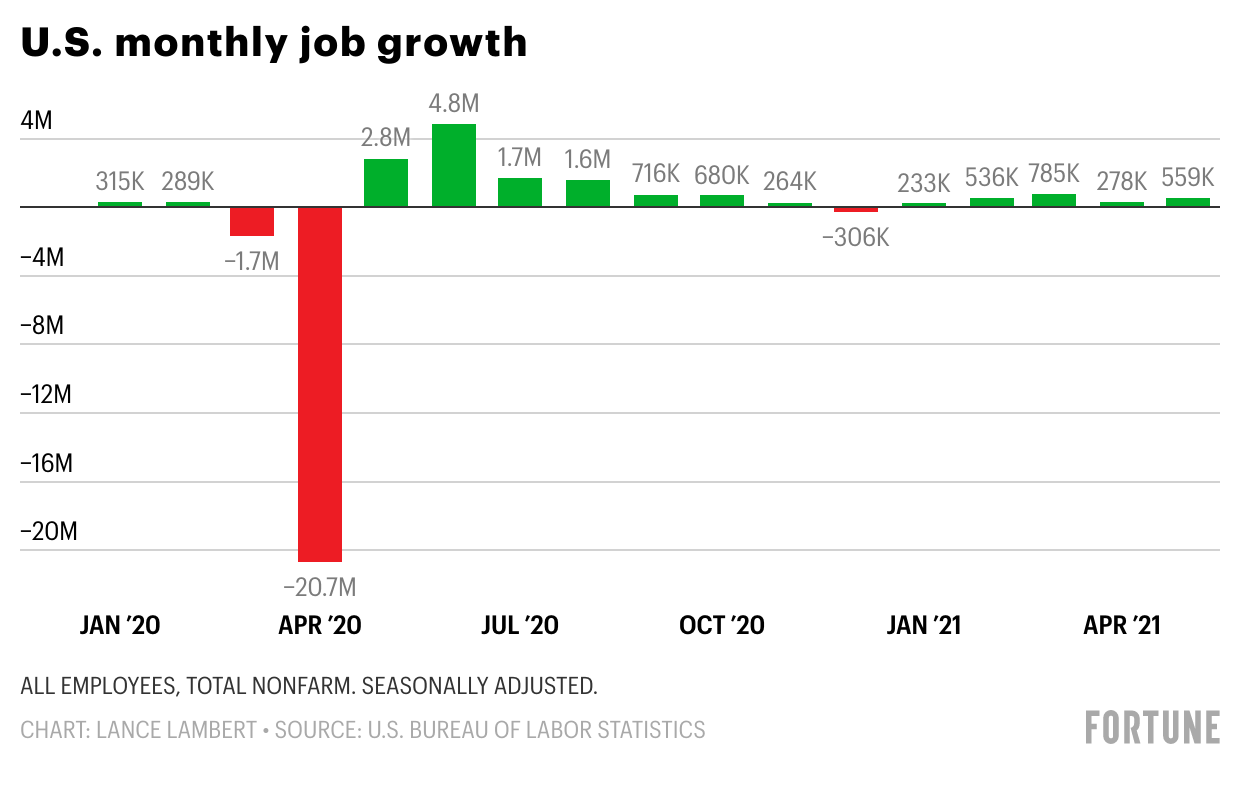

Last Friday, before the markets opened, there was rising consensus we’d see knockout payroll figures—a print approaching 1 million new jobs in May was on the cards. It didn’t happen. And, on cue, stocks rallied.

What gives?

The truth is there was some good and some bad to be found in the jobs report, and that was just enough to send stocks higher on Friday.

The good: average hourly earnings rose 0.5% month over month.

The bad: 559,000 jobs was well below the consensus.

“It is hard to view 559,000 added jobs as a disappointment, but it does leave something to be desired,” LPL Financial Chief Market Strategist Ryan Detrick wrote in an investor note on Friday afternoon. “There is strong potential for job prints in excess of one million over the coming months, but the truth is as strong as the economy is right now, the employment backdrop is clearly lagging what we were all expecting just a few months ago.”

Here’s what job growth has looked like over the past year. (HT to my colleague Lance Lambert for this chart):

Let’s look at the wages picture now.

According to Mickey Levy, chief economist for Americas and Asia at Berenberg Capital Markets, the wage increases could be found across the board. And, he adds, over the past six months wages have climbed 4.9% on an annualized basis, with the biggest gains in construction (+5.2%), transportation and warehousing (+6.4%) and a 12% rise in leisure and hospitality.

That’s good news for workers, of course. But that almost certainly will push up inflation.

“Consistent with our projection of sustained strong aggregate demand after the economy reopens, we anticipate further high increases in wages, and a sustained upward trend in consumer inflation as businesses raise product prices to maintain their margins,” Levy adds.

So what does that mean for your portfolio?

It’s widely accepted that stock markets perform better in a low-inflation world. That’s certainly been true during the past decade. How then will stocks respond in an environment of high prices that are projected to rise quickly?

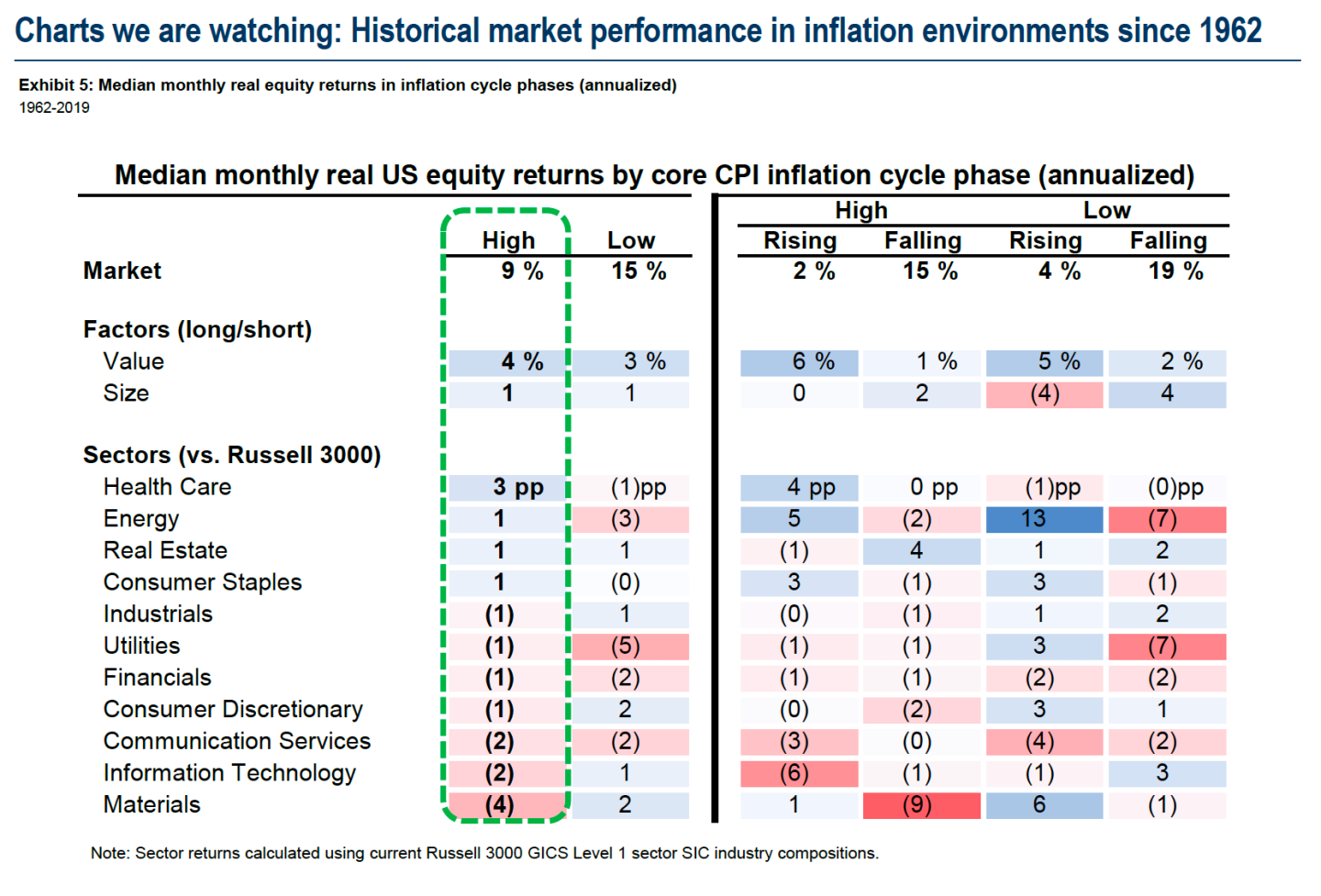

Goldman Sachs has an idea. Looking back at 50 years worth of markets data, Goldman says there are sector winners and losers to be found in periods of rising prices.

In general, health care, energy, real estate, and consumer staples outperform. The laggards, meanwhile, are materials and technology stocks.

But even within those generalities, the numbers tell a more nuanced story.

“Equity performance has differed greatly in periods where inflation was high and rising versus high and falling,” Goldman analysts wrote in an investor note this weekend. “The median monthly market real return has been 2% annualized in phases where inflation was high and rising vs. 15% when inflation was high and falling.

“At the factor level,” they continue, “value [stocks] have generally fared better when inflation was high and rising than when it was high and falling. Among sectors, although energy and health care have outperformed in periods of high inflation, they have performed much better when inflation was rising than falling.”

Here’s Goldman’s full breakdown:

***

Postscript

A little news you can use: don’t mess with crows. Or, at least, the Roman variety.

Two weeks ago, I had a Hitchcockian moment that is still messing with my sense of up and down.

Let me explain: After I send out the Bull Sheet each morning, I take the dog for a walk. After a few hours of morning-markets chatter, Scilla and I both need to blow off steam. We usually head down the hill to the big park in the shadows of the Basilica of Saint Paul—”Saint Paul’s outside the walls,” as it’s known.

Lately, Scilla has it in her head that she’s a hunting dog. This means she sits in the tall grass and waits for butterflies to flit by, and then she tears after them. It’s not at all a ridiculous sight to see a dog leaping and snapping at a butterfly, and not even coming close.

So, two weeks ago something larger crossed paths with Scilla down at the park. It was a young crow. It just walked past her, a few feet away. I puzzled over this scene for an instant, but Scilla didn’t hesitate. She crouched, ready to pounce. The bird? It ran away.

Yes, ran. It either couldn’t fly, or it didn’t want to. I told you; these are Roman crows.

Scilla caught up to this unlikely perambulator in a few strides. That’s when the tables turned, and the trouble started. The young crow decided it was going to stand its ground and fight—bad news for Scilla. As you and I know, crows have no problem picking a fight with larger animals, and they don’t fight fair.

That’s when your markets correspondent jumped in. I tried to shoo the two away from each other. As I approached the standoff, the trees above me exploded in cackles and caws. Seeing me step forward, Scilla backed off. Pheww, I thought. That could have gotten ugly.

Just then—whap!—I got hit in the back of the head. A large crow dive-bombed out of the trees and knuckled me up the backside, knocking my baseball cap clear off my head. Hit me right in the back of the head, I tell you.

I’d gone through hostile-environment training many years ago, but nothing could prepare me for birds-on-the-attack in a city park. And so I adopted some kind of pathetic, crouchy crab-like posture and backed out of there as fast as I could.

Scilla managed to distance herself, too. But they continued to swoop at her, which she found way more exhilarating than I did. Eventually, she too got the message, and trotted into a clearing where she could better see what was coming at her. (Maybe she is a hunting dog, after all).

Just then an old-timer carrying a panino sat down on a shady bench. I don’t know what he was thinking. The commotion in the trees above his head was cacophonous. Buddy, I hollered, Che fai! What are you doing!? You can’t eat a panino here?!

He was dumbfounded to find this American madly gesturing at the trees. Just then another crow—maybe it was the same one—dive-bombed at me. I saw it this time, and leaped out of the way. My heart was pounding. The old-timer, seeing this, grabbed his panino and fled. Yes, ran.

Eventually, Scilla came to my side. She had this “let’s play the bird game again!” look. I grabbed her, leashed her, and we were out of there.

This weekend, a Bull Sheet reader sent me a note. Have you seen this?, he asked. It was a weekend story in the New York Times. The headline read: “Emerging From One Plague, Some Romans Face Another: Attacking Crows.” The Times reporter tells the story of escalating crow attacks on Romans. In some instances, the locals were bloodied and scarred.

Reading the story, I started to feel better about my encounter. Scilla and I weren’t alone. But I’m still finding it hard to muster the nerve to go back to that park.

Crows can memorize human faces. And I made some pretty ridiculous faces that day in trying to avoid danger.

Anyhow, don’t mess with the crows.

***

I have a programming note: I am co-chairing the Fortune Global Forum (there’s still time to register!) this week. As such, Fortune‘s Anne Sraders will be taking the keys to Bull Sheet over the next three days. That means the Bull Sheet will arrive in your inbox at a different time tomorrow, Wednesday and Thursday.

In the meantime, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

L'amour. Foodies, here's one for you. Professional chefs and amateurs cooks the world over swear on their Le Creuset casserole pots, the staple of many a kitchen. These French ovens, or, cocottes, have been around since the 1920s, but have experienced a huge global upsurge since the pandemic with so many of us cooking from home. This kitchenware does not come cheap, but they're flying off the shelves, explains Eric J. Lyman, as part of our series on iconic brands that are doing surprisingly well in these uncertain times.

Pros and cons of home refi's. A reader recently asked Fortune columnist and Ritholtz Wealth Management director of institutional asset management, Ben Carlson, whether it would be a good idea to take advantage of these low mortgage rates and refinance the family home to—get this—use the capital to invest in the stock market. That prompted Carlson to dive into the merits of refi's and HELOCs, and whether that capital could be better deployed investing elsewhere. It's a fascinating read.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quiz time

El Salvador—we don't talk enough about El Salvador here in Bull Sheet; that's on me—made huge news this weekend when President Nayib Bukele out-Elon-Musked the crypto markets by saying he will make Bitcoin legal tender. Dear reader, what is the official currency of El Salvador? Is it...

- A. The Bolivar

- B. The peso

- C. The colón

- D. The U.S. dollar

The answer, as of 2001, is D...the U.S. dollar. 🤷♂️